Keith Brofsky/DigitalVision via Getty Images

Dear readers/followers,

It’s time for an update on Exchange Income Corporation (OTCPK:EIFZF). This is a very underappreciated little gem of a company and one to which I’ve been almost the sole contributor going on several years at this point. It’s small, yes. It’s regional, for the most part, yes. But it’s also of extremely high quality despite its size and other questions that you may have.

Let’s see what this update brings us in terms of appeal – because this business brings a lot to the table.

Updating on Exchange Income Corporation

My coverage and my love for Exchange income is well-established at this particular time. Far from being a risky play as would be suggested by its relatively high yield, its size, its sectors (aerospace/manufacturing/airline services), and its lack of a credit rating, it actually has performed remarkably stable for what has been an amazingly unstable period of time.

It’s down around 11.5% for the year, but this is still far better than most indices – and including dividends, it’s not as bad as all that either. The company recently bumped its dividend by 5% as well, back in August, in a long time of confirmations of company quality that Exchange has been on for the past few years.

Revisiting Exchange Income, then. For the uninitiated, Exchange Income Corporation is an M&A-focused business with a historical primary focus on aviation, aerospace, and manufacturing. You might expect that this turns the company into a horror show given what aviation has been exposed to for the past few years – but this is not the case.

The company focuses on small players with high moats, attractive margins, defensible positions, low CapEx, and good competitive advantages. Historically speaking, their acquisitions were almost purely small airlines and aerospace operators, but this has shifted to manufacturing as well over the past few years, with M&A’s in communications infrastructure, technical services, stainless steel manufacturing, processing equipment, precision parts, heavy-duty pressure washing/steam systems, water recycling tanks, and transportation tanks for various energy products.

There are also operations focusing on the “window wall system”, used in high-rises in the NA markets. So, there’s some overlap to aviation here where the company owns manufacturing capacities with that profile, but not much.

Exchange Income remains very diversified, and in fact grows more diversified on an annual basis as its manufacturing focus increases, and its legacy airline focus somewhat lessens, while still remaining important to the overall mix.

To give you an idea how I’ve invested and how I’ve “timed” my buys, the company’s current yield is around 5.62%. My own Yield on cost in my core portfolio is above 9.8% at this point after the recent bump, and the company keeps mailing me that monthly “paycheck” again and again and again.

I hope that the company drops. It would enable me to buy more. I’m not worried in the least, despite some of the company’s drawbacks that investors focus on.

The biggest argument here is credit risk. As I view the company, they have time and time again proven their ability to handle both leverage and little leverage, and their credit/debt covenants reflect confidence from their creditors. Long-term debt is up around $1B Canadian, and it has been at that level for around 3 years at this point. The company has only one debt maturity until 2025, and it’s a $100M debenture that is already anticipated to be retired prior to the due date of December 2022. There is almost no refinance risk, and this allows EIF to execute its growth targets.

The best way to introduce EIF to the uninitiated is to look at its longer-term performance. 10 or 20 years is generally a pretty good indicator. On a 20-year basis, EIF has turned a $10,000 investment into $68,656, with a 12.2% annual CAGR despite it trading down, or a total RoR of 586%. A pretty good track record of beating the market if you ask me.

Recent results are not in any way worrying me. Why do I say this?

Because the most recent results, the 2Q22, were essentially record-breaking results. Sales revenues were up 64% YoY, EBITDA grew by 42% to a quarterly record high on an adjusted basis, and the ever-important EIF metric of FCF-less-CapEx payout coverage was 56% before the dividend bump. Even a 5% dividend bump will do nothing to endanger this. The company could have raised it far more, should they want to do so.

I foresee the aerospace recovery in the company’s segments to continue along according to expectations, with robust strength in things like Medevac and logistics. Remember, EIF is one of the only options for logistics for many northern-located Canadian settlements. This isn’t an “optional” business – it’s a must-have – and my stance reflects this.

There are many moving parts that show me why Exchange Income is a company worth investing in. From trying to solve its own pilot shortage by starting pop-up schools to managing with Regional One, to its active M&A pipeline, it’s a successful track record of working these new operations, to a management team that over time has proven again and again that it can adapt to any new business environment without ever endangering the dividend or shareholder returns.

The highest we saw the company’s payout ratio was slightly above 74% – this is not exactly problematic.

The company used extremely positive verbiage in its last report:

We are ecstatic with our progress in the second quarter. We completed our largest acquisition to date, enhanced our liquidity with a larger, more flexible debt facility with our Bank syndicate partners, and most importantly delivered the strongest financial performance in our 20- year history. Increasing our dividend in consecutive quarters is not something we have regularly done in the past, nor is it expected to be the norm in the future, but it shows the strength of our results and our confidence in the future. We demonstrated the resilience of our model during the pandemic when we were able to maintain our dividend when most companies with significant aviation exposure were forced to cut or cancel it. Now, we are able to demonstrate the impact of the investments made over the last three years and reward our shareholders with a second increase to our dividend

(Source: Mike Pyle, 2Q22 Report, emphasis added)

This illustrates very well how I feel about the company. Without wishing to mimic executive perspectives here, I can say that the fundamentals are very much in line with what’s being presented here. The company has extremely safe cash flows based on contracts and counterparties that have very low risk. The inclusion and adaptation of manufacturing represent diversification, but also a bit of a risk in terms of industrial volatility. But as long as the company continues to have a solid base – which they currently do, I see no worries that would derail this company’s position as an income play.

Therefore, I would say that at the right valuation, this one is a “BUY”.

Let’s double-check the valuation.

Exchange Income – Valuation

Now, Exchange doesn’t have a flawless forecast-related track record when it comes to meeting estimates. On a 2-year basis, 14% of results for the past 10 years are off negatively. Still, for its size and what it is, I view this company as having proven its mettle throughout this pandemic, and coming out of it, is actually a substantially more conservative and better company than it was going in.

What’s more, it’s proven that it can handle a fundamental downturn in its core businesses without even needing to draw on debt to fund CapEx or payouts. That’s a big one.

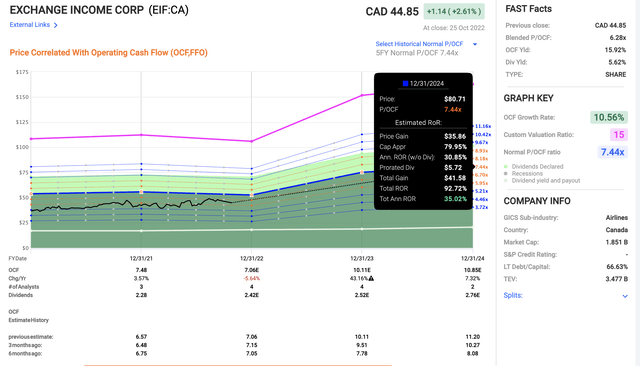

We used normalized P/FFO, or operating cash flows to forecast EIF. The reason we do this is that this is the historically most stable and forecastable indicator for where the company’s results come in. On a 5-year historical basis, the average P/FFO for the company has been close to 7.5x. You were able to pick up the company close to 4x back in the worst of the pandemic. That is no longer possible. What was once below 35 CAD is now closer to 45 CAD, and what was an 8-9% yield is now 5.62% – quite a difference.

However, we have fundamental changes to income and cash flows due to new operating segments/manufacturing M&As, which are set to substantially improve the company’s generation of cash flows. What was once 7-8 CAD per year is set to become 10-11 by 2024E and forward. Based on this, the company’s normalized P/FFO is set to settle at share prices of closer to 80 CAD, providing us an upside close to triple digits and 35% per year.

Exchange Income Upside (F.A.S.T graphs)

Street targets are slowly starting to reflect this forward upside. Based on current average targets, we’re at a low of $53CAD to a high of $66CAD, with an 11-analyst average of $60 for the native. That’s an upside of 35%. Out of 11 analysts, 11 analysts have either a “BUY” or “Outperform” rating, making this company a superb possibility even here.

Because the company does have some of the size-related disadvantages we’ve mentioned, I’m careful about pushing “too much” to work here. But my position in EIF is up nearly 70% since starting my investment, and 2.5% of my portfolio is in this company. I wouldn’t mind seeing this up to 3-4%, truth be told, given the massive yield advantage.

This is an income play – and I’m happy to keep investing in it at this price.

In light of recent news, I’m raising my PT for EIF.

My rating continues to be a “BUY”. My own price target, conservative, is $58/share for the Canadian ticker of the shares.

Thesis

My thesis for Exchange Income is fairly simple.

- This is a small operator with a big upside. Fundamentals are solid, and I like their operations and their niche. At an attractive price, and for the right investor, this is a definite “BUY” at a $58 PT.

- Risks do exist, but they’re on a more subjective and “what-if” level, with very few actual logical risks to the company’s balance sheet or operations.

- My stance is a “BUY”, and I’m excited about the 3Q22.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment