alvarez/E+ via Getty Images

The Basic Story

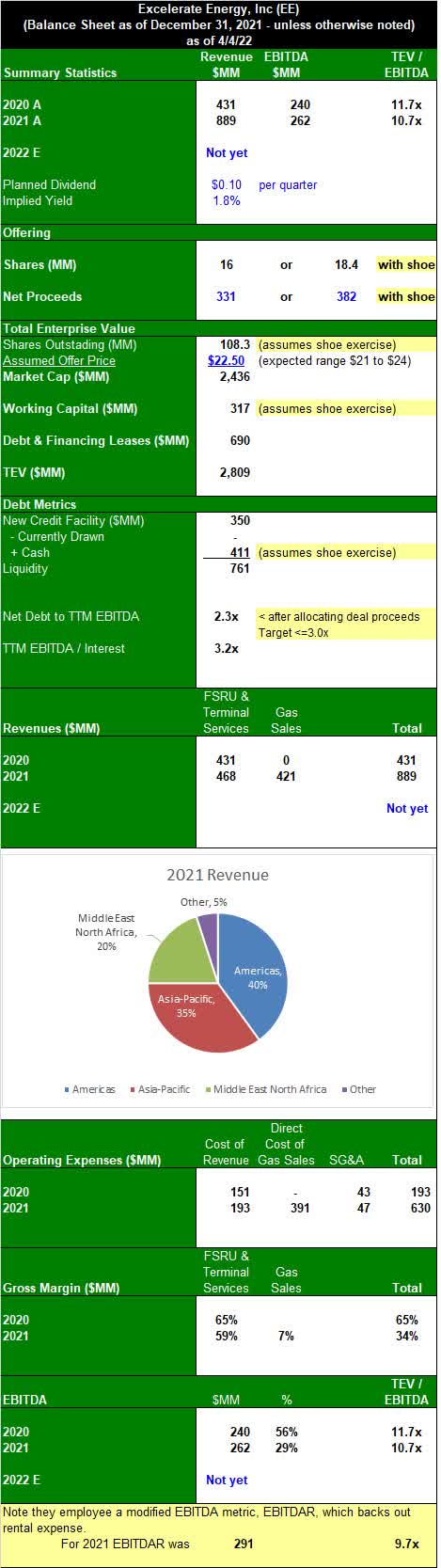

Excelerate (EE) is a flexible LNG regasification and further downstream solutions focused name that is expected to IPO on or about 4/12/22. Their history dates to 2003 beginning with a single chartered FSRU (floating storage and regasification unit) to present with multiple owned and operated FSRU’s in 7 countries in North and South America, Asia/Pacific, North Africa and the Middle East and they own or operator multiple LNG receiving terminals. Revenues are derived from take or pay time charters and terminal services (purchase and resale of LNG). Revenues more than doubled in 2021 from 2021. Margins are solid but moved lower from 2020 to 2021 as procured LNG (gas sales) made up a significant wedge. While they provide secure access to LNG now they are expanding into DGS (distributed gas services – small scale natural gas distribution projects) and LNG to Power (gas fired electricity generation). The company also plans to expand existing terminal capacity in some cases and enter new markets.

Macro: (estimates from BNEF, Wood Mac, IGU)

After dipping with the first half of the pandemic global electricity demand rebounded 6% in 2021. Electricity demand is expected to grow ~ 3% in 2022 and again in 2023. LNG will be needed to meet this demand and coal consumption continues to retreat and nuclear capacity remains stagnant. As such, LNG demand is seen steadily rising at a rate of 2.3% per year from 2022 to 2025 to 401 mm tons per year, with Asia expected to be over half of this growth.

When viewed through a longer term lens electricity demand is forecast to grow by 60% by 2050. Much like with oil, per capital consumption of electricity on a global basis is low but growing. EE noted in their presentation that almost half of the households in world use less electricity per year than the average American refrigerator. As the globe becomes more electrified, the expectation by LNG forecasters is that demand will outpace electricity demand growth (taking market share) with LNG annual demand doubling from 360 mm TPY in 2020 to 720 mm TPY by 2040.

A Little Excelerate History

Excelerate Energy

Excelerate is a highly experienced and respected operator in the LNG space. The company has performed over 2,200 ship to ship transfers to date for over 40 LNG carriers and has delivered 5,500 Bcf to date. They have deep experience in both terminal development and operations as well as experience in construction and management of assets, port services, procurement of LNG, operation of the FSRU’s, and final delivery of natural gas.

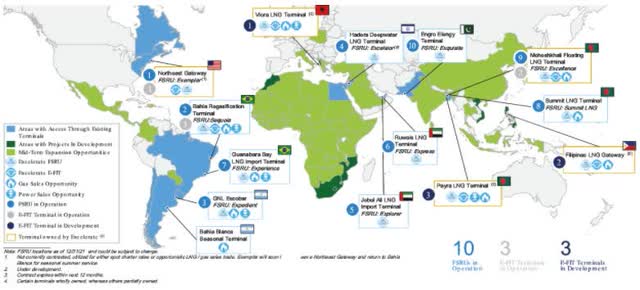

Excelerate’s Footprint

FSRU’s – Ten purpose built vessels (seven fully owned pro forma the offering) with an average remaining life of 20 years. All ten were built by Daewoo helping them to provide reliable service. This is one of the largest FSRU fleets equating to 20% of all FSRU’s in service. These ships can transport LNG, vaporize it, and deliver natural gas to offshore or near-shore facilities. In total their ten FSRU’s have the ability to deliver 61 mm TPY of total send out capacity.

To put that in perspective, operating at 65% of capacity, that would still be over 10% of global LNG demand.

Eight of their vessels are under long term contract (average 6.9 years) and the contract ends are cascaded to avoid “cliff years”. All FSRU contracts are take or pay and are designed to minimize commodity risk.

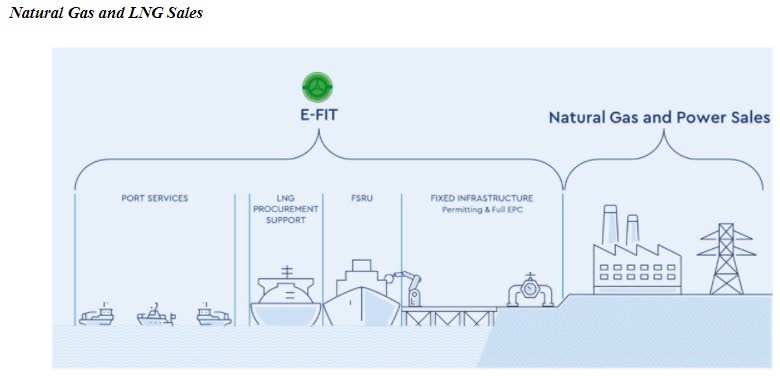

E-Fit (Excelerate Flexible Integrated) Terminals. Three integrated LNG terminals in operation:

- A 100% owned terminal outside of Boston (Northeast Gate),

- An 80% owned terminal in Bangladesh,

- And the Bahia regasification terminal in Brazil leased through 2023 (they’re looking to extend this least now).

The E-FITs provide a single interface for customers for: port services (tug, supply, and crew boats), LNG procurement support – ship to ship trans support, LNG regasification – provision of FSRUs, floating storage with onshore regasification, and/or onshore storage, permitting services, EPCIC (engineering, procurement, construction, installation, and commissioning) services, and operation and management of the supporting vessels and terminal.

Terminals can also serve as distribution hubs in some cases for LNG to be transported where needed onshore via trucks, trains, or small marine vessels. E-FIT terminals use take or pay contracts with terms that minimize commodity risk and run from 15 to 20 years. In the infographic below the bracket on the left is where they operate now. The bracket on the right is shows their near term expansion plans.

Excelerate Energy

Advanced Development Projects. Multiple E-Fit terminals and downstream opportunities are in development. There are a lot of moving pieces here and we don’t have a financial handle on them at this time (just not enough data). We do note that gas and power sale contracts typically run 15 to 20 years, are also take or pay in nature, and are also structured to minimize commodity risk.

- Albania – Emergency Power for Albania to help with the country’s energy security. They have MOUs in place to study a LNG-to-Power project with Exxon as well as to tie a terminal to local gas infrastructure. In the meantime, they have been asked by the government to operate power barges beginning in 3Q22 to help supplant Albania’s high cost European electricity imports.

- Argentina – Bahia Blanca – contract awarded March 2022 for seasonal regasification to supply natural gas to the local market beginning summer 2022.

- Philippines – The Filipinas Gateway in Batangas Bay, will be a terminal with planned natural gas sales and power generation.

- Bangladesh – The Payra LNG terminal (which will be their 3rd there), an FSRU and terminal with planned natural gas and power sales and they plan to expand the capacity of one of their existing two terminal.

- Vietnam – in active discussions for a potential project.

This is a map of their global footprint.

Company data

The Offering

- Size: 16 mm shares (18.4 mm with the shoe)

- Outstanding Afterward: ~ 106 mm shares.

- Assumed Pricing: Mid point of the expected range is $22.50 with net proceeds from the range $21 to $24 of $331 to $382 mm.

- Use of proceeds:

- $281 mm for growth projects in Brazil, Albania, Philippines, and Bangladesh.

- $50 mm to purchase vessels in connection with reorganization of the go-forward entity.

- The offering will fund near term capital needs but as they note this is not a needed liquidity event for them.

- The company will be majority held (80%) by the Kaiser family in the wake of the offering. Kaiser is selling no shares with this offering.

- They don’t see a need to raise additional capital for the next two years.

- The deal is expected to price on or about April 12th, 2022.

Management is highly experienced

- EE’s President has 27 years of experience in “complex energy and infrastructure development projects and general maritime operations, specifically LNG shipping, FSRUs, chartering of vessels, shipbuilding contracts, operational agreements and related project finance and tax matters”.

- EVP and Chief Commercial Officer has 24 years in “leading commercial development of oil and gas projects across the globe, with a particular focus on LNG, and is responsible for the commercial development of our LNG import projects, expansion of our customer base and the buildout of our global network of regional offices”

- and their CFO has 25 years of experience in “oversight of all global financial reporting, financial planning and analysis, accounting, treasury, tax, financial systems and internal controls and has led both public and private multinational companies within the energy and biotechnology industries”.

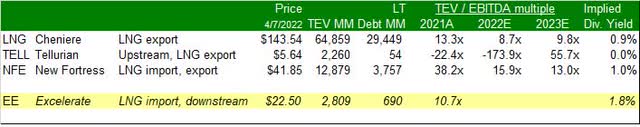

Return of capital from the start. The company plans to pay a 10 cent per quarter dividend for an implied yield of 1.8% at the currently expected offering mid point offering price. Partial competitor New Fortress Energy (NFE) also has a dime per quarter dividend for an implied forward yield of 1.0%.

Relative Valuation

Management will not publicly guide in front of the deal (this is an IPO, not a SPAC) but a degree of growth in 2023 is assured as they get a full year of revenues from the Bahia terminal in Brazil and as Additional Developments noted above are layered in. We look forward to their initial public guidance after they announce their 1Q22 results. When we view names in the LNG space like Cheniere (LNG) and Tellurian (TELL) to more diversified names like a New Fortress we see the market as having bid them up on the strong macro backdrop outlined above with the European crisis driving the latest leg. As you can see from the table below this is not a sector that is currently fearful of what we would normally call elevated multiples and EE compares pretty favorable on both TEV/EBITDA and implied dividend yield at the expected mid point price.

Z4 Energy Research, company data

Nutshell

This is a name we’d like to get to know better and may take a position in the IPO (personally and potentially in the aftermarket for the our primary portfolio).

Flexible, integrated LNG terminals speed time to market for LNG hungry regions, making them a potentially good fit when emergency gas supplies. Europe could benefit from several E-FIT terminals given the pressing need for additional gas supplies there.

This appears to us to be optimal timing to be a publicly traded name is this space (and probably an easy pitch for analysts and brokers). Our sense is that within a month of the offering a majority of the names in the deal will initiate with Buy ratings. Furthermore, we generally like high gross and high EBITDA margin plays and this fits that bill. We see potentially holding EE as complimentary to our position in flexible LNG provider New Fortress.

Z4 Energy Research, company data

Be the first to comment