e55evu/iStock via Getty Images

The iShares MSCI Italy ETF (NYSEARCA:EWI) is getting pretty low in multiple, but there are some genuine concerns about the Italian economy that render the ETF rather uninteresting. The proximity to the energy crisis but also an especially high reliance on gas is going to put pressure on a lot of stocks in the ETF directly but also on their end-markets by straining households. Overall, the downside in terms of earnings and the impact that it might have on earnings growth makes the multiple actually a little rich. We pass on EWI.

EWI Breakdown

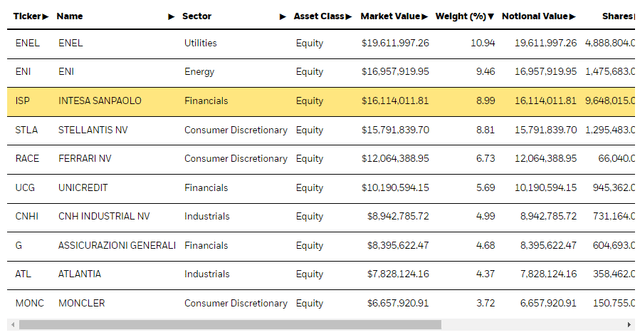

Let’s have a look at this ETF’s top holdings, because they tell us a fair bit about what’s going on with this ETF.

Clearly, these are mostly Italian companies, or companies that at least trade on the Milan Stock Exchange. The number of holdings is only 24, so the allocations are all pretty substantial, and the first few are going to account for most of the portfolio’s moves.

Enel (OTCPK:ENLAY) which accounts for 11% of the portfolio is a major one, and it is very much moved by the risk factors related to the price of gas. This is because a very large proportion, around 18%, of its generation capacity comes from gas-fired energy generation, or CCGT assets. About 50% of the business is power generation while the rest is networks, but that’s still about 10% of the company’s revenue generation coming from gas-fired installations. With a rough winter coming on, this is going to matter for the profitability of these assets. Thankfully, the gas-fired issue only relates to ENLAY, and not to the other utility players, which are all regulated utilities and don’t have earnings volatility to speak of. Still, the 10% in ENLAY is a bit of an issue, as the company also has a very substantial debt load at 80 billion EUR. 30% is floating, and a doubling in rates from low corporate rates at around 3% to possibly 6% could alone have a 20% impact on net income, not irrelevant at all. Also, a decent amount of maturities come in 2 years, about 10% of the overall load, and this will not roll over nicely if rates stay high longer term as we expect. It’s hard for public utilities like Enel to pass on all the cost increases, especially when operating in emerging markets with more interventionist and populist governments.

Remarks

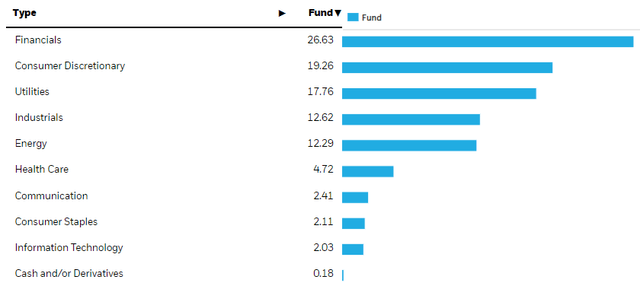

Financials make up a big part of the ETF as well at 27%. With earnings hikes being less aggressive than in the US, possibly due to the greater cost-push pressure on inflation, financial stocks will have less of an impulse from interest rate hikes.

Eni (E) is the energy exposure, and that is going to be relatively stably positioned with respect to at least the supply environment for oil and gas, but a bit of a blemish on the ETF is the consumer discretionary exposure, helmed by Stellantis (STLA). At 8%, STLA accounts for a mid-range consumer discretionary with more mass markets in automotive. It will suffer substantially as a consumer durable when rates rise, even if only modestly, and if recessionary pressures from higher cost of living take a toll on end-markets, which they definitely already have. The rest of the consumer discretionary exposures are luxuries, and those perform decently well even in the current recessionary environment.

In general, the higher rates are probably going to affect earnings directly from more interest costs, with the exception of the 27% allocated to financials. In the case of about 20% of the portfolio, either gas price inflation or cost of living issues are going to damage profits directly and with quite a bit of leverage. The rest of the portfolio is rather resilient, admittedly, even though we think the 9x multiple and the 11% earnings yield that the multiple implies are not enough.

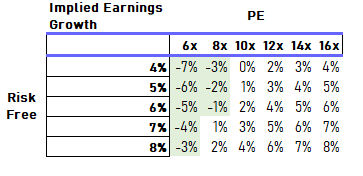

ETF Valuation (VTS)

Such multiples imply about a flat earnings picture, but the companies in EWI don’t have secular growth factors like tech-focused US ETFs have. In fact, there is almost no IT exposure at all in EWI, whereas in a broad US ETF, there will usually be at least 20% exposure. With interest burdens but also much more severe and evident recessionary forces in the EU being a problem for earnings growth, a flat expectation for earnings growth is just not very reasonable. While the growth rates presented in the table above are implied to be long-term, the lack of general secularity (indeed, even demographics are bad in Italy) and real income pressures right now have us staying away.

Be the first to comment