Daniel Balakov/E+ via Getty Images

Evoqua (NYSE:AQUA) is a company that we would love to invest in, if the price was not completely unrealistic. Its mission is water treatment, or as they like to put it, they make dirty water clean. Given the water scarcity issues in many places around the world, and the increasing environmental awareness, we believe that a company with this type of focus should benefit from growing demand for its solutions. What the company does is nothing short of incredible, it transforms approximately 100 billion gallons of water every day with its products and services. This is over 4.5 times the amount of water flowing over Niagara Falls every single day. This contribution to the world is starting to get reflected in its financials, with growing revenue and profitability, but we still find the valuation too demanding.

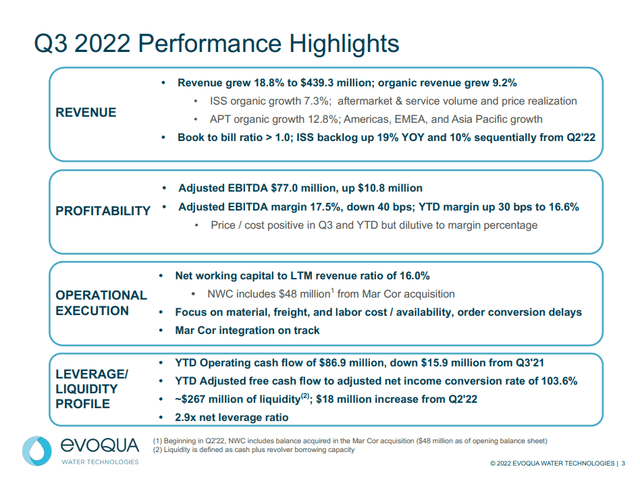

Q3 22 Performance

Evoqua just reported Q3 results, the main takeaway in our opinion is that the company is once again delivering strong organic revenue growth. Revenue grew 18.8%, and organic revenue grew 9.2%. The company also has a robust pipeline with a book to bill >1.0.

For FY 2022 the company is guiding revenue to be between $1.64 billion and $1.70 billion, which would represent YoY growth of 12% to 16%. Adjusted EBITDA is being guided to be between $285 million and $300 million, which would represent YoY growth of 14% to 20%.

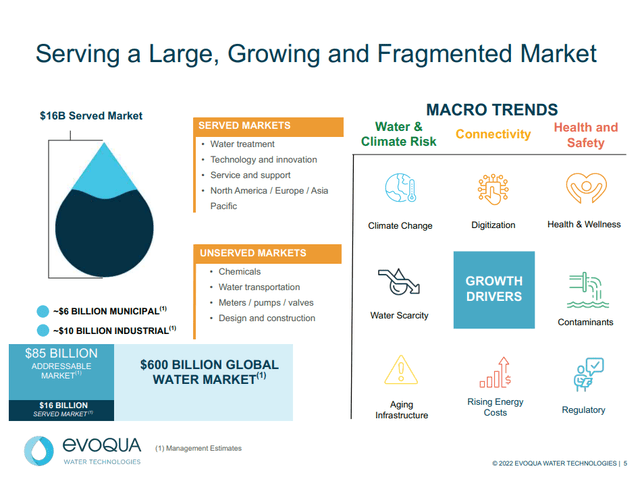

Market

We believe one of the key things that has attracted a lot of investor attention to Evoqua is the massive addressable market that it has. The company estimates its served market at $16 billion, and its addressable market at $85 billion. If the company is right about the size of the opportunity, and with all the macro trends in it has in its favor, then it should have a very long growth runway ahead.

Financials

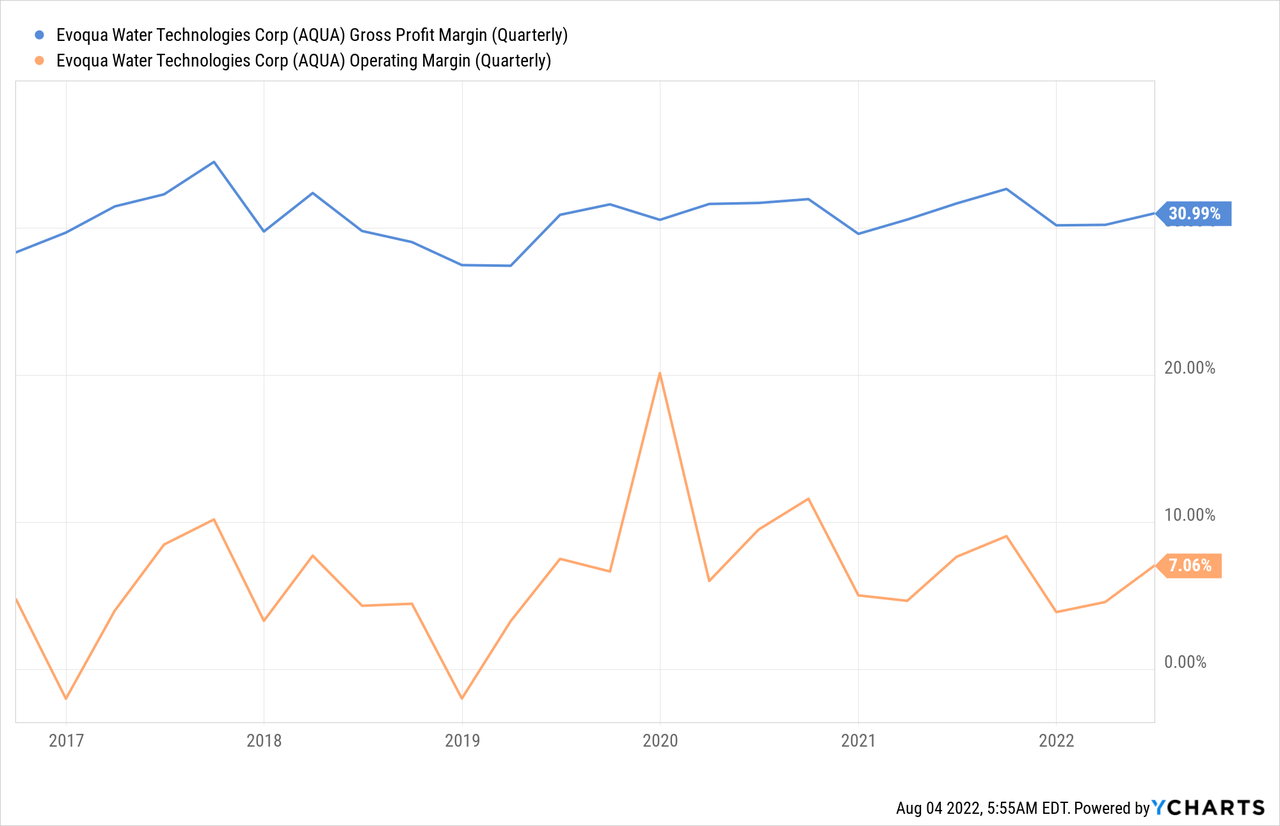

While the company is profitable, its profit margins are a little bit disappointing. Gross profit margins have remained stable around 30%. Operating margins do appear to be showing some operating leverage, which we view as very positive, but are still very low. Hopefully operating margins will continue trending higher on average as revenue grows.

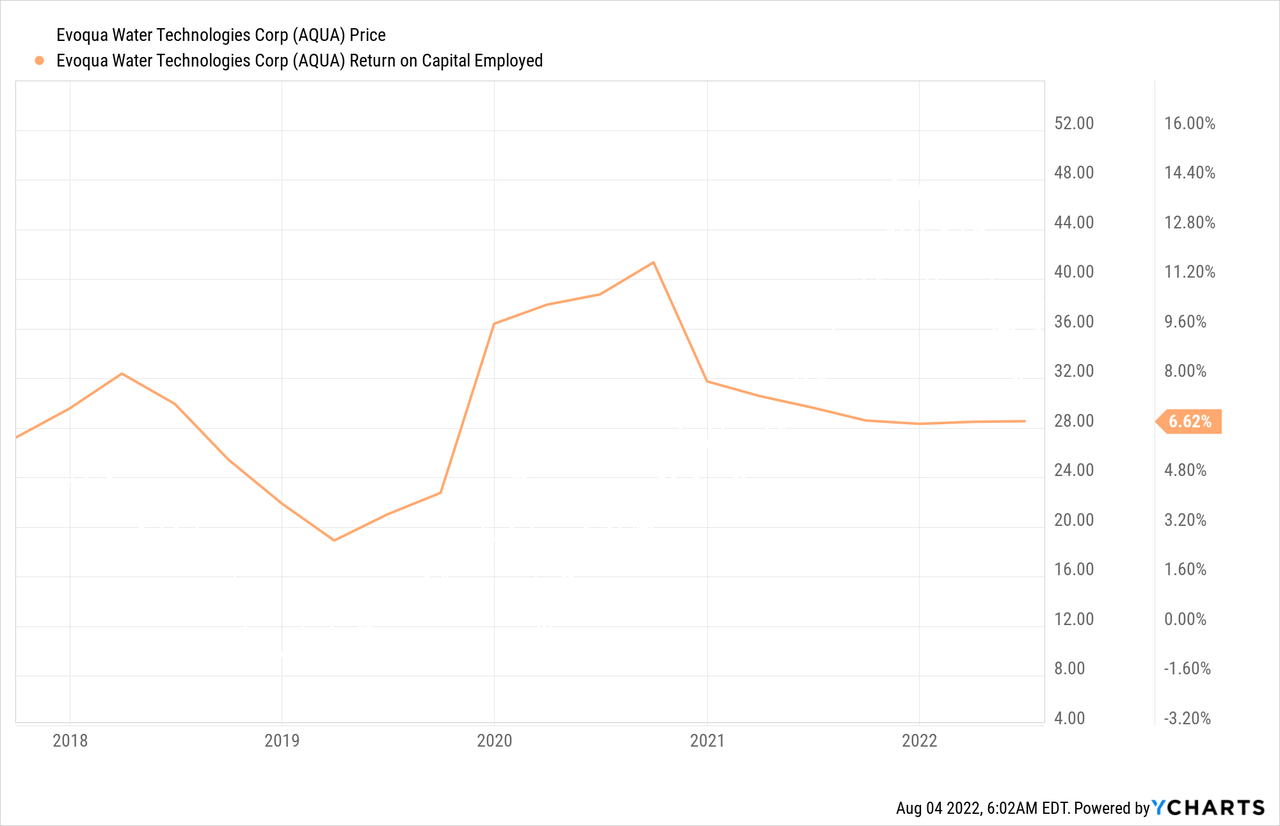

So far returns on capital employed are also disappointing, but the expectation here as well is that as the company grows revenue that margins and returns improve.

Balance Sheet

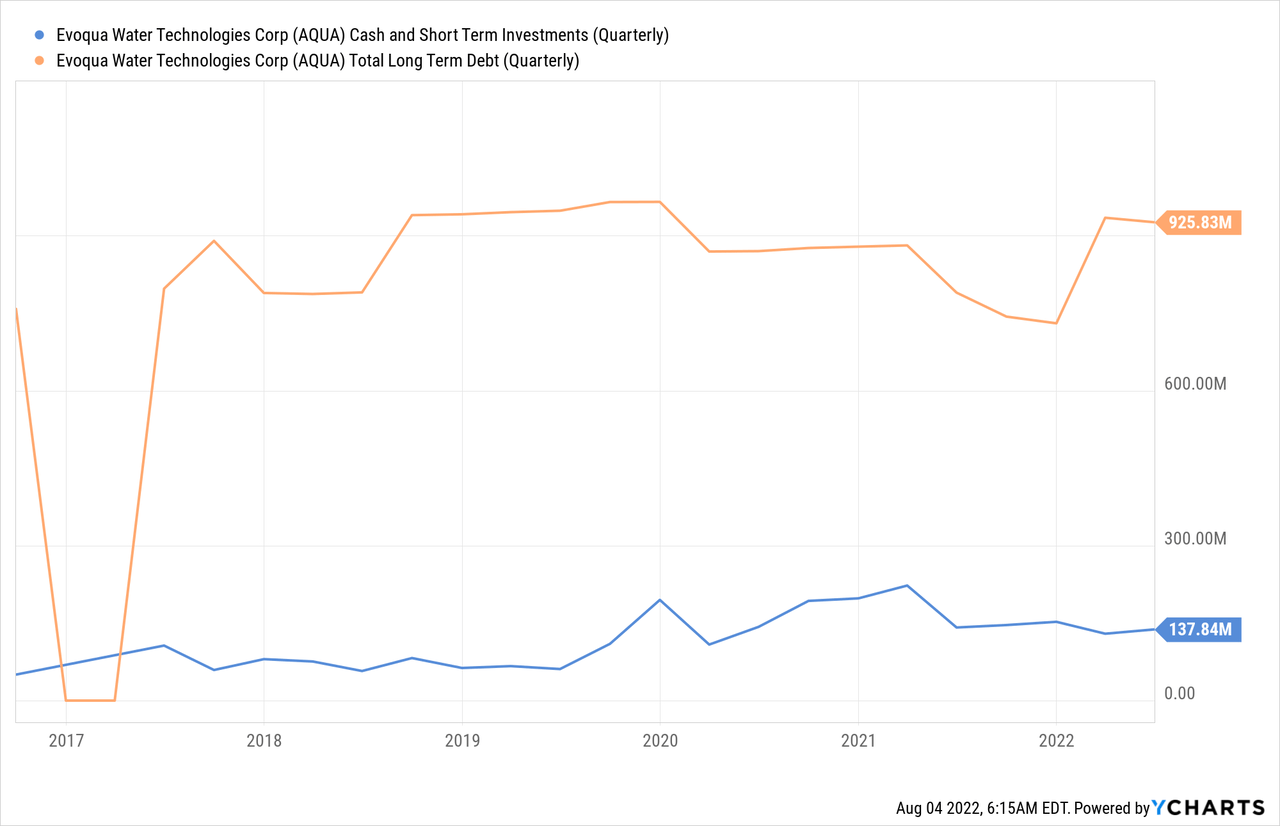

Evoqua has a significant debt load, which is approaching a billion dollars. It has a decent amount of cash and short term investments, but it is low compared to the debt.

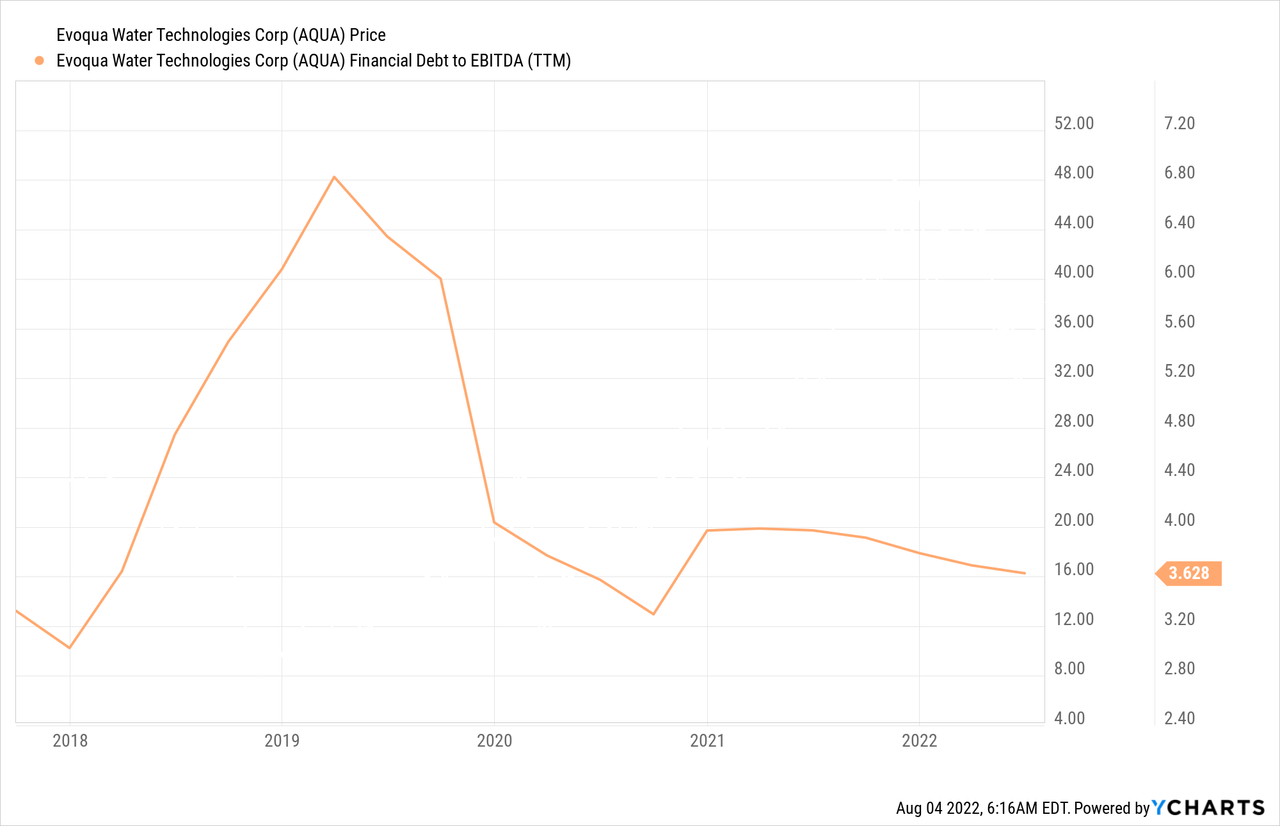

We view the debt as still manageable, given that the debt to EBITDA ratio is ~3.6x, but hope the company does not leverage itself much further.

Growth

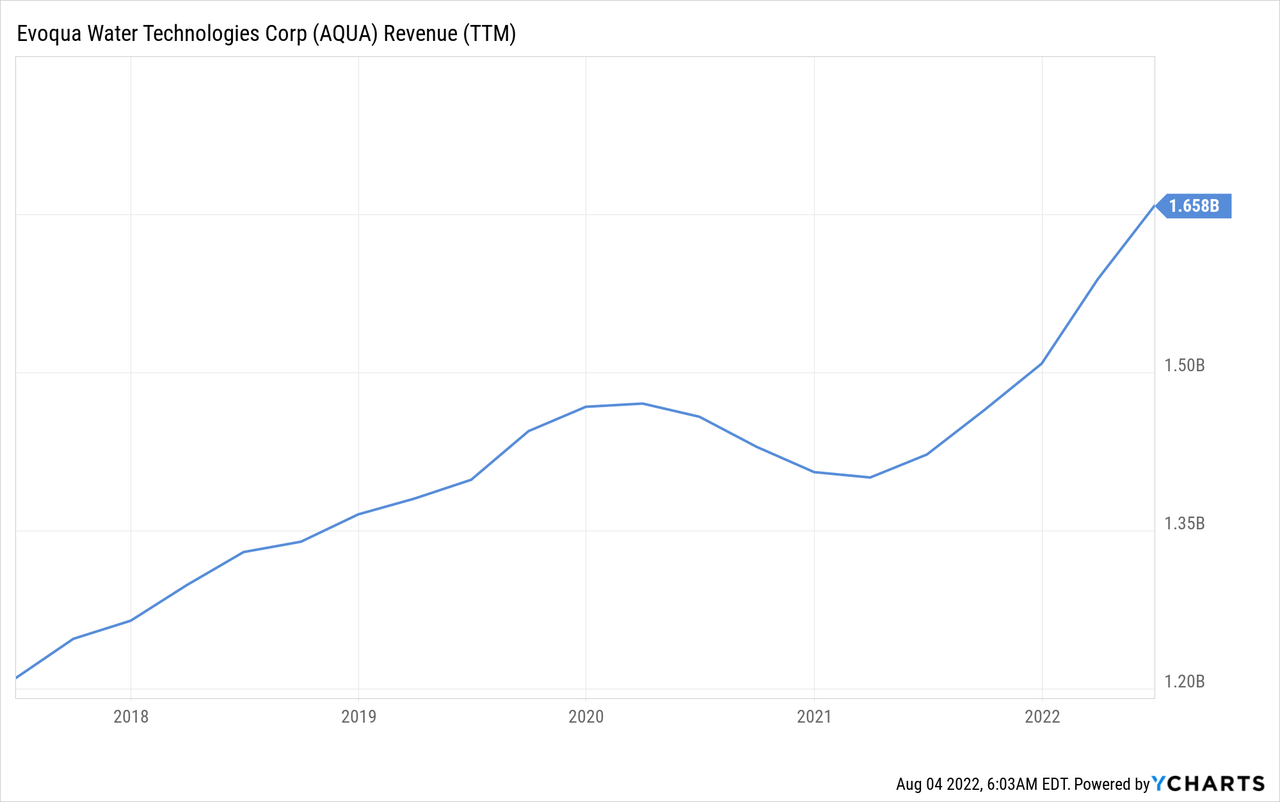

Growth has been very significant for Evoqua, despite the tough period around the worse of the COVID crisis. The company is once again posting record revenue and growth rates close to 20%, through a combination of organic and inorganic growth.

Valuation

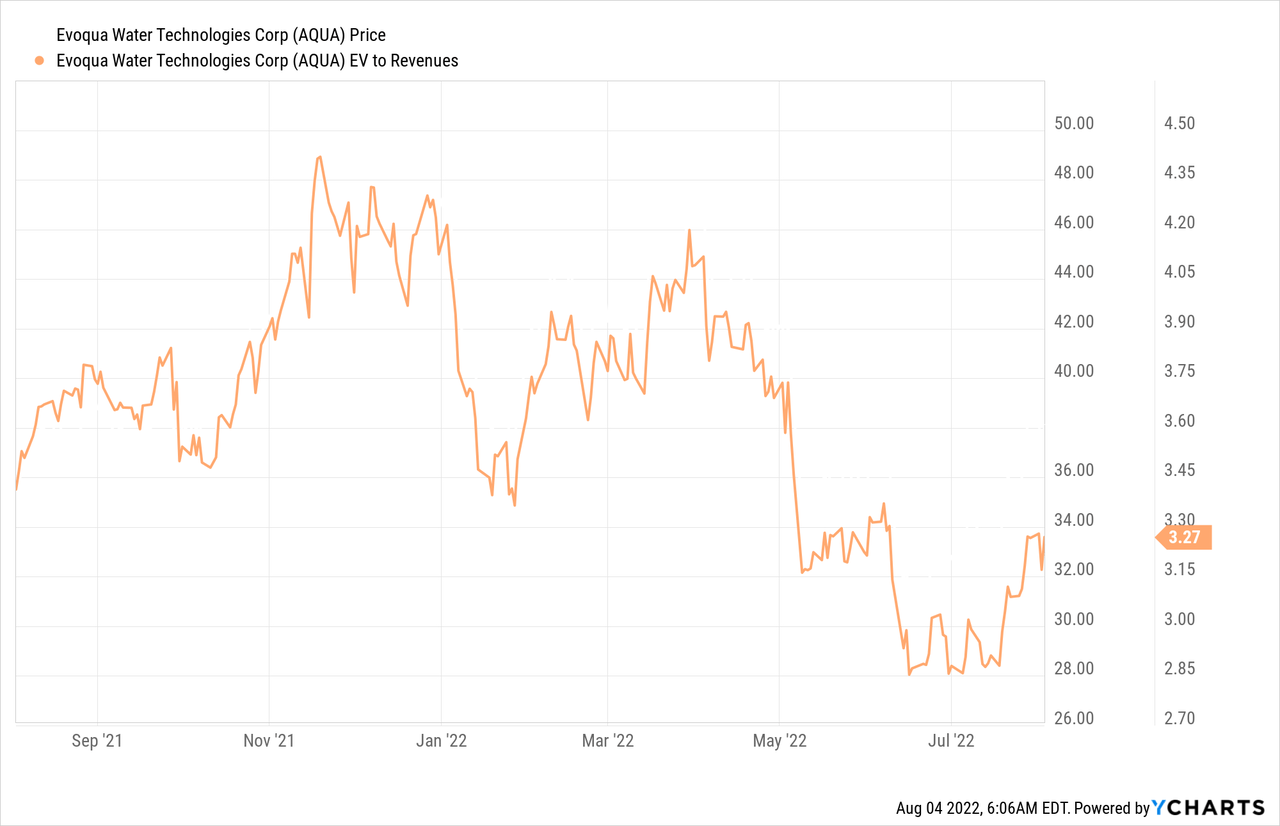

While we view Evoqua as a very promising company that is quickly growing, and that has several macro trends in its favor, we have a difficult time recommending the shares given the expensive valuation. For example, shares are trading with an EV/Revenues multiple of ~3.2x, which is unusual outside of the technology and software industries.

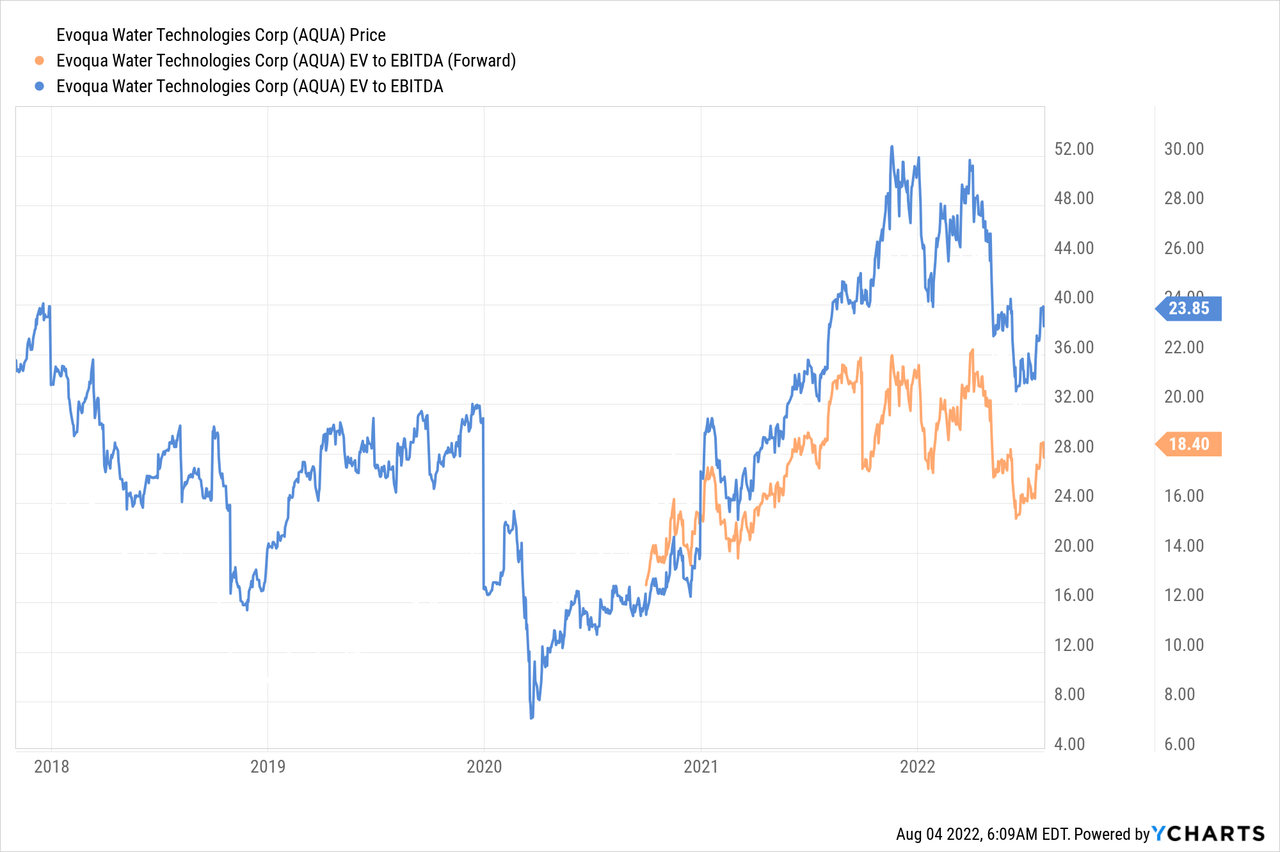

EV/EBITDA also appears high at ~23x, even if the forward multiple is a little bit lower at ~18x, showing that analysts expect EBITDA to significantly improve next year.

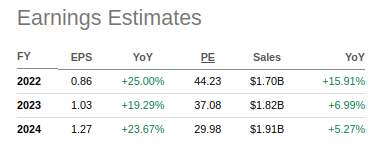

Looking further ahead we can see that based on analysts estimates shares remain expensive many years into the future. Even using FY 24 estimates still results in a p/e approaching 30x.

Seeking Alpha

Our estimated net present value for the shares is ~$29, using very optimistic assumptions. We use average analyst estimates as compiled by Seeking Alpha for the next three years, and then assume 15% growth until FY32, after that we assign a 3% terminal growth rate. Discounting everything with a 10% rate we get $29, which is considerably lower compared to where shares trade today, and leading us to belief shares are ~20-30% overvalued.

| Estimated EPS | Discounted @ 10% | |

| FY 22E | 0.86 | 0.78 |

| FY 23E | 1.03 | 0.85 |

| FY 24E | 1.27 | 0.95 |

| FY 25E | 1.46 | 1.00 |

| FY 26E | 1.68 | 1.04 |

| FY 27E | 1.93 | 1.09 |

| FY 28E | 2.22 | 1.14 |

| FY 29E | 2.55 | 1.19 |

| FY 30E | 2.94 | 1.25 |

| FY 31E | 3.38 | 1.30 |

| FY 32E | 3.88 | 1.36 |

| Terminal Value @ 3% terminal growth | 55.50 | 17.68 |

| NPV | $29.64 |

Risks

The main risk we see with Evoqua is the elevated valuation, and which could correct sharply should its growth disappoint even slightly. There is also integration risk, given that Evoqua has been acquiring other companies, and will likely continue to do so. The balance sheet could also be a risk, as the company does carry a significant amount of debt, even if the leverage can be argued to still be at a reasonable level.

Conclusion

We can see why investors are attracted to Evoqua, it is a company with a very large addressable market and which has a number of macro trends in its favor. It is also doing remarkable work ‘making dirty water clean’. Unfortunately shares appear overvalued at the moment, and investors might want to wait for a better entry point in the future.

Be the first to comment