Robert Way

I have been bullish on Alibaba Group Holding Limited (NYSE:BABA, OTCPK:BABAF) stock ever since the stock price settled below $150. There has not been much joy so far, as you know, but investing in stocks calls for patience on the part of investors to see handsome returns in the long run. I am in it for the long run, and there are clear signs to suggest Alibaba stock is deeply undervalued today.

Many investors, believing that Alibaba is undervalued, are looking for catalysts that could help BABA stock make a U-turn and head higher. Chinese tech stocks, including Alibaba, gained some momentum in June when it seemed the Chinese government’s crackdown on the tech sector could be coming to an end, but the enthusiasm soon waned on the back of continued pressure from authorities and macroeconomic challenges.

In this article, I will highlight the reasons why a major shift in investor focus is bound to occur in the coming months and how this shift will help Alibaba investors in the long run. At the time of writing this article, Alibaba is yet to announce Q1 FY2023 earnings, and my investment thesis has little to do with the performance of Alibaba in the June quarter.

Is the Chinese crackdown on Alibaba truly over?

Let’s address the elephant in the room first. There is no way to be sure of the intentions of Chinese policymakers, but as investors, we have to rely on publicly available information to reach justifiable conclusions. Such information available on the actions of Chinese regulators suggest the tech sector is likely entering a phase in which policymakers will promote growth contrary to what has happened over the last couple of years.

In addition to the $2.75 billion fine imposed on Alibaba back in early 2021, Chinese regulators fined Alibaba last July as well for failing to comply with anti-monopoly disclosure requirements, but I believe this should not be viewed in isolation. Rather, investors should consider other actions taken by regulators to gauge a measure of where policymakers are headed. Below are some of the noteworthy decisions taken by Chinese regulators in the recent past.

- In March, Chinese vice-premier Liu He said that market-friendly policies are required to support the economic growth of the country as well as the technology sector.

- In April, the gaming regulator of the country ended a nine-month freeze on the approval of new video games and granted 45 new licenses to games developed by Chinese tech companies.

- The Politburo of the Chinese Communist Party, which is the decision-making body of the Chinese Community Party consisting of 25 top officials, said in April that adequate policy support will be put in place to lift the economy higher. Importantly, Politburo highlighted that policy support will be given to Internet companies as well. The Politburo is headed by Chinese President Xi Jinping.

A close evaluation of the above decisions taken by Chinese regulators in recent months suggests the crackdown on the tech sector is nearing the end game. That being said, I believe investors will have to wait until the 20th National Congress of the Chinese Communist Party, which is scheduled for later this year, to get a more concrete idea of regulators’ stance on the tech sector.

Mr. Market’s shift in focus is a blessing for investors

With Chinese regulators taking a back seat, which is evident from their recent decisions, investor focus is likely to shift to the corporate earnings of Chinese tech companies. This may not be good news for traders looking to make some quick profits, but as a long-term-oriented investor, I welcome this development. A shift from the tech crackdown to Alibaba’s earnings may initially lead to even lower stock prices because of a few reasons.

- The World Bank projects China’s economy to grow 4.3% this year against 8.1% last year. The World Bank initially guided for 5.1% GDP growth this year, but the guidance was slashed last June on the back of a new wave of Covid-19 infections that triggered stringent lockdowns in key industrial areas of the country. Slower than expected economic growth will impact Alibaba’s earnings growth negatively.

- The zero-Covid-19 policy of China is likely to continue well into 2023 or as long as Covid-19 poses serious health risks. This policy may lead to continued business disruptions, which are likely to have an impact on Alibaba’s earnings.

- A shift in consumer demand from non-essential items to essential items amid rising inflation is likely to hurt Alibaba’s profit margins.

Macroeconomic and core business challenges faced by Alibaba will come to light in the coming quarters, and the profit margins of the company may further be impacted by the massive investments carried out by the tech giant to pursue growth opportunities in the cloud computing space. The combination of macro pressures and declining margins sounds like a recipe for more volatility in stock prices.

Although the outlook may not look rosy for the next few quarters, I believe the shift in focus to the fundamentals of the company will help Alibaba win the trust of long-term investors yet again for a few reasons.

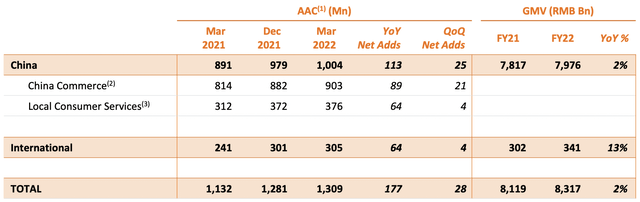

- As of March 31, Alibaba served over 1 billion Annual Active Consumers in China. The country has a population of 1.4 billion. In other words, almost 3 out of 4 people in China actively use Alibaba. I cannot think of another company with this kind of scale, and Alibaba enjoys unparalleled access to sensitive consumer data that could help the company aggressively move into new business sectors.

- The cloud business accounts for around 10% of Alibaba’s revenue today, and the company is investing aggressively in this business. Although these investments result in margin compression, I believe the cloud business has a long runway for growth and that the true return on these investments can only be seen in the long run. The adjusted EBITA margin of around 1% from the cloud segment, in my opinion, is not a true reflection of the massive long-term potential of this segment.

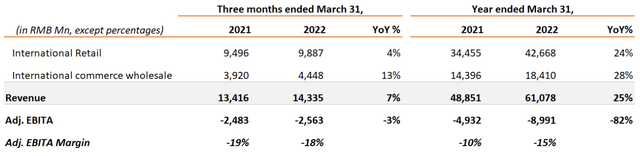

- Alibaba is still making losses at the operating level from its international business as well, but I believe this segment will be an important growth driver in the next decade as the company establishes its presence in the Southeast Asian market both in the retail and wholesale sectors.

Exhibit 1: Global Annual Active Consumers

Exhibit 2: International business performance in FY 2022

With a renewed focus on earnings and company fundamentals, I believe Mr. Market will initially punish Alibaba. However, for the reasons discussed above, I believe this will be a blessing in disguise for long-term investors, considering how the company is well-positioned to grow for many years to come.

Takeaway

Q1 FY2023 earnings that are expected to be released before the market opens are likely to highlight how macroeconomic challenges are eating into Alibaba’s revenue growth expectations. Regardless of the company’s performance in the fiscal first quarter, I believe Alibaba investors finally have something to cheer for as investor focus is shifting to company fundamentals in the absence of regulatory intervention. Because we are talking about a Chinese tech giant, it seems reasonable to expect policymakers to continue to have a say in the company’s business, but this is not something new. This has always been the case, but things got out of hand in late 2020, but are settling down today.

Beyond fiscal 2023, I believe Alibaba will start realizing a higher return on its investments in the international business and the cloud business, paving the way for stellar revenue and earnings growth. I do not expect a meaningful improvement in operating margins until FY2025 as the company will have to navigate turbulent economic conditions while continuing to ramp up investments in product development. Alibaba’s stock seems deeply undervalued today, and I believe long-term investors are in for blockbuster gains in the next decade.

Be the first to comment