Sergey Shulgin/iStock via Getty Images

Published on the Value Lab 10/6/22

Evolution AB (OTCPK:EVVTY) offers investors quite a lot in terms of gambling exposures. A superb B2B model with great margins and economics and strong end-markets puts Evolution in an attractive position even in traditionally weak-growth markets. The growth is sustainable and the multiples will come down. The business isn’t completely recession resistant, but there is inelasticity. However, while attractive we continue to prefer Betsson as our online gambling exposure.

Looking at Evolution’s Financials

The company has really good economics. Margins are superb and so is growth. They develop games that are then operated by online gambling operators who face the customer. Betsson (OTCPK:BTSNF) for example has a portfolio of brands that they operate online casinos through, as well as being a software developer for some of the casino backend. However, Evolution makes the games themselves, both live games that simulate a live casino game experience, as well as RNG games that can be played by gamblers alone. They earn commission as a proportion of the winnings of the games operated by customer facing companies.

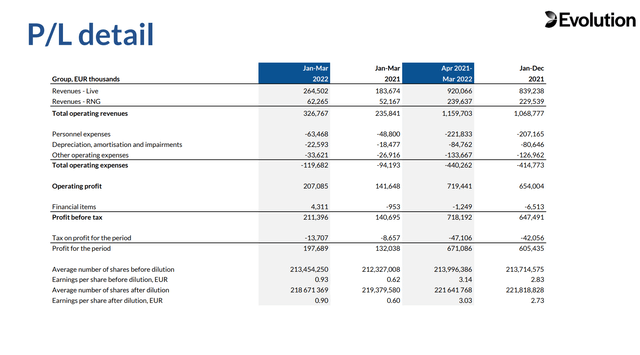

P/L (Q1 2022 Pres)

The ‘selling the picks to the miner’ model really shows with the margins that are above 50% for net income. Headcount has grown YoY by about 2x and the personnel expenses are up, but substantial growth ahead of that has sustained margin growth.

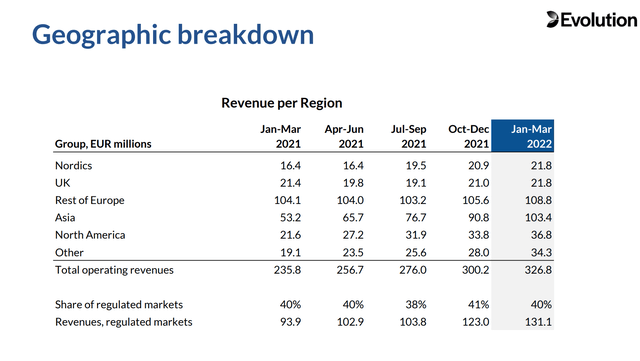

Geographies (Q1 2022 Pres)

Geographic breakdown is important as it gives you a sense of how many unregulated markets they operate in. As markets regulate, disruption ensues in the form of mandated adjustments to games or even the banning of operators who were exploiting a prior grey market. Both of these factors can affect Evolution through the need to adjust the games or the loss of the commission stream from operators, but only 60% of their markets are unregulated which includes plenty of emerging markets where there are bigger fish to fry. This is a relatively alright proportion, but investors should bear the risk in mind.

In fact, regulation of the Dutch market meant Betsson got kicked out, however, Holland is now one of Evolution’s new markets in western Europe which is typically a no growth region. The re-establishing of new players backed by Evolution’s games is a catalyst for the rest-of-Europe exposure and shores up the risk of more regulatory clampdown in markets where Evolution is already an incumbent.

The US Market

The real promise is in the US market, which is a massive longstanding grey market that has recently started regulating on a state-by-state basis creating lots of interesting opportunities. Betsson is working with land-based casinos in Colorado to also launch an online offering in partnership with them, and Entain (OTCPK:GMVHF) has BetMGM which is claiming lots of share and capable of really moving the profit needle once it has matured. Evolution is also launching games as operators pop up in the US, causing the region to be a major source of growth. Revenue has almost doubled YoY, and we are already looking at an NA exposure worth 10% of overall operating revenues. With markets barely penetrated and as more states lay down the regulatory framework for online gambling, things will keep getting better here.

Conclusions

With Asia also being a strong market, and other emerging markets constituting important areas for growth, the 90% growth for the FY 2021 and the 40% YoY growth in Q1 2022 are bringing revenues rapidly forward and driving down an almost 20x multiple. In 2024 the multiple should come down to about 12x constituting an achievable and much more reasonable multiple. While 12x is an alright multiple for a business that serves an inelastic market, we acknowledge two things. For Entain, BetMGM can only really rocket profits up by about 50% as more reasonable levels of penetration are met, so for Evolution to double profits, other markets than the US will have to sustain. While not unlikely, growth needs to remain strong for years in order to arrive at a 12x multiple. So while Entain and Betsson trade at 12x and 9x normalised respectively, and also benefit from similar growth drivers albeit lacking in the same B2B industry positioning and favourable industry structure, a bet on growth is more soundly made with them. On top of recession risks, we already feel we met the quota in our betting exposure and will therefore pass on Evolution despite some of their advantages.

If you thought our angle on this company was interesting, you may want to check out our service, The Value Lab. We focus on long-only value strategies, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our group of buy-side and sell-side experienced analysts will have lots to talk about. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment