Jub Job/iStock via Getty Images

“Half of the people lie with their lips; the other half with their tears“― Nassim Nicholas Taleb

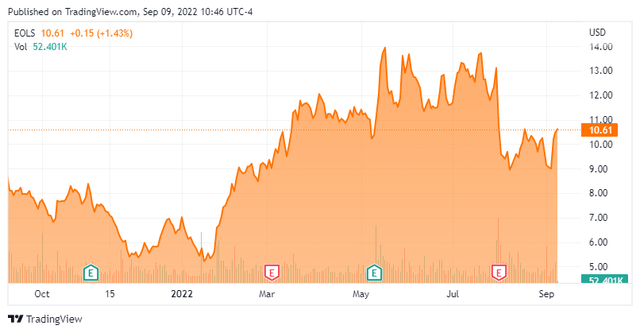

It has been exactly one year since our last look at Evolus, Inc. (NASDAQ:EOLS). This performance beauty company comes up from time to time in comments from Seeking Alpha followers. Since no one has posted any research on it here on Seeking Alpha since our last article, it seemed a good time to revisit this concern and update the investment thesis around it. An analysis follows below.

Company Overview:

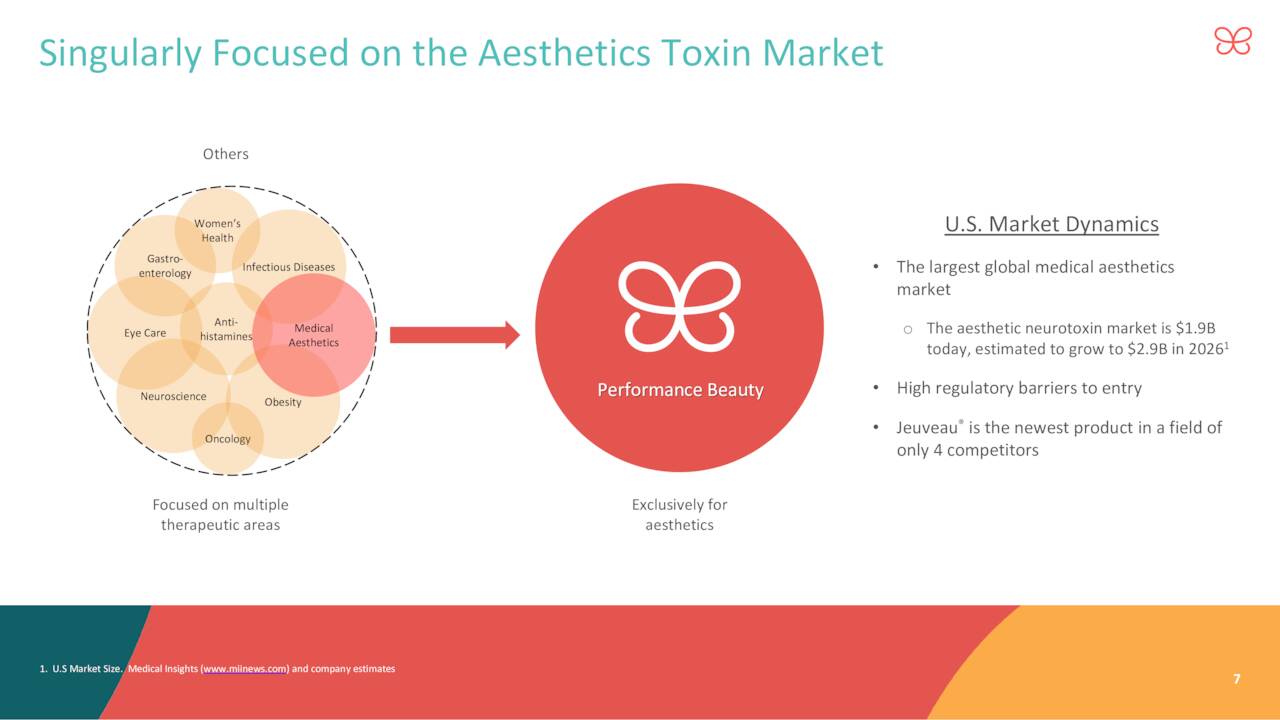

This performance beauty company is based in California and is focused on the aesthetic neurotoxin market, the largest part of the medical aesthetics market. Evolus’ core asset is Jeuveau which was approved early in 2019 for the temporary improvement in the appearance of frown lines. Currently the stock trades around $10.50 a share and sports an approximate market capitalization of $585 million.

May Company Presentation

Recent Developments:

At the end of August, the company welcomed a long time Vice-President of Finance from Experian as its new CFO. The company posted second quarter earnings on August 2nd. Evolus had GAAP loss of 42 cents a share in the quarter, just over a dime worse than the consensus. Revenues rose by more than 40% to $37.2 million, roughly in line with expectations. Most of the increase was driven by volume and a smaller part by a slightly higher average price for Jeuveau. Operating expenses increased 18% on a year-over-year basis to $58.5 million. Customer account rose by 590 in the quarter to 8,100. The reorder rate for Jeuveau continues to run over 70%.

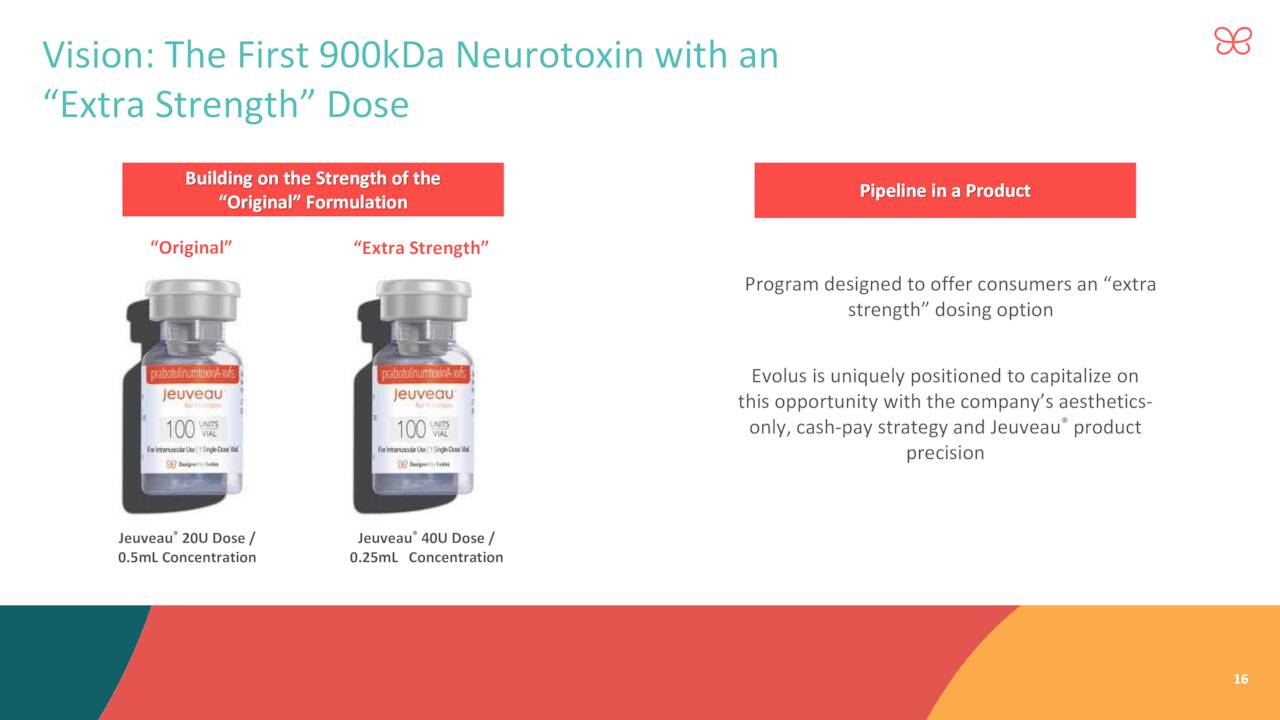

Management reaffirmed its FY2022 net revenue guidance for the upper end of $143 million to $150 million. In addition, the company completed patient enrollment in a Phase II “extra strength” Jeuveau clinical study. This enhanced product would provide the first multi-strength neurotoxin, giving customers and consumers increased treatment options once approved.

May Company Presentation

The company is launching the European version of its product called Nuceiva in England and Germany this quarter. Further European countries and Australia are scheduled to be brought online in 2023.

Analyst Commentary & Balance Sheet:

Since second quarter earnings were posted, four analyst firms including Needham and Mizuho Securities have reiterated Buy ratings on EOLS. Price targets proffered range between $15 and $18 a share.

Two directors bought 30,000 shares in EOLS in aggregate on September 6th. It was the first insider buying in the stock since August of last year. Several other insiders have sold just under $3 million worth of shares so far in 2022. Just over six percent of the outstanding float is currently sold short.

After posting a non-GAAP loss of $14.3 million in the second quarter, the company ended the first half of 2022 with approximately $85 million of cash and marketable securities on its balance sheet. Management has stated that it ‘continues to expect that its existing cash balance will fund current operations through cash flow breakeven.’ The company does have a $50 million tranche on a debt facility it can draw on if necessary. Evolus already has just over $70 million in long term debt.

Verdict:

The current analyst firm consensus is that the company will post a loss of around a buck a share in FY2022 as sales increase just over 50% to $150 million. They expect that loss will be cut substantially to 16 cents a share in FY2023 as revenues grow some 35%.

The company seems to be doing a good job rolling out Jeuveau. Evolus still has plenty of growth opportunities in the States as Jeuveau is still only available to less than one-third of the aesthetic neurotoxin customers in the country.

May Company Presentation

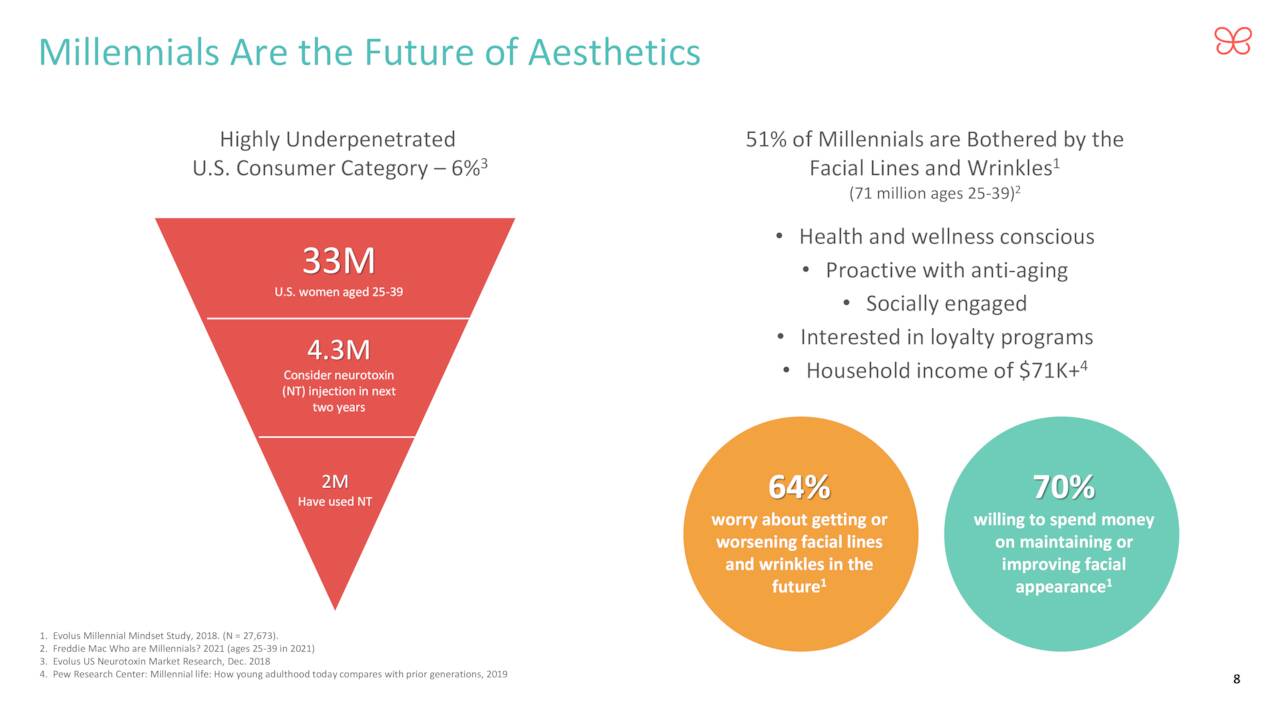

Obviously, a recession could impact sales. However, the aesthetic neurotoxin market continued to grow during the last recessionary period of 2007 through 2009. The only time the market lost ground was during the pandemic lock downs that closed medical facilities. Jeuveau continues to take market share and has an effective loyalty program primarily targeting Millennials.

May Company Presentation

All in all, Evolus appears to have moved itself up to meriting a small ‘watch item‘ holding as the company moves to profitability, which seems likely in 2024. Options are available against this equity and they are lucrative with decent liquidity. Therefore, I plan to take a small position in EOLS Monday via covered call orders so I can keep an eye on this story as it continues to develop.

“You will never get the truth out of a Narcissist. The closest you will ever come is a story that either makes them the victim or the hero, but never the villain.”― Shannon Alder

Be the first to comment