vitranc

The Company

I present to you another compelling “hard money” lender opportunity. You may recall I discussed a somewhat similar mREIT a few weeks ago which was Broadmark Reality Capital Inc. (BRMK). This opportunity is with Sachem Capital Corp. (NYSE:SACH). “Hard money” lending is essentially private equity versus cash flow lending as it focuses on the collateral (what it can realize in the event of default) versus business cash flows which you would tend to see with a chartered bank.

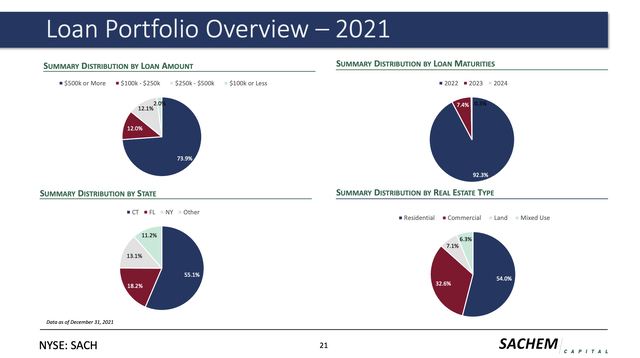

SACH is much more residential focused than its counterpart BRMK with 54% of its portfolio in that space as their loans are focused more on “fix and flip,” construction, or distressed foreclosed loans. They have however diversified into commercial focused loans as a hedge on the residential market as a result of the reliability of cash flow and CAP rate calculations by borrowers and investors. SACH’s loans are typically for the purpose of renovating/converting a property, such as a warehouse to a multi-family unit.

Sachem Capital Corp. (Investor Presentation – August 2022)

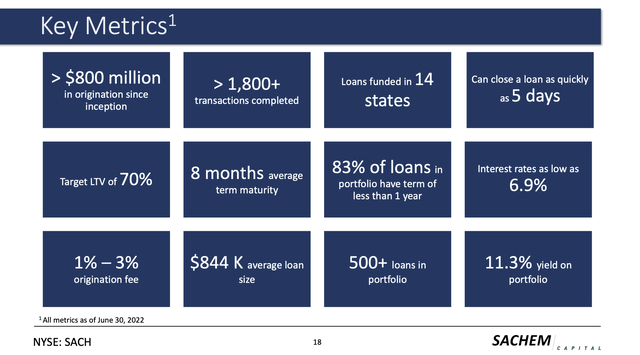

55% of SACH’s loans are in Connecticut but have diversified into Florida, NY, and other states. Although BRMK’s loan sizes tend to be small and they utilize very short maturities, SACH’s loan sizes tend to be even smaller at no more than $1MM and their average term to maturity is only 8 months. SACH can also close a loan in as little as 5 days. SACH’s portfolio yield is about the same as BRMK as they charge similar interest rates and have a 1-3% origination fee. Although BRMK is fairly rigorous in their underwriting process, SACH is even more so as their loans all require personal guarantees and since they do multiple projects for the same developer it is not uncommon for them to cross collateralize security. What this means is if the developer defaults on one loan, all collateral held under the borrower can be seized rather than just the collateral securing the loan in default. As a result, SACH will allow for a slightly higher LTV on their projects at 70% versus 60% for BRMK. Both companies are 100% senior secured.

Sachem Capital Corp. (Investor Presentation – August 2022)

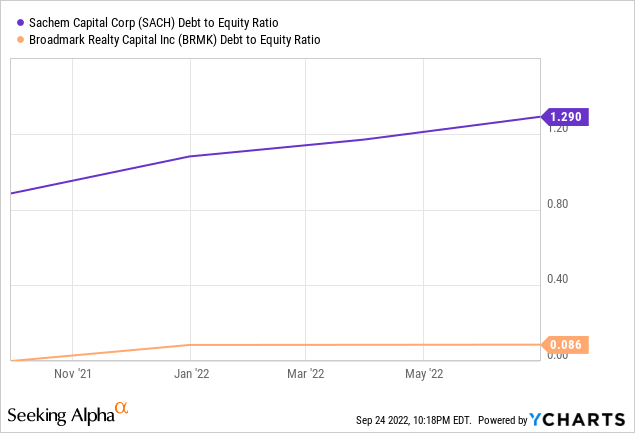

SACH is a fair bit more leveraged than BRMK, but it did take a tremendous job over the last year at issuing new unsecured fixed-rate notes at rates of 6-7.2% which is lower than they would get today. Nothing comes due until at least 2024. Therefore, rising interest rates should actually be more of a tailwind than a headwind as they can keep underwriting new loans at higher rates as they come off the books within one year of underwriting while their current interest expense will remain largely unchanged for the next four to five years.

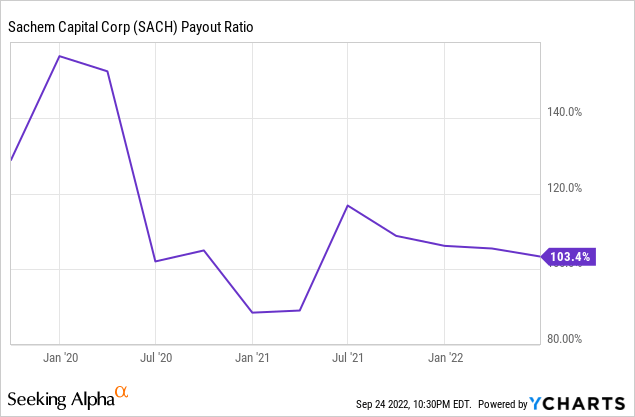

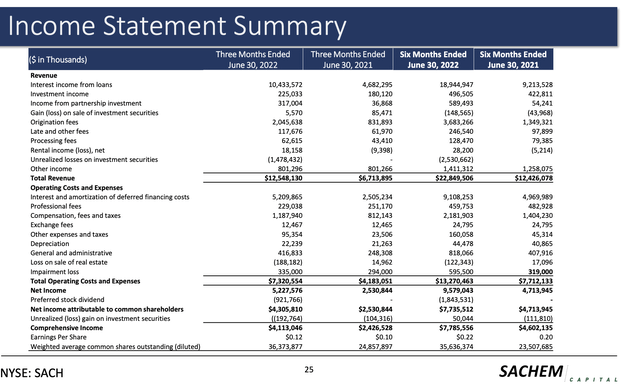

The Dividend

Much like BRMK the common dividend coverage has been a concern for some time. Even when adding back the $2.5 Billion YTD unrealized losses on investment securities and $595MM impairment loss, dividend coverage is at ~93% on the $0.14/share quarterly dividend, which was recently announced. This is still much more preferable than BRMK’s 130% payout ratio but is not low for a REIT.

Sachem Capital Corp. (Investor Presentation – August 2022)

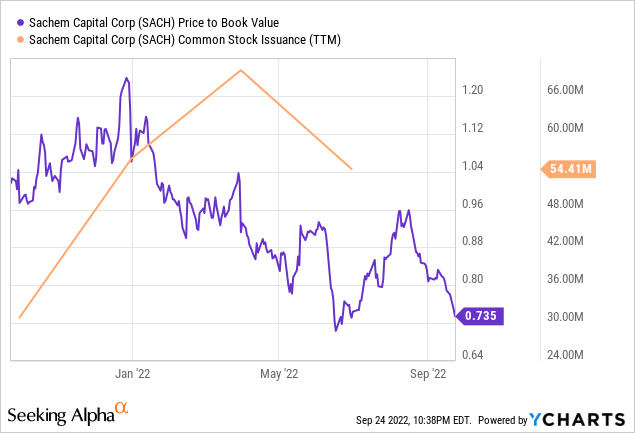

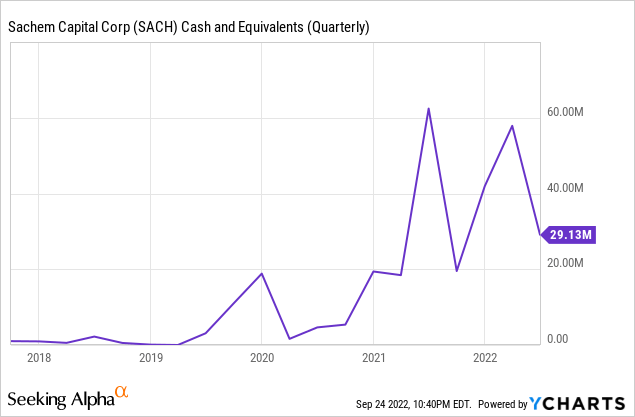

Management stated last year that they expected net income to cover the common dividend by 2022 YE. They made the prudent decision of issuing shares in 2021 and early 2022 when the share price traded at a premium to book value as they now have $29MM in cash.

In June 2021, SACH sold a total of 1.70 million shares of preferred stock with a 7.75% dividend which are the 7.75% Series A Cumulative Redeemable Preferred Stock (NYSE:SACH.PA). SACH raised $45.5 million in new capital net of fees. SACH also sold a total of 6.10 million shares of common stock in 2021 for $30.88 million in proceeds. SACH also sold two new note offerings. In early December 2021, Sachem raised $43.3 million in net proceeds from the sale of 6.0% notes due in 2026 and then in March 2022, an additional $48.2 million net of fees was received from these sales and the notes do not mature until 2027. The result of issuing new capital at favourable prices has kept TBV intact unlike BRMK which has seen their TBV drop in recent months as a result of the aggressive dividend.

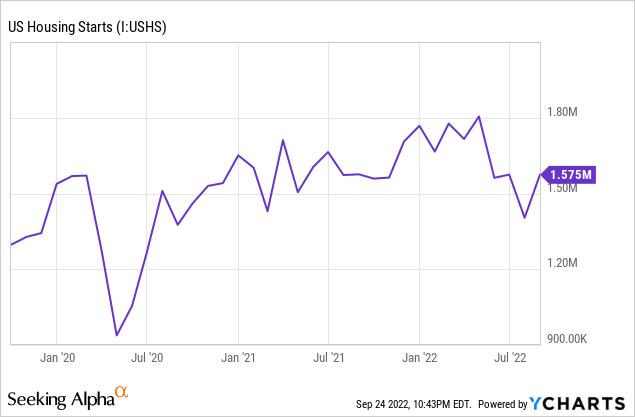

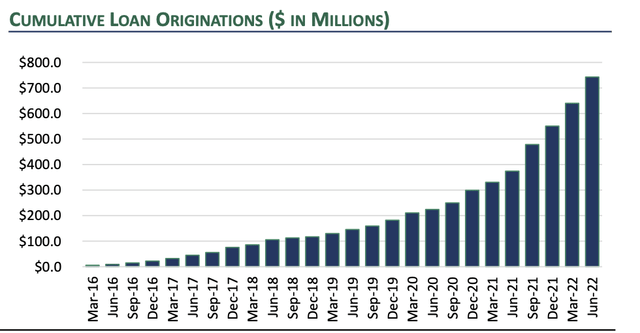

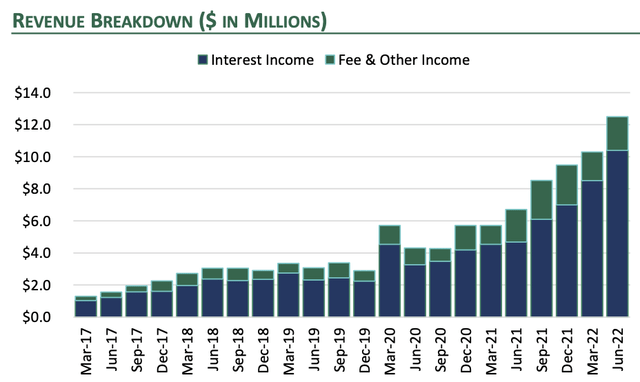

U.S Housing starts have begun to drop to their lowest levels since 2020 as interest rates have begun to inflict their pain on the market. Unlike BRMK however, we have not seen originations and their revenue drop yet and their default rate has remained a ~3% as of Q2 2022 which is in line with their 2021 YE default rate and the value of owned real estate has remained in line with YE.

Sachem Capital Corp. (Investor Presentation – August 2022)

Sachem Capital Corp. (Investor Presentation – August 2022)

The 7.75% Series A Cumulative Redeemable Preferred Stock has covered ~7x by net income when adding back non-cash expenses, the loan book could fall more than 50% and the preferred dividend could still be covered. The shares are also cumulative so payments cannot be suspended unless the common dividend is cut. The stock is not redeemable until June 2026 and is redeemable at liquidation preference of $25/share. At the current price of $21.30/share the Yield to Call is ~12.4% relative to the ~14% yield on the common stock. Sacrificing even 200 bps seems like a fair price to pay for the elevated protection of a dividend cut and capital loss. Although the shares are convertible, I have chosen not to discuss the conversion rates as they are not much of a factor with SACH’s current share price.

Concluding remarks

Although SACH has done all the right things and is well capitalized as the overall housing market has begun to show some weakness, we cannot ignore the fact that this is a tough business and management must take a much more conservative approach in assessing property values which will almost certainly slow loan book growth. This will result in some further impairment charges which we are already seeing and weakened coverage of the common dividend which is already precarious. The company is internally managed with long-term thinking and exactly who we want lending for us. The company has a board that reviews loans over $5MM, utilizes 3rd party national vendors for appraisals, and has an internal audit committee as a second level review pre-funding. Therefore, the preferred shares should provide stable double-digit returns over at least the next four years.

Be the first to comment