marchmeena29

Introduction

EVERTEC (NYSE:EVTC) has fallen 33% YTD, and the state of Latin America’s economies has left many investors fearful as they have rotated out of growth stocks. However, I believe that EVERTEC has been resilient as they continue to produce solid financial results and its valuation remains attractive.

Company and Market Overview

EVERTEC, a Caribbean and Latin American-based electronic transactions company, provides merchant acquiring, payment processing, and business management services. About 48% of its revenue revolves around managing a system of electronic payment networks in which the company collects fees for various transaction/processing services. The other 52% of revenue stems from a mix of providing customers with “mission-critical” business solutions and charging various fees to merchants. Customers tend to choose EVERTEC for their ability to supply a thorough set of services without having to subcontract different providers-making managing businesses simpler with its payment and solution resources.

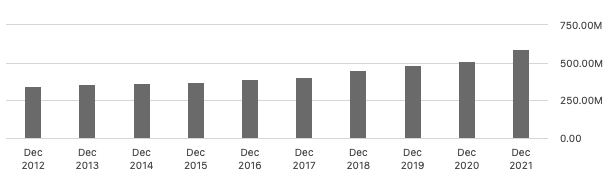

Currently, the Latin America digital payments market is worth $153Bn, with EVERTEC holding about 0.4% in market share. The market is estimated to grow at a 15.74% CAGR to $318.07 Bn by 2027 as e-commerce has massively expanded in Latin America during the pandemic while consumers are adapting to digital payments.

Rough Earnings

Recently, as Q2 2022 came to a close, EVERTEC reported a revenue of $161M which exceeded estimates by $11M and grew 8% YoY. EPS is reported to be at $0.65 and missed analyst estimates by $0.01, representing a 17% YoY decrease. For FY 2022, management projected a total revenue growth of only 3-4% YoY.

Seeking Alpha

Sound Fundamentals

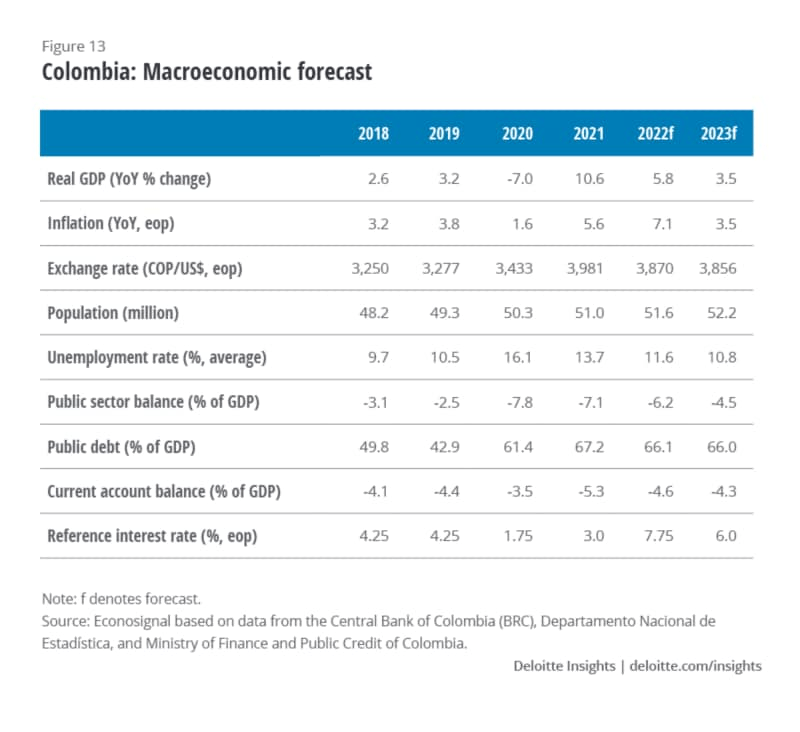

It is not a surprise that investors have sold off EVTC given the state of Latin America’s economy. High governmental spending during COVID-19 has led to governmental debts reaching 71.6% of GDP in 2021. According to the World Bank’s development indicators, Latin America’s unemployment rate was 9.9% in 2021 and is still up 2% compared to 2019. Both of these factors combined with rising inflation felt around the world are all inhibitors for the business.

Deloitte

However, EVERTEC has managed to effectively grow and strengthen their balance sheet. Their total debt first decreased by 4% while revenue from merchant acquiring grew 1%, payment services 19%, and business solutions 7%. Also, with an increase of $25M, EVERTEC’s overall cash balance also grew 8% since the start of 2022. Management remains positive on outlooks because of the recent recovery in travel and tourism as in Puerto Rico (where most of the company’s operations are based), the unemployment rates have been favorable. Management further reports in their Q2 2022 call that “The unemployment rate has also dropped to 6.6% in 2022, down from 8.1% in 2021, and this is the lowest unemployment rate in Puerto Rico in over 60 years.”

Stock Buyback

EVERTEC is currently carrying out a buyback program, with plans to repurchase a total of $100 million worth of shares. The company’s Board of Directors authorized this program in December 2020 and plan to continue it through December 2023. I believe that management beginning this program amidst these uncertain times signals to me their continued confidence in effectively enduring the macroeconomic conditions and their future prospects.

Valuation

In order to price in all of EVERTEC’s growth potential while remaining conservative, I set out to predict its market value in 2027. Assuming it retains its 0.4% market share, using the predicted market size in 2027 yields $1.274 billion in revenue. Using its historical pandemic low p/s ratio of 4.2x (just to stay conservative), that leaves its market capitalization at $5.35 Bn. Discounting it back with an 8.5% discount rate yields a target market capitalization at $3.56 Bn, a 52.4% upside.

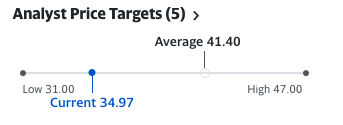

My price target also is not far off from other Wall Street analysts, with the average price of $34.97 (an 18.3% upside).

Yahoo Finance

Conclusion

Although EVERTEC is facing headwinds from the weakness of the Latin American economies, the company has remained resilient. I believe that tailwinds like the recovering unemployment rates, general trend of digital payments adoption, combined with its attractive valuation, make EVTC a “Buy”.

Be the first to comment