Win McNamee

Eurofins Scientific (OTCPK:ERFSF) has been active on the M&A front. Most recently, the company announced its first material buyback program involving the repurchase of up to 2% of its share capital (equivalent to ~4m at the time of announcement). This follows Eurofins’ divestment of its Digital Testing business at a favorable valuation, another important milestone in the company’s capital allocation journey. With ~EUR220m of capital freed up, the company has ample runway to fund its mid to long-term priorities, either via acquisitions to build its leadership in bio-analytical testing and other life science areas or by ramping up capex for laboratories and accelerating firm-wide digitalization.

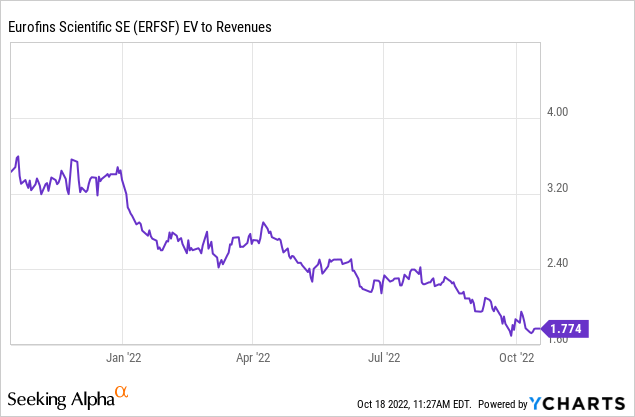

As its solid Q3 2022 trading update confirmed, Eurofins’ mid-term organic growth target remains firmly intact, given its leading competitive position across end markets such as Food, BioPharma, Environmental, and Clinical Diagnostics. Net, Eurofins screens as one of the better-positioned players in the space heading into the coming macro turbulence; the stock is down to ~1.8x EV/Revenue as well and looks attractively priced at current levels.

Unveiling a New Stock Buyback Program

Eurofins has announced its intention to buy back stock amounting to a maximum of ~2% (or ~4m) of its share capital over a maximum twelve-month period. Per the buyback terms, the company will have the mandate to buy back an initial ~0.5% of the share capital or ~1m of stock (i.e., the first tranche) over a maximum duration of two months before completing the rest of the program over the following ten months. Of note, this is the first time Eurofins has launched a material buyback program. Coming on the heels of a meaningful YTD decline in the stock price, though, the announcement makes sense and will be well-received by investors. In addition to potentially driving additional returns to shareholders, the repurchased stock will be used to hedge any dilution from the company’s long-term incentives (LTIPs). Alternatively, the shares may also be canceled or partially allocated to accretive growth acquisitions over the coming months.

Freeing Up Capacity with Digital Testing Divestment

The buyback announcement comes right after Eurofins’ agreement to divest its Digital Testing business to private equity firm Stirling Square Capital Partners for EUR220m in cash. For context, the business, established in 2015, is involved in global testing and quality assurance, as well as the technical analysis of digital systems and cyber security, among others. Completion of the transaction remains subject to approval from the regulators but should face limited hurdles heading into the targeted year-end close.

Financially, Digital Testing contributes a modest ~1% to group-wide revenue (based on reporting for the last fiscal year) and employs >600 staff. Using the FY21 revenue base, the EUR220m price tag would imply a favorable EV/Sales valuation of >3x, well above the 1-2x trading multiple for the Eurofins group. The divestment proceeds should help support its mid to long-term capital allocation priorities as well – these include lab-driven capex and ongoing digitalization efforts, along with growth acquisitions to strengthen the company’s competitiveness in bio-analytical testing and other key life science areas. Importantly, this is Eurofins’ first material divestment in years, representing a clear statement of intent on the capital allocation front.

Margin Concerns Likely Overblown

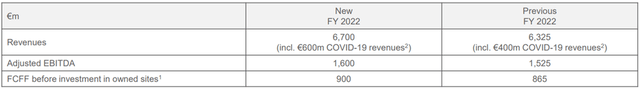

While Eurofins’ in-line H1 report and solid Q3 trading update saw steady organic growth across the board, the market likely remains skeptical about the path of EBITDA margins for the company in the coming quarters. Recall that the current fiscal year guidance implies further expansion to an ~24% margin, which is well above the ~20% pre-COVID. Still, context is important here – Eurofins suffered a significant ransomware attack in 2019, which likely dragged down the headline margin; on a normalized basis, pre-COVID margins would have been closer to ~22%. In essence, the implied 24% margin for 2022 implies a manageable ~200bps expansion from 2019 levels – modestly above the historical >110bps expansion over the 2013-2018 period. The absence of major capex outlays should further accelerate the company’s path to achieving near-term guidance, while in the long run, its lab-based business model offers ample room for operating leverage benefits.

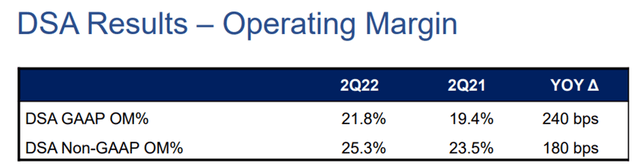

The read-through from key peer Charles River’s (CRL) disappointing Q2 is also worth noting, in my view. Despite the headline miss, the Discovery and Safety Assessment segment (i.e., a close comparable to Eurofins’ business) saw ~13% organic growth (in line with prior expectations) while the segment adj operating margin also expanded to ~25%. Plus, management guided for the full-year segment margin to further improve (in line with prior commentary), supported by stronger pricing on the Safety side (directly relevant for Eurofins), and continued ~20% organic growth rate in H2 2022. All in all, the reiterated CRL guidance bodes well for Eurofins heading into the back half of the year.

Positive Capital Allocation Shifts Reinforce the Bull Case

Eurofins has been making all the right moves in recent weeks, initiating a major divestment and buyback program for the first time. Both represent important evolutions in the company’s capital allocation process while balancing a focus on strategic priorities over the mid to long-term. Heading into the back half of the fiscal year, the secular growth drivers in Eurofins’ end markets remain intact and should support the mid-term organic growth target of >6%. Plus, markets like Food, BioPharma, Environmental, and Clinical Diagnostics tend to be more resilient to economic shocks, and thus, Eurofins is one of the more well-positioned players in the space. For a quality, steady single-digit grower, the stock’s current valuation is very reasonable, offering ample upside to patient investors with a long-term horizon.

Be the first to comment