EURO FORECAST & EUR PRICE ANALYSIS POST-ECB MEETING: EUR/USD, EUR/GBP, EUR/CAD & EUR/AUD

- The Euro has ripped higher over the last two trading sessions

- EUR price action is getting a boost from ramped up ECB stimulus measures targeted at countering the coronavirus recession

- EUR/USD recovery threatened by resistance as trader sentiment sours, but the recent advance by EUR/GBP, EUR/CAD an EUR/AUD could continue

The Euro has strengthened considerably over the last two trading sessions. EUR price action since Thursday has largely dominated the direction of major currency pairs. Upside recently recorded by the Euro against its USD, GBP, CAD and AUD peers seems driven mostly by market participants reacting to the latest European Central Bank update.

Recommended by Rich Dvorak

Forex for Beginners

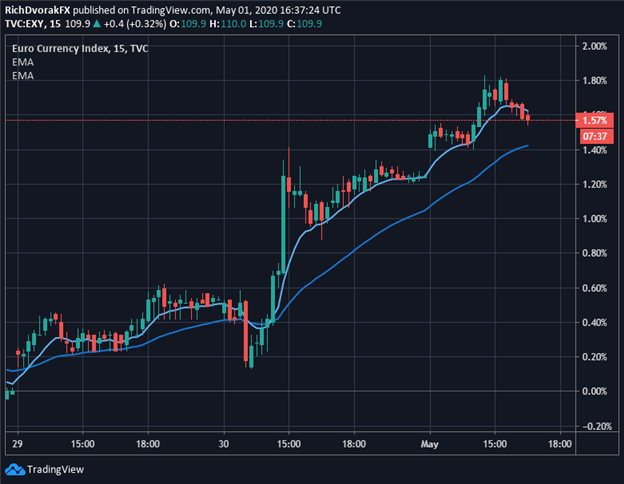

EURO CURRENCY INDEX PRICE CHART: 15-MINUTE TIME FRAME (29 APRIL TO 01 MAY 2020)

Euro bulls have rejoiced expanded ECB measures set forth to counter a slump in the Eurozone economy, which has deepened exponentially over the last three months amid the coronavirus pandemic. The Euro Currency Index now trades about 1.5% higher since the March 28 close and broadly reflects the advance printed by EUR/USD price action, as well as the jump in EUR/GBP, EUR/CAD and EUR/AUD. That said, on the back of the ECB meeting, can Euro strength continue as traders turn their calendars to the new month?

Recommended by Rich Dvorak

Trading Forex News: The Strategy

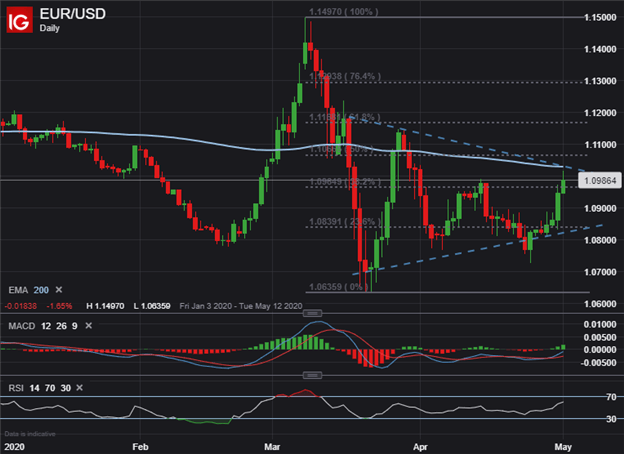

EUR/USD PRICE CHART: DAILY TIME FRAME (03 JANUARY TO 01 MAY 2020)

EUR/USD upward momentum has accelerated over the last two days and is reflected by bullish divergence on the MACD indicator. The Euro spiked by about 130-pips against its US Dollar peer as EUR/USD, arguably the most popular currency pair, attempts to rebound from three-year lows.

| Change in | Longs | Shorts | OI |

| Daily | -5% | 12% | 5% |

| Weekly | -19% | 6% | -5% |

The bounce-back attempt by the Euro may prove short-lived, however, considering it is likely that demand for safe-haven currencies, such as the US Dollar, may resurface and spark another aggressive selloff in spot EUR/USD price action.

EUR/GBP PRICE CHART: DAILY TIME FRAME (24 JANUARY TO 01 MAY 2020)

EUR/GBP price action is rocketing higher as the Euro catches bid against the Pound Sterling near a huge level of confluence noted by the 200-day exponential moving average around the 0.8700 handle. This area of technical support could continue bolstering spot EUR/GBP going forward. At the same time, technical resistance highlighted by the 23.6% Fibonacci retracement of the latest bearish leg could hinder a protracted advance.

| Change in | Longs | Shorts | OI |

| Daily | -20% | 4% | -10% |

| Weekly | -34% | 3% | -21% |

EUR/CAD PRICE CHART: DAILY TIME FRAME (03 FEBRUARY TO 01 MAY 2020)

Euro outlook against the Canadian Dollar and Australian Dollar also hints at potential for further strength. After probing a critical technical support level outlined in this Canadian Dollar forecast, EUR/CAD has exploded since last Wednesday as the Euro rockets higher. Spot EUR/CAD could continue climbing in light of recent dovish commentary from the Bank of Canada, which adds to downside risk facing CAD price action due to crude oil demand woes.

Recommended by Rich Dvorak

Traits of Successful Traders

EUR/AUD PRICE CHART: DAILY TIME FRAME (03 JANUARY TO 01 MAY 2020)

EUR/AUD shows potential to extend its advance as well, particularly in consideration of this Australian Dollar forecast, which outlines major fundamental threats faced by the pro-risk Aussie. On that note, spot EUR/AUD price action looks like it may have already begun a topside breakout after eclipsing its bearish trendline extended through the series of higher lows since mid-March.

— Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight

Be the first to comment