EUR/USD Rate Talking Points

The recent rally in EUR/USD appears to be sputtering ahead of the yearly high (1.1222) as the European Central Bank (ECB) shows a greater willingness to combat the coronavirus, and the Relative Strength Index (RSI) may highlight a similar dynamic if the oscillator fails to push into overbought territory.

EUR/USD Rally Sputters as ECB Prepares to Combat Coronavirus

EUR/USD struggles to extend the series of higher highs and lows from the yearly low (1.0778) as ECB President Christine Lagarde issues a statement regarding COVID-19 and insists that the Governing Council stands “ready to take appropriate and targeted measures” that would support the Euro area economy.

The statement coincide with a recent speech by VicePresident Luis de Guindos, with the Governing Council official endorsing a dovish forward guidance as the central bank remains prepared to “adjust all its instruments, as appropriate, to ensure that inflation moves towards its aim in a sustained manner.”

The remarks suggest the ECB will take additional steps to achieve its one and only mandate for price stability even though the central bank expands its balance sheet by EUR 20B/month, but it remains to be seen if the Governing Council will implement lower interest rates as President Lagarde and Co. remain reluctant to push the main refinance rate, the benchmark for borrowing costs, into negative territory.

In turn, the Governing Council may continue to rely on non-standard measures to mitigate the downside risks surrounding the monetary union, and the Euro may face headwinds ahead of the next ECB meeting on March 12 as the central bank shows a greater willingness to push monetary policy into uncharted territory.

With that said, the recent rally in EUR/USD appears to be stalling ahead of the 2020 high (1.1222) as it struggles to extend the series of higher highs and lows from the yearly low (1.0778), and the Relative Strength Index (RSI) may highlight a similar dynamic if the oscillator fails to push into overbought territory.

Recommended by David Song

Forex for Beginners

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss key themes and potential trade setups surrounding foreign exchange markets.

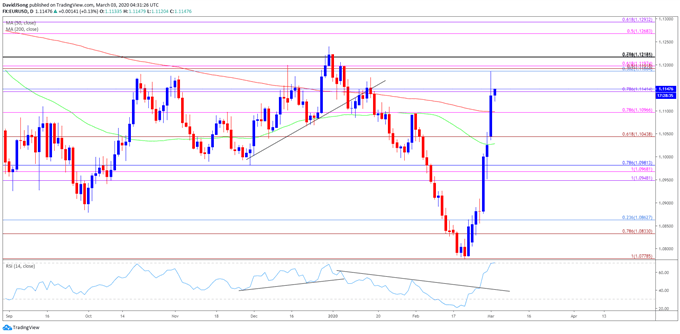

EUR/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the monthly opening range has been a key dynamic for EUR/USD in the fourth quarter of 2019 as the exchange rate carved a major low on October 1, with the high for November occurring during the first full week of the month, while the low for December happened on the first day of the month.

- The opening range for 2020 showed a similar scenario as EUR/USD marked the high of the month on January 2, with the exchange rate carving the February high during the first trading day of the month.

- With that in mind, the opening range is in focus for March, but the recent recovery in EUR/USD appears to be sputtering ahead of the 2020 high (1.1222) as the exchange rate struggles to extend the series of higher highs and lows from the yearly low (1.0778).

- The Relative Strength Index (RSI) may highlight if the oscillator fails to push into overbought territory.

- The failed attempt to break/close above the Fibonacci overlap around 1.1190 (38.2% retracement) to 1.1220 (78.6% retracement) may push EUR/USD back below 1.1140 (78.6% expansion), with the next area of interest coming in around the 1.1100 (78.6% expansion) handle.

- Need a move below 1.1040 (61.8% expansion) to open up the overlap around 1.0950 (100% expansion) to 1.0980 (78.6% retracement), with the next area of interest coming in around 1.0830 (78.6% expansion) to 1.0860 (23.6% retracement).

Recommended by David Song

Traits of Successful Traders

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

Be the first to comment