POUND STERLING TALKING POINTS

- ECB rate decision skewed towards more aggressive path.

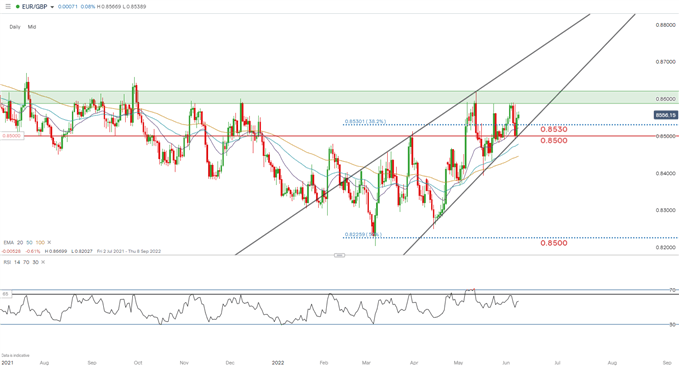

- Attention on rising wedge pattern.

EUR/GBP FUNDAMENTAL BACKDROP

EUR/GBP looks ahead to the ECB rate decision (see calendar below) for guidance. Markets have been expectant of a more hawkish ECB by way of possibly opening up the possibility for a 50bps rate in in their next meeting in July. Should this come to fruition we would likely see the euro strengthen while an ECB that maintains its current stance will weigh on the EUR across the board. This hawkish prospect stemmed from strong eurozone GDP data along with the persistent long-term inflationary pressure.

EUR/GBP ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

EUR/GBP DAILY CHART

Chart prepared by Warren Venketas, IG

EUR/GBP price action continues to trade within the developing rising wedge chart pattern (black) which could break through wedge support should the ECB release a dovish statement. This is unlikely in my opinion leaving the green inflection zone in focus short-term.

Key resistance levels:

- Resistance zone around 0.8600 (green)

Key support levels:

- 0.8530

- 20-day EMA (purple)

- 0.8500

BULLISH IG CLIENT SENTIMENT

IG Client Sentiment Data (IGCS) shows retail traders are currently LONG on GBP/USD, with 54% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment however, recent changes in long and short positioning result in an upside bias.

Contact and follow Warren on Twitter: @WVenketas

Be the first to comment