Last week investors were on a full-panic mode, unloading equities rapidly, causing the market to have its worst week since the 2008 financial crisis. Despite such a sell-off, Etsy’s (ETSY) shares surged, after the company reported an excellent quarter.

Growth accelerates

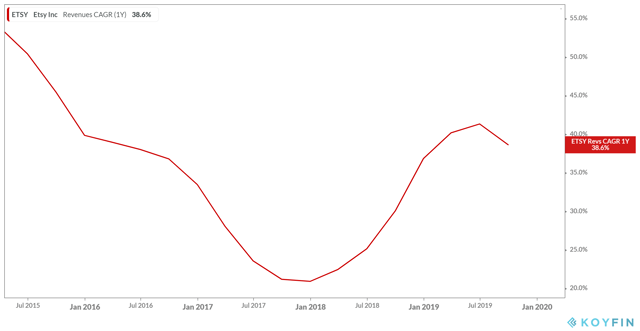

What is noteworthy about Etsy’s revenue growth is that it has gone back into accelerating, after taking a dip during FY2018. Etsy’s sales CAGR (1Y) has been an impressive 38.6% over LTM (Last Twelve Months), after taking into account Q4, in which the company grew its sales by a considerable 35%. Etsy’s growth is led by the company’s multiyear strategy, which includes providing an ambitious platform, revolutionary marketing tools, and technology, in a five-year road map through 2023. Management seems to be pleased with the progress so far.

Etsy’s growth is led by the company’s multiyear strategy, which includes providing an ambitious platform, revolutionary marketing tools, and technology, in a five-year road map through 2023. Management seems to be pleased with the progress so far.

The accelerated revenue growth shown above could not have been materialized without increased volume. GMS (Gross merchandise sales) reached a record high of $1.65B during the quarter, taking advantage of the holiday period from Thanksgiving through Cyber Monday. Management stated that volume was up 30% compared to the same period last year, driven primarily by product launches and their investment in marketing channels.

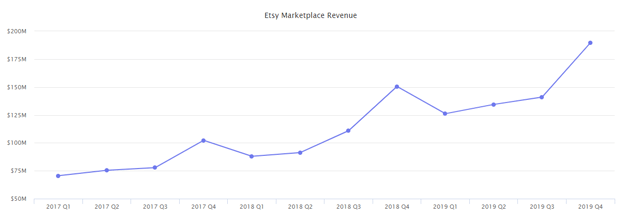

The company’s total revenue can be split into two categories: Marketplace and Services.

Marketplace

Marketplace revenue grew by 25.3% and accounted for ~70% of the total turnover. This segment represents the fees Etsy charges sellers to list items in the marketplace, the fees the company charges for transactions between buyers and sellers, and the use of Etsy Payments by sellers to process payments. While the division is on the lower-growth side of sales, there are lots to be excited about, such as the company’s free shipping initiative. Source: Marketplace Pulse

Source: Marketplace Pulse

Etsy’s data had shown that buyers are more likely to buy items that are listed with free shipping included. High shipping prices would often deter shoppers from completing their purchases. Last summer, Etsy unveiled its plans to make free shipping a core part of the Etsy shopping experience. The company is now providing sellers with tools and support to help them guarantee free shipping to U.S. buyers who spend at least $35 in their shop.

As of the latest report, management is pleased with that initiative, seeing improved dynamics in the marketplace. As of the end of the year, 65% of U.S. buyer GMS shipped for free, 74% of U.S. listing views were eligible to ship for free, and 48% of orders were delivered with free shipping.

Services

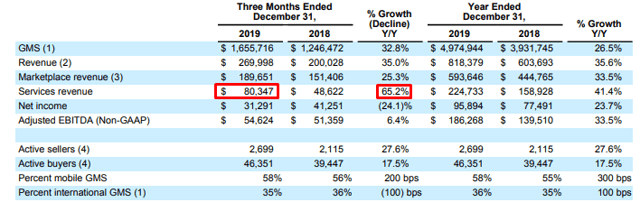

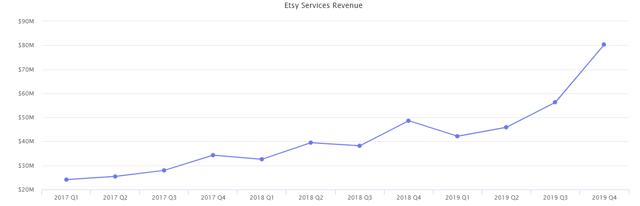

While the marketplace’s growth driven by increased sales volume is pleasant, what I find more interesting is the red-marked segment below, called “Services revenue”. Services revenue, formerly called Seller Services revenue, is derived from the optional services Etsy provides to sellers, which include Promoted Listings, Etsy Shipping Labels, and Pattern by Etsy. This segment grew by 65.2% and is increasingly becoming a more significant part of Etsy’s total sales. Services for the three months ended accounted for ~30% of turnover, vs. ~22.5% in the year before.  Source: Earnings report

Source: Earnings report

Looking into the future, in the second quarter of 2020, Etsy is planning to launch a new advertising service for Etsy sellers, called Offsite Ads. The company will pay the upfront costs to promote its sellers’ listings on multiple internet platforms, without any upfront costs for sellers. When a shopper clicks on an online offsite ad highlighting a seller’s listing and purchases from their shop, the seller will pay Etsy an advertising fee on that order – only when the sale is completed. I believe that this move is an excellent way to incentivize sellers to be more active, leading to further listings, and as a result, an increase in sales.

In my view, such optimizations by Etsy are very beneficial and create a smooth experience for both buyers and sellers. With the tools introduced for free shipping, as well as the upcoming boost on listings by Offsite Ads, Etsy’s growth is building a robust revenue ecosystem. Not only services revenues will grow faster by the Offsite Ads program, but its sequence of increased listings and GMS growth will drive the marketplace revenues as well.

As you can see, revenues from services have more than tripled over the past three years. Should this rate of growth continue, services will soon become the leading source of revenue, leaving the marketplace one behind.

Source: Marketplace Pulse

FY2020 Outlook and valuation

First, a note in terms of the company’s profitability.

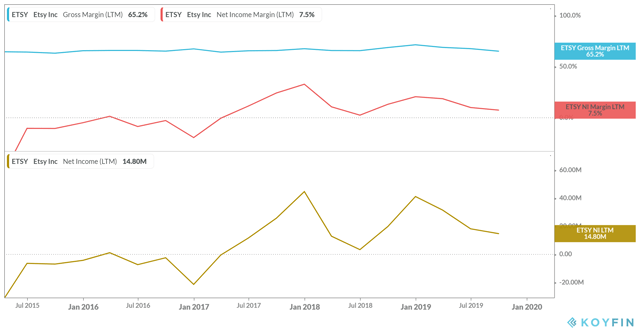

What’s very important for Etsy in terms of being a sustainable investment is its profitability. Burning cash for growth is a valid strategy, but strong free cash flow generation should eventually be the goal. Etsy’s balance of considerable growth, along with a healthy bottom line, makes for a great combo. Knowing that the company will not need to issue further share to fund its operations is particularly comforting, especially in times of uncertainty.

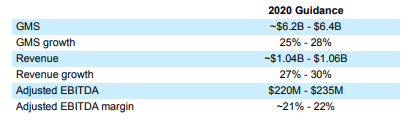

Etsy’s gross and net margins were 65.2% and 7.5% as of last quarter, respectively. The company has been consistently profitable over the past three years. For FY2020’s guidance, Mr. Silverman, Etsy’s CEO, mentioned that the company entered the year with great momentum, poised for further growth. Revenue is expected to be between $1.04B and $1.06B, an increase of 27%-30%, and Adjusted EBITDA of $220M – $235M, an increase of ~21% – 22%.

For FY2020’s guidance, Mr. Silverman, Etsy’s CEO, mentioned that the company entered the year with great momentum, poised for further growth. Revenue is expected to be between $1.04B and $1.06B, an increase of 27%-30%, and Adjusted EBITDA of $220M – $235M, an increase of ~21% – 22%.

Mr. Silverman also noted that the company is unable, at this time, to provide GAAP targets for net income margin for 2020 because of uncertainties such as provision or benefit for income taxes and foreign exchange gain or loss, which may have a significant impact.

While Etsy’s EBITDA and net income margins are almost identical over the past three years, to use the projected EBITDA 21% as an approximation for FY2020’s net margins, would not be prudent. Instead, let’s remain with the existing last-twelve-month net income margin of ~14%, to reflect the CEO’s concerns as well. Using the mid-range guidance of $1.5B in revenues, the company’s net earnings should be ~$147M, at a 14% net profit margin. This represents an increase of ~55% over last year’s profits of $95.8M. At ~118M shares outstanding, that should represent FY2020 EPS of ~$0.8. As of Friday’s closing price of $57.81, Etsy is trading at ~72 times its forward earnings.

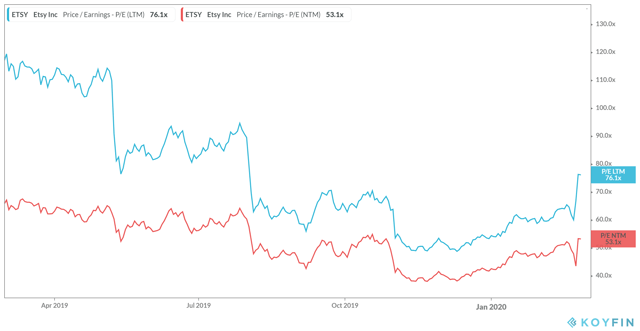

However, since Etsy has been historically beating its estimates, and since we used a conservative net income margin approach, the actual number should be even more optimistic. Indeed analysts expect FY2020 EPS of $1.03. At this amount, Etsy is currently trading at 53.3 times its forward earnings.  In my view, while the valuation is certainly not cheap, considering Etsy’s growth, new initiatives, and consistent profitability, the stock remains attractive, even after its recent climb. Moreover, the stock is trading near historic lows in terms of its multiples, further encouraging an entry, recognizing its acceleration in sales.

In my view, while the valuation is certainly not cheap, considering Etsy’s growth, new initiatives, and consistent profitability, the stock remains attractive, even after its recent climb. Moreover, the stock is trading near historic lows in terms of its multiples, further encouraging an entry, recognizing its acceleration in sales.

Risks

The most concerning risk for Etsy is competition. As online shopping grows, so do the aggregate players. While Etsy focuses on the handmade, customized, niche items that shoppers cannot find in, say Amazon (AMZN), there are dozens of marketplaces with similar characteristics. Some of them are Zazzle, ArtFire, UncommonGoods, and more. While none of them has reached the scale of Etsy, they could arise as a potential threat in the future. Until then, Etsy is well-positioned, growing rapidly, and can always leverage its public listing to raise more cash through equity/debt, that these other platforms probably lack.

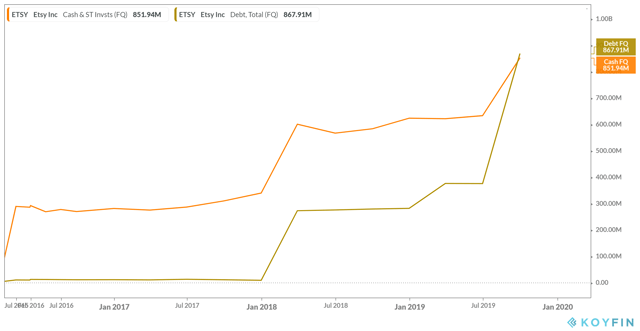

Moreover, another potential issue is the company’s debt. The company’s cash position has grown significantly, but that’s only because of its $650 Million convertible senior notes offering.

Since the notes are convertible, the interest is a meager 0.125%. The initial conversion rate will be 11.4040 shares of Etsy’s common stock per $1,000 principal amount of notes (equivalent to an initial conversion price of approximately $87.69 per share). The initial conversion price of the notes represents a premium of roughly 52% over the stock’s current price. The notes will be convertible into cash, shares of Etsy’s common stock or a combination of cash and shares of Etsy’s common stock, at Etsy’s election.

While cash flow from operations should be more than enough to cover these notes, the real risk comes from diluting existing shareholders, amid conversion. However, assuming Etsy successfully executes its investments, said dilution should be well worth it.

Finally, entering into a recession which could decrease consumer spending may also be a potential threat to the company’s top and bottom line.

Conclusion

Etsy remains a compelling investment. The growth is robust, and its acceleration is plenty to keep investors excited. I view Etsy’s current price as a great entry point, despite its recent rally after its exciting earnings report. The valuation is fair, even on conservative, unchanged net income margins. While risks such as competition and a potential dilution could materialize, Etsy’s presence in the online-shopping world is only getting stronger. Should consumer spending continue being ample, Etsy should keep thriving. Looking forward, investors should be excited about Etsy both for its trajectory against a slowdown, as well as its consistent generation profits.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment