chaofann/iStock via Getty Images

One month ago, Etsy, Inc. (NASDAQ:ETSY), an online marketplace for unique items, posted its Q3 results, which showed good performance under current market conditions. Although many believe the e-commerce company is overvalued with little room to grow due to its overvalued PEG ratio of 3.79. If we look at the last six months of trading, we see the company has rewarded investors with returns of 61.05%. The stock price has also reached much higher levels in previous years. From November 2020 to the end of January 2022, the stock remained above $140 per share, with a peak value of $294.48.

6 month stock trend (SeekingAlpha.com)

One key growth driver is the increase in its transaction fee, while retaining its seller base of at least 5.3 million. The company has increased its cash flows year on year and has good profitability, although we have seen losses this past quarter due to a sizeable one-off goodwill expense of $1 billion in impairment charges dedicated to the international acquisition of Depop and Elo7, made in 2021. Not only has this company’s marketplace doubled since 2019, it has completed three significant acquisitions since 2019, totalling nine worth $2.13 billion in its short seventeen-year existence. With these new markets, there is much more upside potential, and investors may want to take a bullish stance on this stock.

Overview

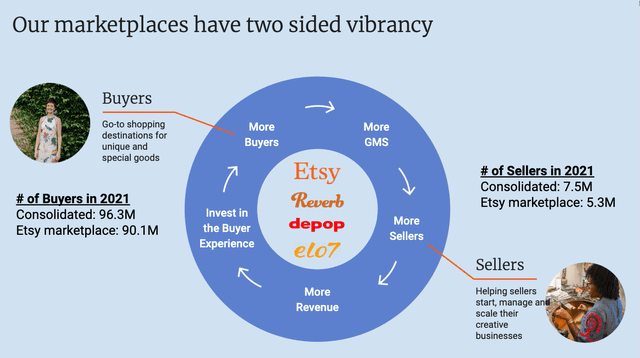

ETSY, created in 2005 in Brooklyn as a platform with humble beginnings for small-time crafters to sell their work, is seen today as one of the largest global e-commerce platforms with over 90 million customers and over 5.3 million sellers.

Buyer and Seller marketplace (Investor Presentation 2022)

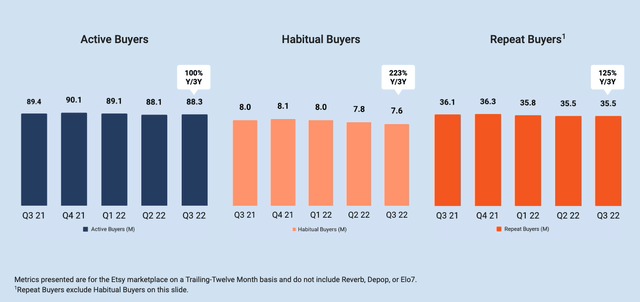

ETSY IPOd at $16 per share in April 2015 on Nasdaq. It has spent over $ 2.13 billion on nine acquisitions over its history. Most recently, the company acquired Elo7 for $217 million in June 2021, Depop for $1.63 billion in June 2021 and Reverb for $275 million in July 2019. The company has 88.3 million active buyers, decreasing from 89.4 million during last year’s quarter. However, there has been an increase since last quarter, and numbers have skyrocketed over the previous three years. The pandemic completely changed the market value of this company. While people were stuck indoors without physical shopping alternatives, the company’s marketplace doubled in size in 2019 and brand awareness significantly grew.

It is part of the transformative sharing economy and aims to keep commerce human. It provides a platform for people to buy and sell original goods.

Future Growth Drivers

Although consumers are spending less money on shopping online than they did during the peak of the COVID-19 pandemic in which, Etsy started seeing elevated revenues. Impressively the company has managed to maintain these higher than previously predicted numbers. One of the main reasons for continued growth is the increase in transaction fees year on year, while retaining its active users.

Buyer activity per quarter (Investor Presentation 2022)

Sellers are attracted to the platform primarily due to the ability to access a potential 90 million customers, although this is at a generous fee to Etsy of almost 19.8% per transaction. Unfortunately for sellers and fortunately for Etsy, its main competitor eBay inc. (EBAY), although we may also consider Amazon Handmade, is taking on the same approach. With both companies taking the same system, sellers have few alternatives to seek. The rate has risen yearly to 19.8% from 17.1% a year ago. Furthermore, it has also increased from the prior quarter. It has a sticky, although not necessarily satisfied, customer and buyer base that it has retained through significant business changes, mainly due to other large alternative platforms. This could be a potential risk in the future.

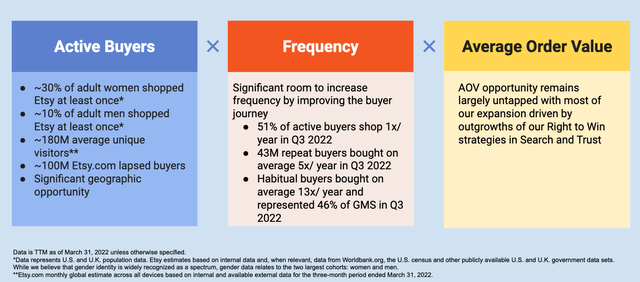

ETSY can reach a broader consumer base as economies open up, although consumers have more options regarding where to spend their money. Furthermore, it has a lot more growth potential if we look at the possibility of growing active users, frequency and average order value, which the recent acquisitions will also add to.

Potential Growth (Investor Presentation 2022)

Financials and Valuation

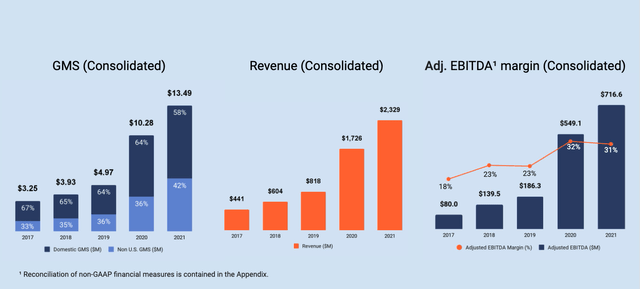

Etsy has been delivering yearly upward-trending top and bottom-line results since 2017, as shown in the graphs below.

Yearly financial trends (Investor Presentation 2022)

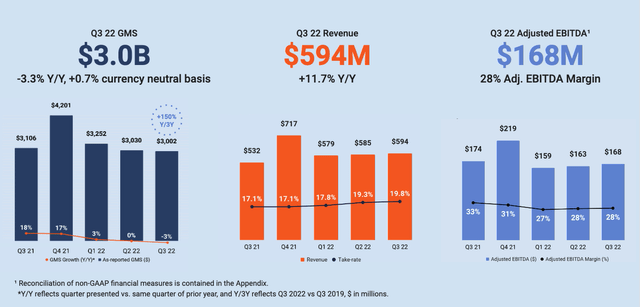

Although the company has significant headwinds that have impacted performance, it has been delivering and showing continued growth. It has been increasing its revenue per transaction. There were operational losses. However, the majority was impacted by an acquisition. Good to note is that the loss was due to goodwill rather than from the day-to-day operations. The graphs below show the quarterly results for gross merchandise sales, revenue and adjusted EBITDA. Revenues increased year on year by 11.7%.

Quarterly financial results (Investor Presentation 2022)

Gross merchandise sales decreased year on year. However, it is still 150% higher than the numbers in 2019.

There have been some impressive increases in cash flow from operations against the backdrop of economic headwinds. Cash flow was $392 million, an increase from $361 million one year prior.

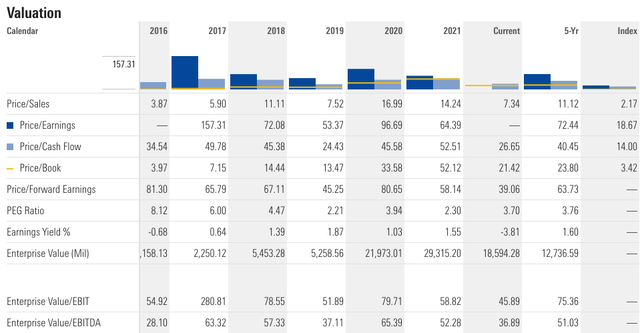

Although the company has strong top and bottom line fundamentals, it is seemingly overvalued if we look at a few of the critical ratios below. We can see that ETSY has a very high enterprise value, which has grown immensely since 2017. We can also see that the PEG ratio of 3.76 is well above one, which is considered unfavourable.

Etsy Valuation Over the Years (Morningstar.com)

Risk

As a company making money off the buying and selling of discretionary goods, it faces headwinds regarding inflation’s impact on customer purchasing decisions. Furthermore, Etsy doesn’t have control over the sellers on the platform. If sellers are unsatisfied or better alternatives arise, they are not fixed on the platform. ETSY has greatly benefited from its first-mover advantage and targeted proposition for people who create and sell unique items. Often on other platforms, their offerings are lost between thousands of cheaper and commercialised goods.

There have been strikes and complaints concerning the business policies, such as increased fees, which on the one hand, ensure company growth, but on the other hand, negatively impact the user’s experience. Once a seller is successful, they may want to leave the platform and grow independently away from often cutthroat business decisions ETSY has made since going public.

Final Thoughts

The third quarter results paint a continued picture of growth regarding revenue and increasing the value of its users. Furthermore, there are exciting times ahead concerning the acquisitions and their impact on growing the customer base and creating repeat and more extensive purchase solutions. For this reason, ETSY is on the up, and investors may be interested in taking a bullish stance on this company.

Be the first to comment