Wirestock/iStock via Getty Images

In mid-September Ethereum (ETH-USD) successfully moved from a Proof-of-Work consensus blockchain to a Proof-of-Stake consensus blockchain. It was one of the most important developments in the cryptocurrency market this year but has since been completely, and rightfully, overshadowed by the drama surrounding FTX (FTT-USD) and Alameda Research. “The Merge” from PoW to PoS was telegraphed for years but was still met with some level of contention from a small fraction of the Ethereum community.

The biggest issue for Ethereum miners at the time was a move to PoS meant the block reward from running expensive GPU-based mining machines was going away. This directly impacted companies that were mining Ethereum for the block reward; notable examples include HIVE Blockchain (HIVE) and to a lesser degree Hut 8 Mining (HUT). There was enough backlash from foreign-based Ethereum miners to fork the Ethereum chain and create an entirely new blockchain called EthreumPOW (ETHW-USD). EthereumPoW remained a Proof-of-Work consensus blockchain, preserving the block reward for GPU miners. Roughly three months later, we can check in on ETHW and see how the network has progressed.

Price and Token Specifics

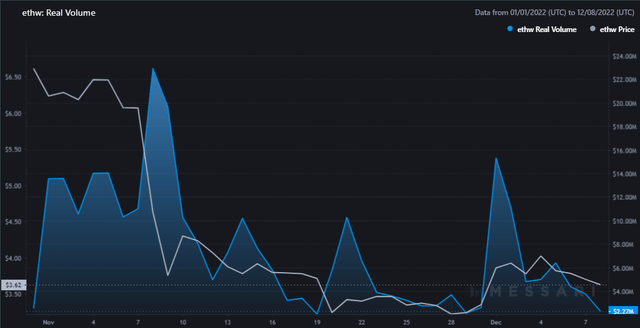

While still well below highs following the launch of the chain, the price of ETHW has experienced a rather large increase over the last few days; rallying from $3.09 on November 29th up to $4.25 on December 2nd. The rally was coupled with a fairly large 7x boost in real volume from roughly $2 million to over $15 million though daily volume has again fallen back to low 7 figures. After a brief pullback in coin price late last week, the coin again went above $4 intraday on Monday.

As of writing, ETHW finds itself at $3.62 with a $391 million dollar market cap. This gives EthereumPoW the 79th ranked market capitalization in the entire cryptocurrency landscape. It’s ranked ahead of some fairly well-known and widely used projects like Curve DAO (CRV-USD), Ethereum Name Service (ENS-USD), Optimism (OP-USD), STEPN (GMT-USD), and Lido Finance (LDO-USD). Price pops are common in crypto and don’t necessarily mean an asset is a good hold. Does the fundamental activity on-chain for EthereumPoW justify a valuation like this? Probably not.

DeFi TVL Collapsing

Part of what makes smart contract chains so useful is how easily they enable blockchain-based ownership and decentralized finance transactions, or DeFi. It’s important to note that after just 3 months from launch, it’s certainly not fair to expect EthereumPoW to be on the level of a top 10 or even top 20 blockchain from a DeFi perspective. Still, the trend that I’m seeing for EthereumPoW’s DeFi activity is not a good one.

A key metric is TVL or total value locked. This allows us to see how much a chain is being used for DeFi purposes. ETHW is way down at #100 in the TVL rank list measured by USD.

| Rank | Chain | Protocols | TVL | MC/TVL Ratio |

|---|---|---|---|---|

| 97 | Kintsugi | 1 | $1,952,963 | 0.51 |

| 98 | XDC | 3 | $1,856,266 | 157.08 |

| 99 | Fuse | 10 | $1,790,808 | 7.47 |

| 100 | EthereumPoW | 15 | $1,624,876 | 241.14 |

| 101 | Callisto | 1 | $1,548,482 | 7.68 |

| 102 | Tombchain | 1 | $1,481,520 | 5.33 |

| 103 | Energi | 1 | $1,464,325 | 8.03 |

Source: DeFi Llama

The good thing from this table is ETHW has more DeFi protocols, or applications, being built on the chain compared to peers with similar TVL figures. That said, the MC/TVL ratio is 241 – that is very high. Given the recent declines in the crypto coin prices, we have to adjust the TVL to native assets to really get the full scope for how a chain is performing. This is where ETHW actually gets pretty ugly:

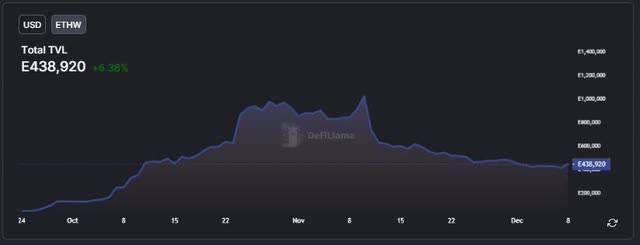

After peaking at little over 1 million ETHW in TVL on November 10th, the ETHW locked in EthereumPoW DeFi protocols has collapsed about 60% in less than one month. This level of native asset decline is not what we’re seeing on stronger chains or from chains that have similar TVL either.

The other thing to consider when analyzing a public blockchain’s DeFi footprint is how reliant a chain is on one or a handful of protocols. The more distributed the TVL is among protocols, the healthier the activity is. Additionally, the more multi-chain applications that have integrated with a blockchain, the more validity the network has in the eyes of the broader crypto community. Here again, we’re seeing a pretty brutal picture for EthereumPoW:

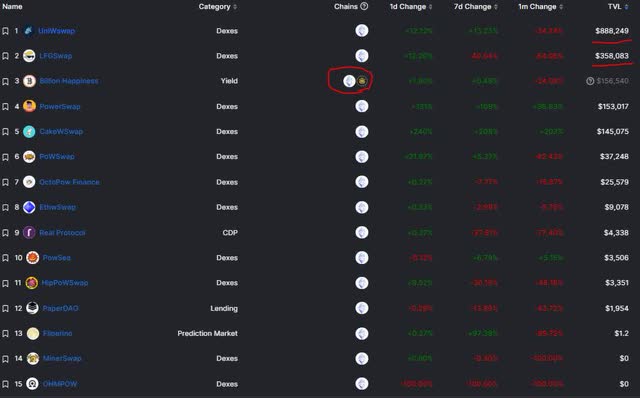

TVL Protocol Breakout (DeFi Llama)

The top protocol on the network is Uniswap, not to be confused with Uniswap (UNI-USD). Not only is EthereumPoW dependent on just two applications for 76% of its DeFi activity, but there isn’t any major DEX or pool that has integrated with EthereumPoW. Of the 15 protocols on ETHW, just one has integration with another chain that isn’t EthereumPoW. This makes EthereumPoW DeFi a very closed, consolidated ecosystem.

Other Applications

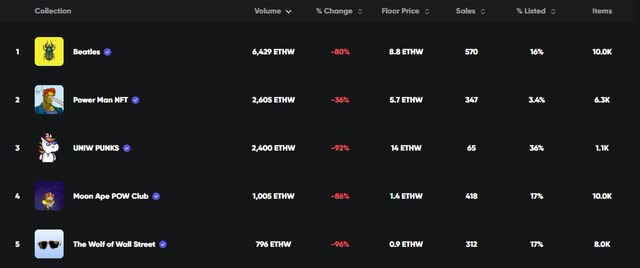

It’s important to remember that strong networks don’t have to be completely dependent on DeFi activity to justify coin valuation. There are other ways to use smart contracts. EthereumPoW has an airtable page that lists a few dozen integrations with the network; many of them are DEXes but there are also some domain projects and independent block explorer apps. NFT ownership is another popular way to use a blockchain. There are a handful of NFT marketplaces on ETHW. One of them that I checked out wouldn’t load any data. This is a screenshot from a more responsive one called Nuwton:

That marketplace shows pretty awful 30 day change metrics for the top 5 NFT projects on EthereumPoW. Most of them show sales volume declines somewhere between 80-90% over the last month. And those monthly change figures are coming down from what were already very low sales figures.

Summary

There are numerous risks associated with buying EthereumPoW. The blockchain network has very little actually being developed on the chain. There isn’t much engagement with the few applications that have been built developed. Furthermore the broad trend in both the coin price and the DeFi footprint is incredibly negative. When you factor in that crypto in general is risky and is dealing with drawdown pressure, I don’t see how it makes any sense to allocate to a fledgling blockchain network that is struggling.

The EthereumPoW team hasn’t tweeted anything yet in the month of December. It hasn’t posted a Medium update since November 6th. The website has virtually no information whatsoever. The optics suggest this is not a network that is seriously trying to grow and my initial theory that EthereumPoW was never meant to be a long term project from the beginning is aging fairly well. If the network somehow survives crypto winter there will likely be plenty of opportunity to buy the coin cheaper than current prices. If you’re holding this coin I’d probably consider selling it if you can.

Be the first to comment