tobiasjo/iStock via Getty Images

Thesis Summary

With the Ethereum (ETH-USD) merge right around the corner, investors are beginning to place their bets on the outcome. There are at least three possible scenarios, if not more, and specific financial instruments have been designed for betting on any of these outcomes.

In this article, I look at the history of Ethereum’s forks to try to gain some insight into what could happen and lay out my expectations as to what will happen to Ethereum in the short and long run after the merge.

Playing The Odds

The Ethereum merge is set for the 15-16th of September and will mark a historical change in the crypto world. Ethereum, the world’s second-largest cryptocurrency and the most used blockchain for decentralised apps, will switch its consensus mechanism from Proof-of-Work to Proof-of-Stake.

This change will have numerous implications, many of which I discussed in my previous Ethereum article. For example, miners will become obsolete, previously staked Ethereum will be released, and the whole ecosystem will be affected, with the “power” now in the hands of large ETH holders instead of miners. On the other hand, the merge should also lead to better efficiency and lower transactions.

With that said, not all are happy about this outcome, especially miners. This is why a hard fork is being proposed. This would mean that an “original” ETH network would keep existing using PoW, probably coexisting with the “new” merged PoS blockchain. The PoS chain would be Ethereum (ETH), while the forked PoW Ethereum would then have a new cryptocurrency, with ETHPOW being the proposed symbol.

An interesting result of this is that Bitfinex, a prominent crypto exchange, has created two tokens, ETHs and ETHw so that traders can bet on the outcome of the merge.

Lessons from History?

In a previous article on Cardano (ADA-USD), I looked at earlier updates in the network. Cardano’s chart showed a pattern of rallies leading up to the updates and a sell-off following updates like Shelley and Goguen.

However, applying this same approach to Ethereum leads to inconclusive results.

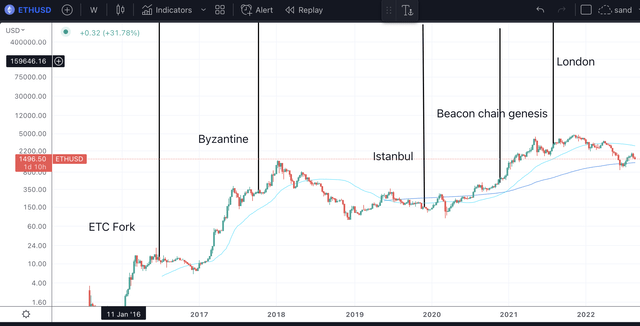

Ethereum Price and Updates (Author’s work)

Pictured above are previous updates and important events in ETH’s history, plotted on top of the logarithmic ETH chart.

The London update introduced changes to the ETH fee system, and we can see the price rallied somewhat leading up to it and then traded sideways for a bit. The Beacon Genesis marked the creation of the first block of the Beacon chain, which is the PoS chain ETH is merging into. Again, price rallied up to and after the event, but this happened during a bull market.

Before that, we saw a sell-off leading into Istanbul, followed by a strong rally and the “COVID crash”. Then, leading up to Byzantine, we had some volatility and a strong rally afterwards. Lastly, ETH entered a noticeable bear phase following the Ethereum Classic (ETC-USD) fork.

There’s not a very strong pattern here, but if there were one, it would be ETH staging rallies following updates. The big expectation is the ETC fork, and this is arguably the scenario most similar to the upcoming merge, which could also result in an Ethereum hard fork.

My 2 Cents

As I write this, we are two weeks away from the merge, and ETH is selling-off, having come down near 30% since its recent high. However, I believe we are now staging a pre-merge rally, which a sharp sell-off will then follow. Again, this is based on technical analysis and my fundamental understanding of investor rationale.

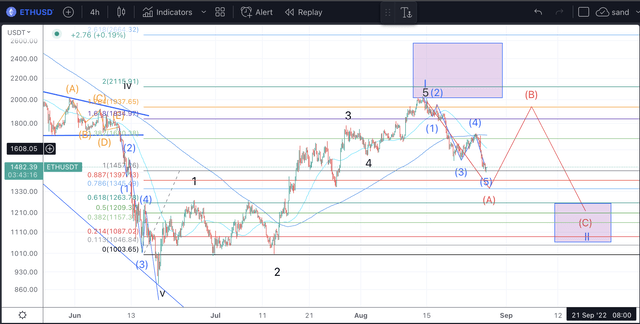

ETH Price analysis (Author’s work)

Since finding a local bottom at around $850, ETH has moved in quite a predictable five-wave pattern. We have an initial rally in wave 1 and then a retracement in wave 2. Wave 3 reached the 1.618 Fibonacci extensions of wave 1, and then wave 5 turned at the 2 ext. This is very much in line with Elliott Wave Theory.

These five waves make up a larger degree wave I, and we are now in an ABC correction of wave II, with the A wave nearing completion:

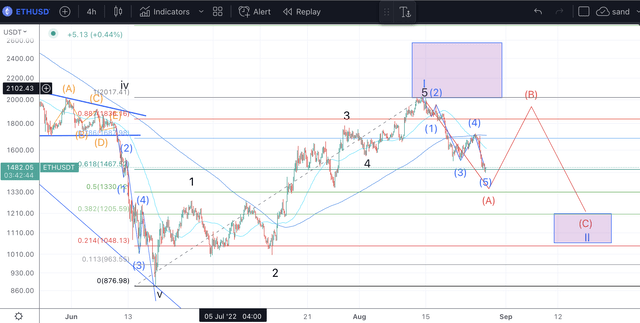

ETH Price analysis (Author’s work)

Based on this analysis, a reasonable target for wave II would be around $1200, which is the 61.8% retracement of wave I. However, before we reach this final level, we should rally strongly in wave B, which could even take out previous highs.

So, based on this count, I believe ETH will rally strongly as we approach the merge and then sell off aggressively following it or just before it.

This also makes sense from a “fundamental” perspective regarding supply and demand dynamics and previous fork events. For starters, as we approach the merge, an ample supply of stake Ethereum will be freed up, creating some supply pressure. In fact, there is evidence that “whales”, large ETH wallets, have been moving their holdings onto exchanges, probably with the idea of selling.

The merge will also be a moment of confusion and inherent volatility. I expect problems to emerge, and so will other investors. This creates selling pressure too.

Lastly, the fact that a contingent of the Ethereum community is looking to fork Ethereum into ETHPOW will also create doubt and pressure on the price.

With that said, do I think that ETHPOW will compete with Ethereum? If history is any indication, it is unlikely. While Ethereum Classic is still a prominent cryptocurrency today, it is nothing compared to Ethereum, and there is no real innovation in app development. The decision to move ETH to a PoS consensus mechanism has been deliberate and well-studied. There is a reason for it, and I believe it is the right move.

All in all, the upcoming merge will definitely be surrounded by volatility. I’m expecting both a big move up and a large swing down. However, when the dust settles, ETH will be ready to continue to rally and reach new all-time highs, as it will remain the go-to blockchain for developers in the crypto space.

Be the first to comment