wildpixel/iStock via Getty Images

Thesis Summary

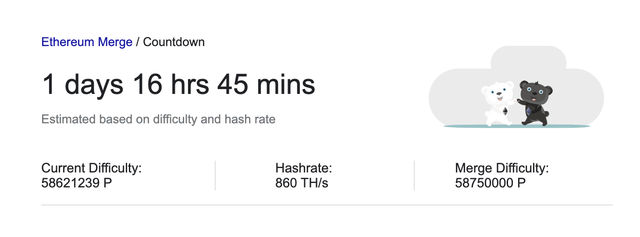

Ethereum (ETH-USD) is now a day away from the much-anticipated Merge. In this article, I quickly review what this means for the Ethereum blockchain in the long run.

On top of that, I look at how the market is reacting to this event and what my expectations are. There is a possibility that the Merge could act as a catalyst for a major liquidation event.

Finally, I suggest three indicators/metrics to keep an eye on as the Merge takes place since these could give us a warning if something goes wrong.

A Quick Overview

The Ethereum Merge is one of the most awaited events in crypto, and it has even reached the mainstream, with Google setting up a countdown just for the occasion:

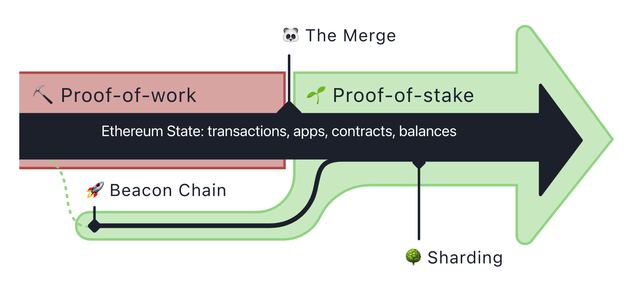

But let’s cut to the chase. The Merge involves merging Ethereum’s mainnet with the Beacon Chain. This chain was developed and launched in December 2020. The Beacon chain has run parallel to the Ethereum chain, but it has been achieving consensus instead of validating transactions. This means it has been setting up validators and agreeing on their account balances.

Now, the Beacon Chain will merge with the Mainnet. This means that the Beacon chain will become the consensus protocol for the whole of Ethereum. In other words, Ethereum is merging its execution layer, the current blockchain, with the consensus layer provided by the Beacon chain:

ETH Merge Diagram (Ethereum website)

The most significant change to come from this will be that ETH will be validated through Proof-of-Stake, rather than Proof-of-work. This will reduce emissions by over 99%. It also has other implications, and some misconceptions surround this upgrade.

For starters, it’s important to note that the Merge will not instantly make transaction fees lower or increase throughput. However, it will pave the way for sharding, which will.

Also, it is widely believed that staked ETH will be available after the Merge, but this will not actually be the case until the Shanghai upgrade.

Lastly, the Merge should not bring about any downtime in the blockchain.

The Ethereum Implosion?

In my last article on Ethereum, I talked about how I was expecting a sell-off in Ethereum around the time of the Merge. Looking at recent data, I believe this sell-off could even go as far as causing a market-wide capitulation.

This idea came to me once I realized that market participants have borrowed massive amounts of Ethereum over the past few days. The reason why this is happening I also discussed in another Ethereum article. In short, there is a possibility that ETH holders will be given ETHPOW after the Merge. This will happen if Ethereum is successfully forked, which we know is being attempted.

However, the large amounts of Ethereum being borrowed could put a big stress on the market. Already, DeFi protocols like Aave (AAVE-USD) are limiting ETH borrowing. The problem here is that utilization rates are getting dangerously high, meaning most, if not all, of the ETH in these DeFi protocols has been lent out.

This poses numerous problems. For starters, if all the ETH in a liquidity pool is lent out, then it can’t be redeemed. Furthermore, liquidators may face problems when trying to liquidate positions due to a lack of collateral, which could eventually render them insolvent. Lastly, interest rates on borrowing ETH are skyrocketing, which will put a strain on borrowers and increase the odds of default.

In general terms, it looks like speculation around the Merge is creating a large imbalance in the crypto market, and large imbalances could have devastating effects.

Keep an Eye on These Metrics

Ultimately, I believe the price could move in either direction, regardless of whether the Merge is successful. That said, here’s what to watch if you’d like to keep an eye on the Merge in real-time.

For starters, the basis of a blockchain is, as the name implies, block validation. A slowdown in block validation, finality and reduced voting participation would be a red flag. This can be tracked through BeaconScan.

Beacon Chain Block Validation (BeaconScan)

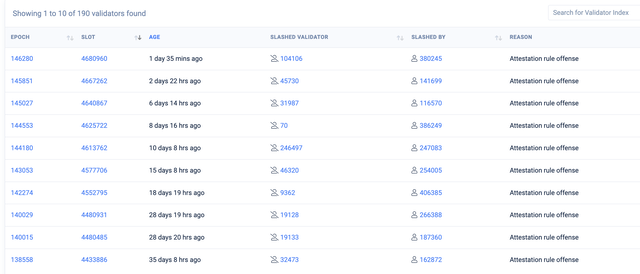

Another key metric we could track from this same website is Validator slashings. If there was a massive increase in slashings, this could indicate faulty software upgrades or perhaps a hosting provider going offline. Slashings are normal, but too many could be indicative of something.

Validator Slashing (BeaconScan)

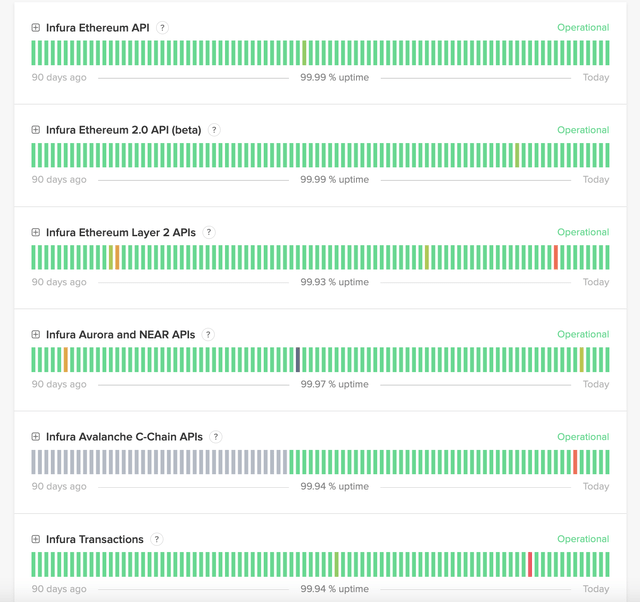

Lastly, it’s also worth looking at dApp activity. This can be done in many ways, but one would be to look at the Infura API. Infura provides infrastructure for those wanting to run dApps on Ethereum. Well-known clients include Uniswopa and MetaMask:

Excessive downtime or lower transactions would also be strong indicators that something is not running smoothly in the Ethereum blockchain.

Takeaway

In conclusion, I still believe it is likely ETH will see weakness in these coming days. Furthermore, there is the potential that excessive borrowing and speculation surrounding the event could cause a market-wide capitulation. And, of course, I will keep track of the metrics laid out above to assess the success of the Merge.

Be the first to comment