CreativaStudio/E+ via Getty Images

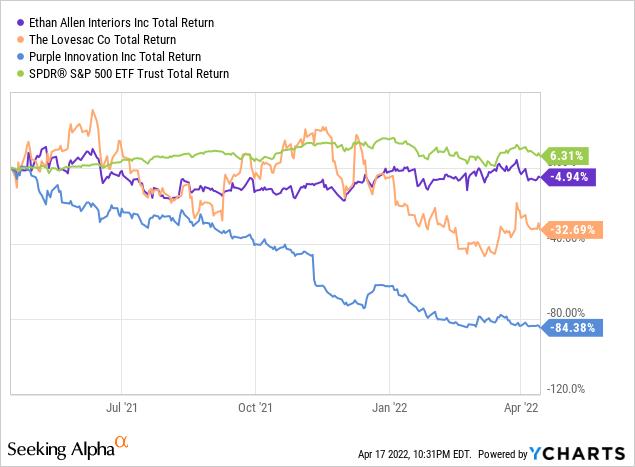

Over the last twelve months, home furnishing chain Ethan Allen Interiors (NYSE:ETD) has lost 5% of value while the S&P 500 was up ~6%. This, however, avoided the worst in its sector, as seen by Lovesac (LOVE) and Purple Innovation (PRPL) that lost ~33% and ~85% of value, respectively. At 8.2x forward earnings and a dividend yield of 4.6% with no debt, Ethan Allen looks like a value play at first blush. For comparison, Purple Innovation trades at 23.8x forward earnings, as it continues to bleed money; Lovesac trades at 12.0x despite smaller operating margins than Ethan Allen (7.7% vs. 14.3%). With a beta of 1.09, the stock also doesn’t appear that risky, especially given the undervalued growth potential (PEG of 0.87), 16% hike in the dividend payout, and solid momentum reflected in the 200 bps increase in gross margins to 58.8% and ~38% gain in EPS y-o-y.

According to Seeking Alpha data, 2 analysts rate the stock a “hold” and 1 a “strong buy”. All the last three articles on Seeking Alpha over the past six months have been a “buy”: see here, here, and here. The company now has a net cash position of $105 million while orders are up 45% from two years ago, reflecting solid momentum. Further, Ethan Allen benefits from vertical integration, with ~75% of the company’s products coming from its plants in North America. For investors weary of trade wars and geopolitical uncertainty, Ethan Allen looks like a safe name at a low price.

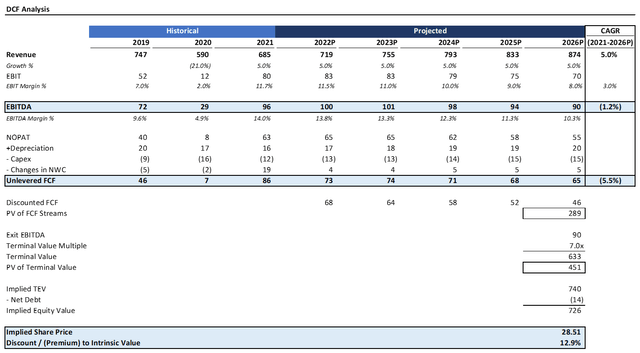

DCF Analysis Indicates Meaningful Upside

To get a sense of the company’s intrinsic value, I ran a DCF analysis. No DCF analysis can provide a perfect picture of future returns for shareholders; however, they can provide an illustrative “story” of the likelihood of different scenarios. I forecast revenue growing at a slow 5% rate into 2026. I assumed margins contracting back to 8.0%. Capex, increase in net working capital, depreciation, and taxes were flat-lined for simplicity. By 2026, I have EBITDA at $90 million.

Source: Created by author using data from Yahoo! Finance

Assuming a terminal EBITDA multiple of 7x and a discount rate of 7%, the stock is ~13% below intrinsic value. Historically, Ethan Allen has traded between 8-11x, so I believe my multiple assumes the very worst of valuation environments, even as the rest of the stock market is trading at lofty levels. Considering that my assumptions assuming minimal incremental growth beyond the broader economy and a contracting in gross margins, I think my valuation is safely on the conservative side.

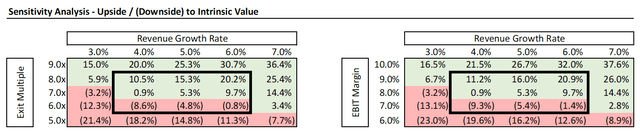

Source: Created by author using data from Yahoo! Finance

Looking at the sensitivity analysis, the upside is material. If the multiple were to expand to 8x and growth run at a 7% clip, there would be 25% upside here. Even if the multiple contracted to bargain levels of 5x, there is only 15% downside, which is more than offset by the 7% returns implicit in my discount rate and the 4.6% dividend yield. Further, if the company just grows at a 5% clip and EBIT margins contract 150 bps, there is still 25%+ upside. Accordingly, I believe Ethan Allen has very favorable risk/reward.

Upside Catalysts

While Ethan Allen looks cheap despite solid operating performance and a strong economic moat, it takes catalysts to unlock value and prevent you from getting tangled in a “value trap”. The main catalyst is continued demonstration of demand in the home. While the pandemic obviously brought a renewed interest in consumers remodeling, it’s up for debate whether the interest in the home represents a “new normal”. With a solid majority, 65%, of employees saying that remote work flexibility impacted their job decision, the work-from-home trend is likely, in my view, to be a permanent trend. With that trend obviously comes an increased interest in home furnishings, which has resulted in Ethan Allen hitting breaking backlogs. I think that as consumers see continued traction in furnishing demand, the upside story will become even more apparent.

I am also optimistic about the company’s e-Commerce business, which posted an 88% y-o-y growth. While it still represents less than 5% of sales, direct-to-consumer remains the way of the future. Wayfair and Amazon have dominated the online furnishing market, but there is no reason why Ethan Allen can’t grab a larger share of the pie, as it has the manufacturing and distribution network to support quick delivery for heavy goods.

Lastly, the company also has a key growth category in product extension. Ethan Allen is diversifying out into Outdoor, Home Office, Dining, and Bedroom, among other categories. By transforming itself into more of a turnkey solution for home furnishing, Ethan Allen is well positioned to further build customer stickiness.

Risks

Like many other consumer goods company, Ethan Allen faces headwinds in the congested supply chain. Although gross margins increased by 200 bps in the last quarter, rising raw material, labor, and freight costs are expected to bring a 130 bps contraction from here. Labor is hard to come by, putting pressure through wage inflation and manufacturing disruptions. Unfortunately, my model indicates that returns are highly sensitive to changes in margins. A 1% change in margins yields a 10% change in returns in my valuation model. Making matters more concerning, management is cutting back on advertising to reduce costs; while Ethan Allen is a solid brand name, the consumer retail space depends on advertising, so the medium-term repercussions of a pullback in advertising concern me.

With that said, I believe these risks are relatively muted compared to other consumer retailers given the company’s vertical integration. Ethan Allen has a network of 300+ design centers and a supporting footprint of distribution centers. This material reduces risk in supply chain bottlenecks.

Conclusion

Ethan Allen trades as if it is struggling with profitability at a time when its gross margins are approaching record levels. With a strong dividend yield, debt free balance sheet, and record momentum in sales & backlog, Ethan Allen is positioned for a major correction. I believe that the market is poised to rotate from large cap growth into small cap value, and Ethan Allen will be a major beneficiary of this great rotation, especially as it is a safer stock than it appears at first blush. Add in product extension, acquisition of additional design centers, a huge growth opportunity in e-Commerce, and secular tailwinds in the remote, work-from-home revolution, and you have a confluence of factors that will lead to Ethan Allen outperforming. This is a stock with a PE multiple of 8.0x at a time when the S&P 500 trades at a multiple of 22.2x. It’s not that Ethan Allen lacks the upside potential; it’s more that it has failed to attract the attention of investors too razor focused on large cap growth. Accordingly, I strongly recommend Ethan Allen as a deep value play.

Be the first to comment