I’ll keep this article short. Based on academic research, the recent stock market crash could decrease U.S. GDP by 1.70% to 3.90%, salaries by at least 2.80%, and hours worked by at least 1.20%, as reduced consumer spending from households with significant equities holdings reduces corporate sales, revenues, and income, leading to reduced production, investment, and employment. Although these effects pale in comparison with those of the coronavirus outbreak as a whole, with several analysts forecasting unemployment of 30%, these are still relatively large and would cause a recession half as bad as the past financial crisis, an economic catastrophe.

The Wealth Effect, Or Why the Stock Market Matters

Stock market investments are of particular importance to the U.S. economy, as these comprise about 20% of total household wealth and add up to slightly over 100% of the country’s GDP. Stock market valuations directly impact most relevant economic variables due to something called the wealth effect.

In simple terms, the wealth effect suggests that as wealth decreases, so does consumer spending, which adversely impacts the economy.

In not so simple terms, we can say that households invest a significant portion of their net worth in equities. As such, household wealth is strongly dependent on stock market valuations. Investor households, including many retirees, are dependent on healthy stock market valuations to finance their spending, and will significantly cut back on their consumption of goods and services during stock market crashes. Reduced consumer spending leads to fewer sales, revenues, and profits for corporations, reducing corporate hiring and investment, and ultimately shrinking the size of the economy. We can say that there is a straightforward, and causal, link between stock market valuations and most relevant economic metrics.

Economists have done quite a bit of research on estimating the specific magnitude of the wealth effect and broader economic impact of stock market valuations. Studies differ on the exact magnitude of these effects, but this study by MIT, Harvard, and Norwegian researchers shows that the consensus seems to be that for every dollar of decreased stock market wealth, consumer spending decreases by between three and seven cents per year. The most recent stock market crash amounted to about 55% of U.S. GDP, which implies a reduction in consumer spending equivalent to between 1.65% and 3.85% of GDP. As a comparison, GDP contracted by 4.2% in the financial crisis.

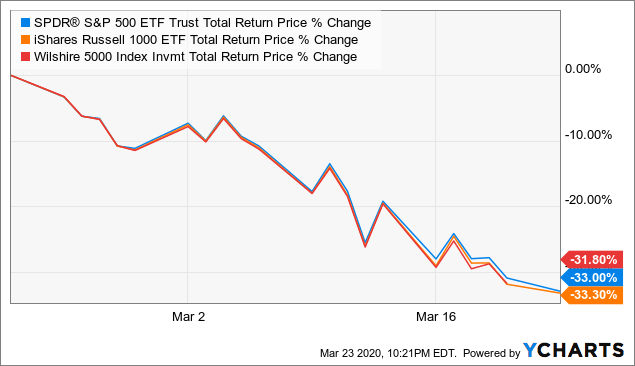

Said study also directly estimates the economic impact of stock market valuations and finds that for every 20% decrease in stock valuations, the aggregate labor bill, roughly equivalent to aggregate salaries, decreases by at least 1.7%, while hours worked decrease by at least 0.75%. Stock market valuations have decreased by about 33% during the past month, which imply a reduction in salaries of 2.8% and a reduction in hours worked of 1.2%.

Data by YCharts

Data by YCharts

These same researchers also show that monetary policy can counteract swings in stock market valuations and prices, although with interest rates at 0%, further monetary stimulus seems unlikely to be effective.

Conclusion – Significant Negative Economic Effects

Based on academic research, the recent stock market crash could decrease U.S. GDP by 1.70% to 3.90%, a significant amount, although relatively small compared to the expected impact of the broader coronavirus outbreak. The stock market crash is one more reason to be bearish about the future trajectory of the U.S. economy and one more thing that the Federal government should endeavor to either fix or to minimize its harmful effects.

Thanks for reading! If you liked this article, please scroll up and click “Follow” next to my name to receive future updates.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment