InnaFelker

Introduction

The Estée Lauder Companies Inc. (NYSE:EL) released Q4 FY22 (April-June 2022) results last Thursday (August 18). EL’s share price has fallen 5.8% since.

We initiated our Buy rating on Estée Lauder in early April 2020 (PRO subscription required). Since then EL shares have gained 65% in just under 2.5 years, though they are currently down 20% from a year ago:

|

Librarian Capital’s EL Rating History vs. Share Price (Last 1 Year)  Source: Seeking Alpha (24-Aug-22). |

Q4 FY22 results were disappointing, with sales down 8% organically year-on-year. FY23 guidance not only lacked the double-digit growth we expect in our investment case but also included an organic sales decline of 4-6% in Q1. EL has been particularly impacted by COVID-related disruptions in China, as well as other one-off factors. However, these problems are temporary and local, and we believe EL’s structural growth drivers are still intact. We reduce our forecasts modestly, but still expect a total return of 61% (13.4% annualized) by June 2026. Buy.

Estée Lauder Buy Case Recap

Our investment case on EL is based on the following:

- The Beauty market will continue its strong structural growth, as an aspirational category for consumers, helped by growing demand from APAC (especially China) and premiumization (especially in Skin Care).

- EL has strong global franchises built on leading brands, high-quality products, scale, innovation and marketing capabilities.

- EL will grow sales faster than the market thanks to these advantages, and grow its earnings faster than sales with natural operational leverage.

- EL’s focus on the Prestige segment and its higher exposure to Skin Care will enable it to continue growing faster than its main rival L’Oréal

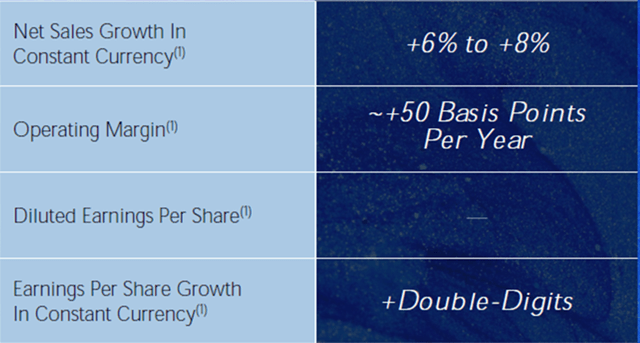

Prior to COVID-19, EL targeted Net Sales growth of 6-8% and EBIT Margin expansion of approx. 50 bps annually (in constant currency), which (with an EBIT margin of around 20%) implies an annual EBIT growth of approximately 11%:

|

EL FY20-22 Outlook (Before COVID-19)  Source: EL presentation at Bernstein conference (May-19). |

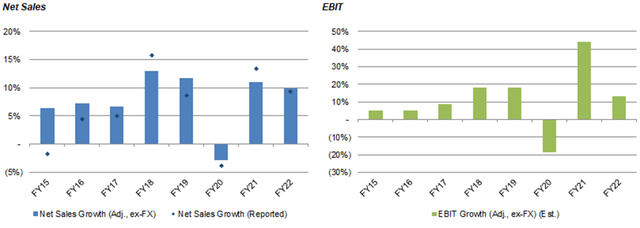

EL achieved much higher growth rates than these in FY18 and FY19, growing sales by more than 10% and EBIT by high-teens each year (excluding currency); growth fell in FY20 due to COVID-19, but rebounded in FY21:

|

EL Net Sales & EBIT Growth Y/Y (ex. FX) (FY15-22)  Source: EL company filings. NB. FY ends 30 Jun. |

EL’s largest markets are China (34% of FY22 sales), the U.S. (23%) and Korea (11%).

In FY22, EL’s full-year results were in line with our investment case, but weakness started to appear in Q4.

FY22 Results In Line With Investment Case

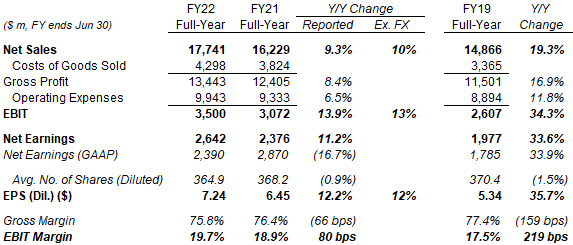

EL’s full-year FY22 results showed the double-digit growth we expect. Excluding currency, Net Sales grew 10% (including 2 ppts from acquisitions), Non-GAAP EBIT grew 13% and Non-GAAP EPS grew 12% year-on-year:

|

EL Non-GAAP P&L (Full-Year FY22 vs. Prior Years)  Source: EL company filings. |

Compared to pre-COVID FY19, including currency and acquisitions, Net Sales was 19.3% higher, Non-GAAP EBIT was 34.3% higher and Non-GAAP EPS was 35.7% higher after 3 years – again with earnings growing by double-digits annually on average.

During FY19-22, EL’s Gross Margin has shrunk but its Non-GAAP EBIT margin has risen. Management attributed part of this shift in margin profile to channel shift and market shift. In particular, new retail partnerships with the likes of Ulta Beauty (ULTA) and Sephora reduce EL’s selling costs but likely come with lower Gross Margins. In FY22, there have also been Gross Margin pressure from supply chain issues and the negative mix shift away from skincare (due to COVID restrictions in China), offset by lower sales and marketing spending (due to the same restrictions).

Weakness Visible in Q4 FY22 Results

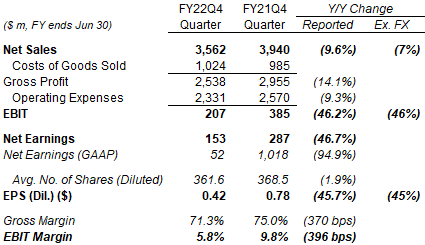

EL’s Q4 FY22 results were disappointing. Excluding currency, Net Sales fell 7% year-on-year, Non-GAAP EBIT fell 46%, and Non-GAAP EPS fell 45%; including currency, Net Sales fell 9.6% and Non-GAAP EPS fell 45.7%:

|

EL Non-GAAP P&L (Q4FY22 vs. Prior Year)  Source: EL company filings. |

In contrast, L’Oréal (OTCPK:LRLCY) reported a like-for-like sales growth of 13.4% year-on-year for the same quarter.

As we will explain later in the article, COVID-related disruptions in China and other one-off factors negatively affected EL in Q4, and their influence are also expected to last into FY23.

Disappointing FY23 Outlook

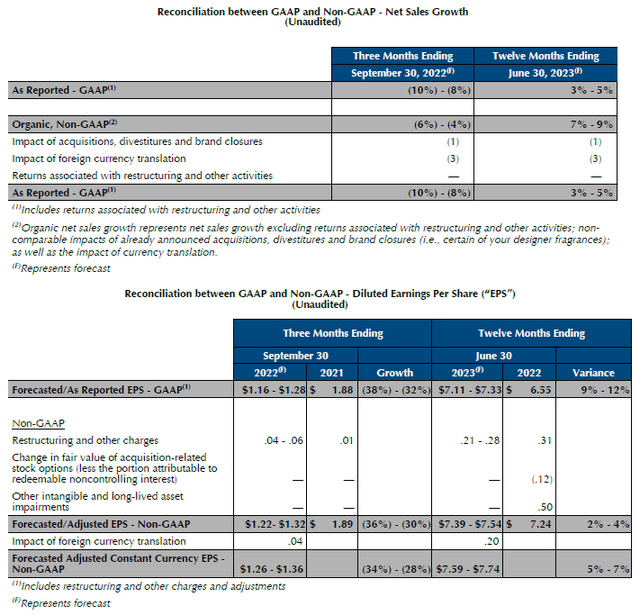

EL provided a FY23 outlook with growth rates that are below our investment case. On a non-GAAP, ex-currency basis, Net Sales are expected to grow 7-9% organically year-on-year, while EPS is expected to grow 5-7%:

|

EL FY23 Sales & EPS Outlook  Source: EL results release (Q4 FY22). |

Including currency, acquisitions and brand closures, EL expects Net Sales growth to be 3-5% and Non-GAAP EPS growth to be 2-4% in FY23 – both materially below our long-term investment case. Net Sales growth is expected to be helped by 5.5 ppt of price increase and 2 ppt of distribution expansion, which implies volume for EL’s existing footprint is expected to decline slightly.

Within FY23, management is also expecting a Q1 where Net Sales will decline by 4-6% organically and Non-GAAP EPS will decline by 28-34% excluding currency year-on-year.

The figures in the new FY23 outlook are disappointing, but mainly attributable to COVID-related disruption in China and other one-off factors.

Multitude of Temporary Headwinds

EL is currently suffering from a multitude of temporary headwinds.

COVID-related restrictions in China were the most material. Multiple cities in China were affected by COVID restrictions in Q2, impacting brick-and-mortar stores, travel retail as well as distribution for online sales. In particular, Shanghai underwent a two-month lockdown in April and May, affecting EL distribution centers there that were supposed to serve the whole of China. The distribution centers are now open, and EL has also just opened a new center in Guangzhou, but the company is still experiencing “intermittent disruptions” in distribution. Hainan, a major Travel Retail destination, has been in lockdown since August 6, with all stores closed and courier services suspended. Management expects only a partial resumption of business in Hainan in September.

EL sales in China fell 13% (while the market was down 10%) in Q4 FY22, and the group sales decline expected for Q1 FY23 largely reflects the ongoing disruptions in China, including in Hainan. (However, EL could have managed things better – L’Oréal sales grew 6% year-on-year like-for-like in Q2 “thanks to its robust supply infrastructure”.)

Brand closures are expected to be a 1 ppt headwind to group sales growth in FY23. As part of its ongoing restructuring, EL is terminating its licenses for four designer fragrances (Donna Karan New York, Michael Kors, Tommy Hilfiger and Ermenegildo Zegna) at the end of FY22. (This is excluded from organic growth rates.)

Suspension of sales in Russia and Ukraine is expected to be another 1 ppt headwind to group sales growth in FY23, after EL closed all its stores in Russia in early March. (This is not excluded from organic growth rates.)

Foreign currency movements, particularly the strengthening of the U.S. dollar, have been a major headwind. For FY23, currency is expected to generate a 3 ppt translational headwind (excluded from organic growth rates) and a 1 ppt transactional headwind (not excluded from organic growth rates).

North American trade inventory movements are expected to a 1.5 ppt headwind to group sales growth in Q1 FY23, as U.S. suppliers have been tightening their inventories this year, compared to the prior-year quarter when they added to their stock levels to secure holiday shipments earlier due to supply chain concerns.

If we add back impact of the suspension of sales in Russia and Ukraine (1 ppt) and the currency transactional headwind (1 ppt), then FY23 organic Net Sales growth will be 9-11% instead of 7-9%, already roughly in line with our long-term investment case. We also believe that all of the headwinds above are temporary and local in nature.

Other evidence also support our belief that EL’s long-term growth trajectory is still intact.

Good Q4 Growth Outside COVID and Russia

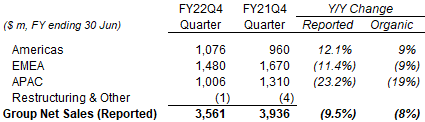

Within Q4 FY22’s disappointing 8% organic sales decline, areas not impacted by the one-off issues described above have done well:

|

EL Net Sales by Region (Q4 FY22 vs. Prior Year)  Source: EL results release (Q4 FY22). |

Sales in the Americas grew 9% organically, with double-digit increases in Make-up and Fragrance:

Sales in APAC fell 19% organically due to COVID-related issues in China described above, as well as similar issues in Korea. However, sales in Malaysia, Japan, the Philippines and Vietnam all grew as re-openings continued.

Sales in EMEA fell 9%, “driven almost entirely by the disruptions in Travel Retail in China and the suspension of business in Russia and Ukraine”. (EL reports all global Travel Retail sales in EMEA.) However, Travel Retail sales grew triple-digits in markets in Europe and the Americas, and 10 markets in Europe grew sales by double-digits.

Robust Growth Trajectory Before New Lockdowns

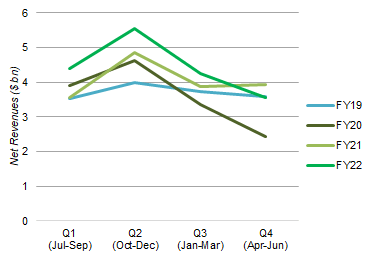

We are reassured by how, prior to the escalation of COVID restrictions in China, EL’s growth trajectory was robust.

In Q1 and Q2 of FY22, EL sales (in USD) had showed the same solid growth against both FY21 and pre-COVID FY19, despite the strengthening of the U.S. dollar; growth only slowed from Q3 FY22 onwards:

|

EL Net Sales by Quarter (FY19-22)  Source: EL company filings. |

New COVID lockdowns in China (largely from April) and EL’s suspension of sales in Russia (from March) were the only changes since Q3 FY22, and the latter was only a 1 ppt impact. We do not believe EL’s underlying structural growth drivers have changed.

No Impact from Weak Chinese Macro

Even for China, EL’s weak sales were almost entirely due to supply, not demand, despite weakness in the Chinese economy. As CEO Fabrizio Freda explained on the call:

“We don’t feel (any economic pressure impacting consumption). It’s probably the prestige cosmetic luxury cosmetic segment is more protected because of the big passion of consumers for this category … The percentage of prestige for the total market keeps improving … The top of the ranges are growing the fastest also on our brands …And importantly, the market is very active when there are no restrictions, when there is no issues. So, we don’t see any impact – obviously, we are prudent in the assumptions we are making on the China economy development in the short-term as everyone is. But we don’t see a very big impact on our business in absence of COVID restrictions situations.:

It is therefore reasonable to assume EL’s sales in China will resume its previous growth once COVID restrictions are lifted. Management expects EL sales in China to grow by double-digits in FY23.

Is Estée Lauder Stock Overvalued?

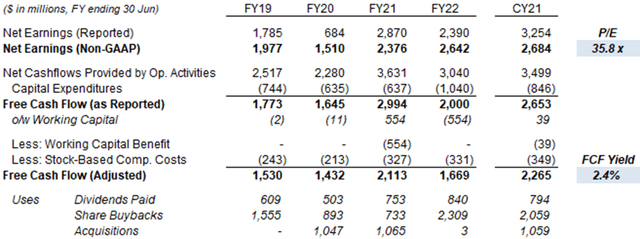

At $265.43, relative to CY21 financials, EL stock is at a 35.8x P/E and a 2.4% Free Cash Flow (“FCF”) Yield:

|

EL Earnings, Cashflows & Valuation (FY19–22)  Source: EL company filings. |

FY22 Non-GAAP Net Earnings were similar to CY21’s, though FCF was much lower due to working capital increases related to efforts to manage supply chain disruptions and future growth.

FY23 Non-GAAP EPS guidance ($7.39-$7.54) implies a P/E of 35.6x at mid-point.

The Dividend Yield is 0.9%, with a dividend of $0.60 per quarter ($2.40 annualized), after it was raised 13% year-on-year in November 2021.

EL repurchased $2.3bn of its shares in FY22, equivalent to 2.4% of its current market capitalization.

Estée Lauder Stock Forecast

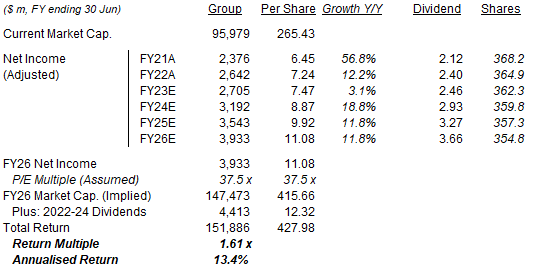

We reduce our growth assumption in FY23 in line with the new outlook, but assume there will be a catch-up in FY24. We also reduce our exit P/E assumption to reflect higher uncertainty and extend our forecasts by a year.

Our key assumptions now include:

- FY23 EPS of $7.47 (was $8.29)

- FY24 Net Income growth of 18.0% (was 11.0%)

- From FY25, Net Income growth of 11.0% (unchanged)

- Share count to fall by 1.0% each year (unchanged)

- From FY24, Dividend Payout Ratio of 33% (unchanged)

- P/E to be at 37.5x at FY26 year-end (was 42.0x)

The 11.0% Net Income growth represents the outcome from the high end of management’s 6-8% sales growth and 50 bps margin expansion targets.

Our new FY25 EPS estimate is 4% lower than before ($10.36):

|

Illustrative EL Return Forecasts  Source: Librarian Capital estimates. |

With shares at $265.43, we expect an exit price of $428 and a total return of 61% (13.4% annualized) by June 2026.

Is Estée Lauder Stock A Buy? Conclusion

We reiterate our Buy rating on Estée Lauder stock.

Be the first to comment