bpawesome/iStock via Getty Images

Esperion Therapeutics (NASDAQ:ESPR) recently reported their Q3 earnings with a beat on EPS and a slight miss on revenue. The company reported significant revenue growth along with encouraging commercial trends. It appears Esperion is in a strong position just ahead of the highly anticipated CLEAR Outcomes data that is expected to be announced in January and additional data in March at the American College of Cardiology Annual Scientific Sessions. I am preparing for a spike in volatility in the coming weeks as we move closer to January and the market attempts to influence the share price. As a result, I will be looking to take advantage of the forecasted volatility and will attempt to manage my ESPR position with buy and sell orders.

I intend to review the company’s Q3 performance and will provide my views on the quarter. In addition, I will recap the CLEAR Outcomes trial and will discuss why the data will be critical to the bull thesis. Finally, I take a look at the charts to identify some key areas for investors who are looking to manage their ESPR position around the data readout and conference presentation.

Q3 Performance

The third quarter was another strong effort by Esperion who pulled in $19M in total revenue which is up 32% over Q3 of 2021. In the U.S., Esperion’s product revenue came in at $14M, up 28% over Q3 of last year. The company’s partner royalty revenue was $1.6M, which is up 33% over the same period last year.

In terms of expenses, Q3’s R&D expenses came in at $29.M, up 15% from the $25.3M in Q3 of 202. Esperion has attributed this increase to the costs of the CLEAR Outcomes study and closing out the trial. Esperion’s SG&A expenses were $25M for Q3, down from $39.3M in Q3 of 2021. The company attributes this decrease to the transformative plan they launched in Q4 of last year. Altogether, Esperion reported a net loss of $55.1M, down from the $69.4M loss in Q3 of last year.

In terms of cash, Esperion finished Q3 with $239.3M in cash, cash equivalents, restricted cash, and investment securities available for sale, down from $309.3M at the end of 2021.

My Views on the Quarter

Esperion’s Q3 was another quarter of significant revenue growth with a reduction in expenses and net loss. It is obvious that the company’s cost-cutting initiative is working, yet, the cuts have not damaged the company’s growth trajectory. Again, U.S. net product revenue grew 28% year-over-year, while SG&A expenses were lower by 36% year-over-year. So far, Esperion has cut spending by $74M in 2022 compared to the same period last year. Recording growth with a limited commercial footprint is something to be optimistic about.

I think it is also important to note that the company’s partner, Daiichi Sankyo (OTCPK:DSKYF), continues to report robust NILEMDO and NUSTENDI growth in the EU. According to Esperion, Daiichi Sankyo treated over 64,400 patients in August. Admittedly, the company’s partnership revenue is not a huge source of revenue, however, seeing growth tells us that NILEMDO and NUSTENDI are gaining traction around the globe, which could accelerate with CVOT expansion.

In addition, to the company’s strong commercial performance, they also had some notable updates including that bempedoic acid was recommended by the American College of Cardiology as an oral non-statin for lowering LDL-C in ASCVD patients. In addition, the company publicized that they started activating sites for their Phase II CLEAR Path 1 Pediatric clinical trial. CLEAR Path 1 is testing bempedoic acid in patients 6-17 years of age with heterozygous familial hypercholesterolemia. These updates might not be as big as the CLEAR Outcomes data, but they do show that professionals are recognizing bempedoic acid as an important tool in the battle against LDL-C and that bempedoic acid has more room to expand.

CLEAR Outcomes

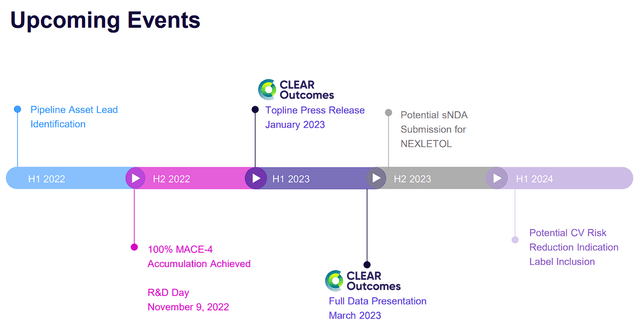

If you have been following my Esperion coverage, you would know that I have the CLEAR Outcomes trial to be the chief growth driver for the near future. Previously, Esperion hit 100% MACE accumulation CLEAR Outcomes trial, which put them on track to report top-line results in early Q1 of 2023. The company just announced that they completed the last patient in October, and are now “on track to report a brief top-line announcement in January 2023.” In addition, Esperion expects to present “comprehensive results with Dr. Steve Nissen, the lead investigator of CLEAR Outcomes at the American College of Cardiology’s 72nd Annual Scientific Sessions in March 2023.”

The January data readout and the March presentation should be extremely powerful because the data could demonstrate that NEXLETOL has the prospective to be the first oral LDL-C lowering drug since statins are indicated for CV risk reduction and be a new class of medicine for CVD. Furthermore, Esperion expects to reveal how NEXLETOL can have a positive impact on anti-inflammatory markers in addition to glucose-lowering abilities. Clearly, having the capacity to improve LDL-C, show CV risk reduction, improve anti-inflammatory levels, and mend glucose numbers could make NEXLETOL one of the most vital cardiovascular and lipid products to hit the market in recent memory.

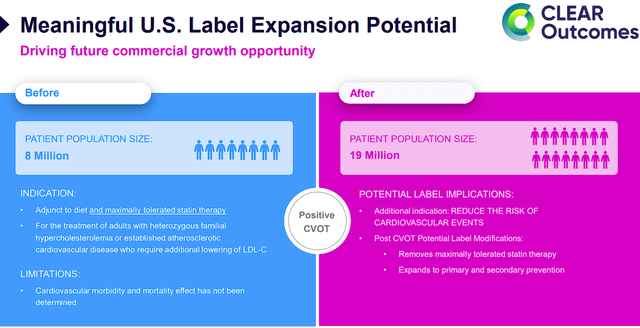

The potential addition of the “Reduce The Risk Of Cardiovascular Events” would expand NEXLETOL’s patient population size from around 8M to 19M people in a global lipid market that is projected to exceed $11B by 2026.

NEXLETOL and NEXLIZET Label Expansion Prospects (Esperion Therapeutics)

Managing ESPR Around CVOT Data

I am fairly confident that the CLEAR Outcome data will be positive, however, I believe investors need to be prepared for volatile trading before and after January’s highly anticipated readout. The company has hinted that they are simply providing a top-line data readout in January, and will disclose some additional granularity in the March presentation. So, investors should be ready for a potential “Sell The News” event following the January data with a more enduring move following the March presentation. Essentially, the January readout is an appetizer and the main course is coming in the March presentation.

As a result, I am going to remain patient and will let the market attempt to shake out the weak hands over the next several months. I will look to restart my accumulation process after the March presentation and possibly wait for the company to submit the sNDA in the second half of 2023.

Esperion Therapeutics Upcoming Events (Esperion Therapeutics)

This way, I won’t be locking up vital funds for over a year while we wait for possible approval in the first half of 2024.

Admittedly, my ESPR position is not anemic and I have a favorable cost average that allows me to sit tight while we wait for a stronger timeline for approval. Investors looking to initiate a position in ESPR, or are looking to build the position over the next year should consider ESPR’s technicals when managing their position.

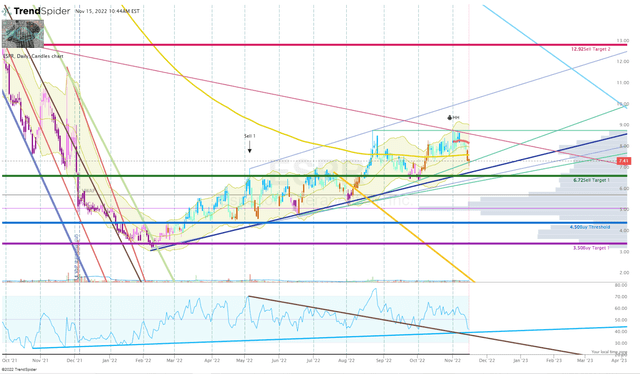

The share price has been on a steady grind up off the bottom following a breakout of a long-term downtrend back in February of this year.

ESPR Daily Chart (Trendspider)

We can see an uptrend ray coming off the lows which has acted as support on pullbacks over the past ten months. This uptrend ray could be used as a technical guide as we move closer to January’s data readout. We could say that ESPR is still on a bullish trend as long as the ticker trades above the uptrend ray. Obviously, the opposite could be said if the share price drops below the trend line. One could continue to add to their position as long as the trend continues and book profits on the break.

For those waiting to establish a position in ESPR, one could wait for the uptrend to break and look for a potential reversal setup, or another uptrend to emerge before pulling the trigger on a buy.

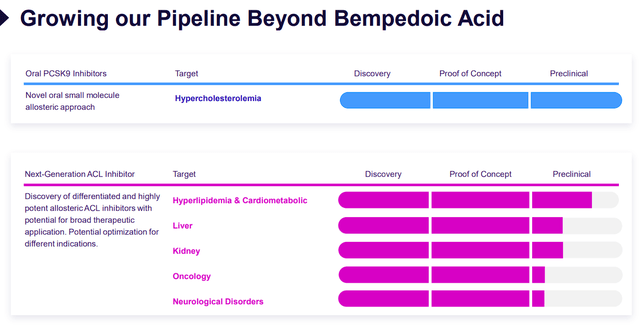

Personally, I have already booked some profits at Sell Target 1 and I am happy to wait to see if the share price wants to hit Sell Target 2 or return to my Buy Threshold ($4.50) in order for me to reload my position. If the share price does return to my buy area, I will not be shy with my sizing and will look to double my position size in anticipation that the CLEAR Outcomes data supports a label expansion in 2024. In addition, the company’s other pipeline programs appear to have strong prospects including their recently announced next-gen ACL inhibitor, which might be operative in numerous therapeutic areas.

Esperion Therapeutics Pipeline Beyond Bempedoic Acid (Esperion Therapeutics)

Esperion’s long-term growth prospects are becoming stronger by the quarter. Therefore, ESPR will remain a “Top Idea” in my Compounding Healthcare Seeking Alpha Marketplace Service for the foreseeable future and has a conviction rating of 3 out of 5.

Be the first to comment