24K-Production

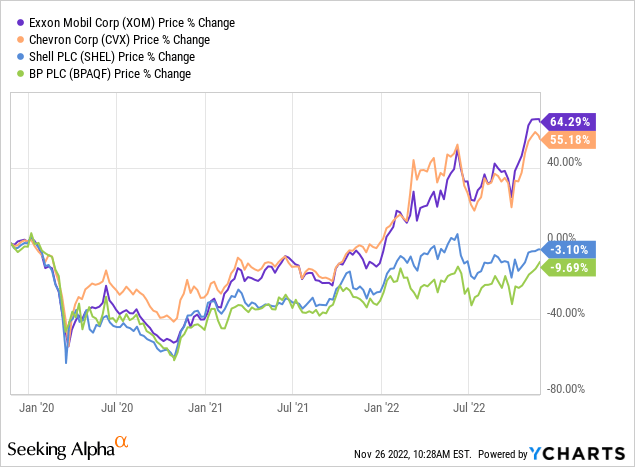

There has been a significant divergence in strategy between US oil majors like Exxon (XOM) and Chevron (CVX) and the European oil majors like BP (BP) and Shell (SHEL). The US majors have focused on maximizing returns, while the European majors have repeatedly emphasized their lower return, virtue signaling, “alternative energy” investments. The divergence in their share price performance has been staggering:

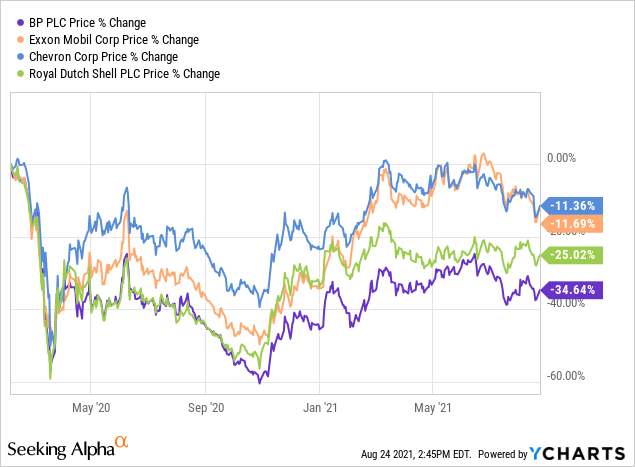

Unfortunately for BP and Shell shareholders, this has been predictable. BP famously doubled down on their alternative energy investments last year, despite their under-performance up until that point:

Seeking Alpha YCharts

I highlighted a major red flag at the time, the focus on virtue signaling and under emphasis on delivering positive shareholder returns:

the CEO answers “personally, no, I do not think we have moved too fast, and here is why” – his why is not “I own a lot of BP shares too, and this strategy will maximize the return on my shares.” Instead, the focus is on being “in step” with society, not the maximization of returns or profits.

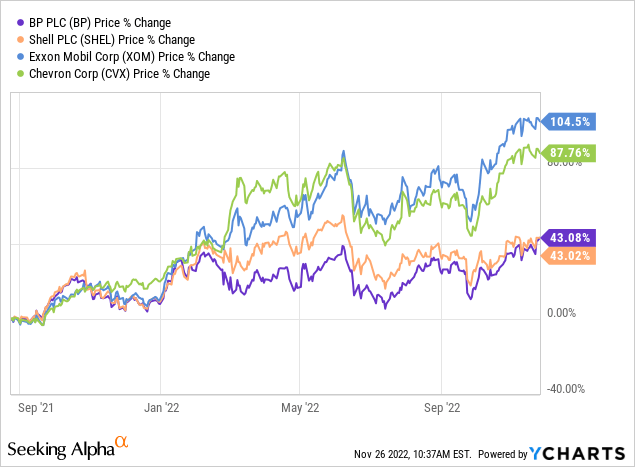

Is it any surprise that BP (and Shell, with a similar approach) has under-performed since then? If anything, it seems like this under-performance is accelerating:

This is particularly important in the context of repeated recommendations to purchase BP and Shell stock, by fund managers, investment bank research analysts, and finance publications. The argument for these stocks is generally along the lines of a “reversion to the mean”.

Even Barron’s makes this argument in “Exxon Stock Is Up. Oil Is Down. Something’s Got to Give”:

Among the big oils, Shell SHEL +1.05% looks like the best play, its stock having lagged behind Exxon’s by more than 50 percentage points this year. At $57, Shell trades for five times projected 2023 earnings and yields 4% (based on an anticipated dividend boost), against 3.2% for Exxon. Shell’s European domicile hurts due to a hostile operating climate for Big Oil, but the discount to Exxon seems too steep.

With BP and Shell continuing to focus on alternative energy investments rather than return maximizing oil and gas investments, their under-performance seems likely to continue. And calls for reversion to the mean seem unlikely to be correct. If their strategies were to change, their lower valuations could offer meaningful upside. But absent that sort of change, BP and Shell seem likely to continue to underperform.

Be the first to comment