adaask

Both Ares Capital Corp. (NASDAQ:ARCC) and FS KKR Capital (NYSE:FSK) are high yield business development companies (i.e., BDCs) (BIZD) that boast investment-grade credit ratings. In this article, we will compare them side by side and offer our take on which one is a better buy.

Ares Capital Vs. FS KKR Capital – Balance Sheet

As was already stated, both boast investment grade credit ratings of Baa3 (Stable) or equivalent.

ARCC boasts immense liquidity of $4.6 billion, with a leverage ratio of 1.23x as of the end of Q2. While the leverage ratio is on the high end of its target range, its substantial liquidity and strong underwriting track record offset this risk to a considerable extent. Furthermore, after Q2 ended, ARCC issued a considerable amount of equity, which has likely reduced its leverage ratio by a considerable amount.

Meanwhile, FSK’s leverage ratio is a little lower at 1.15x as of the end of Q2, while its total liquidity stands at $2.7 billion. The company’s debt maturity ladder is conservatively positioned, with no maturities until 2024 and the vast majority of its debt not maturing until 2027 or later.

While both appear to be in solid shape, we give ARCC the slight edge here given that its liquidity is superior to FSK’s as well as the fact that a greater percentage of its debt is fixed rate.

Ares Capital Vs. FS KKR Capital – Investment Portfolio

ARCC’s investment portfolio is very well positioned to benefit from rising interest rates. ARCC’s CEO stated during the Q2 earnings call:

As of quarter end, holding all else equal and after considering the impact of income-based fees, we calculated that a 100-basis point increase in short-term rates could increase our annual earnings by approximately $0.23 per share, a 14% increase above this quarter’s core EPS run rate.

A 200-basis point increase in short-term rates could increase our total annual earnings by approximately $0.44 per share, a 26% increase above this quarter’s core EPS run rate.

On top of that, its portfolio companies have strong interest coverage of 2.9x, giving them considerable capacity to handle rising interest rates. Furthermore, with a conservative 44% average loan to value ratio among its portfolio businesses, there is considerable protection for its investments should they enter into default. Overall, 71% of its investments are senior secured debt and its non-accruals stood at a mere 0.9% at fair market value as of the end of Q2.

FSK is also well-positioned to benefit from rising interest rates, given that 87% of its debt investments have floating interest rates. On the other hand, its portfolio underwriting performance continues to lag behind ARCC’s as non-accruals at fair value now stand at 2.9% as of the end of Q2. Moving forward, this performance should improve given that management continues to prune legacy investments from the portfolio, with 90% of the investment portfolio now originated by either KKR credit or the FS KKR advisor. Among the 90% of the portfolio that has been originated by KKR/FS KKR, the non-accrual rate on a fair value basis is a mere 0.5%. Finally, with 93% of its portfolio invested in senior secured debt or asset-based finance investments, its portfolio is positioned rather defensively.

Overall, we give the edge to ARCC here as its non-accruals are considerably lower than FSK’s.

Ares Capital Vs. FS KKR Capital – Dividend Safety

ARCC’s dividend is clearly safer than FSK’s right now, given that it has quite a bit of spillover income:

We currently estimate that our spillover income from 2021 into 2022, will be approximately $651 million or $1.32 per share. We believe having a strong and meaningful undistributed spillover supports our goal of maintaining a steady dividend throughout market cycles and sets us apart from many other BDCs that do not have this level of spillover.

In contrast, FSK employs a variable dividend payout policy. While its yield is considerably higher than ARCC’s at the moment, investors should keep in mind that the exact level of it is also far less reliable than ARCC’s payout.

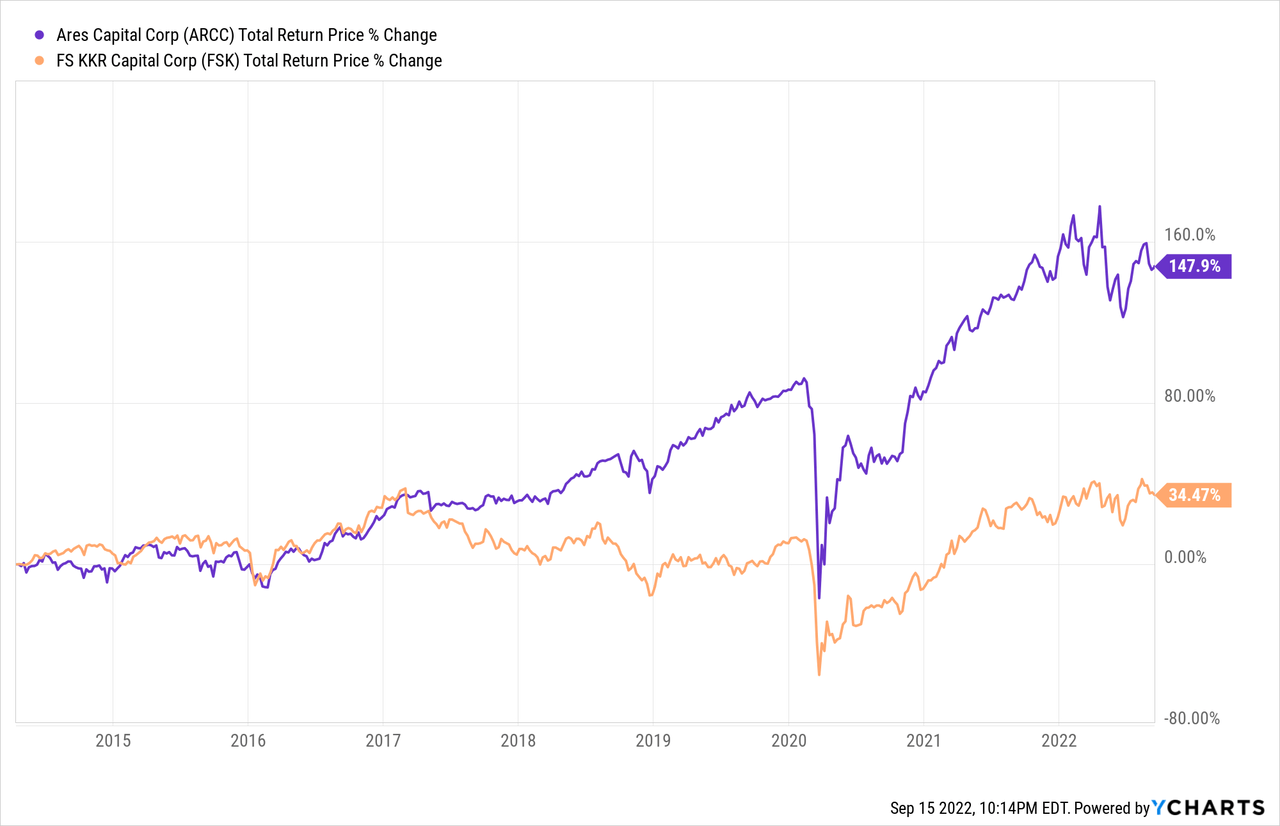

Ares Capital Vs. FS KKR Capital – Track Record

ARCC has a hands-down better track record than FSK, as it has crushed SLRC since FSK went public:

However, it is important to note that FSK recently completed a merger that led to improved efficiencies and synergies, improved diversification, and also set off a buyback program. As a result, we expect FSK’s performance to improve moving forward.

Ares Capital Stock Vs. FS KKR Capital Stock – Valuation

FSK’s valuation is considerably cheaper than ARCC’s across a variety of metrics in both a relative and historical manner:

| Valuation Metric | FSK | ARCC |

| P/E | 7.22x | 9.40x |

| P/E (5-Year Average) | 8.05x | 10.24x |

| Dividend Yield | 12.64% | 9.33% |

| Dividend Yield (5-Year Average) | 12.60% | 9.35% |

| P/NAV | 0.78x | 1.01x |

| P/NAV (5-Year Average) | 0.76x | 1.02x |

The deep value at FSK is evident given management’s plan to buy back tens of millions of dollars in stock in the coming quarters.

Given how high FSK’s dividend yield is at about 330 basis points higher than ARCC’s, it has considerable margin of safety that can offset an inferior growth rate relative to ARCC. Furthermore, its steep discount to NAV helps to insulate investors from book value losses due to write-offs from the legacy portfolio, and it also gives management an easy way to create value by simply buying back stock.

Investor Takeaway

Unsurprisingly, this comes down to a competition between value and quality. When it comes to overall BDC quality, ARCC wins hands down, as its balance sheet, investment portfolio, dividend safety, and performance track record crush FSK’s. However, FSK still boasts an investment grade credit rating, and its underwriting performance is poised to improve moving forward as KKR originated loans are increasingly dominating the portfolio and are enjoying a higher performance rate. On top of that, the discount at FSK is overwhelmingly greater than it is at ARCC, where the stock appears to be trading roughly in-line with the fair value of the underlying investments.

As a result, we favor FSK at the moment as we believe its fundamentals will continue to improve on a relative basis while its steep discount gives it an enormous margin of safety and investors an enormous dividend income yield. We rate FSK a Strong Buy and ARCC a Hold at current prices.

Be the first to comment