HT Ganzo

This article first appeared on Trend Investing on September 15, 2022, but has been updated for this article.

Europe set to potentially follow the USA with their own ‘European Critical Raw Materials Act’.

In some interesting news announced last month by the European Commission, they said that they intend to follow the USA with their own ‘European Critical Raw Materials Act’. The Sept. 14, 2022 news release stated:

Critical Raw Materials Act: securing the new gas & oil at the heart of our economy I Blog of Commissioner Thierry Breton. “Lithium and rare earths will soon be more important than oil and gas. Our demand for rare earths alone will increase fivefold by 2030. […] We must avoid becoming dependent again, as we did with oil and gas. […] We will identify strategic projects all along the supply chain, from extraction to refining, from processing to recycling. And we will build up strategic reserves where supply is at risk. This is why today I am announcing a European Critical Raw Materials Act.”… To frame the ambition, objectives could be introduced in the legislation. For example, a target could be set that at least 30% of the EU’s demand for refined lithium should originate from the EU by 2030, or to recover at least 20% of the rare earth elements present in relevant waste streams by 2030.

Note: Bold emphasis by the author.

Today’s company looks set to be the first battery grade lithium hydroxide (“LiOH”) refiner in Europe, with their Germany LiOH refinery set to open in Q3, 2023. AMG Lithium state that they “will be the first Lithium Hydroxide Battery Grade supplier with a production site on European mainland.”

The Company is Advanced Metallurgical Group NV [AMS:AMG] [GR:ADG] (OTCPK:AMVMF) (“AMG”). For a background on AMG you can read our past article:

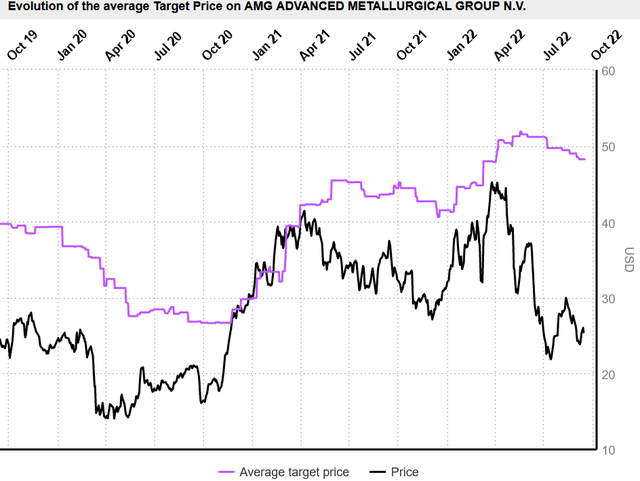

As shown below the stock price has fallen in 2022 on poor European market sentiment and lower vanadium prices; however lithium prices have surged higher and the Company is making record earnings (record EBITDA in Q2, 2022).

Advanced Metallurgical Group NV 5 year price chart – Price = Euro 24.38

Advanced Metallurgical Group 5 year price chart

Yahoo Finance![Advanced Metallurgical Group NV [AMS:AMG] [GR:ADG] (<span class='ticker-hover-wrapper'>OTCPK:<a href='https://seekingalpha.com/symbol/AMVMF' title='AMG Advanced Metallurgical Group N.V.'>AMVMF</a></span>) 5 year price chart](https://static.seekingalpha.com/uploads/2022/10/18/37628986-1666069534800256.png)

Advanced Metallurgical Group (“AMG”) produces highly engineered specialty metals and mineral products, and provide related vacuum furnace systems and services to the transportation, infrastructure, energy, and specialty metals and chemicals end markets.

AMG was incorporated in the Netherlands in November 2006, formed as a portfolio from a combination of specialty metals businesses.

AMG operates globally with production facilities in Germany, the United Kingdom, France, the United States, China, Mexico, Brazil, India, Sri Lanka, and Mozambique.

AMG’s three divisions

- AMG Clean Energy Materials – Includes lithium, tantalum, niobium, vanadium and recycling; lithium hydroxide production (once operational). Subdivisions are AMG Lithium, AMG Brazil, AMG Vanadium, AMG Aluminum. Details here.

- AMG Critical Materials – AMG’s antimony, graphite and silicon metal businesses.

- AMG Critical Materials Technologies – Includes AMG Engineering (vacuum furnace systems), AMG Titanium Alloys and AMG Chrome.

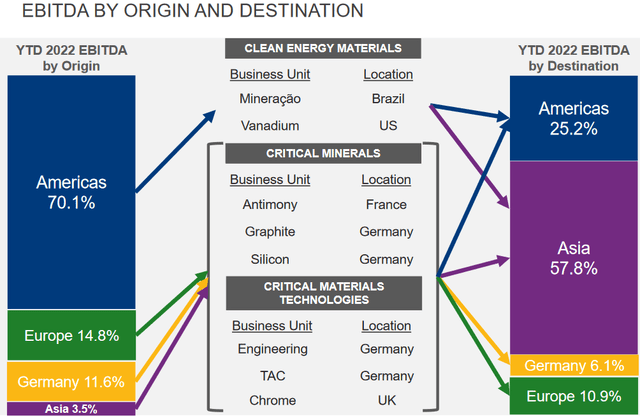

AMG’s recent great financial results are being driven by their Clean Energy Materials Division – Lithium from Brazil and vanadium from USA, accounting for 70.1% of EBITDA YTD in 2022

AMG Q2, 2022 results presentation

AMG’s lithium and vanadium growth plans

Lithium spodumene – Mibra Mine expansion from 90-130,000tpa

AMG is in process of expanding their Mibra lithium mine in Brazil from 90,000tpa of lithium spodumene production to 130,000tpa. This is expected to be completed by Q2, 2023.

AMG’s Mibra lithium-tantalum-niobium spodumene mine in Brazil

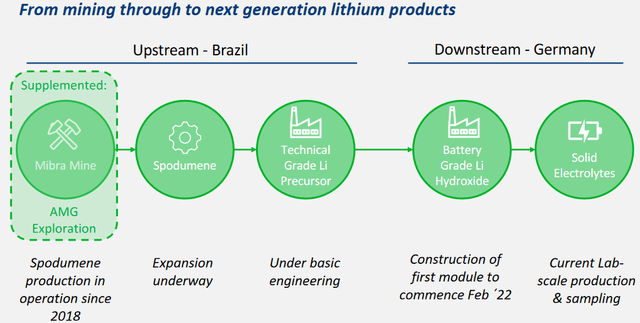

AMG’s spodumene (“supplemented’ by some other source) from Brazil will be used to feed their new Germany LiOH facility (Module 1) once completed in Q3, 2023 (source)

AMG May 2022 company presentation

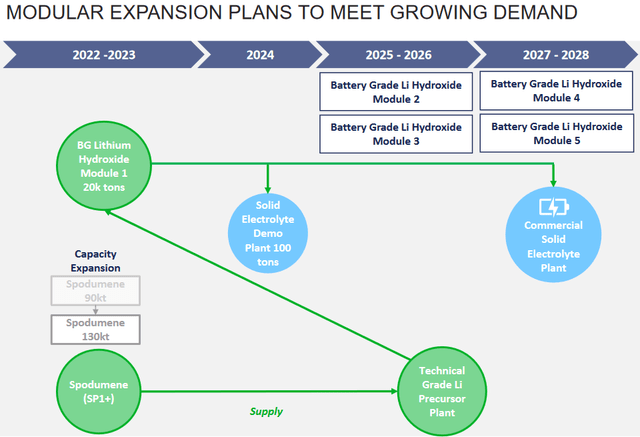

Lithium hydroxide (20,000tpa modules –> 100,000tpa by ~2028)

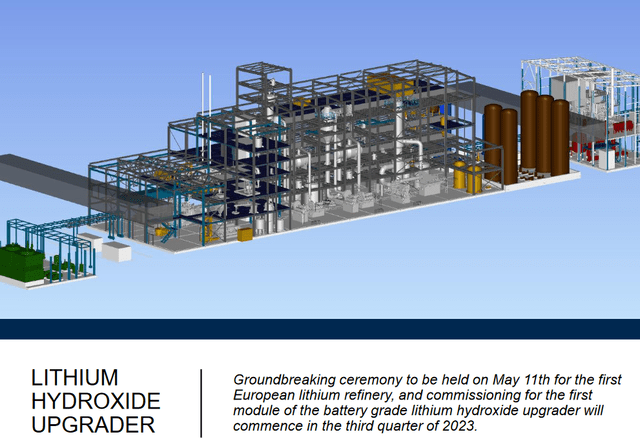

AMG has started construction of the first European battery grade LiOH refinery in Europe, located in Bitterfeld, Germany. Commissioning for module 1 (20,000tpa LiOH) is set to commence in Q3, 2023.

AMG plans to add Modules 2 and 3 in 2025/26 and Modules 4 and 5 in 2027/28, with a goal to then achieve a LiOH refinery with a total of 100,000tpa LiOH production. Each module is 20,000tpa LiOH. The expected CapEx is US$120m for module 1 and US$75m per modules 2-5.

Schematic of AMG’s LiOH facility under construction in Germany

AMG’s lithium expansion plans with timeline

Vanadium – Ohio expansion

AMG has an existing vanadium recycling facility in Ohio, USA, with plans to at least double production. Once the expansion is ramped it should achieve over 35,000 tons of incremental spent catalyst processing capacity and over 6 million pounds of incremental vanadium production capacity.

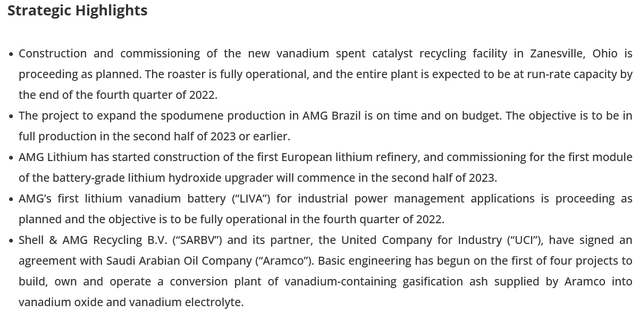

Construction and commissioning of the new vanadium spent catalyst recycling facility in Zanesville, Ohio is proceeding as planned. The roaster is fully operational, and the entire plant is expected to be at run-rate capacity by the end of the fourth quarter of 2022.

AMG state: “Upon completion, AMG will be the largest recycler of vanadium-bearing materials globally.”

AMG’s Zanesville Ohio vanadium spent catalyst recycling facility

Vanadium – Saudi Arabia Project JV

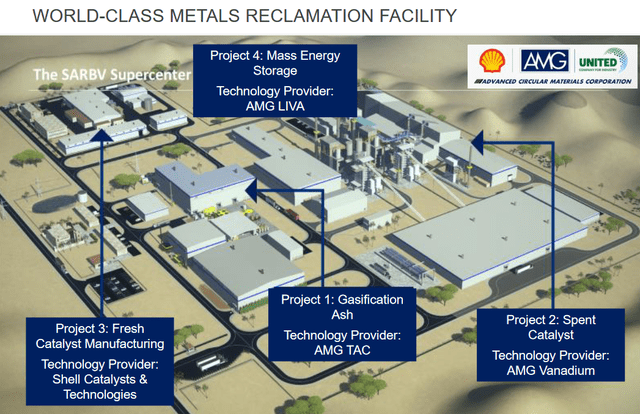

Shell & AMG Recycling B.V. (“SARBV”) and its partner, the United Company for Industry (“UCI”), have signed an agreement with Saudi Arabian Oil Company (“Aramco”) to build four projects in Saudi Arabi. The Projects will consist of conversion plants of vanadium-containing gasification ash supplied by Aramco into vanadium oxide and vanadium electrolyte. Basic engineering has begun on the first of four projects. You can read a presentation on the Saudi Arabia Project here.

Schematic sample of the Saudi Arabia Project JV to produce vanadium oxide and vanadium electrolyte, used in VRFB’s

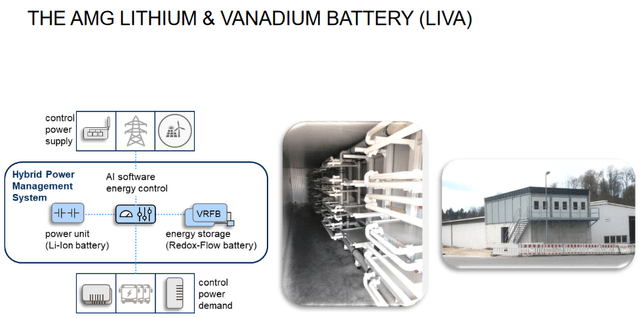

AMG also has a lithium-vanadium battery (“LIVA”) for the energy storage market

AMG’s first lithium vanadium battery (“LIVA”) for industrial power management applications is proceeding as planned and the objective is to be fully operational in Q4, 2022.

AMG update on expansion plans as of July 28, 2022

Valuation

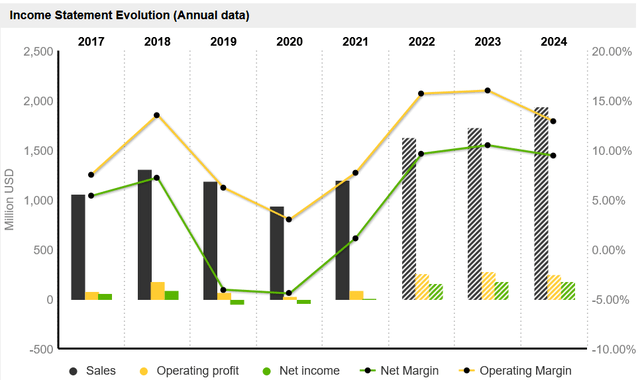

AMG’s current market cap is Euro 777m (~USD 766m). As of June 30, 2022 AMG had $301m in cash and US$708m in debt. Market screener shows 2022 estimated net debt at US$352m.

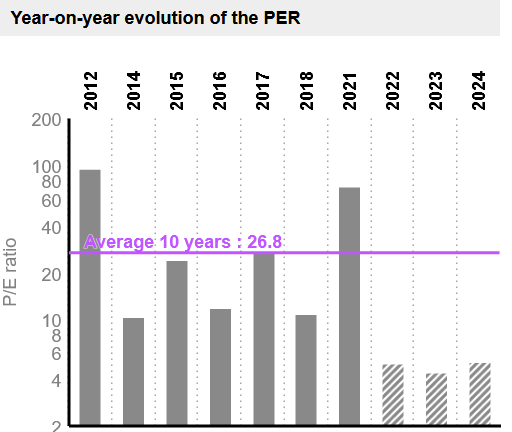

2022 PE is 4.39 and 2023 PE is 3.5. 2022 estimated dividend yield is 3.60%. 2022 net profit margin is forecast at 10.62%.

Current consensus analyst price target is USD 49.95, representing 92% potential upside. Yahoo Finance shows a price target of Euro 45.17 (USD 44.52).

AMG’s financials and forecast financials (source: Market Screener)

Market Screener Market Screener

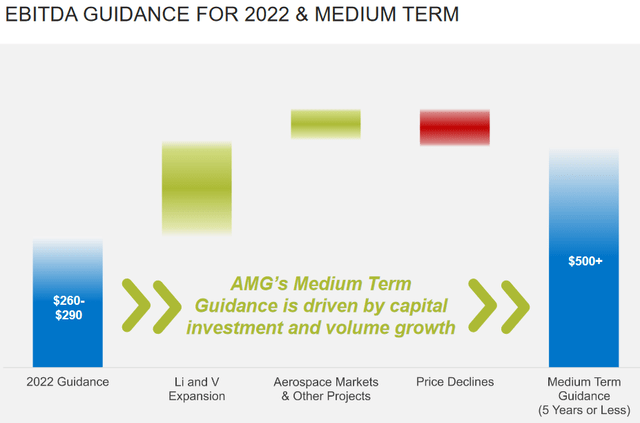

AMG’s 2022 EBITDA guidance is US$260-290m and ~2027 target is US$500m+

Analyst’s consensus price target is USD 49.95, representing 92% potential upside

Management and top shareholders

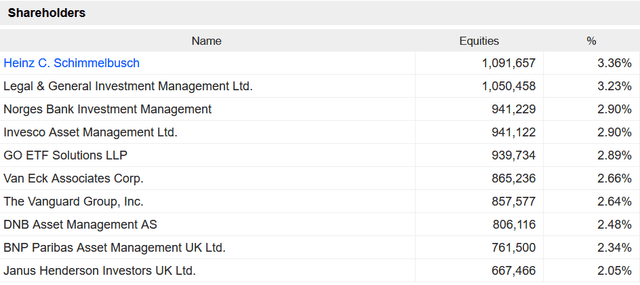

AMG is led by Chairman and CEO Dr. Heinz Schimmelbusch. He has vast experience and has led the company since November 21, 2006. You can read more details on the board and management here.

Insider ownership is quite low at 3.36%, institutional ownership is quite high

Upcoming Catalysts

- Q4, 2022 – Lithium-vanadium battery (“LIVA”) for the energy storage market to be ready.

- End Q4, 2022 – New vanadium spent catalyst recycling facility in Zanesville, Ohio to be commissioned.

- Q2, 2023 – Stage 2 production at Mibra Lithium-Tantalum mine (additional 40ktpa) forecast to begin, bringing total production capacity to 130ktpa.

- Q3, 2023 – Lithium hydroxide facility in Bitterfeld-Wolfen Germany to be commissioned. First module to be 20,000tpa LiOH.

- 2023 –> Saudi Arabia vanadium Projects JV with Shell & Aramco.

- 2025-2028 – German LiOH facility expansion with Modules 2-5 (100,00tpa LiOH.

You can read the latest company news here.

Risks

- A global slowdown may reduce demand for AMG’s products.

- Metal prices falling (notably lithium and vanadium). AMG is a low cost lithium producer. With regards to vanadium, AMG is somewhat less impacted as they don’t mine vanadium, but buy waste from oil refineries then process that to extract the vanadium paying a fee based on the trailing vanadium price.

- With regards to their direct mining exposure the usual mining risks apply: Exploration risks, funding risks, permitting risks, production risks, project delays.

- New expansion and projects execution and budget risks.

- Sourcing lithium spodumene for Modules 1-5 for the LiOH facility in Germany as the Mibra Mine life is ~20+ years and would likely not be enough spodumene to source, especially considering current off-take arrangements.

- Company risks (management, debt, liquidity and currency risks).

- Sovereign risk – Their lithium project is in Brazil (medium risk). Vanadium project is in USA (low risk). The LiOH refinery is being built in Germany. AMG’s sales are very well diversified globally.

- Stock market risks – Dilution, lack of liquidity (best to buy on local exchange – Amsterdam), market sentiment.

You can view the company’s latest presentations here.

Further reading

Conclusion

It is hard to think of a more undervalued lithium and vanadium producer than AMG. The cause appears to be poor European equities sentiment with the war in Ukraine, and the fact AMG falls under the radar of many investors. A fall in vanadium prices in 2022 has also been a contributor and perhaps the significant debt is a factor also.

AMG is quietly executing a massive growth plan that includes the following:

- Mibra spodumene Mine expansion from 90-130,000tpa by Q2, 2023.

- Europe’s 1st battery grade LiOH refinery (in Germany) – 1st 20,000tpa module by Q3, 2023, then plan to expand to 100,00tpa LiOH by ~2028.

- New vanadium spent catalyst recycling facility in Zanesville, Ohio by end Q4, 2022. An expansion of the existing facility in Ohio.

- Saudi Arabia vanadium Project JV with Shell & Aramco – 4 projects in total.

- Lithium-vanadium battery (“LIVA”) for the energy storage market by Q4, 2022.

Valuation is currently extremely attractive on a 2023 PE of 3.5, especially when considering the near term growth potential from lithium and vanadium. AMG’s market cap of ~USD 777m looks extremely low when compared to other lithium producers that range from US$5.91b (Allkem (OTCPK:OROCF)) to US$29b (Albemarle (ALB)).

The biggest risks would be a fall in lithium prices, company debt, and executing multiple growth strategies on time and on budget. The latter is mitigated by strong recent cash flow, cash reserves, staged expansion, and JV partners in Saudi Arabia.

We rate AMG as a great buy, best suited for a 5 year+ time frame.

As usual, all comments are welcome.

Be the first to comment