JariJ

Ericsson (NASDAQ:ERIC) is one of those companies that many readers want me to report continually about, given the size of its listing and its business, but is a company I’m relatively mellow about. I own a few of the native shares, but most of my ownership in Ericsson is through the holding in Swedish giant Investor AB (OTCPK:IVSXF). This dilutes and balances my risk while adding several, non-sensitive businesses and guaranteeing based on history, a decent and stable dividend.

Nonetheless, the company does have arguments to consider – and a positive thesis. And here it is.

Ericsson – An Update

In my previous article on Ericsson, I made a case for the company, owned in large parts by Wallenberg, for being a decent investment. Legacy Ericsson was an early pioneer in building telephones and switchboards for Sweden’s first operating telco, Stockholms Allmänna Telefonaktiebolag. This building of Switchboards and phones is what the company would do for over 100 years – and still does to some extent today.

While the US has traditionally remained closed to the company due to the dominance of Bell, Kellogg, and Automatic Electric, this is a bit changed today. The internet and the rise of cell phones may have killed off Ericsson’s telephone business – not because they missed it, but because they handled it incorrectly.

The reason why Ericsson saw a decline in mobile is in part due to its pushing for the WCDMA standard above the Qualcomm (QCOM) standard CDMA2000 which already had CDMA tailwinds in the USA. While this wasn’t integral in its fall, it was nonetheless the start during the 1999 lawsuit where both parties agreed to essentially pay one another for royalties for the use of their technologies.

The company issued its first profit warning in early 2001 (I remember this because the news was very prominent in Sweden – a legacy like Ericsson essentially in trouble).

Sales to mobile operators halved. Landline phone sales declined, and new product development fell.

The mobile telephone segment/JV became a financial burden, showing a loss of 24B in 2000, not much better in 2001. Then came a factory fire, delivery stops which crippled Scandinavian companies including Nokia (NOK), and Ericsson spun its phones off into a Sony (SONY) JV.

Since 2012, Ericsson hasn’t built a single phone – but instead focuses on enabling data and phone communication through backend hardware. This is a 170+ billion SEK sales industry or more than 70% of company revenue.

The market characteristics of these operations are cyclical. Telcos invest in infrastructure during rollouts of network. It’s a front-loaded hardware order cycle, complemented by continuing orders of software and service. That’s how it works. How much they spend depends on how well they can monetize these networks. While the first generations focused on GSM, current generations are focused on LTE and 5G. Any attempt by Ericsson to spin or focus away from the RAN market (which is very cyclical) has really failed, and it’s what causing the company’s massive ups and downs we’ve seen for the past 10-or-so-years (coupled with a truly terrible personnel policy that still isn’t entirely “fixed”)

Ericsson, for all intents and purposes, should be viewed as nothing more or nothing less than an infrastructure hardware and software provider. That is what they know and can do. One of my biggest gripes with Investor AB remains the opinion that the Wallenbergs did not enter early on and put a leash around management to stop them from burning cash through bad investments.

Because legacy infrastructure Ericsson is good and operates with China essentially being closed in many nations in terms of telco infrastructure, in a global duopoly. The only non-Chinese company doing what Ericsson does to any sort of scale is Nokia.

Any other peer you mention is too small to matter on a global scale. The lack of an American peer here is quite surprising, but M&A actions and company development have made it this way.

Ericsson’s balance sheet still might not be the most pleasant evening night-read, but it isn’t as bad as it once was. Coverage of debt and interest is good, and sales for 5G and related things are starting to see an upside.

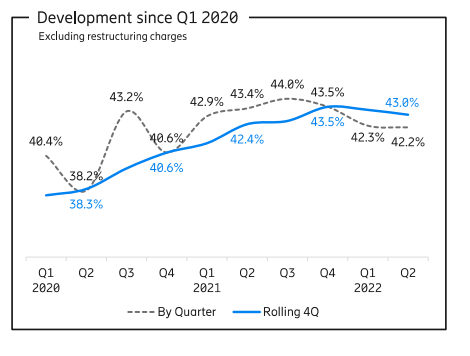

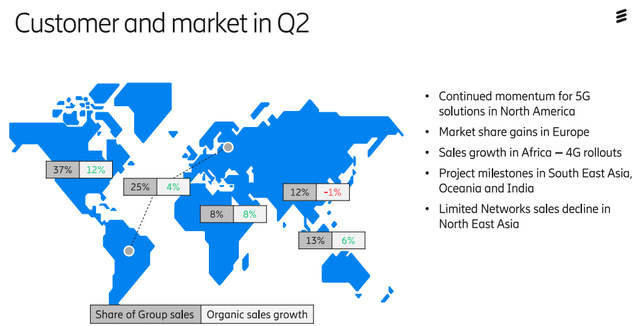

2Q22 momentum is good. The rollout of 5G is seeing organic sales grow by 5%, and the company is actually still above a 42% gross margin despite inflation and other issues, with EBITDA margins of around 14% on a rolling 4-quarter basis. The company is generating cash once again and doing so well. Unlike in the early 2000s, ERIC has learned its lessons about infrastructure and supply chain resilience. The company hasn’t seen material adverse effects from the crisis that have caused it not to be able to fulfill orders.

The company is even positive on significant EBITDA margin expansion, and are targeting upward of 400 bps margin growth in the next 2-3 years.

Most markets that matter are up significantly for the year.

Yeah, northeast Asia is down, but that’s where Huawei and ZTE are, and I don’t expect Ericsson to deliver a massive market share growth in currently somewhat hostile home markets.

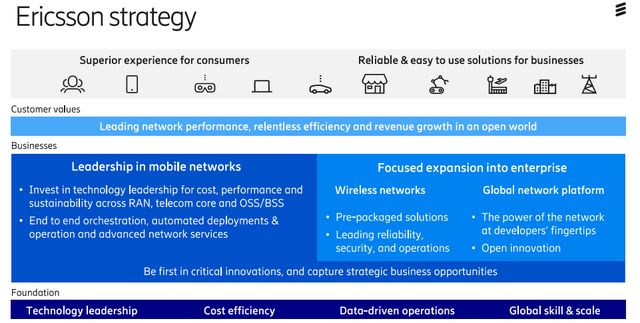

The company’s strategy remains intact, and for the first time perhaps more crystallized and clear than ever.

For the quarter, we saw some problematic costs in OpEx mixed with overall gross margin decreases. This was due to both investments/R&D, but also due to SG&A costs related to legal and compliance. The issue I mentioned in my last article with regards to ISIS still is very much relevant here.

Still, take a look at the recent two-year development of gross margins, and you’ll see the average ramp-up here.

ERIC IR (ERIC IR)

Fundamentals remain intact and solid. The company delivered 4.4BSEK of FCF. The company repaid a 10B bond, delivered dividends worth 4.2BSEK and saw an increase in net cash to 70.3BSEK, or around $6.5B for the quarter.

In short, Ericsson is, with mixed success, trying to mitigate inflationary pressures, but is seeing strong continued momentum based on the 5G rollout, and this rollout will continue for far longer. It’s M&A’ing Vonage and has adjusted its structure to better capture digital opportunities.

Risks exist – one being this.

I wish I could say I was surprised – but Swedish Telco and infrastructure companies have a solid history (See Telia (OTCPK:TLSNF)) of getting involved in these sorts of quagmires. To a degree where I believe they really should be fundamentally discounted for it from the get-go. That is what I am doing to Ericsson, as well as other Scandinavian telcos with the same tendencies.

However, Ericsson has been doing well – and this shows in the company’s current valuation and forecast.

Ericsson Valuation

As I said in my last article on the company, anything can be attractive at the right price – Ericsson is certainly no different. We could have bought it at 50 SEK and had excellent returns.

The change in Ericsson fundamentals justifies, together with the solid restructuring and more focus on OpenRAN, a higher consideration due to better-expected margins. 2021 was a good start, and 2022 seems to be on track to result in similar trends. The company has a very high cost of debt for the context – over 5% as of 2Q22 – and comes to a WACC of 8.4%. I’ve applied a range of growth that’s at 2.5-3%. This is significantly below my peer analysts – but I am very clear in that I am taking a more conservative stance here, as I expect Ericsson’s issues not to be over.

I’m keeping my higher CapEx estimate as a portion of sales revenue to 4-4.5%, which is above the 3.8-4% consensus seen by peers. My conservative approach gives me an implied equity value of around 140-152 SEK/share.

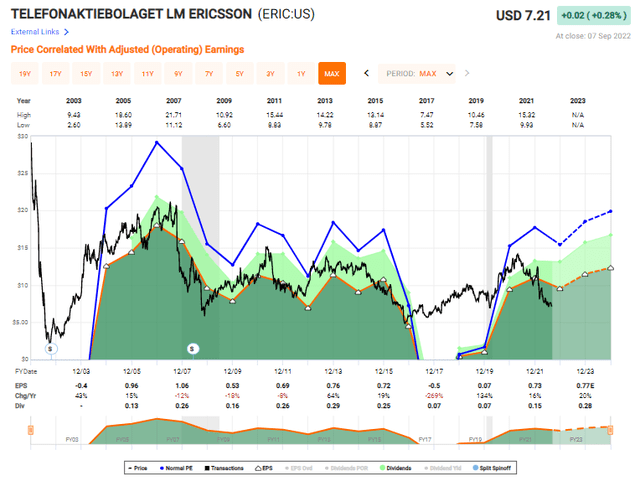

Ericsson has been a very volatile investment over time. Take a look at the trends in earnings.

This gives you the picture of an almost-schizophrenic company with fundamental issues in getting or holding its earnings stable. And such a picture would indeed be an accurate one. Fundamentally the company is no higher than BBB-, which is low for what the company is, and certainties and forecast accuracy are historically on the lower side. Analysts fail to forecast this company accurately around 77% of the time even on a 2-year basis with a 20% margin of error. Those are some truly abysmal track records – as you’d have better luck flipping a coin than following these analysts.

However, we’ve reached a pivot where I think it may be time to take Ericsson more seriously. Despite an increased stability in EPS, the company has traded down significantly since early this year, now seeing P/E levels below 11x for the ticker ERIC.

Using some conservative 15x P/E multiple targets, we can see that the company may have an upside of around 29% per year, or 80% in 3 years, based on a 2024E 15x P/E. Based on the forecasts calling for improved margins and better earnings, this does not seem outside the realm of possibility at all.

Peer comparisons are extremely difficult. There are really only two we can use, given that Huawei has no public listing. That’s ZTE and Nokia, and I would tend to regard ZTE with a bit of conservativism given the history of China and accounting. Consensus comes to a P/E of around 14.9X on average, with an EV/EBITDA of 8.5X, a 2.3X book value multiple and a low 1.75% average yields, owing to Nokia and ZTE’s low yield. Again, it’s only two peers.

That’s all we have – and Ericsson is below this in most respects, excepting yield, where ERIC currently sports 3.22%. The obvious conclusion from public comps given Ericsson’s current ~10x P/E ratio, depending on how you view it, as well as a lower EV/EBITDA and same-level P/Book, gives us undervaluation.

So, if you wanted you could really consider Ericsson at least 20-30% undervalued on every public comp basis (except P/B and yield).

Remember though, that this disregards the fact that the company paid an unsure, low dividend for years, and only very recently started bringing it back to play. P/E and other multiples completely disregard the forward political risks and current standards.

In my original thesis, I discounted Ericsson by about 15% and gave it a native share price target of 115 SEK – and the company is currently significantly below this. I won’t change my discounting, and I also won’t lower my overall share price target.

Why not?

Because I don’t see that the company, due to the geopolitical issues, has become fundamentally more unsafe or unsound. In fact, valuation has improved, and the upside hasn’t changed overly much.

I, therefore, stick to my “BUY” with my original target of 115 SEK/share.

However – I personally invest not in ERIC but in the investment company Investor AB. By doing so, I get exposure to Ericsson, but also to a whole other host of great businesses, and in doing so I diversify my holdings and my risk. Investor AB is currently at a discount to NAV, so makes for a good investment, all things considered.

So my choice is Investor AB, but Ericsson here remains a “BUY”. For ERIC, I put the price target at around $9.50/share.

My stance is therefore a “BUY”.

Thesis

My thesis is therefore the following:

- Ericsson is one of the premiere backbone communication hardware companies in the world, with impressive software capabilities. The company is technically sound, but has a bit of a 20-year troubled past, leading it to trade in a volatile manner.

- The valuation has dropped to “too low” levels, and I believe it time to look at buying/investing more in Ericsson, either directly or through my preferred proxy, Investor AB.

- I view Ericsson as a “BUY” with a 115 SEK, or $9.50 price target.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment