imaginima/E+ via Getty Images

Equitrans Midstream Corporation (NYSE:ETRN) is a natural gas-focused midstream company that primarily operates in the Marcellus and Utica Basins of Appalachia. This is a particularly good place to be given the very strong fundamentals for natural gas along with the ongoing energy crisis in Europe. This second aspect comes from the fact that the Russian invasion of Ukraine has caused many European countries to look for alternate suppliers for their natural gas, such as the United States. Although many American energy companies are being cautious about increasing their production, the company still has significant growth potential. Equitrans has a number of things to like about it and there may be some reasons to include this 7.08%-yielding company in your portfolio.

About Equitrans Midstream

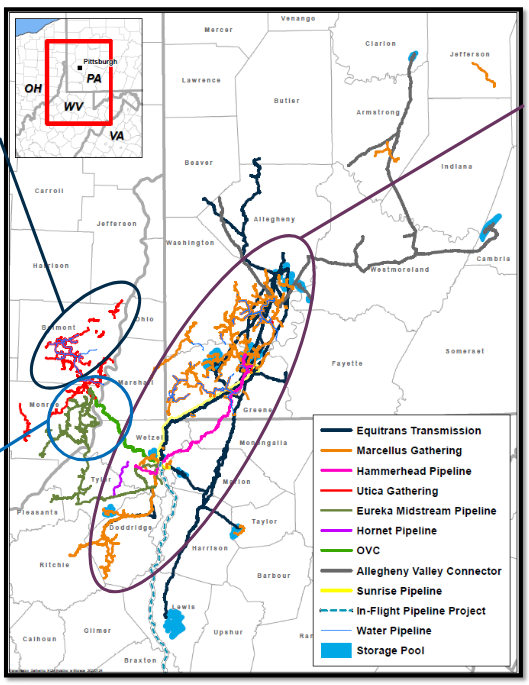

As stated in the introduction, Equitrans Midstream Corporation is a natural gas-focused midstream company that operates primarily in the Marcellus and Utica Basins of Pennsylvania, West Virginia, and Ohio.

Equitrans Investor Presentation

This makes Equitrans Midstream one of the only midstream companies to operate exclusively in the Appalachian region. This is generally a good place for the company to operate. As I discussed in a previous article, the Marcellus and Utica shales are some of the richest regions in the world in terms of natural gas reserves.

Admittedly, though, Equitrans does not produce any natural gas itself, but it does still benefit from this. This is because the enormous reserves in the region ensure that Equitrans’s customers are able to keep producing for an extended period of time. As Equitrans makes its money based on the volume of resources that moves through its infrastructure, this dynamic should ensure that the company is able to generate relatively steady cash flows for a very long time. That is exactly the kind of thing that we like to see as income investors.

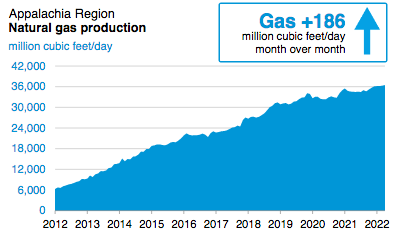

As investors, we are not content with stability, though. After all, growth is very important as well. Fortunately, production in the Appalachian region has been growing, albeit not as quickly as it has in the past.

U.S. Energy Information Administration

Unfortunately, Equitrans did not really benefit from this in 2021 as the company’s full-year 2021 results were generally worse than the company’s comparable full-year 2020 results. With that said, though, the weaker financial performance was not entirely within Equitrans’s control as the earnings results specifically stated that the decrease was caused by some of the company’s earned revenues being deferred to a later date. In addition, the company’s reported net income was negatively impacted by a $1.9 billion impairment charge.

As I have pointed out in the past, impairment charges do not actually represent money leaving the company, so we do not typically need to worry about charges like this. The company’s free cash flow is much more important, and this was actually up significantly year-over-year. During the full-year 2021 period, Equitrans reported a levered free cash flow of $376.7 million, which was a substantial increase over the $144.1 million that the company reported in the full-year 2020 period. As the free cash flow is the money that the company can use to reward its shareholders through dividends, share buybacks, or other means, the year-over-year increase here is something that any investor should be able to appreciate.

Equitrans is positioned to continue its growth trajectory going forward. This is being driven by a very long-term contract that Equitrans has with natural gas giant EQT Corporation (EQT). This is a fifteen-year contract that started in 2020, so it will ensure that EQT has steady business until 2035. The length of this contract is actually quite impressive since most midstream contracts are only five to ten years in length. This length should allow the company to ride through any short-term economic disruption like the one we saw in 2020 because the economic problems will likely both start and end within the contract term.

The contract promises more than stability, too, as the minimum volume commitment, which specifies the number of resources that EQT sends through the company’s infrastructure, increases from two billion to three billion cubic feet of natural gas per day over the contract term. As Equitrans’s revenue and especially cash flow is dependent on resource volumes, this should cause the company’s cash flows to grow. The company has guided for a free cash flow of $340 million to $420 million during 2022. This would represent an improvement over the company’s cash flow in 2021 at the high end, although the midpoint of this range is relatively in-line with the company’s 2021 figure. That still overall shows the stability that the company possesses, even if it does take it longer than one year to show all of the promised contractual growth.

One of the characteristics of midstream infrastructure is that there is a finite quantity of resources that it is capable of handling. As such, Equitrans will need to construct new infrastructure in order to accommodate the higher quantity of resources that EQT and other smaller customers are planning to send through the company’s infrastructure over the next few years. Equitrans is doing exactly this. The company has already stated that it intends to invest $525 million to $625 million in 2022 into its various growth projects, with most of the money being directed into Equitrans’s gathering pipeline infrastructure, which is the business unit that directly supports the planned production growth that EQT is planning within the area that is serviced by Equitrans’s infrastructure.

Equitrans is also planning to make significant investments into its transmission network, which carries the natural gas over much longer distances than the gathering pipelines do. This is also intended to support the EQT contract since the customer will need to move the gas away from the fields in order to sell it and it is easiest for EQT to simply have this service performed by Equitrans under the same contract. This is nice for Equitrans because it allows it to make money from providing both services to EQT instead of just the one, which ultimately results in more cash for the shareholders.

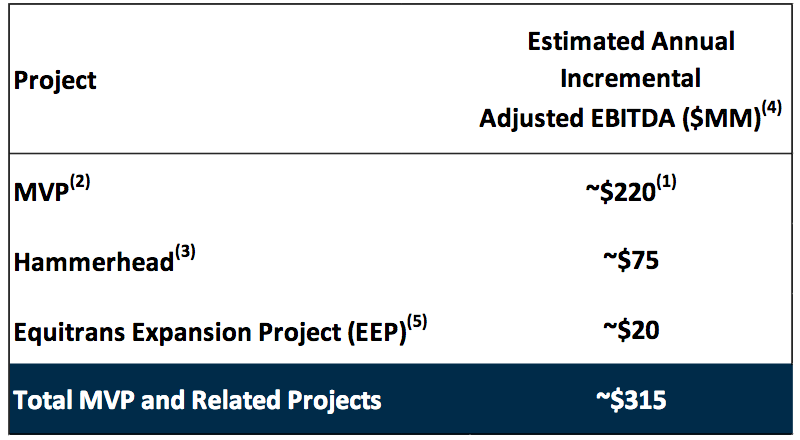

Although the contract with EQT will be the largest forward driver of growth for Equitrans, it is not the only one. The company’s infrastructure investments are also meant to support these other customers’ needs for additional takeaway volume. The nice thing about all of the company’s growth projects is that Equitrans has already secured contracts for the use of all the new capacity. This ensures that Equitrans is not spending a great deal of money to construct midstream infrastructure that nobody wants to use. The fact that Equitrans already has contracts in place also allows Equitrans to know how profitable these projects will be. Overall, Equitrans expects that the company’s growth projects will increase its adjusted EBITDA by approximately $315 million annually.

Equitrans Investor Presentation

This represents a very impressive 31.11% increase over the $1.0124 billion that the company actually reported in 2021. This is a much higher growth rate than most other midstream firms are likely to achieve given the broader environment in the energy sector right now, which seems likely to appeal to some investors.

Another nice thing about Equitrans Midstream is that the company has a fairly low long-term debt load. We can see this by looking at the company’s leverage ratio (defined here as consolidated debt-to-adjusted EBITDA), which essentially tells us how many years it would take the company to completely pay off all its debt if it were to devote the entirety of its pre-tax cash flow to that task. The company has stated that it has the long-term goal of getting this ratio under 4.0x, which is quite reasonable. After all, analysts generally consider anything under 5.0x to be reasonable and sustainable.

However, Equitrans is not there yet due largely to the expenses that it has incurred in the process of building out its infrastructure to support EQT’s needs. As of December 31, 2021, Equitrans had a total debt of $6.9843 billion, which gives it a leverage ratio of 6.90x based on its trailing twelve-month adjusted EBITDA. This ratio is admittedly far above the level that I like to see, which makes me rather uncomfortable. Fortunately, Equitrans does have a plan to get this down to its target range. As we have already discussed, the company is quite likely to deliver reasonably strong cash flow growth going forward. This will provide the company with free cash in excess of what it needs to pay its dividend (Equitrans is projecting $80 million to $160 million in 2022).

The company is planning to use this surplus free cash flow to pay down its debt until it gets into the target range. Admittedly, this may result in a few years of negligible dividend growth, but that is worth it for the company to reduce its debt load and by extension its risk.

Macro-Economic Fundamentals

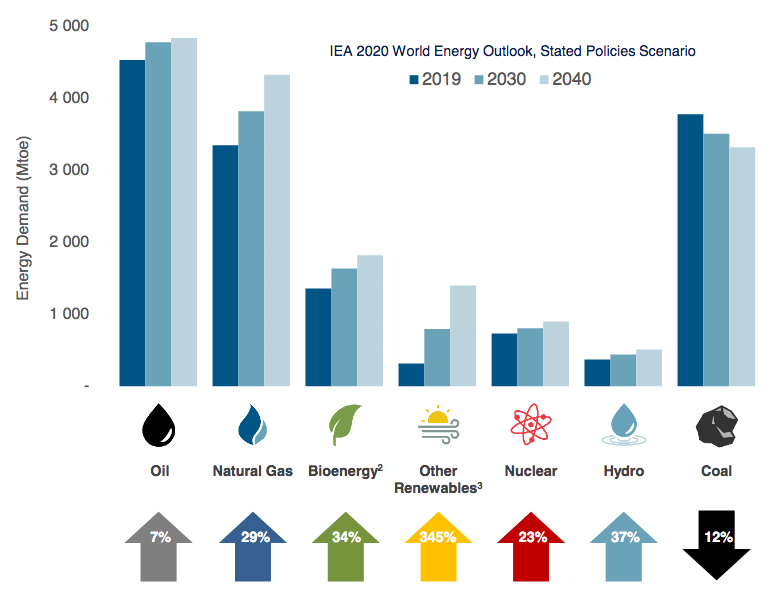

As already discussed, Equitrans is focused on providing midstream services for natural gas producers and is not really involved in any other fossil fuels. Fortunately, the fundamentals for natural gas are quite good, with demand expected to grow significantly over the coming years. According to the International Energy Agency, the global demand for natural gas is expected to grow by 29% over the next twenty years.

Pembina Pipeline/Data from IEA 2021 World Energy Outlook

This demand growth is, perhaps surprisingly, being caused by global concerns about climate change. These concerns have induced governments all over the world to impose a variety of incentives and mandates that are intended to reduce the carbon emissions of their respective nations. One of the most popular of these strategies is to encourage utilities to retire their old coal-fired power plants, which are replaced with new ones driven by natural gas and renewables. The unfortunate fact about renewables is that they are not reliable enough to support a modern electric grid on their own, so the natural gas turbines are being used to supplement renewables and ensure that the grid continues to deliver the reliability that we have come to expect from it.

The recent Russian invasion of Ukraine has created a new opportunity for the American natural gas industry. This is because Russia is the major supplier of natural gas to the European Union, supplying 159 billion cubic meters of gas to the bloc. This is about 59% of the natural gas consumed by the European Union. The invasion of Ukraine and the resulting sanctions on Russia have caused the Europeans to look for an alternate supplier. The United States is one of the only nations in the world that has the reserves to increase its production to satisfy this demand, although it does not have the infrastructure to export that much natural gas. Nonetheless, this could represent a long-term opportunity for the industry.

Equitrans is in a position to benefit from this, although it does not actually produce any natural gas. This is because it is one of the only midstream companies that operate exclusively in the Appalachian gas basins. These basins are geographically relatively close to the U.S. East Coast, which is a prime position for the export of natural gas to Europe. Appalachia is also one of the only basins that are thought of as a natural gas play so companies looking to produce solely natural gas or natural gas liquids will naturally be somewhat attracted to it. This could result in growing production in the region and since Equitrans’s cash flows increase when volumes do, it stands to profit as this thesis plays out.

Dividend Analysis

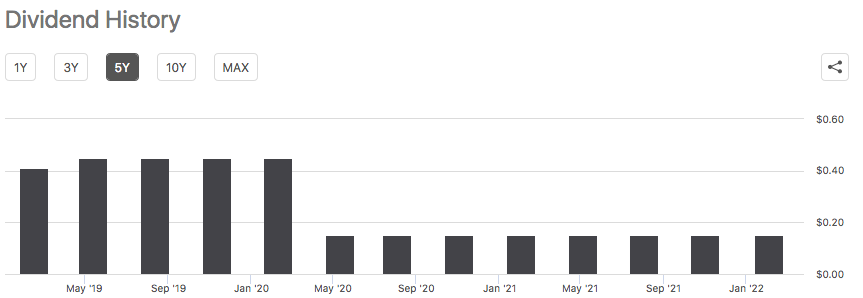

One of the biggest reasons why investors purchase shares in midstream companies like Equitrans Midstream is because of the very high dividend yields that they tend to possess. As of the time of writing, Equitrans yields 7.08% so it is certainly not an exception to this. Unfortunately, Equitrans’s dividend history leaves something to be desired, as it was forced to cut the dividend in 2020 in response to the crisis in the energy markets that occurred during that year.

Seeking Alpha

Equitrans was certainly not alone in making that cut, though, as many midstream companies were forced to do the same. This, therefore, does not necessarily mean that the company is a bad investment. In addition, it is important to keep in mind that an investor that is purchasing the stock today will receive the current yield and will not actually be hurt by the events of the past. It is still obviously important for us to ensure that the company can continue to pay out its dividend at the current level though since we do not want to be the victims of another dividend cut. That event would reduce our incomes and likely cause the stock price to decline.

The usual way that we judge a company’s ability to pay its dividend is by looking at its free cash flow. A firm’s free cash flow is the amount of cash generated by the company’s ordinary operations that is left over after it pays all its bills and makes all its capital expenditures. This is, therefore, the money that is available to do things such as buying back stock, reducing debt, or paying a dividend. As stated earlier, Equitrans had a levered free cash flow of $376.7 million in 2021 but it only paid out $318 million in dividends. Thus, it did easily cover its dividend with money left over for other purposes, such as its much-needed debt reduction. Admittedly, the coverage here is tighter than I might like, but when we consider the very strong likelihood of forward growth, it should be okay. The company can probably afford to maintain its current dividend going forward and it does not appear that we have too much to worry about.

Conclusion

In conclusion, Equitrans is a somewhat little-known and underfollowed midstream company that has a lot to like about it. The most important of its positive characteristics is that it is positioned to deliver a significant amount of cash flow growth going forward, which differentiates it from many of its peers. Unfortunately, the company’s debt is currently a bit higher than I would like, but it does have a plan to get this problem fixed up. The company is also likely to be able to maintain its 7.08% yield. Overall, this one could deserve a position in your portfolio if you trust management to get the debt load down.

Be the first to comment