curraheeshutter/iStock via Getty Images

Management Meeting

I attended an energy investment conference in New York last week. Meeting with over a dozen energy management teams including SM Energy (SM), Southwestern Energy (SWN), Chesapeake (CHK), Weatherford (WFRD), California Resources (CRC), TotalEnergies (TTE), Diamondback Energy (FANG) and Equinor (NYSE:EQNR) was instructive on macro and micro levels. I will be sharing my thoughts about a number of the above companies, but world events since the conference have conspired to make EQNR the most topical.

I have written about EQNR several times over the past few months, most recently after first quarter results. To remind everyone, EQNR generated adjusted earnings of over $5 billion last quarter after tax, which were ~71% for the quarter. Q2 commodity pricing has the potential to be even better. See the table below for quarterly pricing. Please note that pricing just spiked in natural gas and could easily lead pricing higher than Q1.

| European Gas in $/mmbtu | |

| Q2 2020 | 1.191 |

| Q3 2020 | 2.91 |

| Q4 2020 | 5.22 |

| Q1 2021 | 6.52 |

| Q2 2021 | 8.76 |

| Q3 2021 | 16.85 |

| Q4 2021 | 32.05 |

| Q1 2022 | 32.72 |

| Q2 2022 (Qtd) | 29.53 |

| Brent Crude in $/barrel | |

| Q2 2020 | 33.39 |

| Q3 2020 | 43.34 |

| Q4 2020 | 45.26 |

| Q1 2021 | 61.28 |

| Q2 2021 | 69.08 |

| Q3 2021 | 73.23 |

| Q4 2021 | 79.66 |

| Q1 2022 | 97.24 |

| Q2 2022 (Qtd) | 110.64 |

The oil and gas exploration, production, and refining industries have attracted negative political attention due to recent success. The UK established a windfall tax on UK-based energy companies. There have been calls for windfall taxes in the US from some of the usual suspects such as long-term oil and gas critic Senator Liz Warren. President Biden recently said in a speech, “Exxon made more money than God this year,” and “Exxon: Start investing, start paying your taxes.”

I have a lot of issues with comments like Biden’s and the concept of a windfall tax on energy companies, particularly given this vitriol is being spewed by people who have left no doubt that they want less fossil fuels in this country not more. I also do not believe this current congress will pass a windfall tax. However, I wanted to clear away that possibility for Equinor. Management seemed confident that the company was not facing one since its tax rate already exceeds 70%. The company has a stake in assets in the US that could potentially be susceptible to US taxes, but the profitability is small compared to that of the company’s operations offshore in Brazil and in the North Sea.

Disrupted European Natural Gas Supply

Two developments have contributed to European natural gas prices spiking from already elevated levels. The first is Gazprom cutting supplies to Europe by up to 40% via the Nord Stream pipeline. Russia is blaming “technical issues” for the supply cut. Call me crazy, but I find that reason extremely hard to believe. This supply cut comes at a time that Europe is trying to build inventory for the winter. If Europe cannot fill gas storage now, Russia will maintain immense leverage over the continent through the winter.

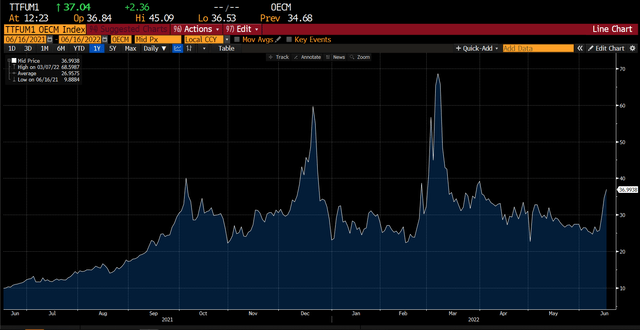

The second issue was the fire at Freeport LNG facility in Texas last week (June 8). Initially, the facility was supposed to be disrupted for a minimum of three weeks. That delay was just extended to ninety days. Shutting off Freeport has a major impact on European gas supplies. As the article states about 80% of the plant’s output goes to Europe. Therefore, any disruption of this supply can and has had a major impact on European gas prices as one can see below.

Chart of Netherlands One Month Forward Natural Gas Prices (Bloomberg)

While the above prices are below the peaks they reached in March and December, remember that natural gas is seasonal. Therefore, peak demand in Europe, where air conditioning is not widespread, is in the winter months. That March peak coincided with the initial invasion of Ukraine and an unusual late-winter cold snap. For pricing to experience a spike in June, particularly one anywhere near this magnitude is very unusual.

Valuation

I have made the argument in a previous piece that EQNR is wildly cheap just based on its European assets. Natural gas prices in the US have spiked recently as well and WTI pricing is basically on top of brent. The company is experiencing some cost inflation (likely 10-15%), but off a lifting cost base of around $30, the company is capturing most of the commodity price increases. Even on a fully taxed basis, I continue to believe this company will easily exceed $25 billion in free cash and perhaps significantly more. With a net cash balance sheet (even including deferred taxes), at less than 5x free cash flow this company remains one of, if not the cheapest energy company that I’ve seen, again without considering ANY value for its renewable energy assets or its newfound strategic value to Europe, its biggest customer.

Risks

As with any commodity company, EQNR is highly exposed to commodity prices. Many people believe we are at an energy top and prices could fall hard and soon. I do not subscribe to that risk in general, but anything can happen in commodity land.

Conclusion

EQNR is not a headline name in this country. It should be. I struggle to think of a better geographically positioned company with a better balance sheet, better cash flows that also has a growth angle.

Be the first to comment