happyphoton

Thesis

I have recently published an article about TotalEnergies (TTE), arguing that the European Oil major is very cheap as compared to US oil companies. Similar arguments could be made for Equinor (NYSE:EQNR), which is one of my personal favorite Oil exploration and production companies. Equinor currently trades at a unbelievable x2.1 EV/EBIT ratio, which implies a discount versus industry peers of more than 80%! That said, it is easy to see that the company is undervalued. Personally, I calculate more than 90% upside based on a residual earnings model. My target price is $65.07/share.

About Equinor

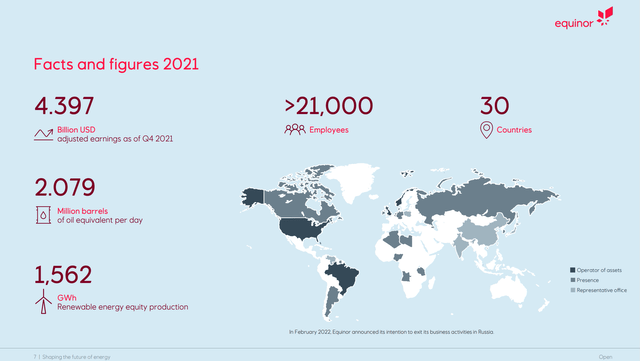

Equinor ASA, is a major international energy company with headquarters in Norway. The company engages in the exploration, production, transportation, refining, and marketing of oil and oil derivatives such as petrochemicals. In addition, Equinor is also highly active in renewable energy solutions as the company is operating and developing multiple wind and solar power projects around the world. In that context, Equinor operates about 1,562 GWh of renewable energy capacity and has established partnership agreements with Vårgrøn, RWE Renewables and Hydro REIN.

Most notably, as of December 31, Equinor has proven oil and gas reserves of about 5.4 billion barrels of oil equivalent. The company produces about 2.08 million barrels of oil daily and accounts for 70% of the oil and gas production in Norway. Equinor was formerly known as Statoil and the Norwegian state is the company’s biggest shareholder, accounting for about 67% of ownership.

Equinor Investor Presentation

Extremely Bullish Performance

Given the rapid price appreciation of oil and gas prices, EQNR stock has strongly outperformed the market for the past 12 months. For reference, EQNR stock is up about more than 26% versus a loss of 17% for the S&P 500. Notably, Equinor’s share price performance was not driven by speculation, but by strong fundamental performance of the company’s E&P business. Higher energy prices pushed Equinor’s revenues for the past 12 months up to $108.6 billion, which represents a more than 100% increase as compared to total revenues in 2020. Moreover, the company’s operating profits increase to about $46 billion and earnings attributable to shareholders to $11.4 billion and profits to $33.5 billion (about 10.5% margin). Personally, in line with analyst consensus forecasts, I see Equinor’s strong business performance as sustainable–at least for the near-term future and Q2 2022 should be a blowout quarter for the company, driven by strong results from the Equinor’s refining and marketing segment. That said, the thesis for investing in oil & gas companies is deeply anchored on oil prices.

Seeking Alpha

Undervalued vs Peers

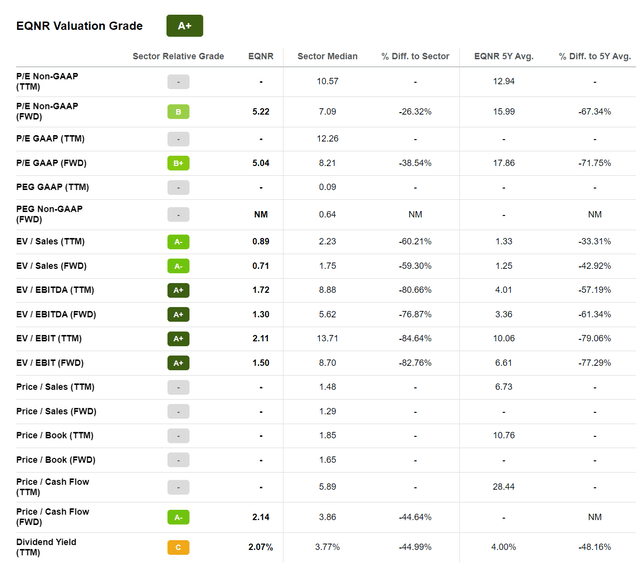

Despite the strong share price performance YTD, Equinor stock still looks very cheap. For reference, Equinor currently trades at a P/E of x5, and EV/sales of below x1 and an EV/EBITDA of unbelievable x1.72. Even more notable is the company’s discount versus peers. As calculated by Seeking Alpha, on an industry comparison Equinor trades at a 26.3% P/E discount and an 84% EV/EBIT discount versus peers. Moreover, if we compare Equinor to US oil companies, the valuation discount becomes even more apparent as EQNR stock trades at an approximate 50% discount to both Chevron (CVX) and Exxon (XOM) as calculated by almost all metrics, including P/E, EV/sales and EV/EBIT.

In my opinion, there is no argument to justify such a significant industry dispersion. In fact, all companies equally share in profit windfalls/contractions driven by oil price volatility.

Seeking Alpha

Residual Earnings Valuation

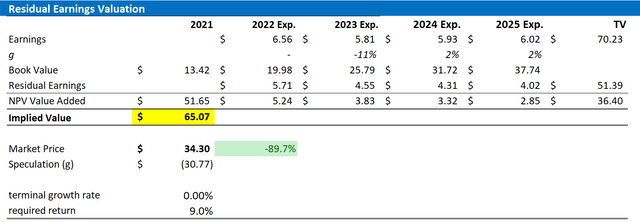

Let us now look at the valuation. What could be a fair per-share value for the company’s stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise. That said, EPS are estimated at $6.56, $5.81, and $5.93 and $6.02 for 2022, 2023, 2024, and 2025, respectively.

- To estimate the cost of capital, I use the WACC framework. I model a three-year regression against the S&P 500 to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of July 22, 2022. My calculation indicates a fair required return of 9%.

- To derive EQNR’s tax rate, I extrapolate the 3-year average effective tax-rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply a 0 percentage points to reflect the balance of a secular decline for oil and gas business and the transition towards green energy.

Based on the above assumptions, my calculation returns a base-case target price for EQNR of $65.07/share, implying material upside of about 90%.

Analyst Consensus EPS; Author’s Calculation

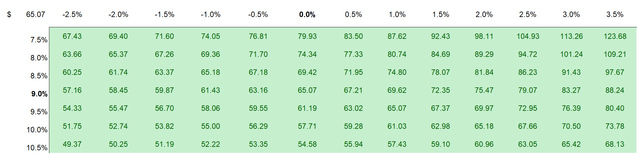

I understand that investors might have different assumptions with regards to EQNR’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst Consensus EPS; Author’s Calculation

Risks To My Thesis

My thesis is connected to the implication that there are no structural differences between European and US oil majors. This, however, is not necessarily true since the respective regulatory exposure is somewhat different. Arguably, the European Union is slightly more aggressive with regards to the green energy push and US stocks generally trade at a premium. Nevertheless, a 100% relative valuation discrepancy is not justified, in my opinion. In addition, investors should note that I assume a sustainable oil price of about $60/barrel. This week Edward Morse, the global head of commodities strategy at Citi with half a century of experience, shared the view that oil (WTI benchmark) could fall to $60 per barrel, if the global economy were to slip into a recession. Although I see the oil price declining to about $60/barrel by year end, driven by the prospects of a recession, rising cost of capital and falling asset prices. While this might seem bearish for some readers, others might argue that the fair value for oil is much lower. As the 2020 covid-19 induced sell-off has shown, oil can even trade at negative price-levels. If oil would break considerably below $60/share and does not recover within a sensible time-period, the bull thesis for Equinor would break.

Conclusion

EQNR stock has outperformed the market YTD, as the rapid price appreciation in oil prices supported the company’s operations. However, the stock is still trailing both fundamentals and industry peers. Thus, I see more upside. For reference, Equinor currently trades at an unbelievable x2.1 EV/EBIT ratio, which implies a discount versus industry peers of more than 80%. Personally, I calculate more than 90% upside based on a residual earnings model. My target price is $65.07/share.

Be the first to comment