tomch

The Quarter

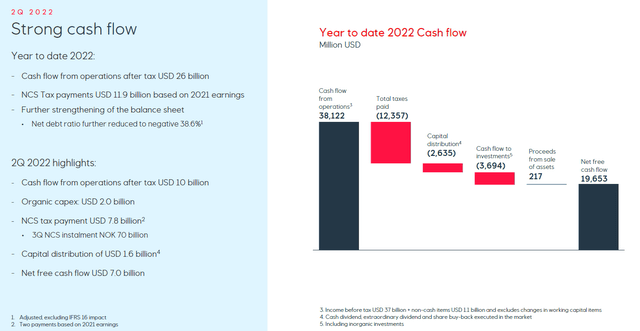

Equinor (NYSE:EQNR) reported another immensely profitable quarter this morning (July 27th) with continued extremely high cash flows. After tax earnings came in at $5 billion and free cash flow of $7 billion. Remember, the timing of tax payments to Norway can lead to large differences between “earnings” and free cash flow.

Equinor Profit Bridge (Equinor Presentation)

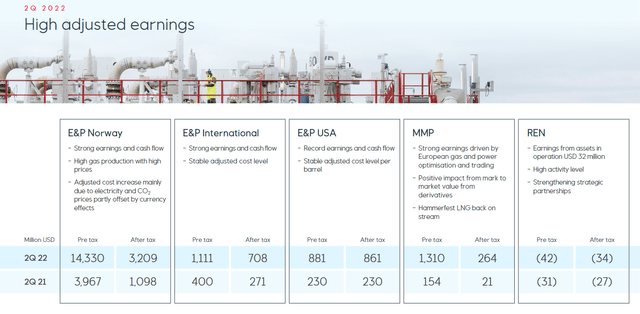

Profitability was well distributed across the company’s operations. NCS (Norwegian Continental Shelf) was the most profitable as usual but the other geographies are bigger and more profitable on their own than many other independent operators.

Equinor Profits by Segment (Equinor Presentation)

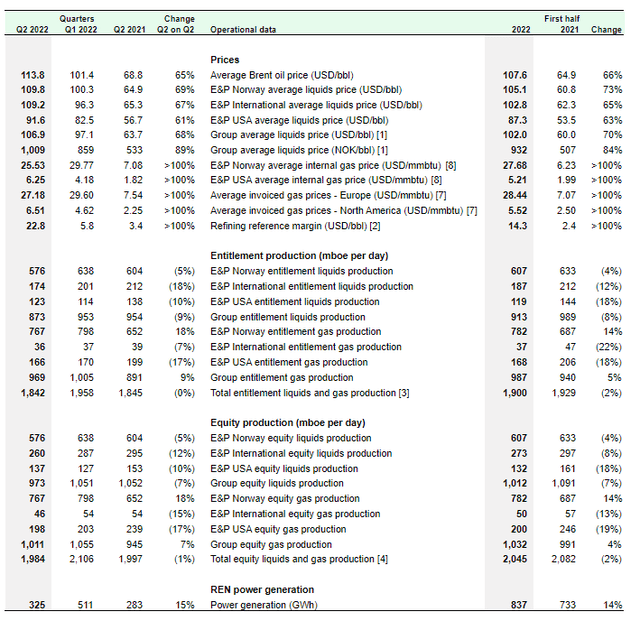

Volumes were down slightly owing to divestment of certain assets (namely Russia) and higher costs of electricity and CO2 in the NCS region partially offset the robust pricing environment. Still the year-over-year and quarter-over-quarter numbers remain amazingly healthy from a volume and pricing perspective.

Breakdown of Equinor Production and Pricing (Equinor Presentation)

The company remains confident about growing production about 2% this year over last and provided updated guidance for capital spending in 2024-2025.

Return of Capital

As I have been writing about for quite some time, Equinor’s balance sheet and cash flow generation are unique for the industry. The company has net cash of about $20 billion. Even offsetting this cash with current taxes payable leaves the company debt free and excludes the benefits of over $30 billion of working capital.

Even fully taxing all profits this year at a blended 71.6% tax rate leaves the company on a pace to exceed $20 billion free cash flow for the year (operating cash flow – capital expenditure already well exceed $20 billion for the first half of 2022).

The balance sheet strength and robust cash flows allow the company to return cash to shareholders. The share buyback plan was increased from $5 billion to $6 billion and the special dividends for Q2 and Q3 were increased from $.20 to $.50 per share. Remember the special dividends are on top of $.20 regular dividends. In all the company will now be returning $13 billion to shareholders this year, which compares favorably to the $117 billion market cap. To the extent the company can keep up the pace of its first half cash flow, I expect capital return to keep growing.

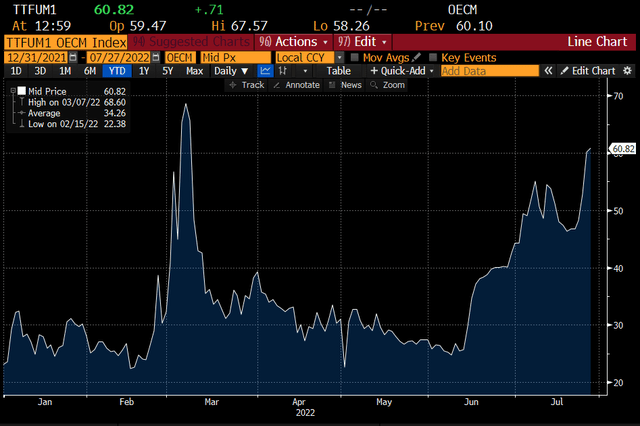

Impact of Nord Stream 1 Closure

European gas prices have been high all year but since June have averaged extremely high levels driven first by the risk of disruption in gas flows via Nord Stream 1. While Putin did not realize my worst fears of not reopening Nord Stream at all, the pipeline is only operating at 20% capacity right now. As I wrote recently, EQNR and Vermilion (VET) are the two biggest relative beneficiaries of these high European natural gas prices. Every day at these levels is like two average days in Q2.

2022 YTD European Natural Gas Prices mmbtu (Bloomberg)

Conclusion

I continue to believe that EQNR is one of the most strategically positioned companies in the world yet it’s priced as if it is an ordinary commodity exposed cyclical. I think Europe will continue to migrate away from Russian natural gas (voluntarily or involuntarily) and EQNR is one of the best solutions for that migration. Consequently, I believe the company will generate the best absolute and relative amounts of cash and has the balance sheet to return the bulk of that cash to shareholders while continuing to invest in its growth.

Be the first to comment