Vadzim Kushniarou/iStock via Getty Images

Investment Thesis

Equinor (NYSE:EQNR) is very well positioned for high natural gas prices in Europe. Anyone interested in Equinor by now knows much of the backdrop. The Russian invasion led to a spike in natural gas prices, particularly in Europe.

In the case of Equinor, it is partly Norwegian state-owned. This has led to Equinor not being as aggressive with its capital return program as many of its peers.

However, despite acknowledging this insight, I simply do not believe that a 2x multiple to free cash flow is a commensurate multiple for this business, even while acquiescing to its notable bearish consideration.

Equinor’s Near-Term Prospects Are Very Attractive

Equinor, formerly Statoil, is focused on the exploration, development, and production of oil and gas on the Norwegian continental shelf. Equinor is the second-largest natural gas supplier to the European market, after Russia.

However, as you know, Russia has started to cut supply via the Nord Stream pipe. Consequently, this leaves Equinor in a highly favorable position.

Furthermore, the fire at the Freeport export facility has led to further tightening in Europe’s already very tight natural gas market.

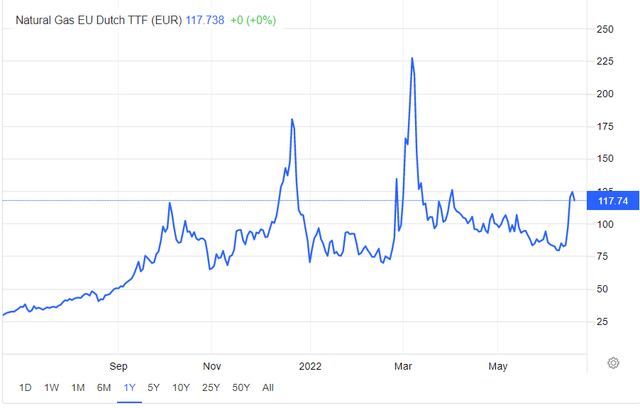

Given this backdrop, you would expect to witness natural gas prices moving upwards steadily without dropping. But that’s not happening, why?

As you can see in the graph above, on Friday, natural gas prices in Europe cooled off slightly. The reason for this sell-off is that the directly linked WTI prices also cooled off by approximately 8% in the last few days.

Investors are now fearing that the global economies might be slowing down and headed into a prolonged recession. This has been brought about by a combination of high inflation and central banks raising interest rates, in an effort to cool the economy and tame inflation.

For my part, I do not believe that the Equinor trade is any less attractive. Why? Because ultimately, we are now in the summer season in Europe.

The demand for natural gas isn’t as high as it will be as we enter the winter season.

For now, countries are only needing to secure natural gas to build inventories for the winter. Consequently, if natural gas is in short supply, most countries can still get through this period, for now.

That being said, not all countries are managing this period with ease. For instance, Germany has requested that residents and businesses look for ways to conserve natural gas.

Traders Are Looking for Direction

Lest we forget, stocks don’t trade in a vacuum.

Outside of energy, stocks have been getting hit to a pulp. Depending on the area of the market that you look towards, countless stocks are down between 30% to 50%, and in other areas, particularly in small and mid-cap spaces, stocks are sometimes down 80% from their highs.

Simply put, the market is jittery. And investors, who are clinging onto any gains in any energy stock right now, are incredibly trigger-happy to take any profits off the table at the first sign of trouble.

The speed of these sell-offs is a reflection of the uncertain times that we are in right now. Much more so than Equinor’s investment being any less attractive.

Equinor’s Balance Sheet Discussed

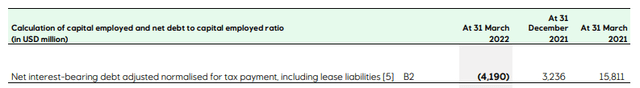

Given that Equinor is a European company, it reports under IFRS. Thus, the measures that it uses to discuss its balance sheet are different from what many readers might be familiar with.

For example, Equinor notes that its balance sheet has a net debt to capital employed adjusted, including lease liabilities, of 10.7% as of Q1 2022.

At first glance, it’s not immediately obvious what this means. However, you see that during last year’s Q1 2022, its balance sheet was in a slightly leveraged position, while in Q1 of this year, Equinor’s balance sheet is in a much stronger position.

More specifically, Equinor’s balance sheet now holds approximately $4 billion of a net cash position, including lease liabilities.

Consequently, given that Equinor’s balance sheet is now in a much stronger position, and the business is very well positioned for an even stronger remainder of 2022.

Hence, it only makes sense that Equinor looks for ways to return excess capital back to shareholders.

Capital Returns Leaves Much to be Desired

Having repurchased $1 billion worth of shares during Q1 2022, Equinor launched a new capital return program to repurchase $1.5 billion worth of shares no later than 26 July. The two programs combined amount to a 2% capital return program during H1 2022.

Meanwhile, Equinor has announced a dividend plus extraordinary dividend combined of $0.40 per share. This amounts to approximately a 1% total dividend yield for Q1 2022, with its shares trading ex-dividend on 11 August 2022.

Evidently, for a business that is oozing free cash flow, with a strong balance sheet, getting a 3% yield via share repurchases and dividends in a quarter leaves a lot to be desired. And part of the reason is that despite all the buzz around Equinor’s potential, its shares haven’t gone anywhere far since the Russian war started.

In fact, since the Russian war started, Equinor’s shares have moved higher less than 10%. Clearly, investors are not too late to participate in Equinor’s opportunity.

EQNR Stock Valuation – Priced at 2x Free Cash Flow

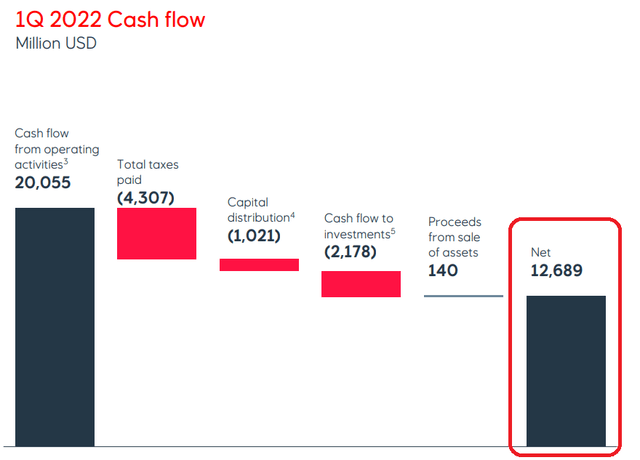

For Q1 2022, Equinor’s cash flows from operations before taxes and working capital changes were $20.1 billion compared to $6.6 billion in the same period in 2021. This amounts to a 3x in cash flows y/y.

These strong cash flows surfaced, even though the bulk of the catalysts that the Russian invasion brought about only came into effect in the later parts of Q1 2022.

In other words, Q2 2022 will be even strong than Q1 2022.

And I believe that H2 2022 will be even stronger than H1. Why such an aggressive view? Because, if anything, the situation is even more intense than it was when the natural gas market started in 2022.

As I stated at the start, we are now in the summer season in Europe. Once we get further into winter, we are going to have even more demand for natural gas.

And I don’t believe that demand destruction and a slowing economy will have much impact on lowering the demand for natural gas in Europe.

If anything, natural gas is used as a fertilizer, and with fertilizer prices moving higher, the demand for natural gas will be even higher, which will provide support for higher natural gas prices.

However, to be conservative, let’s assume that Equinor’s free cash flow will be level with that reported in Q1 2022. This is clearly very conservative.

Consequently, I believe that $51 billion (12.7*4=$50.8) of free cash flow for 2022 is simply too conservative an estimate. Yet, I have to start my assumptions somewhere.

This puts Equinor priced at 2x free cash flows.

The Bottom Line

The main fear investors have right now is a lack of visibility. Investors are fearful that demand destruction and overall oil volatility will lead to Equinor’s prospects retracing lower in the second half of 2022 and certainly into 2023.

That is the bear case facing nearly all energy companies. I simply do not believe that to be the case. I simply do not see a scenario where demand destruction leads to such a pronounced impact on Equinor’s cash flow prospects that makes it commensurate with its stock trading at approximately 2x this year’s free cash flows.

The other consideration to keep in mind is that the Norwegian state is a large stakeholder in the company. For many investors, there’s the concern that the Norwegian state will not be interested in seeing substantial capital returns to shareholders, preferring instead to invest for growth. And this is something that investors are unequivocally not interested in, seeing more capital being kept in energy companies.

However, even with that consideration in mind, paying 2x free cash flows already accounts for that insight many times over.

Be the first to comment