Dilok Klaisataporn

The ProShares Equities For Rising Rates ETF (NASDAQ:EQRR) is an interesting fund concept that provide exposure to large cap stocks with high historical correlation to rising treasury yields. The fund’s strategy worked well in 2022, outperforming the S&P 500 by 20%. Looking forward, as long as inflation remains high, I expect the Fed to continue with its ‘higher for longer’ interest rate policy, which could benefit EQRR.

However, investors need to be mindful that if the Fed raises interest rates too high or keeps it high for too long, they risk causing a recession, in which case EQRR’s economically sensitive sectors could be negatively impacted.

Fund Overview

The ProShares Equities for Rising Rates ETF seeks to provide exposure to securities that have historically outperformed in a rising interest rate environment. EQRR’s strategy is relatively novel, with the fund inception date of July 24, 2017.

The EQRR ETF charges a 0.35% expense ratio.

Strategy

EQRR tracks the Nasdaq U.S. Large Cap Equities for Rising Rates Index (“Index”), an index designed to contain securities that have historically outperformed in rising interest rate environments.

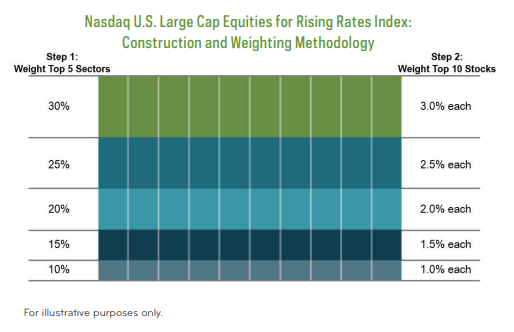

On a quarterly basis, the index selects the 5 sectors with the highest correlation to weekly changes in the 10Yr treasury yield over the past 3 years. The highest correlated sector receives 30% of the fund’s allocation, the second highest receives 25%, and so on and so forth (Figure 1).

Figure 1 – EQRR index construction (proshares.com)

Within each sector, the index identifies the top 10 stocks with the highest correlation to changes in the 10Yr treasury yield. The stocks are assigned equal weights within each sector.

Portfolio Holdings

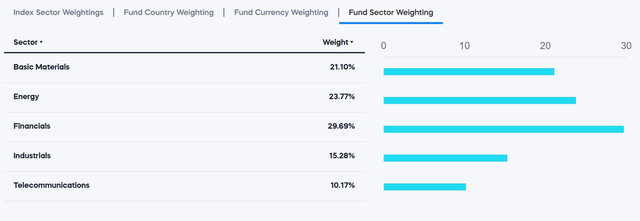

Figure 2 shows EQRR’s current sector weights. The largest sector is Financials at 29.7%, followed by Energy at 23.8%, Basic Materials at 21.1%, Industrials at 15.3%, and Telecommunications at 10.2%.

Figure 2 – EQRR sector allocation (proshares.com)

Distribution & Yield

The EQRR ETF pays a quarterly distribution with a trailing 12 month distribution rate of $1.19 or 2.1% distribution yield.

Returns

EQRR appears to be a fund designed for 2022, as the ETF returned 2.4%, vastly outperforming the S&P 500 Index, which lost ~18% (Figure 3).

Figure 3 – EQRR outperformed S&P 500 by 20% in 2022 (Seeking Alpha)

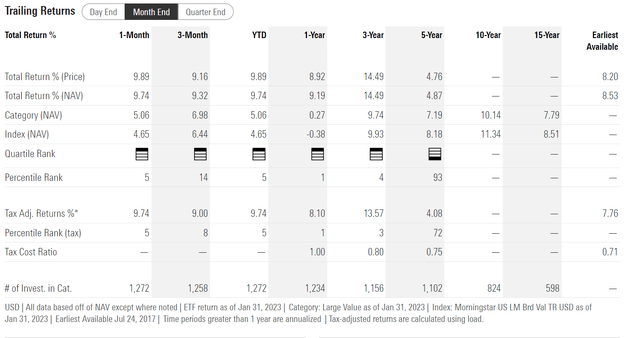

However, on a longer-term basis, the EQRR ETF has only generated mediocre historical returns, with trailing 5 yr average annual returns of 4.9% to January 31, 2023 (Figure 4).

Figure 5 – EQRR has mediocre long-term returns (morningstar.com)

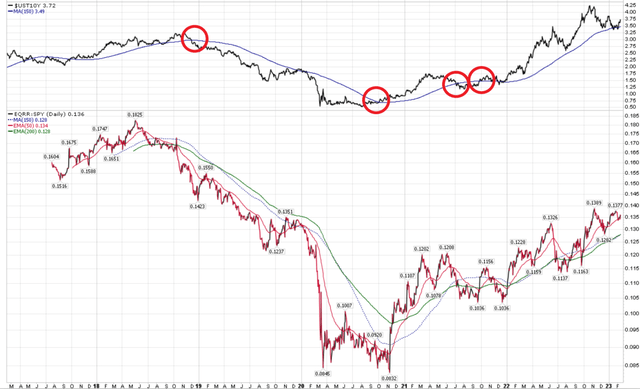

Looking at EQRR’s relative performance against the SPDR S&P 500 Trust ETF Trust, we can see that true to its design, the EQRR ETF generally outperforms SPY when the 10Yr treasury yield is rising (Figure 5).

Figure 5 – EQRR / SPY ratio outperforms when 10Yr treasury yields are rising (Author created with price chart from stockcharts.com)

However, when the 10Yr treasury yield is declining, the EQRR ETF can also significantly underperform, like it did in 2019 to 2020 when EQRR underperformed by 46.8% over 2 years.

Figure 6 – EQRR underperformed by 47% over 2 years in 2019 and 2020. (Seeking Alpha)

The reason for EQRR’s massive underperformance is because sectors that tend to have high correlation to rising interest rates such as Financials, Energy, Materials, and Industrials, are economically sensitive sectors. Falling interest rates are usually a sign of economic weakness, so economically sensitive sectors tend to do very poorly during those periods (especially during the 2020 COVID recession).

Conclusion

The EQRR ETF provides exposure to large cap stocks that have a high historical correlation to rising interest rates. These tend to be found in cyclical sectors such as Financials, Energy, Materials, and Industrials. During periods of rising interest rates like in 2022, EQRR’s strategy can significantly outperform. Looking forward, as long as inflation remains high, I expect the Fed to continue with its ‘higher for longer’ interest rate policy, which could benefit EQRR.

However, investors need to be mindful that at a certain level of interest rates, the Fed risk ‘breaking’ the economy, in which case, EQRR’s economically sensitive sectors could be negatively impacted.

Be the first to comment