Scott Olson/Getty Images News

EPR Properties (NYSE:EPR) investment story since the onset of the pandemic has been highly punctuated by fear, uncertainty, and doubt. Fear about what was thought then to be a permanent shift away from moviegoing. Uncertainty around whether post-pandemic modes of entertainment would forever favour the remote. Doubt that the company would remain a going concern in spite of its large cash and equivalents position.

The company not just survived the pandemic in stride, it emerged with a record liquidity position, hiked its monthly dividend payout, and has now embarked on back-to-back cash buyouts of experiential assets designed to diversify its rental revenue stream and shift from recovery to growth.

The collapse of Cineworld (OTCPK:CNNWQ), Regal’s parent company, came as a surprise to theatre bulls on the back of what was an extremely strong year for moviegoing. But the second-largest theatre chain in the United States after AMC Entertainment (AMC) was overburdened with debt from its parent company. Regal was acquired by Cineworld in a $3.2 billion leveraged buyout deal and has actually filed for bankruptcy once before in 2001. Fundamentally, its parent was extremely overleveraged and unnecessarily acquisitory. Indeed, it was actually facing a $1 billion breach of contract lawsuit payout from its abandoned acquisition of Canada’s Cineplex.

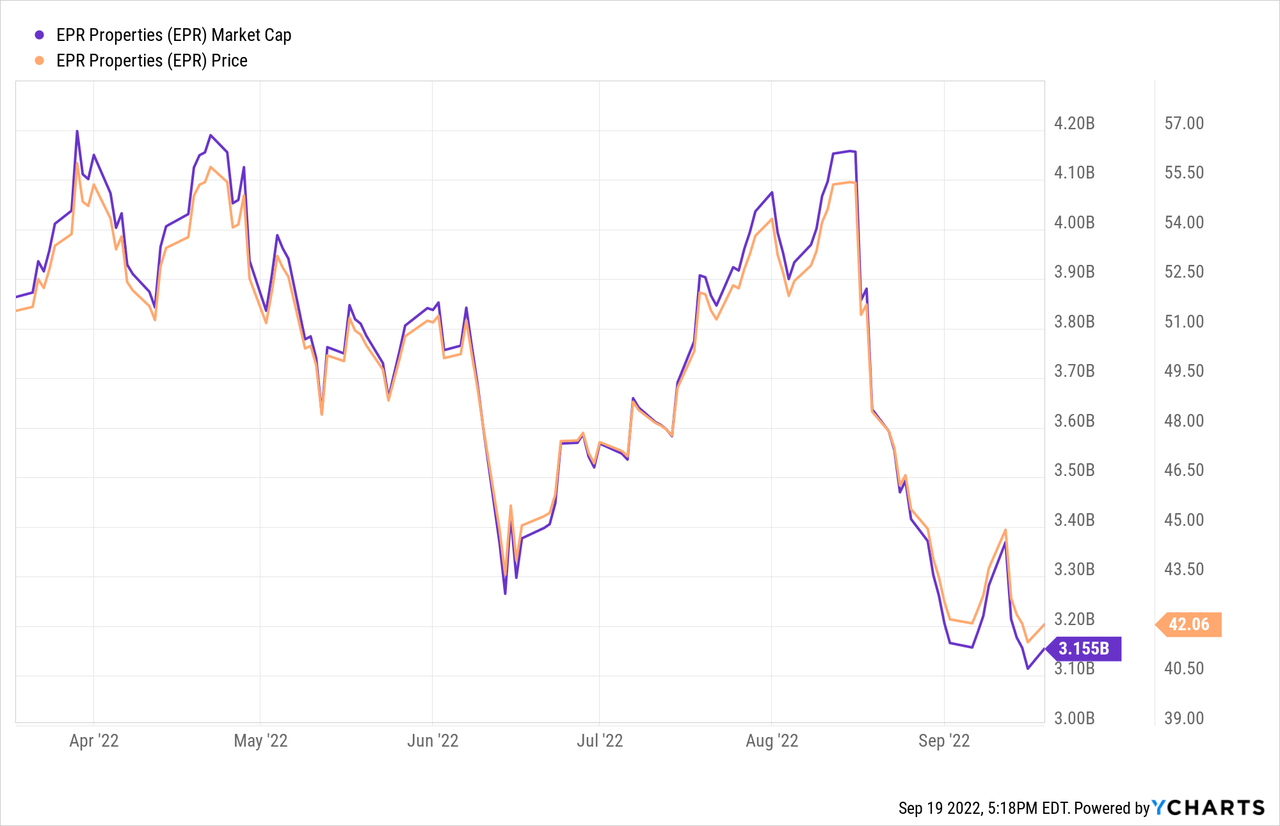

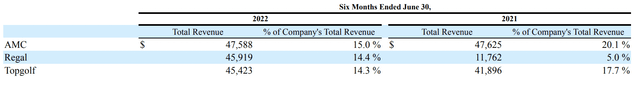

EPR’s common shares have pulled back sharply on the news from just over $55 to $42 as of writing this article. Hence, the Regal chapter 11 news has essentially erased just over $1 billion in value from EPR. This is extremely excessive with total rental revenue from Regal of just $45.9 million for the six months to the end of June. So even if you assumed a total worst-case scenario that Regal closes every single one of the just under sixty it rents from EPR, the market cap retracement would still be incredibly disproportional. Of course, bears would be right to flag that Regal’s collapse brings back the fear that AMC, EPR’s largest tenant, will also collapse. AMC is also highly leveraged and is battling to find new avenues of liquidity. Both these form the top 2 of EPR’s tenants, underscoring their overall importance to financial performance.

Regal’s Chapter 11 Brings Material Uncertainty But Is Manageable

Regal is currently in discussions with its creditors and landlords concerning the restructuring of its liabilities. The most likely impact will be rent reductions being conceded by EPR to starve off closures. Theatres are typically quite hard to repurpose but EPR’s Regal properties are in good locations with most likely to be retained through chapter 11. There will also most likely be an up to 15% discount on the total rental revenue from Regal.

This would of course have a negative impact on financials that were on the cusp of moving more broadly from recovery to growth, but would certainly not warrant the movement we’ve seen thus far. Regal will have around two months to accept or reject each lease with the total shutdown of several Regal but non-EPR locations in Irvine, Anaheim Hills, and Calabasas already being announced. We should hear about more closures in the coming weeks.

EPR Properties

Regal comprised 14.4% of total revenue for the first half of fiscal 2022, up from just 5% for the same year-ago period as pandemic-era deferred rent was likely still in place for the over-leveraged company. With trailing twelve-month revenue at $610 million, the company could see around $14 million being eroded. This amounts to 2.25% of total rental revenue. Assuming that this revenue decline drops dollar-for-dollar out of per share adjusted FFO, the higher dividend payout would still be protected albeit with some risk that the upwardly revised guidance of between $4.39 to $4.55 is revised down.

EPR is still around halfway through its $500 million to $700 million investment spending guidance with these having been completed at an 8% cap rate. As investment spending was expected to be ramped up in the second half of this year, there is a risk of this being delayed as the company manages the fallout of Regal’s bankruptcy. Lower growth expectations in the interim on the back of this could also have played a role in the current retracement of EPR’s common shares.

Theatres Might Face An Uncertain Future But They Still Have One

EPR has been a core holding of mine since the pandemic hit. I hold no qualms and believe the management faced worse a few years ago. The collapse of Regal is not a damning indictment of moviegoing, its parent was simply too overleveraged and still chasing more growth for no reason. In this, the failure of Cineworld to close the Cineplex buyout and its collapse could end up being good by reducing customer concentration and hastening EPR’s diversification strategy. Cineworld’s unwarranted expansionism was simply misguided.

EPR held cash and equivalents of $168.3 million as of the end of its last reported quarter with no balance drawn on its $1 billion debt facility. This will set the foundations for further value-creating buyouts and stability in the face of unending entropy. Bearish warnings that theatres are dead are overdone, the current retracement is a gift and I’m a buyer at these levels.

Be the first to comment