These are not the movie theaters EPR bulls are looking for.

mixetto/E+ via Getty Images

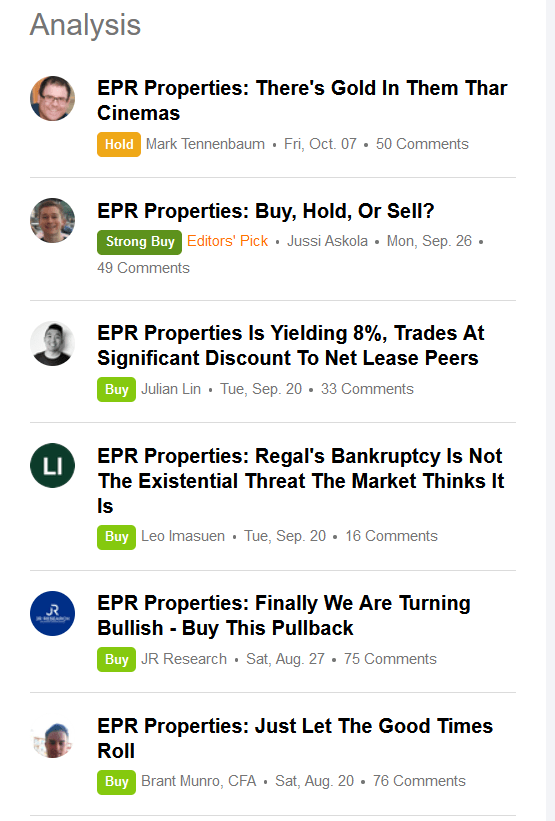

EPR Properties (NYSE:EPR) is a net lease REIT which invests in experiential properties primarily in movie theaters but also in golf complexes, ski areas, and others. Six different contributors on Seeking Alpha have written up EPR since August: 4 buys, 1 strong buy, and 1 hold.

Seeking Alpha: Recent EPR Articles

Those months have not been kind to the stock price though. The stock price sat at $54.32 at the beginning of August and is now trading around $38.00. That’s about a 30% decline. And much steeper than the decline of the S&P 500 in a similar time frame.

Seeking Alpha: EPR 6-month Price Chart

Seeking Alpha: EPR & SPY 6-month Total Return Chart

So what’s underneath driving the price action? I like how fellow SA Contributor Leo Imasuen put it in their article from September:

EPR Properties (NYSE:EPR) investment story since the onset of the pandemic has been highly punctuated by fear, uncertainty, and doubt. Fear about what was thought then to be a permanent shift away from moviegoing. Uncertainty around whether post-pandemic modes of entertainment would forever favour the remote. Doubt that the company would remain a going concern in spite of its large cash and equivalents position.

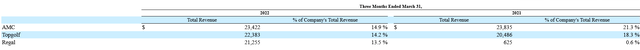

That fear, uncertainty, and doubt continue as one of EPR’s top three tenants, Cineworld (OTCPK:CNWGQ), filed for bankruptcy at the beginning of September. One of their other top three tenants, AMC Entertainment (AMC), also seems poised for a restructuring. When we look at their revenue concentration, we can see how this may impact EPR.

Q1’22 10-Q: Revenue Breakdown

Cineworld is the parent company of Regal. So if we consider AMC and Regal together, they represent 28.4% of revenue generated in Q1’22. The story for cinema does not appear to be improving either. Consider some data from Elephant Analytics’ recent article about AMC showing that box office recovery has stalled out at around ~30% below pre-pandemic levels.

|

Q1 2022 |

Q2 2022 |

Q3 2022 |

YTD |

|

|

Vs. 2019 |

-44% |

-29% |

-32% |

-34% |

With Cineworld (hence Regal) in the midst of a restructuring process we may see rent reductions for EPR properties. The reason for this is in order to maintain an operator for these theaters. On the other hand, the company has also shown that they are open to selling theaters for repurposing. At a conference last year CEO Greg Silvers had this to say:

We sold a theater late last year for industrial conversion, and people were asking us. So, how did they convert the building? They used a bulldozer…

Where there’s a will, there’s a way. Especially with a bulldozer behind it.

A Review Of Recent Contributor Bullishness

I reviewed the last seven Seeking Alpha articles on EPR to compile data for this table. Each of these articles was published by a different contributor.

EPR Properties stock currently sits at $38.83 with only the last two articles having a price at publication below this. The average price target from the authors ($58.71) implies a 53% upside from current prices.

With context, we can acknowledge that this 53% potential upside is exposed to risk from the Cineworld restructuring and potential AMC restructuring. The Cineworld restructuring may result in less impact than expected and the AMC restructuring may not happen at all. We simply do not yet know the full impact here.

Total return could be greater than 53% upside when we consider the current annual dividend yield of 8.50%. EPR is a monthly payer which may attract income seekers and currently pays $0.275 a month. A note here is that during the pandemic the company temporarily suspended the dividend. Prior to that the company paid $0.38 a month, a 28% decrease.

Seeking Alpha: EPR Dividend History

Assuming the EPR Properties Bull Case

If we assume the bull case and take the average price target of $58.71, we could estimate a one-year return potential of 59.70% with the dividend included.

There are a couple of different preferred shares as well which could be a way to invest in EPR Properties. Two of these preferred shares are convertible, which not only gives them a more secure spot in the capital stack, it exposes them to potential common stock upside potential. Here’s a table with some baseline data on the preferreds.

|

Preferred Shares |

Current Price |

Par Value |

Dividend |

Dividend Yield |

1st Call Date |

Maturity Date |

|

NYSE:EPR.PC |

$18.33 |

$25.00 |

$1.44 |

7.856% |

1/12/2012 |

None |

|

$26.58 |

$25.00 |

$2.25 |

8.465% |

4/20/2013 |

None |

|

|

$17.01 |

$25.00 |

$1.44 |

8.466% |

11/30/2022 |

None |

A couple of things to highlight. All of these are perpetual preferreds, meaning they have no requirements on calling these. Each of these are quarterly dividend payers versus the common’s monthly payment. As we can see from the table, both EPR.PC and EPR.PE have been callable for nigh on a decade. And these are also the two convertible shares that I mentioned.

If we focus on the convertible preferreds we can find their conversion ratio in the company’s most recent 10-K. But don’t worry, I found it for you.

|

Preferred Shares |

Conversion Rate |

Par |

EPR Conversion Price |

|

0.4148 |

$25.00 |

$60.27 |

|

|

0.4826 |

$25.00 |

$51.80 |

What this means is that if the average target price of $58.71 is met then each of the preferred shares looks interesting from a conversion perspective. If the common stock is trading at price target levels, then it’s likely EPR.PC will begin trading closer to par given the conversion mechanics. Right now we can observe that each of the preferred shares seems to be trading according to yield and with rates rising the price has been driven down until the yield has become attractive.

With EPR.PE trading above par already I would argue the interesting security here is EPR.PC. Let’s look at the bull case scenario from the perspective of these shares. Assuming EPR hits $58.71 in a year we can do some estimation to gauge where EPR.PC might trade based on its conversion rate. Using the 0.4148 conversion rate one EPR.PC share at $24.35 would convert to one EPR share at $58.71.

That gives us a price target for the preferred shares to compare. Here’s what returns would look like assuming a one-year time frame and $58.71 as the price target.

|

Current Price |

Price Target |

Return |

Dividend Yield |

Total Return |

|

|

$38.83 |

$58.71 |

51.20% |

8.50% |

59.70% |

|

|

$18.33 |

$24.35 |

32.84% |

7.86% |

40.70% |

The differential in return between the two is not much considering the preferred shares carry much less risk. Particularly, given the recent past of cutting the common dividend we could see that happen again if the Cineworld restructuring causes more adverse effects than expected. Similarly if an AMC restructuring ensues.

The preferred shares are not at the same level of risk. EPR.PC is a cumulative preferred as well, meaning even if the company doesn’t pay the dividend, it will still be owed. Not only that, liquidation value for all of the preferred securities totals $371 million and is covered 6.95x by the $2.579 billion in stockholders’ equity.

Typically with preferred securities the upside potential is capped at par value. But with these convertible types of preferred shares they are exposed to potential upside of the equity, as we’ve seen. So it seems like another way to play the bullishness of EPR if you’re feeling a little more risk-averse is via EPR.PC.

The one major trade-off here is a somewhat lower (-19%) implied total return versus the common stock if the $58.71 price target is hit. That trade-off is coupled with a number of benefits which I think makes this preferred security an even safer way to invest with an EPR bull thesis.

What Risk is 19% Worth?

It seems to me that playing the EPR bull story via the common is a rather risky way to approach things. With one major tenant in restructuring currently and another possibly on the way there are clear and present risks to the business no matter how one spins it. The question is by what degree.

From my viewpoint, the reality is simply unknown one way or the other. Yet what we do know is that if things go in the wrong direction for EPR that the common dividend is something they are willing to sacrifice. The downside potential in the case of another dividend suspension and further weakness in the business are likely much greater in the common than in the preferred shares.

So bull investors must ask themselves how much risk is 19% more upside worth? Some may choose an exchange into the preferreds as a result of their answer.

Be the first to comment