Bilgehan Tuzcu/iStock via Getty Images

EPAM Systems, Inc. (NYSE:EPAM) stands as a clear buy for market participants, as I believe it is thoroughly prepared to meet its upcoming challenge of market disruption in the Eastern European region. Given the company’s access to financing, its market credibility, and competitive advantage, it stands ready to restructure and respond to the crisis in Ukraine. I am optimistic about its growth trajectory, and here’s why.

What You Need to Know About EPAM Systems

EPAM Systems, Inc. is an information technology company that serves its clients by offering software development and digital platform engineering. Holding a presence across the lucrative markets of North America, Western and Eastern Europe, Central Asia, East Asia, Southeast Asia, as well as Australia, EPAM is one of the largest IT players in the global industry. Given the company’s widescale expertise, the nature of its services falls into multiple sub-sectors such as healthcare, digital media, financial services, travel, supply chains, and many others.

EPAM is on the S&P 500 Index (SP500), which indicates it is an industry leader. It further points to the company having a substantial market capitalization, which is currently above $18 billion. As a result of its inclusion within this prominent index, EPAM is a closely followed stock, with analysts frequently reporting on the swings observed across its trajectory.

What Initial Insight Do We Gain from EPAM’s Price Trajectory?

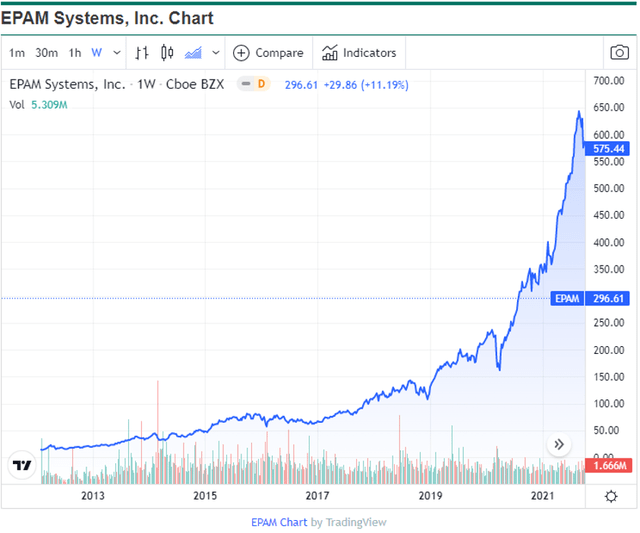

Since its trade initiation in early 2012, EPAM has been riding a consistent bullish wave. It started at a low of $13 and has seen a persistent rise, on an annual basis, ever since. Throughout its lifecycle, the stock has experienced dips, some of which have been substantial. However, it has consistently managed to eventually bounce back and recover from them.

2020 brought EPAM substantial growth, as IT Stocks saw a surge in value during the initial Covid outbreak. Investors were betting on the tech sectors to drive high amidst remote learning, virtual organizations, and crucial healthcare breakthroughs.

The year 2022 began with a sharp tumble for EPAM, which was a dip collectively experienced by stocks anticipating tensions in Eastern Europe and disruptions to supply chain logistics.

By March, EPAM had fallen by over 70%, in a decline that was collectively shared by tech stocks. However, EPAM, as is true of its past movements, seems to be fighting back, pushing up from its lows of $174 earlier in March 2022 to trading on the verge of $300 in April 2022. This 70% climb is indicative of the idea of EPAM being a long-term growth stock, which can recover from its brief dips.

What Picture Does EPAM’s Financials Paint for Investors?

EPAM’s financial release for the full-year 2021 indicates substantial growth and enhanced profitability. Revenue climbed up by over 41% to a figure of $3.76 billion, versus 2020. Of this revenue growth, only 4.3% was attributable to acquisitions, which shows EPAM’s inherent value-generating capability. Similarly, its income from operations alone, for the year 2021, stood at $542 million, which was an increase from $379 million in the prior year. The company’s market expansion indicates a robust profile and indicates the degree to which the management has strategically positioned the company towards constant growth.

The clearest indicator of this optimistic sentiment is the growth the company had managed to deliver on its earnings per share. Calculated on a diluted GAAP basis, the company’s EPS for 2021 was at $8.15 per share, up 45.5% from the prior year’s $5.60 per share. The financials are consistent with its unstopping growth trajectory that was aforementioned, giving the stock a reputation of being a fighter, and overcoming temporary dips in price.

How Sensitive is the EPAM Trajectory to the Russia-Ukraine Crisis?

While it is true that entire industries from across the globe felt the shockwaves of the Russian invasion of Ukraine, the exposure of specific stocks to the crisis has been relatively far more worrisome. To the dismay of its investors, EPAM has been one of these stocks, finding itself heavily exposed to these disruptions.

With EPAM holding a substantial market share in Ukraine, Russia, and Belarus, investor panic throughout March was not an unsubstantiated move. Even the 70% bounce-back experienced recently ties into crucial updates coming out of Ukraine. The growth spurt presumably links to the optimism that had come about as a result of Ukraine-Russia peace talks, which indicates the stock’s sensitivity to developments relating to the crisis.

EPAM is closely tied to the region hit by the crisis. In 1992, the company was formed in Belarus, which was a Soviet ally at the time, and presently one of the few countries sanctioned alongside the Russian Federation due to its stance on the Ukrainian invasion. In Ukraine alone, the company employs 14,000 individuals, to whom it has recently pledged $100 million in humanitarian assistance. In 2021, Ukraine’s IT industry was described as being one of the most dynamic and lucrative across Europe. Similarly, the company announced in March 2022 its decision to cease service provision to Russia-based customers.

Whilst its proximity to the crisis is alarming to investors, EPAM Systems has upscaled its hiring in other regions, which suggests a resilient organizational restructure. The strategy is aimed at reducing exposure to the impacted region. However, this reorganization is not necessarily an instant fix for EPAM prospects but does show its preparedness in facing crises head-on.

Market capture in alternative regions to offset risk is the real challenge for the company and could potentially take years to establish to the same degree as in the Ukraine and Russian markets. However, EPAM does hold a significant advantage in the execution of this strategy namely, its strong brand name across the globe. Furthermore, its substantial market capitalization of over $18 billion gives it access to financial resources which could aid this expansion in alternative regions through mergers and acquisitions. In fact, the move does push the company to force its sights toward previously untapped and overlooked markets, especially in the developing world, bringing within its reach substantial growth prospects.

Why EPAM is Worth Betting On?

Given the information provided above, it is safe to say, EPAM is a good investment choice. Its robust financial fundamentals, along with its optimistic market perceptions, put up all the green signals to go ahead. EPAM stock has a short float of 1.4%, which is impressively low. The market as a whole is betting on the stock to gain big, despite the forthcoming challenges. Furthermore, institutional ownership of the stock is a staggering 95%, above an industry average of 70%. Given the intensive risk calculation models, and other assessments carried out by institutions, this level of ownership is nothing short of remarkable.

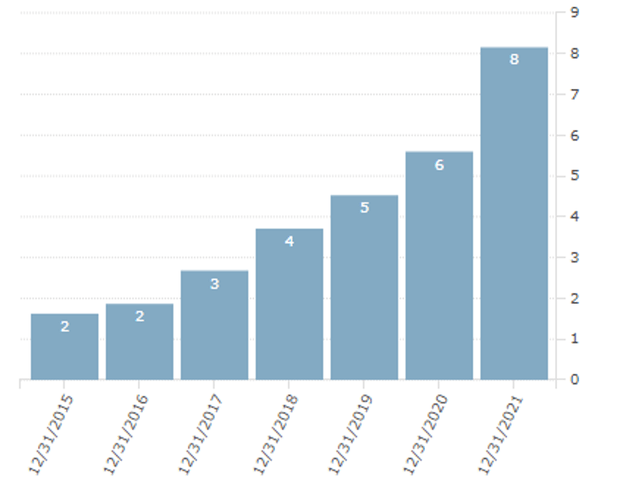

EPAM’s Diluted EPS figures from 2015 to its most recent reporting period are indicated in the graph below.

EPAM Diluted EPS figures (Finviz)

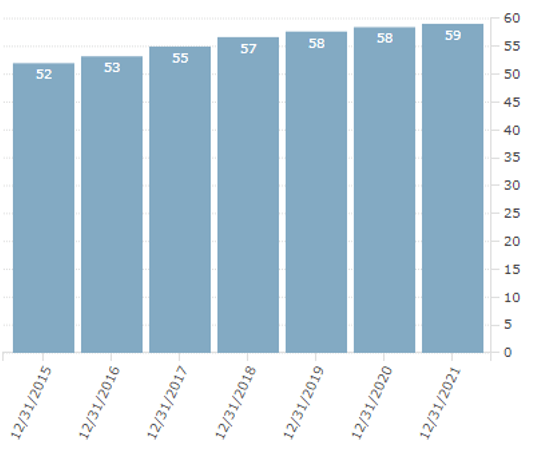

A consistent rise in EPS indicates growth and enhanced performance over the years, which explains why EPAM is a strong investment choice amongst market participants. The company has clearly been enhancing its earning power for years in a trend that seems unending. As a result, it is a great time for investors to gain exposure to this growth trajectory by adding EPAM to their portfolios. What is even more impressive is that this EPS growth is not a result of share buybacks, but rather has come about despite a steady increase in diluted average shares across this time period.

EPAM Diluted Average Shares (Finviz)

Conclusion

EPAM is a stock that is a favorite of bulls in the market. It is a stock that has rode a long and steady growth wave, whilst overcoming the dips it has faced. For those looking to enhance their exposure on a long-term growth path, the IT sector is a great starting point, with EPAM being the best possible bet. The company’s strong financials indicate its value-generating capability and potential for real growth through operations, rather than artificial growth through acquisitions.

EPAM has grown despite facing severe obstacles such as global recessions and the Covid-19 pandemic. Its recent challenge is a strategic restructure that minimizes its exposure to the crisis in Ukraine, which the company is fully pushing towards, whilst relying on its market credentials as a global IT leader. The company’s substantial market capitalization further enhances its prospects by granting it access to finances that could aid its growth. Insider transactions do not indicate any pessimism towards EPAM’s prospects, but rather are consistent with its optimistic growth trajectory.

Be the first to comment