imaginima/E+ via Getty Images

EOG Resources, Inc. (EOG) is one of the largest independent oil and natural gas exploration companies operating primarily in the United States but also boasting operations in China and Trinidad. The company prides itself on focusing its drilling operations only in areas where it can maximize returns and recoveries. This is something that has proven beneficial in today’s environment as evidenced by the company’s spectacular performance in the third quarter of 2021, particularly when compared to 2020. This has allowed the company to reward its shareholders with a very large dividend increase that brought its forward yield up to 3.14% at the current price. The company is not content to rest on its laurels however as it works to improve its efficiency, which should ultimately benefit shareholders through rising free cash flow and dividends.

About EOG Resources

As mentioned in the introduction, EOG Resources is one of the largest independent exploration and production companies in the United States, which features a unique focus on premium low-cost drilling operations. As such, we might expect the company to boast some of the most attractive and productive acreage available in the United States. This is indeed the case:

Source: EOG Resources

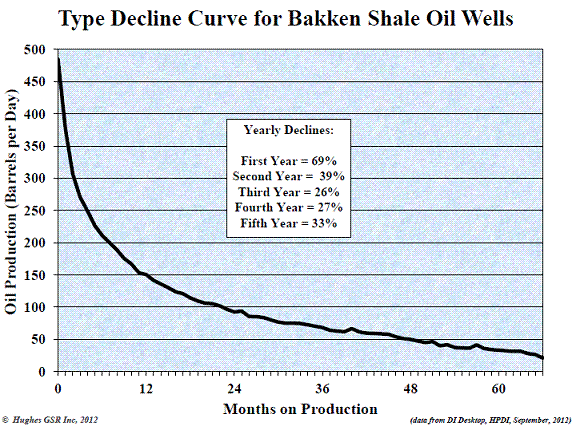

As we can clearly see, EOG Resources has operations in several of the most famous crude oil and natural gas-producing basins in the United States. The company’s acreage is in some of the most resource-rich areas in these basins. This is important because not all wells are created equal. As I discussed in a recent article, wells in areas in which resources are more concentrated tend to both last longer and produce more resources overall. This is quite nice because it helps to overcome one of the biggest problems with shale oil production, which is the high decline rate of the wells. As I discussed in a previous article, shale wells tend to see their production decline very rapidly after they are drilled. In fact, by the end of the second year of operation, a shale well could produce as little as 10% of the daily output that it did when it was first drilled:

Source: Econbrowser.com

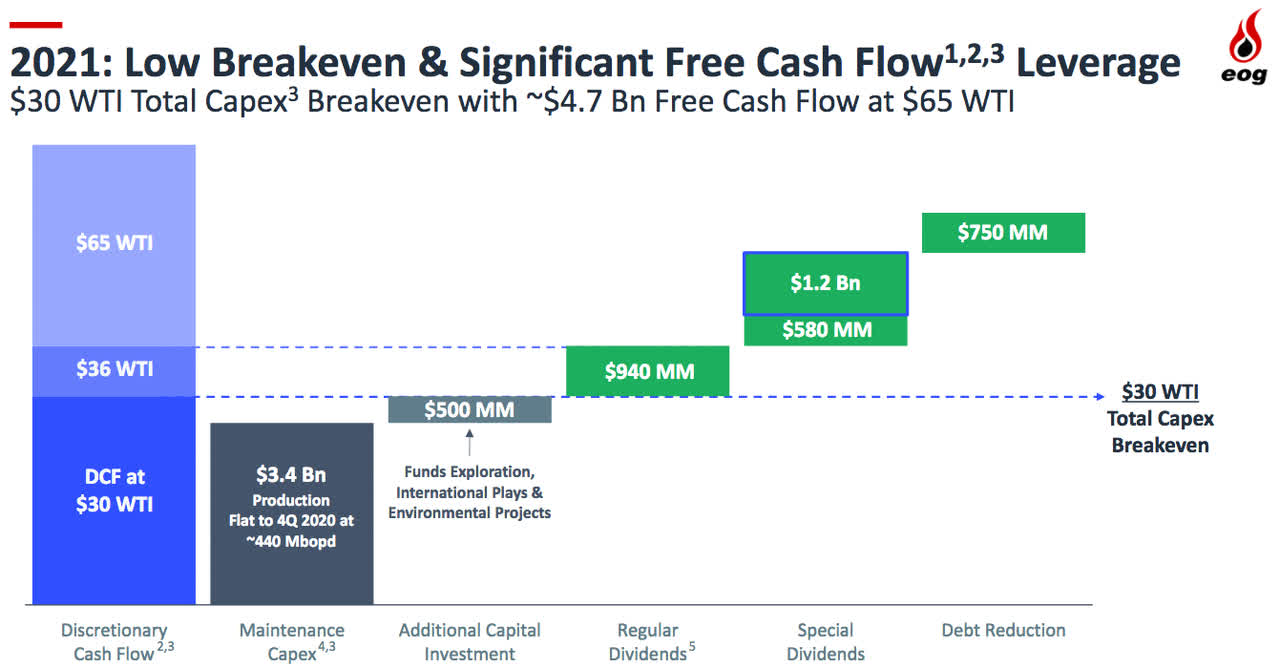

The problem with this is that it makes shale oil incredibly expensive to produce compared to more conventional methods of production. This is because these companies have to constantly drill new wells simply to maintain, let alone grow, their output. As EOG Resources focuses its operations only in the most resource-rich areas, it is able to achieve lower decline rates than its peers, which helps the company achieve lower costs. In fact, EOG Resources has a cash flow breakeven of only $30 per barrel:

This has obvious advantages for the company in both low-oil price and high-oil price environments. This was nice in 2020 because it helped the company weather through a year in which the average price of West Texas Intermediate crude oil was barely above that level. In fact, EOG Resources has positive free cash flow in all but one quarter of 2020 despite the incredibly low prices:

|

Q3 2021 |

Q2 2021 |

Q1 2021 |

Q4 2020 |

Q3 2020 |

Q2 2020 |

Q1 2020 |

|

|

Levered Free Cash Flow |

537.8 |

1,091.5 |

968.8 |

2,188.7 |

721.6 |

(379.7) |

894.7 |

|

Unlevered Free Cash Flow |

567.8 |

1,119.6 |

998.2 |

2,221.9 |

754.8 |

(346.0) |

922.8 |

(all figures in millions)

This is obviously better than the financial trouble that some other companies encountered. The company’s low costs gave it a nice advantage in 2021’s much higher price environment since the less that it spends on operations then the more money is available to make its way down to the company’s free cash flow and ultimately to the shareholders.

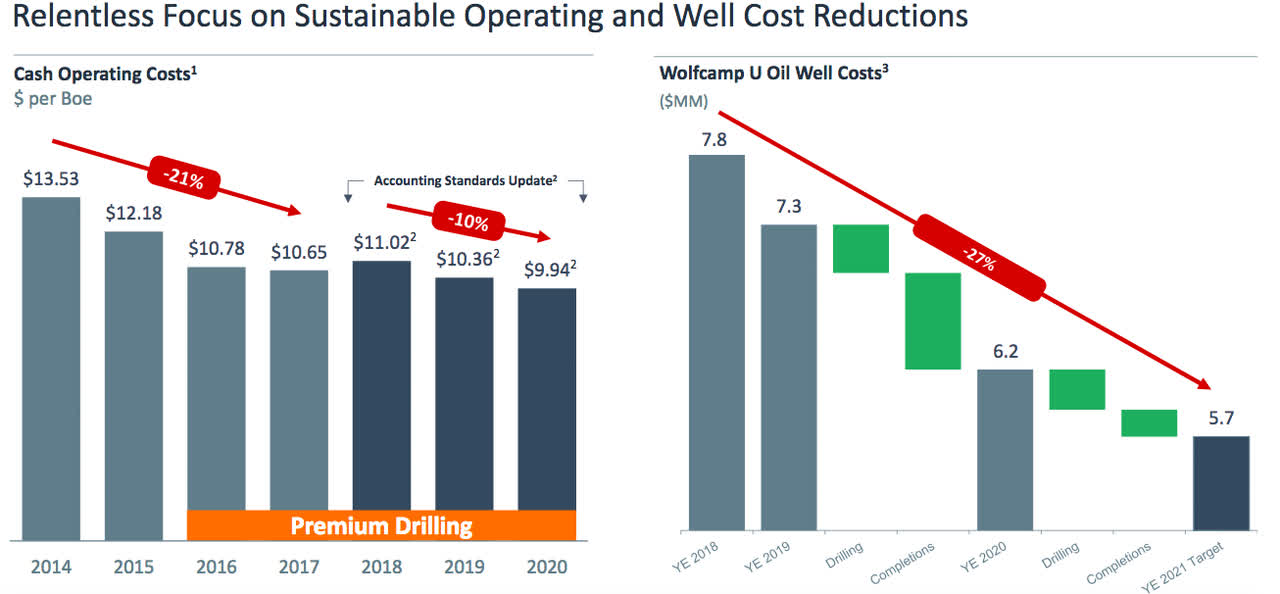

EOG Resources’s current low drilling costs are a direct result of the company’s relentless focus on controlling its costs over a period of many years. As we can see here, the company has managed to reduce both its operating and drilling expenses over time:

We can see that the sharp increase in crude oil prices that we saw in 2021 did not stop the company from continuing its relentless focus on costs. This is something else that is generally nice to see since it tells us that the firm will likely continue this focus regardless of energy prices. The focus on cost reductions is overall very shareholder-friendly because the free cash flow lets it pay a dividend or buy back stock. Indeed, the company announced the payment of $2.7 billion to shareholders in 2021, which was just over half of the $5.3 billion that the company paid out over its history.

The company’s focus on maximizing returns extends to more than just minimizing costs. As many long-term followers of the energy industry already know, one strategy that energy producers utilize to stabilize their cash flows over time is hedging. Basically, the company will enter into a forward contract to see its production at a specified price. This allows the company to insulate itself from commodity price declines like what we saw in 2020. With that said though, they do not typically use these forward contracts on all of their production so that they can see benefit from price increases. EOG is no exception to this but it does it somewhat better than its peers, which likewise gives the company a notable competitive advantage. As we can see here, the prices that EOG Resources manages to get for its oil under these contracts tend to be higher than that of its peers:

This overall results in EOG Resources having overall higher margins than its peer companies. This, especially when combined with the firm’s lower operating costs, gives it a substantial free cash flow generation advantage compared to its peers. This naturally makes it more capable than its peers at delivering the shareholder-friendly things that we have already discussed. Obviously, as investors, our goal is to maximize our returns.

Fundamentals Of Oil And Natural Gas

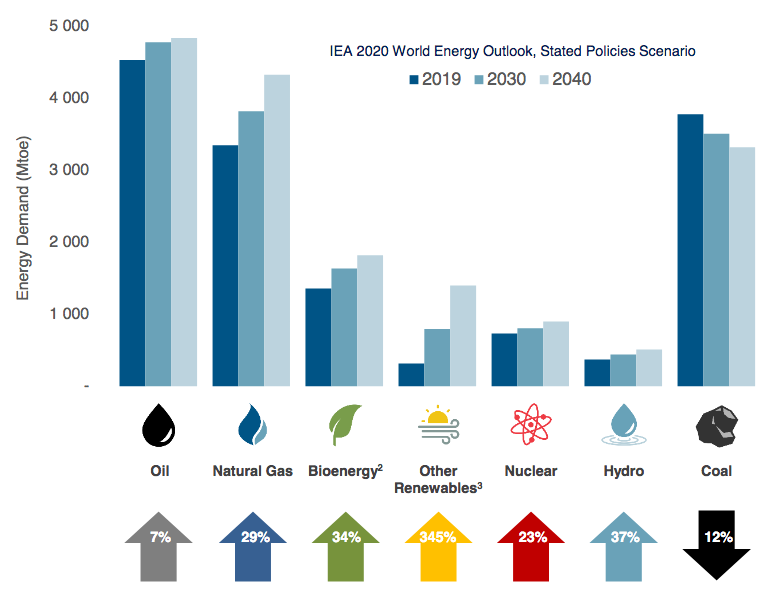

As EOG Resources is a producer of crude oil and natural gas, it would be a good idea to take a look at the fundamentals of these resources. Fortunately, these fundamentals are quite positive. According to the International Energy Agency, the global demand for crude oil will increase by 7% while the demand for natural gas will increase by a whopping 29% over the next twenty years:

Source: International Energy Agency, Pembina Pipeline

Perhaps surprisingly, the surge in natural gas demand is being driven by global concerns about climate change. These concerns have caused governments all around the world to impose a variety of incentives and mandates that are intended to reduce the carbon emissions of their respective nations. One of the most common strategies is to convert old coal-fired power plants to the use of natural gas instead. This is because natural gas burns cleaner than other fossil fuels and is more reliable than renewables given today’s technology. This is why natural gas is commonly referred to as a “transitional fuel” since it provides a way to reduce greenhouse emissions and support the needs of a modern electrical grid until renewables are ready to completely take over.

The story for crude oil demand growth is a bit harder to understand, particularly since many Western nations are working to reduce their consumption of crude oil. The solution to this comes from the various emerging markets around the world, which are expected to see phenomenal economic growth over the period. This economic growth can be expected to lift the citizens of these nations out of poverty and put them securely into the middle class. As this trend takes place, these people will want to enjoy a lifestyle that is closer to what their counterparts in the developed nations enjoy than they have now. This will result in increasing energy consumption, including that derived from crude oil. As the populations of these nations exceeds that of the developed nations, the rising demand for crude oil from these emerging nations will more than offset the stagnant to declining demand elsewhere.

The United States is one of the only nations in the world that has the ability to significantly increase its resource production due to the mineral wealth of the regions in which EOG Resources operates. It, therefore, makes sense that those companies operating in these areas will increase their production in order to capitalize off of this growing demand. When we consider EOG Resources’s numerous competitive advantages, we can see that it is likely to be a beneficiary of this production growth.

Financial Considerations

One thing that is always important to analyze before making an investment into a company is the way that it finances itself. This is because debt is a riskier way to finance a company than equity. This is because debt must be repaid at maturity. In addition, a company must make regular payments on its debt if it is to remain solvent. There is no such requirement with equity.

The most common way to examine a company’s financial structure is to take a look at its net debt-to-equity ratio. This tells us to what degree the company is financing its operations with debt as opposed to wholly-owned funds. In addition, it tells us to what degree the company’s equity can cover its debt in the event of a bankruptcy or liquidation, which is arguably more important.

As of September 30, 2021, EOG Resources had $1.074 billion in net debt compared to $21.765 billion in shareholders’ equity. This gives the company a net debt-to-equity ratio of 0.05, which is one of the lowest ratios in the entire industry. We can see this by comparing the company’s ratio to those of some of its peers:

|

Company |

Net Debt-to-Equity Ratio |

|

EOG Resources |

0.05 |

|

Continental Resources (CLR) |

0.56 |

|

Diamondback Energy (FANG) |

0.52 |

Clearly, the company has a much more conservative financial structure than even some of the strongest companies in the industry. This should give the company greater flexibility during a long-term downturn or similar event and thus reduce our overall investment risk.

Valuation

As is always the case, it is critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return. One method that we can use to value an independent exploration and production company like EOG Resources is to look at a ratio called the price-to-earnings growth ratio. This is an adjusted form of the more familiar price-to-earnings ratio that takes the company’s forward growth prospects into account. As a general rule, a price-to-earnings growth ratio of less than 1.0 is a sign that a stock could be undervalued relative to its earnings per share growth and vice versa. With that said though, very few companies in today’s frothy stock market have a ratio that low.

According to Zacks Investment Research, EOG Resources will grow its earnings per share at a 20.71% rate over the next three to five years. This gives the company a price-to-earnings growth ratio of 0.45 at the current price. Thus, this could be a sign that the stock is undervalued relative to its earnings growth. Let us see how it compares to the same peer growth:

|

Company |

PEG Ratio |

|

EOG Resources |

0.45 |

|

Continental Resources |

0.26 |

|

Diamondback Energy |

0.32 |

The traditional energy industry is one of the few that typically has ratios below 1.0 today, which could indicate that investors are not showing it the respect that it deserves so the whole industry could present an opportunity for a savvy investor. We can see though that EOG Resources appears to be somewhat more expensive relative to its peers. Therefore, none of these companies appears to be particularly expensive right now but a very deep value investor might want to wait until either EOG Resources declines relative to its peers or its peers rise in price.

Conclusion

In conclusion, EOG Resources appears to have a great deal to offer to its investors. In particular, the company’s strategy gives it incredibly low costs and high margins, which allows it to weather through poor industry conditions as well as significantly profit in stronger ones. EOG Resources also is positioned to take advantage of the continuing growing demand for fossil fuels. The company has one of the strongest balance sheets in the industry, which likewise positions it quite well regardless of any future crises or problems. The only concern is that the stock is a bit more expensive than some of its peers but it still has a very attractive valuation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment