grandriver

EOG Resources, Inc. (NYSE:EOG) is an American energy company that has been punished by the recent downturn in oil prices, dropping more than 30%. The company has an almost $60 billion market cap and a more than 3% dividend yield. As we’ll see throughout this article, the company’s impressive low-cost assets will support substantial shareholder returns.

EOG Resources’ Overview

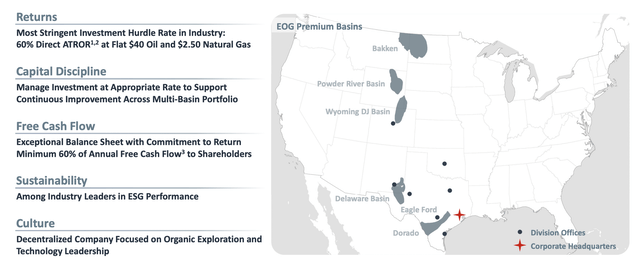

EOG Resources has a unique and well-distributed portfolio of assets.

The company has some of the most stringent investment hurdles in the industry with a focus on strong rewards. The company has an exceptional balance sheet, and it’s focused on driving that free cash flow (“FCF”) towards shareholder returns. From a marketing perspective, the company has diversified sales to domestic refiners and is a major supplier of LNG projects.

The company is connected to several major supply markets and nearly every major supply basin in the United States.

EOG Resources’ Financial Performance

EOG Resources has continued to perform well financially, which can be expected to continue.

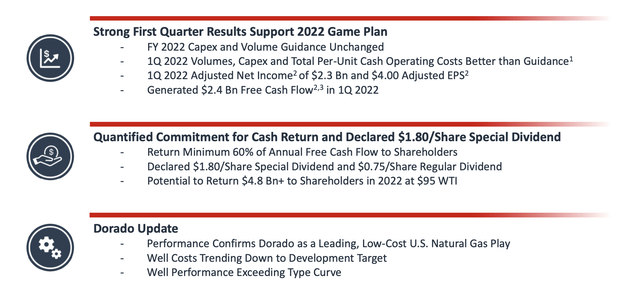

The company has rapidly accelerated its dividend towards $1.7 billion for 2022, which is like a 3% yield. The company’s current guidance for 2022 is unchanged, and the company generated a massive $2.4 billion, implying an almost 20% annualized FCF yield for the company that can be directed to shareholders.

The company plans to return a minimum of 60% of annual FCF to shareholders, and it declared an additional $1.8 / share special dividend. The company sees the ability to return $4.8 billion to shareholders in 2022 at $95 WTI, several % below current prices, which would imply an 8.5% shareholder yield while leaving additional cash.

The company still has share repurchases, which we would like to see an increase. However, given the company’s minimal debt ($1.1 billion) we expect overall share repurchases to remain strong.

EOG Resources’ Capital Spending

From a capital perspective, the company is continuing to invest in its business.

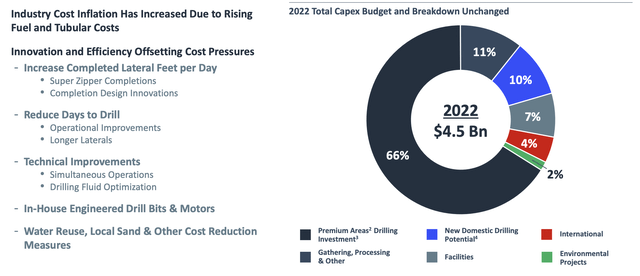

The company’s 2022 plan is for $4.5 billion in capital spending, which the company can cover at $32 WTI. The company is continuing to improve efficiency with increase completed lateral feet and reduced days to drill along with technical improvements. In-house engineering will continue to enable the company to save on costs on as well.

The company is spending $3 billion on premium areas drilling investment with roughly $300 million on gathering & processing assets and $450 million on new domestic drilling. The company’s projects will at least enable it to maintain production if not potentially expand its production from current levels.

EOG Resources’ Shareholder Return Potential

EOG Resources has the ability to drive substantial shareholder returns going forward.

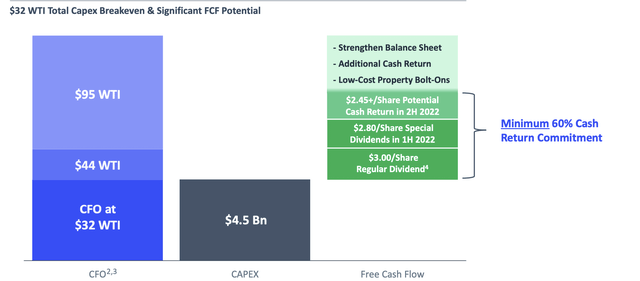

EOG Resources can cover its entire capital expenditures at $32 WTI. The company’s regular dividend, which has a yield of just over 3%, is coverable at $44 WTI. Going towards $95 WTI, the company can pay total dividends $8.25 with $4.8 billion in total cash returned to shareholders. Those are significant returns.

However, after that, the company will still have $3.2 billion left over. For that amount of money, the company could repurchase shares, make opportunistic acquisitions, or more. Regardless of what the company does, $8 billion in FCF represents a 15% FCF yield at $95 WTI, highlighting how the company was a valuable investment.

Our View

Our view is that the company represents a valuable investment that can generate valuable shareholder returns.

The company has an impressive portfolio of assets with a focus on generating incredibly high returns. The company has a capital spending breakeven of $32 / barrel WTI and its dividend breakeven is $44 / barrel. The company is paying substantial special dividends with a roughly 60% FCF dividend yield resulting in total dividends of 8.5%.

The company has billions in additional FCF past this and with minimal net debt past this, we expect the company to generate substantial shareholder rewards. All of this is at WTI prices below current prices, despite the recent drop in oil prices. Putting all of this together makes the company a valuable generator of double-digit returns in our view.

EOG Resources’ Risk

The largest risk to EOG Resources, of course, is oil prices. At $80/barrel WTI, the company can continue paying its high-single-digit dividend yield and cover all capital spending. At prices above that, the company is a valuable business. However, below that, the story changes. That makes the company a worse investment.

Conclusion

EOG Resources has a unique portfolio of resources a high hurdle for generating strong returns. The company is paying out a dividend yield of more than 3%, and it has the ability to pay out a special dividend taking its total yield to more than 8%. That’s a yield that alone makes the company a valuable investment worth paying attention to.

The company after that will still have several billion dollars left over. The company has incredibly low net debt meaning that it can use its cash for a variety of shareholder rewards. Regardless of how the company spends the money, it can generate double-digit shareholder returns, helping to make the company a valuable investment.

Be the first to comment