The SPDR S&P Oil & Gas Exploration & Production ETF (XOP), which is one of the largest energy ETFs, has been under a lot of pressure this year, thanks to the plunge in oil prices, and the fund’s future is looking challenging. The SPDR S&P Oil & Gas Exploration & Production ETF’s portfolio consists primarily of the shale oil producers who will likely burn cash flows and report quarterly losses this year as the US benchmark WTI crude trades below $30 a barrel. The oil prices are also facing a significant downside risk, which can also push this ETF lower. I believe investors should avoid this ETF at the moment.

Image courtesy of Pixabay

The past few weeks have been tough for the oil market as two major oil-producing nations, Russia and Saudi Arabia, started battling for market share through a price war at a time when the commodity was already under pressure due to the demand shock coming from the spread of COVID-19 from China to other parts of the world. The price of the US oil has fallen from more than $60 a barrel at the start of the year to just $25 at the time of this writing which crushed energy equities. The SPDR S&P Oil & Gas Exploration & Production ETF, which is the benchmark ETF for the oil producers, has tumbled by 65% since the start of this year and the fund is facing a grim outlook.

The SPDR Oil & Gas Exploration & Production ETF, or XOP, is one of the largest and most liquid energy market funds. The ETF has $1.6 billion of assets under management, making it considerably larger than some of its closest peers, such as the iShares U.S. Oil & Gas Exploration & Production ETF (IEO) or the Invesco Dynamic Energy Exploration & Production ETF (PXE) that have $110.62 million and $14.1 million of net assets respectively. In addition to this, XOP is also one of the cheapest funds in the exploration and production space. It comes with an expense ratio of 0.35%, which means the fund charges $35 each year on every $10,000 of investment. By comparison, IEO and PXE have higher expense ratios of 0.42% and 0.63% respectively. Both IEO and PXE have also fallen by more than 60% this year, largely in-line with XOP. And I think we are not out of the woods yet. The oil prices are facing significant downside risk.

Image: XOP: SPDR® S&P® Oil & Gas Exploration & Production ETF.

The spread of the coronavirus to the US, Europe, Asia, and other parts of the world, could be followed by severe travel restrictions. In the US, some states, including California and New York, have enacted strict lockdown measures and others are planning to do the same. Italy, where more than 4,800 people have died from the disease, has imposed a national quarantine. Spain and France have also announced sweeping emergency restrictions. Other nations might also take similar steps as coronavirus continues to spread. That’s going to hurt the demand for oil and energy products, which will weigh on crude oil prices.

Furthermore, Saudi Arabia is planning to ramp up supplies as it escalates the price war and captures additional market share. Saudi Aramco, the kingdom’s flagship oil producer has been pumping 9.7 million barrels of oil per day but plans to increase output to 12.3 million bpd in April and its capacity to 13 million bpd. Fellow OPEC member UAE has also said it will increase its output to 4 million bpd next month, up from 3.03 million bpd in January, and will accelerate work on ramping up capacity to 5 million bpd. I think there’s a possibility of oil prices falling further in late-March and April in anticipation of these additional barrels.

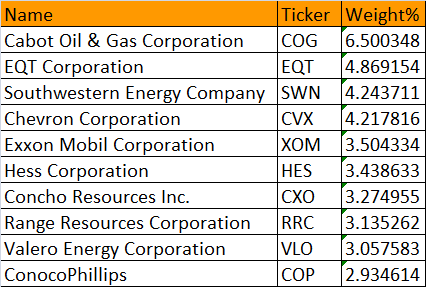

The plunge in oil prices is going to hurt the shale oil drillers which constitute a majority of XOP’s holdings. The ETF tracks the S&P Oil & Gas Exploration & Production Select Industry index which includes independent oil producers, vertically integrated oil majors, and refining and marketing companies. The fund is heavily tilted towards the independent oil producers which together account for 71% of the ETF’s assets while the vertically integrated majors and refiners represent 10% and 19% of XOP respectively. A total of seven of the ETF’s top-10 holdings are independent exploration and production companies including Cabot Oil & Gas Corp. (COG), Hess Corp. (HES), Concho Resources (CXO), and ConocoPhillips. XOP has a total of 57 holdings.

XOP Top-10 Holdings as on 12-Mar-2020. Image Author.

The energy industry, however, is dominated by a few big names, particularly Exxon Mobil (XOM) and Chevron (CVX). Therefore, most market-cap-weighted energy ETFs, such as the SPDR Energy Select Sector (XLE), usually have a massive bias to these few companies. XOP, however, uses a modified equal-weighted methodology to rank stocks. It doesn’t allocate a large percentage of funds for any single stock and therefore gives investors un-concentrated exposure to a range of oil producers including the industry titans like Exxon Mobil and small-cap operators like Whiting Petroleum (WLL).

With WTI hovering in the $20 to $30 a barrel range, the exploration and production companies will be forced to cut spending to preserve cash flows. They might slash capital spending as well as dividend and buyback expenditures. Some operators might shift to maintenance mode, meaning they will cut the CapEx down to a level where they can keep production flat. Others will aggressively reduce drilling activity by dropping several rigs and frac crews which might lead to a drop in production. We’ve already seen this happen with Apache Corp. (APA) which cut dividends by 90%, slashed CapEx by almost 40%, and plans to remove all of its rigs from the Permian Basin. This effectively means Apache, which is XOP’s 17th largest holding, won’t be operating any rigs in the US. Instead, the company will focus on producing oil from its high-margin international operations.

Other independent oil producers will also likely follow in Apache’s footsteps by announcing large spending cuts, but with oil in the $20s a barrel, they will still likely burn cash flows and report quarterly losses. The shale oil producers have become more efficient at pumping hydrocarbons and have considerably reduced their cost structures in the last couple of years, which has improved their ability to generate profits and free cash flows at low oil prices. But in a sub-$30 a barrel oil price scenario, pretty much nothing works in US shale.

The Delaware Basin and the Midland Basin regions, which are located within the Permian Basin that spreads over West Texas and New Mexico, are the most prolific and lowest-cost shale oil-producing plays in the US but they require oil prices of more than $40 a barrel to breakeven, as per RS Energy data shared by Hess Corp. in a presentation. The latest data from the Dallas Fed Energy Survey shows that the Permian Basin operators need oil prices of around $48 to $49 a barrel to profitably drill a new well. At $30 WTI, I believe it might be feasible for some efficient shale drillers operating in the low-cost regions to continue pumping oil from existing wells. These companies could still generate enough revenues to cover their operating costs. But at $20s a barrel and below, I think even the lowest cost and most efficient operators might start shutting-in production.

Some oil producers, however, have downside protection. Over the last two years several oil producers, ranging from small-cap operators like PDC Energy (PDCE) to the large-cap players like Pioneer Natural Resources (PXD) have hedged a significant chunk of 2020 production at attractive prices. These hedges will soften the blow coming from the plunge in oil prices and the well-hedged companies might still generate decent levels of cash flows this year. But the industry doesn’t have a strong hedge coverage for 2021, which is going to put many oil producers in an even more difficult position if oil stays below $30 for a long period. Some oil producers, such as Apache Corp. and Continental Resources (CLR), which are XOP’s 17th and 30th largest holdings respectively, haven’t hedged their future production for the current or subsequent years. This leaves their cash flows fully exposed to oil price swings.

That being said, Russia, OPEC members, and other oil producers need higher oil prices of more than $40 a barrel to drive economic growth. The global oil market will likely rebalance in the long run, which will push prices higher, just as we’ve seen in all of the previous downturns. But until that happens, the US shale drillers will remain under a lot of pressure. During the downturn, all oil producers will find it difficult to generate enough cash flow from operations to fund their CapEx and dividends. The industry will likely face a cash flow shortfall but those companies that have a strong balance sheet can borrow additional debt to bridge the funding gap. The strong oil E&P companies, such as Pioneer Natural Resources, who have a rock-solid balance sheet and a high-quality asset base will survive. But the weak ones, particularly the inefficient shale drillers with fragile financial health, such as Whiting Petroleum and Chesapeake Energy (CHK), are facing a grim future.

In short, XOP’s holdings are facing a tough outlook. Unless oil prices improve dramatically, the shale oil drillers will struggle with weak levels of cash flows and losses in the future. The entire sector will remain under pressure but this might create buying opportunities for long-term oriented investors as even some of the highest quality oil producers will trade at a steep discount relative to their historical valuation. Although I think investors should stay on the sidelines in the short-term, considering oil prices are still facing considerable downside risk, they should consider buying some shares of high-quality producers like EOG Resources and Pioneer Natural Resources on weakness. But, in my view, this is no time to bet on the entire E&P space through XOP which will give investors exposure to several low-quality energy companies as well.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment