Apiruk/iStock via Getty Images

Introduction

Despite the impressive share price performance of Enviva (NYSE:EVA) during 2021, I have not been a fan of their dividends because even though their moderate and quickly growing yield of 4.62% looks appealing, it nevertheless remains oversized even with their IDRs gone following their accompanying corporate restructuring, as my previous article discussed. A follow-up analysis is provided within this article now that their corporate restructuring is completed, although sadly, accounting complexities make their 2022 outlook difficult to ascertain and by extension, their dividends remain very risky.

Executive Summary & Ratings

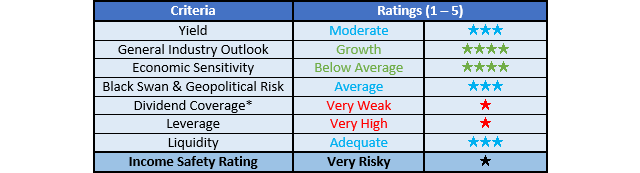

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

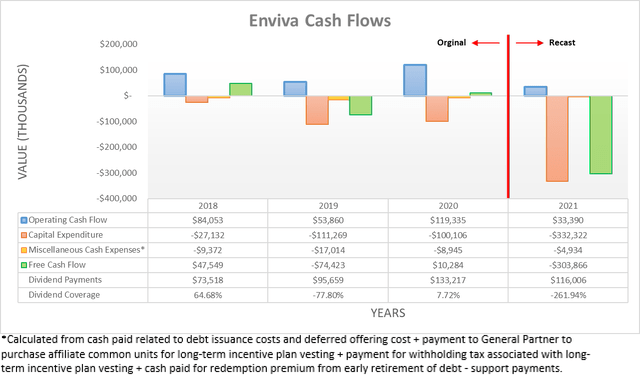

Since completing their corporate restructuring during the fourth quarter of 2021, which included the acquisition of their former holdings company, Enviva Holdings, they were required to recast their financial statements for the past two years. Whilst this was expected to see changes, the extent is surprising with their operating cash flow technically ending 2021 at a mere $33.4m, which apart from being down massively versus their previous non-recast result of $119.3m during 2020, also pales in comparison to the $111.4m they already generated during the first nine months of 2021 before completing their corporate restructuring. This was not a simple one-off change with their recast 2019 and 2020 results now showing operating cash flow of negative $55.4m and positive $14.4m respectively, thereby clearly down massively versus their non-recast results of $53.9m and $119.3m respectively. Heading forwards, future articles will utilize their recast numbers but this time, their non-recast historical results for 2020 and earlier were left to display the magnitude of changes stemming from the accounting complexities that predominantly arises as a result of intercompany eliminations, which are also evident within their accrual-based results, as the graph included below displays.

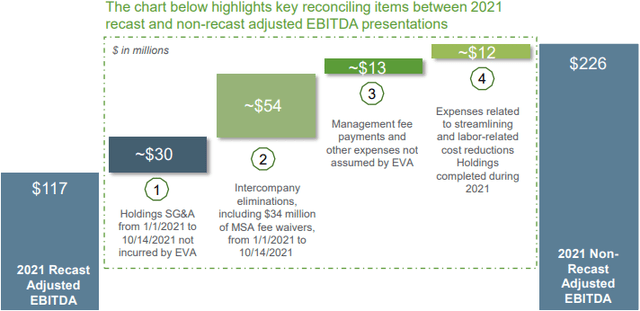

Enviva Fourth Quarter Of 2021 Results Presentation

The very significant difference between their recast adjusted EBITDA for 2021 of $117m and their non-recast adjusted EBITDA of $226m can easily be observed, which sees four main items that should theoretically also be responsible for the massive change their operating cash flow witnessed. The first item relates to selling, general and administrative expenses incurred by their now acquired holding company before the date of acquisition. The second and largest item relates to intercompany eliminations, which arise because as a partnership they previously derived a portion of their earnings from their holdings company, although this is no longer the case because they own the holding company following their corporate restructuring. When these two items are combined, they comprise the majority of the difference and thus explain why their recast operating cash flow is now down massively following their corporate restructuring and worryingly, in my view these two items seem likely to continue weighing down their results in the future.

Meanwhile, the third and fourth items relate to management and streamlining expenses that seem unlikely to continue in the future since they were not assumed as part of the transaction, as per slide thirteen of their fourth quarter of 2021 results presentation. Despite being interesting, these results sit in the rear-view mirror, their outlook for 2022 and beyond is far more important, although this too remains rather unclear despite their guidance for 2022 pointing towards very strong year-on-year growth, as the tabled included below displays.

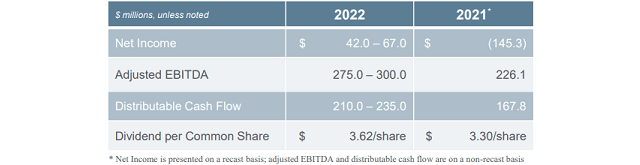

Enviva Fourth Quarter Of 2021 Results Presentation

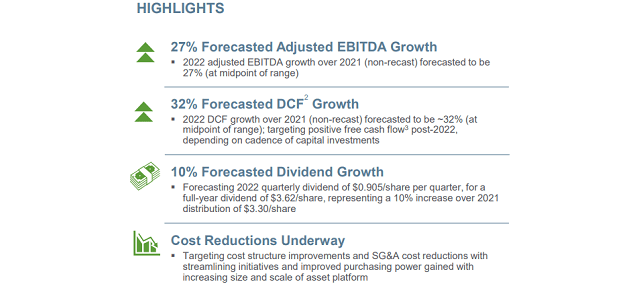

It can be seen that their guidance for 2022 forecasts adjusted EBITDA of $287.5m at the midpoint and thus represents a very strong increase of 27.16% year-on-year against their previous result of $226.1m during 2021. Although before getting too excited, this is based upon their non-recast results, as noted beneath the table included above as well as elsewhere in their 2022 guidance, as the slide included below displays.

Enviva Fourth Quarter Of 2021 Results Presentation

Since their recast results for 2021 included the two items that significantly reduced their results, which were likely to continue in my view, their guidance that is based upon their non-recast results makes it difficult to ascertain expectations for 2022 and more importantly, whether their operating cash flow will return back to its former level at north of $100m per annum. Whilst this remains uncertain, the burdensome cost of funding their dividend payments remains certain with their guidance for 2022 pointing to dividends of $3.62 per share, as per the slide included above. If these come to fruition, it would see record dividends but at a cost of $240.9m per annum given their latest outstanding share count of 66,558,919, which as a side note, includes their latest equity issuance.

This sees the cost for their dividend payments standing approximately 100% higher than their non-recast operating cash flow of $119.3m during 2020 and many magnitudes above their recast operating cash flow of only $33.4m during 2021. Unless there is a dramatic improvement, this makes it seem very unlikely that their 2022 operating cash flow will even match their dividend payments, which was the core issue raised back in July 2021 when publishing my first article on the matter.

Ultimately only time will tell how their cash flow performance unfolds following their corporate restructuring given the difficulty utilizing their 2022 guidance but obviously the prospects to see their dividend payments outpacing their operating cash flow leaves them very risky and in my view, makes them unsustainable. Meanwhile, they still have to fund their capital expenditure that their guidance for 2022 forecasts to reach $265m at the midpoint, as per slide sixteen of their previously linked fourth quarter of 2021 results presentation and thus even if their operating cash flow was to increase dramatically, this still ensures their dividend coverage will remain very weak.

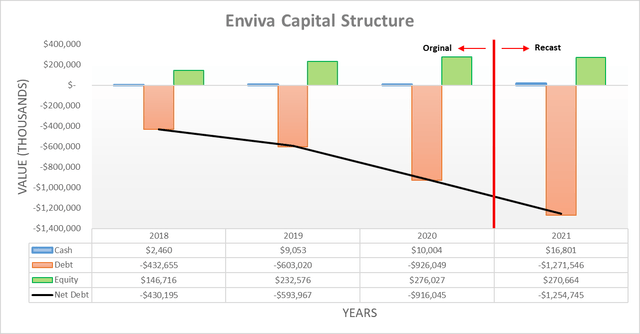

Following the end of 2021, they have once again seen their net debt surge higher to $1.254b, which marks a new record and stands a very large 36.97% higher year-on-year versus its previous level of $916m at the end of 2020, if utilizing their non-recast results. Although if utilizing their recast results for 2020, it shows their net debt ending the year at $861.9m and thus 2021 actually saw an even higher increase of 45.57% year-on-year, which is not in the least way surprising given the almost non-existent operating cash flow observed within their recast results. When looking ahead into 2022, it obviously remains difficult to ascertain exactly how their capital structure will evolve due to the previously discussed accounting complexities but suffice to say, the burdensome $240.9m cost to fund their dividend payments makes it very likely to see their net debt trending significantly higher.

Rather unsurprisingly, the massive change to their recast financial performance also saw their leverage ratios change comparable with their mere $33.4m of operating cash flow for 2021 indicating an insanely high net debt-to-operating cash flow of 37.58. Even if utilizing their recast adjusted EBITDA for 2021 of $117m, it still leaves their net debt-to-EBITDA effectively off the charts at a very high result of 10.72. Until greater clarity emerges during 2022, it would be rather pointless to assess their leverage in further detail but if any new readers are interested in their historical leverage that was already very high, my other article provided a detailed analysis.

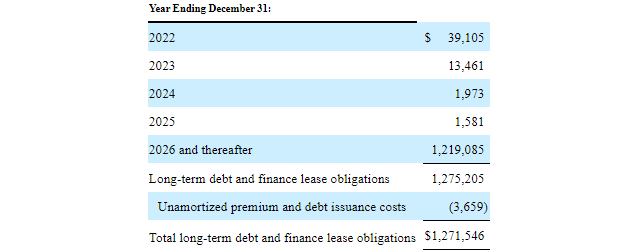

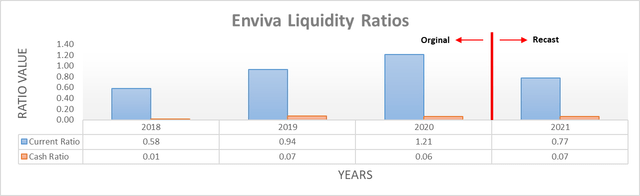

Despite their net debt surging higher during 2021, thankfully their liquidity remained adequate even after their corporate restructuring with a current ratio of 0.77 and a cash ratio of 0.07. It remains to be seen how this fairs during 2022 given their likely reliance upon debt-funding, not to mention that their credit facility only retains a further $99.8m available, which may become restricting and pose additional risks to their dividends, unless they can increase its borrowing base. At least they only see minimal debt maturities until after 2025, thereby providing breathing room elsewhere, as the table included below displays.

Enviva 2021 10-K

Conclusion

Whilst I was expecting sizeable changes following their corporate restructuring, the extent of changes was still surprising with their recast results showing their operating cash flow plunging by circa 80% versus their non-recast results from earlier in 2021. When combined with the way management presented their guidance for 2022 that still appears based upon their non-recast results, it makes the resulting outlook for their cash flow performance difficult to ascertain. Even though my rating would normally be lifted from sell to hold until more time elapses, I nevertheless still believe that my existing sell rating is appropriate given their burdensome dividend payments, which I remain skeptical are sustainable.

Notes: Unless specified otherwise, all figures in this article were taken from Enviva’s SEC filings, all calculated figures were performed by the author.

Be the first to comment