megaflopp/iStock via Getty Images

Envista Holdings Corporation (NYSE:NVST) does not only report an aggressive M&A strategy, but management is also enacting the reshaping of its portfolio. In my view, if emerging markets continue to perform, and solid growth and EBITDA margin expansion continue, Envista Holdings appears undervalued by the market. Yes, there are risks from third-party suppliers and a potential economic downturn. However, NVST appears to have an appealing valuation.

Envista Holdings

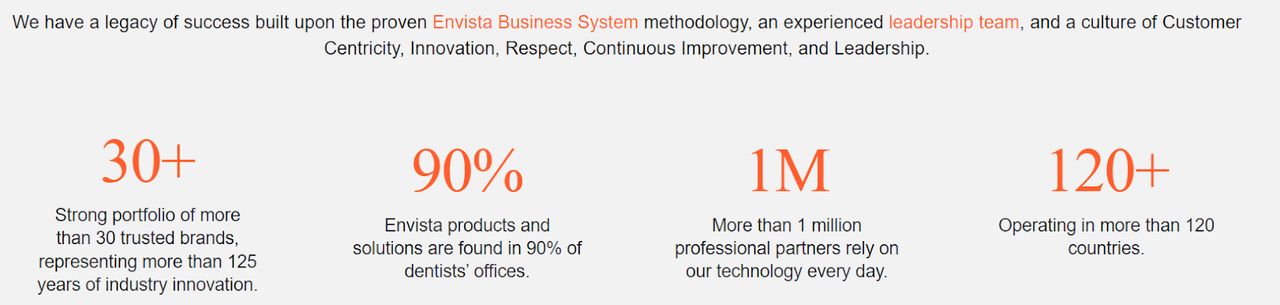

With more than 30 trusted brands, Envista reports that 90% of dentists have some of the company’s products in their offices. Besides, the company operates in more than 120 countries, so the target market is most likely quite significant.

Company’s Website

In my view, one of the most relevant reasons to like Envista is the guidance given by management. The company expects an adjusted EBITDA margin of 20%. Considering previous increases in the EBITDA margins and expectations, in my view, stock demand would increase as investors learn about Envista’s incoming numbers.

Despite the persistent inflationary pressures, continued supply chain disruptions, and an uncertain geopolitical environment, we are reiterating our guidance for core growth and profitability for the full year 2022. We expect core sales to grow mid-single digits for 2022 and to deliver adjusted EBITDA margin of 20% for the full year.

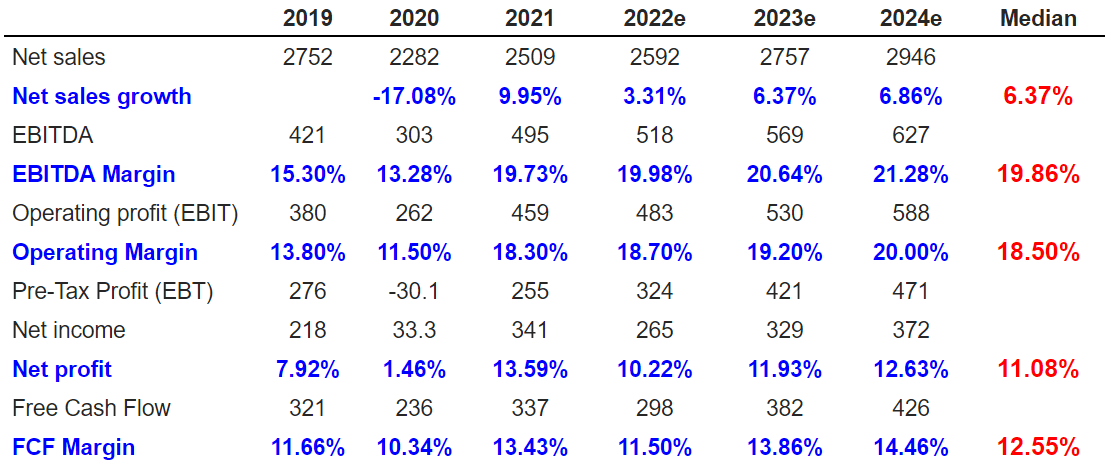

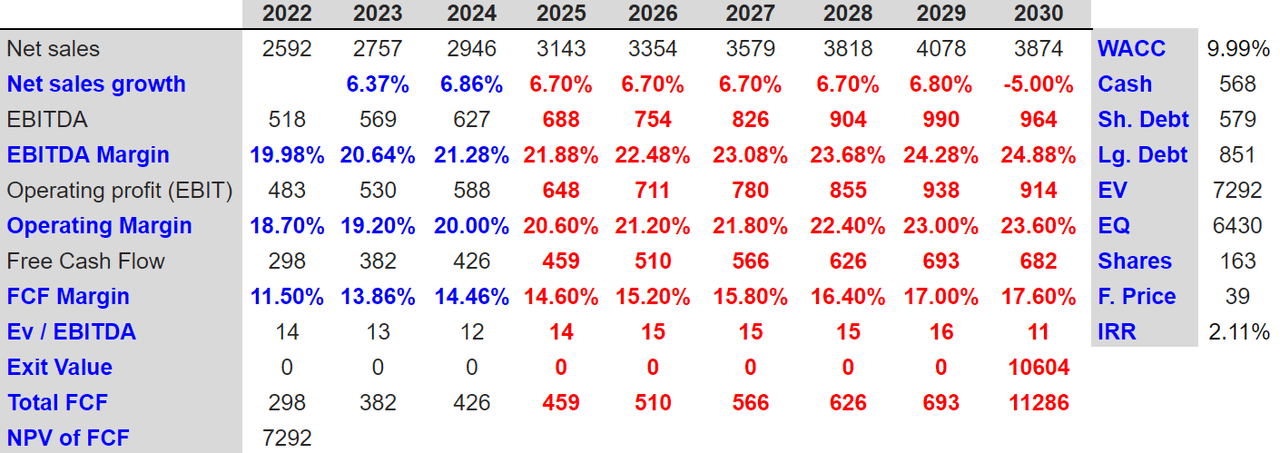

Expectations From Analysts Include 6.8% Sales Growth, EBITDA Margin Of 19.86%, And Free Cash Flow Margin Of 12.55%

For 2024, estimates include 2024 net sales of $2.946 million, with a net sales growth of 6.86%. 2024 EBITDA would stand at $627 million with an EBITDA margin of 21.28% and operating profit of $588 million with operating margin of 20%. Net income would stand at close to $372 million, with 2024 free cash flow of $426 million.

Marketscreener.com

Balance Sheet

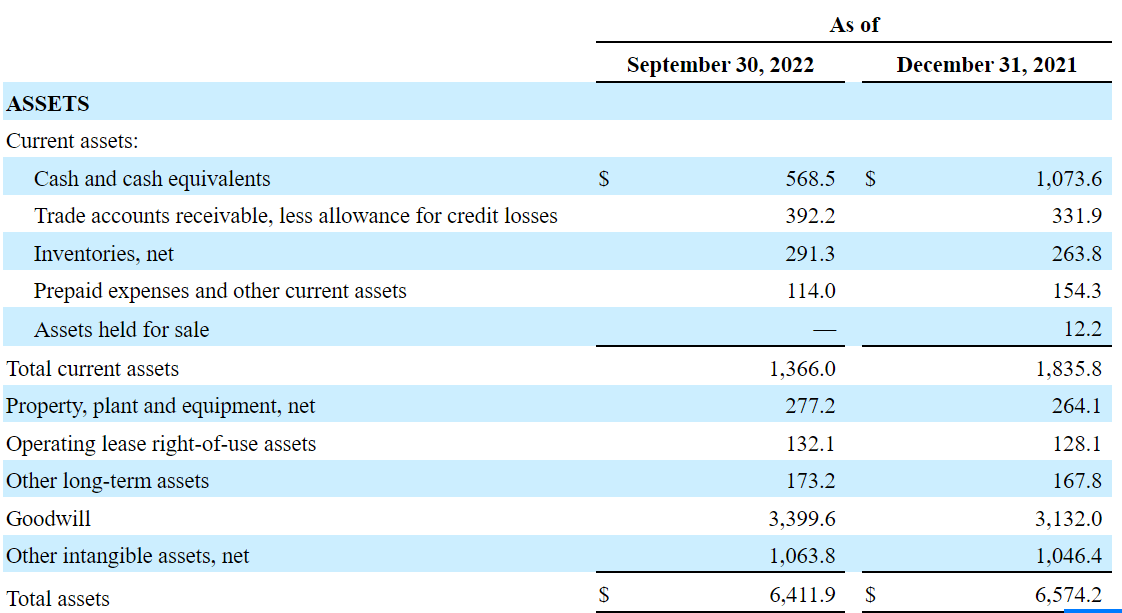

As of September 30, 2022, cash and cash equivalents were equal to $568 million, and trade accounts receivable stood at $392 million with inventories worth $291 million. Besides, prepaid expenses and other current assets were $114 million, and total current assets were equal to $1.3 billion. Current assets/current liabilities stand at more than 1x.

With a property, plant and equipment of $277 million and operating lease rights of use assets worth $132 million, goodwill stands at $3.3 billion. I believe that impairment of goodwill or intangible assets could happen. Keep in mind that other intangible assets are worth $1.06 billion.

10-Q

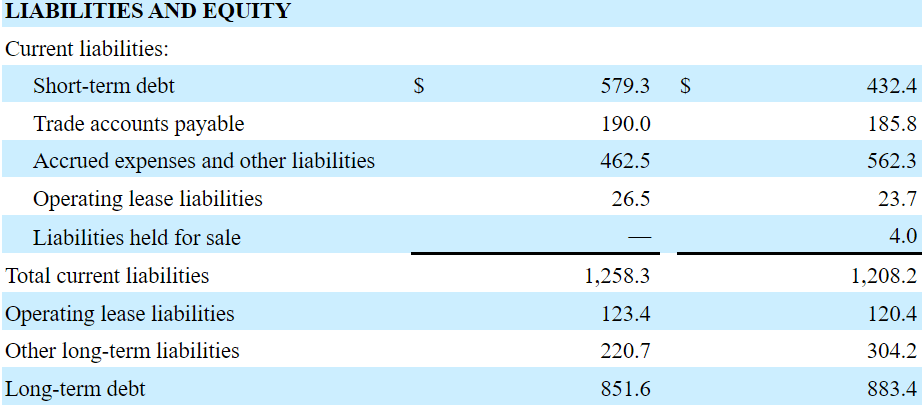

Regarding the list of liabilities, the short-term debt was $579 million. Trade accounts payable were $190 million, and accrued expenses and other liabilities were worth $462 million. Operating lease liabilities were $26 million. Finally, long-term debt stands at $851 million.

10-Q

Base-Case Scenario

Under normal circumstances, I expect Envista to grow thanks to the digitization of dental practices globally. Besides, in my view, the penetration of new dental procedures in emerging markets will most likely enhance revenue generation in the near future. In this regard, management provided some information about the future of orthodontics and implants in emerging markets:

In addition, we believe future growth in the dental industry will be driven by an aging population, the current under penetration of dental procedures, especially in emerging markets, improving access to complex procedures due to increasing technological innovation, an increasing demand for cosmetic dentistry, and the growth of Dental Service Organizations, which are expected to drive increasing penetration and access to care globally. Orthodontics and implants both have less than 10% market penetration globally and are areas where we have a significant market presence. Source: 10-K

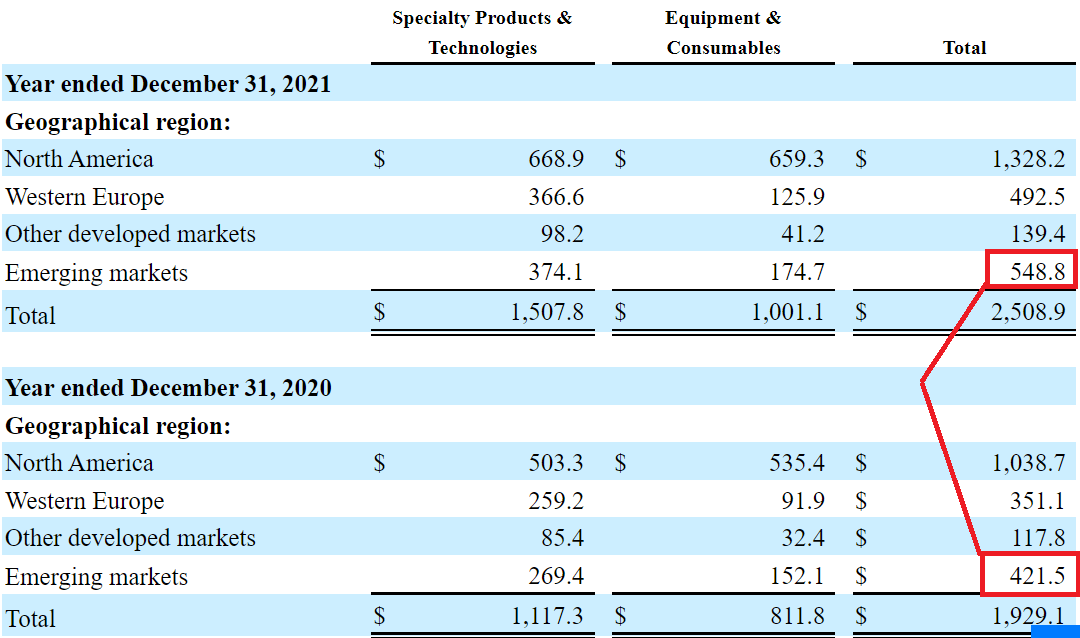

In line with the previous words, let’s note that sales in emerging markets increased significantly in 2021. Under this case scenario, I assumed that shareholders will enjoy a similar revenue growth trend in the following years.

10-K

Envista is also enacting new structural cost reduction initiatives, reshaping its brands, and working towards improvements in manufacturing. In my view, these initiatives will most likely bring EBITDA margin increases, which could lead to increases in Envista’s stock valuation.

We simplified our portfolio by reducing the number of our imaging brands and exiting lower growth/margin businesses. In 2020, we also executed a $100 million structural cost reduction initiative. We continue to pursue a number of ongoing strategic initiatives across our operating companies relating to efficient sourcing and improvements in manufacturing and back-office support, all with a focus on continually improving quality, delivery, cost, growth and innovation. Source: 10-K

Under the previous assumptions, I included 2030 net sales of $3.874 billion, with an EBITDA of $964 million, and an EBITDA margin of 24%. The operating profit is likely to be $914 million, with an operating margin of 23.60%. The free cash flow will likely be $682 million, with an FCF margin of 17.60%.

Finally, if we assume an EV/EBITDA of 11x, the exit value would stand at $10.604 billion, with an NPV of FCF of $7.292 billion. My results also include an equity valuation of $6 billion, a fair price of $39, and an IRR of 2.1%.

Bersit’s DCF Model

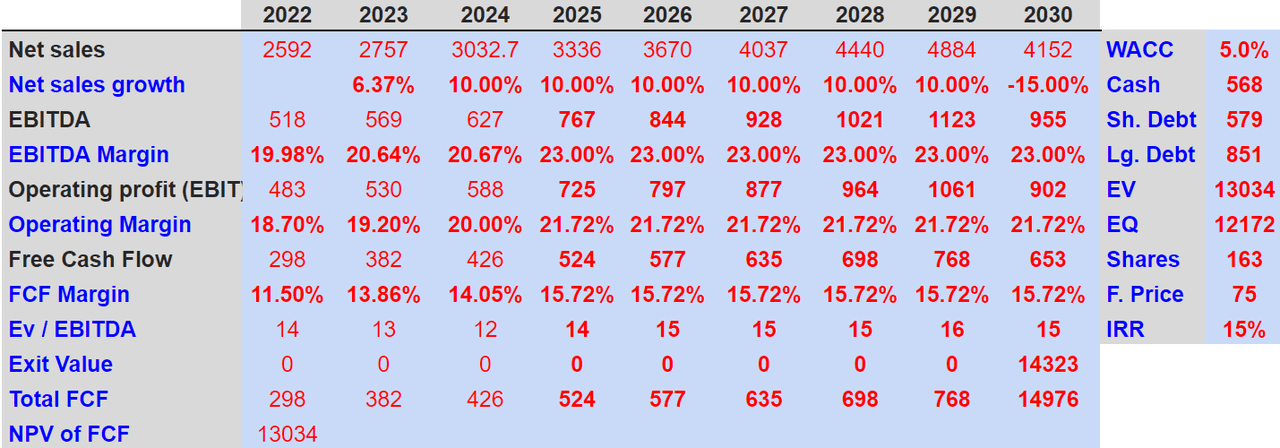

My Best-Case Scenario Would Include Successful M&A And Divestitures

Under my best-case scenario, I expect a significant number of acquisitions in the Specialty Products & Technology segment as well as strong growth. Let’s note that Envista made a clear statement about its intentions in the last annual report. In my view, a sufficient number of acquisitions could bring the revenue growth to double digits.

We have invested in our Specialty Products & Technology segment, adding manufacturing capacity and personnel to these businesses, with plans for further investment in 2022. We intend to drive shareholder value by deploying capital to acquire or invest in other businesses that strategically fit into or extend our product offering into new or attractive adjacent markets. Source: 10-K

My results included 2030 net sales of $4.15 billion and 2030 EBITDA of $955 million, with an EBITDA margin of $23%. The operating profit would be close to $902 million, with operating margin of 21.72%. 2030 free cash flow would be close to $653 million, with an FCF margin of 15%. If we also assume an EV/EBITDA multiple of 15x, I obtained a net present value of future FCF of $13 billion. My results would also include an implied fair price of $75 with a WACC of 5% and an IRR of 15%.

Bersit’s DCF Model

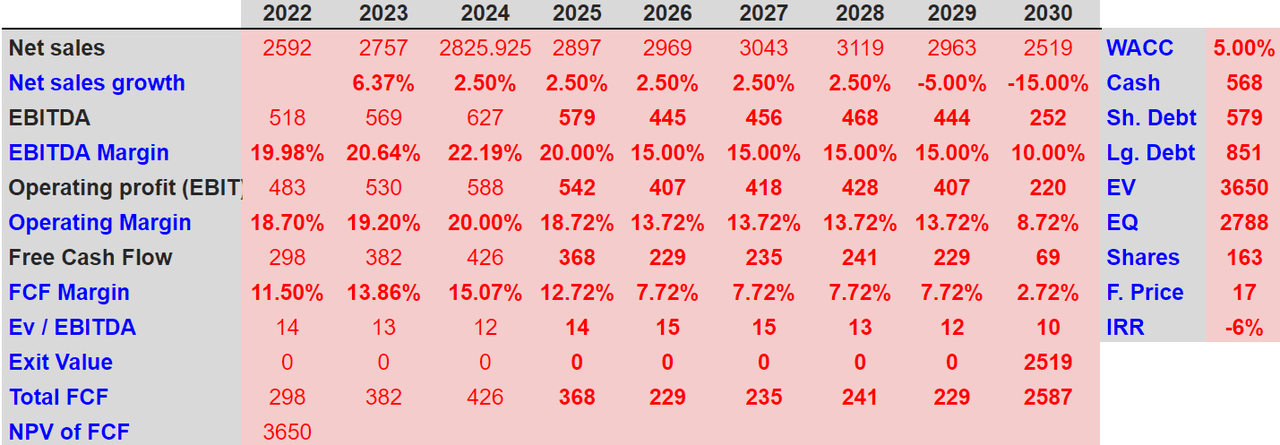

Cyclical Downturns In Certain Regions, Lack of Suppliers, Or Commodities Increase Could Lead To A Fair Valuation Of $16.5 Per Share

Envista’s business model depends on the future growth of target markets. The company operates all over the world, so a cyclical downturn in one of these regions could bring revenue growth declines. In this regard, let’s note that the fiscal quarter appears to be the most relevant for Envista. With this in mind, as a shareholder, I would be studying very carefully the numbers delivered at the beginning of the year.

Our growth depends in part on the growth of the markets which we serve, and visibility into these markets is limited (particularly for markets into which we sell through distribution). Any decline or lower than expected growth in our served markets could diminish demand for our products and services, which would adversely affect our financial statements. Our quarterly sales and profits depend substantially on the volume and timing of orders received during the fiscal quarter, which are difficult to forecast. Certain of our businesses operate in industries that may also experience periodic, cyclical downturns. Source: 10-K

An increase in the price of commodities may also drive Envista’s profitability down. If management cannot increase its prices, I would be expecting a decline in Envista’s FCF margin, which may later push Envista’s total valuation down.

If we are unable to fully recover higher commodity costs through price increases or offset these increases through cost reductions, or if there is a time delay between the increase in costs and our ability to recover or offset these costs, our margins and profitability could decline and our financial statements could be adversely affected. Source: 10-K

Envista Holdings also receives a substantial number of products and supplies from third parties. If these suppliers decide to renegotiate their agreements, management may suffer production declines and perhaps a deterioration in Envista’s margins.

The following information is expected for 2030. 2030 Net sales would be close to $2.5 billion. 2030 EBITDA would be $252 million, with an EBITDA margin of 10%, and an operating profit of $220 million.

2030 free cash flow would be close to $69 million, and FCF margin would be close to 2.72%. With an EV/EBITDA of 10x, the exit value would be close to $2.5 billion, the implied enterprise value would be $3.65 billion, and the fair price would be close to $16.5 per share.

Bersit’s DCF Model

Conclusion

Envista Holdings is making a lot of efforts to reshape its portfolio of brands and expects significant business growth in emerging markets. Considering the expectations of other investment analysts and my own financial models, in my view, Envista is quite undervalued. Even if the company has issues with third-party suppliers, or an economic downturn occurs in some regions, the sum of future FCF wouldn’t decline that much in my opinion. In sum, I would be carefully studying the price dynamics in the coming months.

Be the first to comment