Paul Campbell/iStock via Getty Images

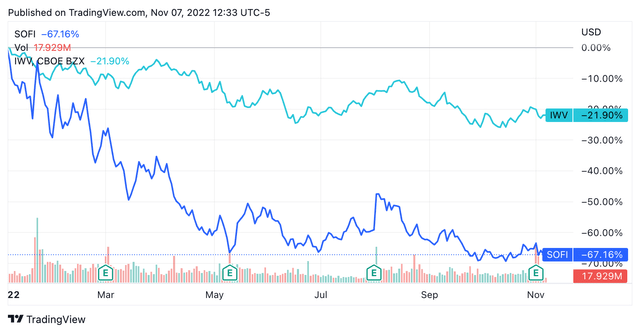

Entropy describes a gradual decline into disorder and is a common enemy of life. For SoFi Technologies (NASDAQ:SOFI) this disorder would be the US in a deep protracted recession with inflation remaining at its elevated level and with the capital markets drying up to levels that would make the Sahara blush. The company just released earnings that brought in a revenue beat with full fiscal year revenue guidance raised. But yet the stock price would react by pulling back sharply to erase a double-digit gain and eventually end below the level it was before the report was released. In this, the market has said that SoFi is worth less than before a retrospective quarterly financial window stated its financials were stronger than the market was initially expecting. Why?

Because of entropy. More clearly, the prospect of material disorder in the months and quarters ahead has rendered the company’s stock price as a serf to the monthly gyrations of economic data and outlooks. Indeed, some of the businesses within the company’s flywheel are already exhibiting serious signs of this disorder. Auto loans are collapsing and Carvana (CVNA), the poster boy for used car retailing, is down 98% from its 52-week high. The housing market looks set to realize a pullback on par with 2008 and Opendoor (OPEN), the golden child of house flipping, is down 92% from its year-ago high. Retail investing has been handed a historic setback, and Robinhood (HOOD) is trading at near distressed levels.

The company’s flywheel is now overlapping layers of businesses at various levels of entropy and the stock price reflects this and will continue to do so regardless of strong results until order is restored. SoFi’s businesses from auto loan refinancing, to banking, investments, and mortgage loans are all at different stages of being discombobulated at a historic scale. The market simply does not have confidence in any pandemic-era company and SoFi’s bulls will have to accept this as the macro backdrop for the foreseeable future.

Revenue Beat With Profitability In View But Pertinent Risks Remain

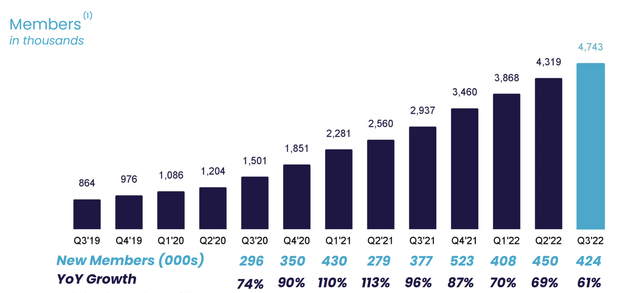

SoFi’s fiscal 2022 third quarter earnings saw revenue come in at $424 million, an increase of around 56% over the year-ago quarter and a beat of $32.22 million on consensus estimates. Growth was driven by an increase in members to 4.7 million with 424,000 new members added during the quarter. This was an increase of 61% over the year-ago quarter with SoFi building on this to sell new products.

The company sold 635,000 new products from across its flywheel to bring its total to 7.2 million, an increase of nearly 70% from the year-ago comp. Strong growth in new members is also a function of strong conventional marketing and the company executed a number of initiatives during the quarter including the signing of Justin Herbert, the Los Angeles Chargers quarterback, for a brand campaign.

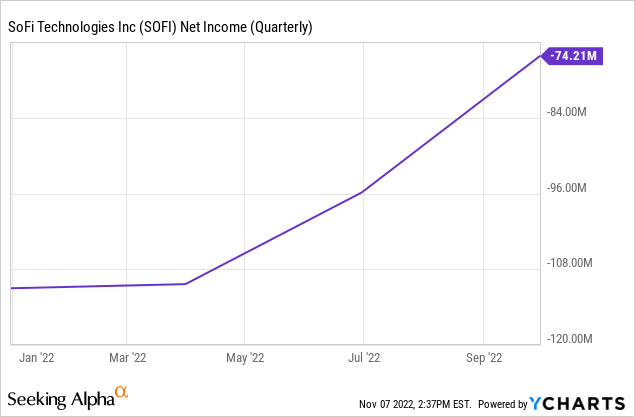

Whilst the company is still not generating positive net income, the trajectory for this is rapidly improving on the back of SoFi Bank. This saw deposits grow to surpass $5 billion, up sequentially by 86% to generate a positive GAAP net income of $28 million at an 11% margin. The company’s Bank forms SoFi 2.0, a future of profitability paired with strong growth. This meant SoFi raised its guidance for its full fiscal year to $1.517 billion to $1.522 billion versus a $1.50 billion consensus. With SoFi’s market cap currently at $4.8 billion, this would place its near-term price-to-revenue multiple at 3.15x.

The Next Few Quarters Could Be Transformational

SoFi’s common shares initially rallied then collapsed quickly on the back of the release of its latest earnings. This was to be expected for a still loss-making entity operating in a risk-off stock market that has decimated the previous stalwarts of growth from the pandemic years. It’s a bloodbath out there and this won’t change because of strong earnings.

There is no indication that the destructive and nearly pertinent risk-off trade will come to an end soon. So prospective longs should heavily consider the valuation at which they intend to buy shares and first consider the passage of time and its impact on the destruction and creation of wealth.

SoFi’s battle with entropy sets the backdrop for the next fiscal year as its lending looks likely to come under siege from the forces of recession and inflation. This would derail its evolution to one of America’s fastest-growing banks. I will use this period as an opportunity to add to my position in full confidence that strong execution so far continues into the coming period of uncertainty. To be clear, I don’t think SoFi will outperform a comparable benchmark like the Russell 3000 until the second half of fiscal 2024 when peak inflation and a hawkish Fed are in the rearview mirror.

Be the first to comment