nemke/E+ via Getty Images

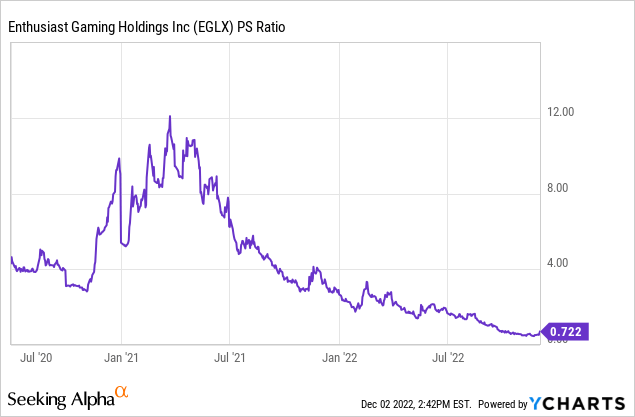

2022 has really been a torrid year for nearly everyone not invested in oil and gas with growth stocks experiencing their worst year since the 2008 financial crisis. Investors only have to look at the plethora of 2021 deSPACs all now trading below NASDAQ’s minimum listing requirement to assess the extent of the total decimation of positive sentiment realized throughout this year. Enthusiast Gaming (NASDAQ:EGLX) is down 70% year-to-date on the back of a material compression of its sales multiple from 12x at its peak in early 2021 to 0.72x as 2023 draws near.

This has left the obvious question; has the collapse gone too far?

Indeed, bulls would be right to flag that Enthusiast Gaming’s sales multiple is essentially at its lowest point since it became public despite the company being significantly larger from both a financial and operational viewpoint. They would also be right to state that the increase in revenue for its last reported fiscal 2022 third quarter came with underlying gross profit margin that was up markedly. Enthusiast Gaming is now expecting to reach sustained profitability from fiscal 2023 and has enhanced its near-term liquidity profile with more debt and the disposal of non-core assets.

Where Next For The Embattled Gaming Media Platform And Its Common Shares?

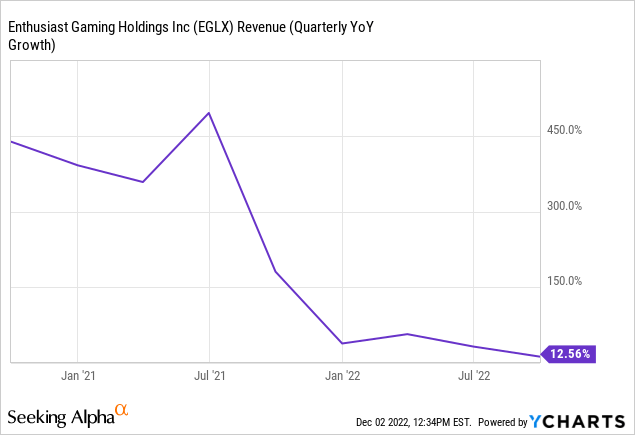

Bears would of course counter that the third quarter saw the company report a still-elevated level of cash burn from operations and that year-over-year revenue growth had slowed. Revenue for the third quarter came in at C$50.6 million, up by 17% over the year-ago quarter and a beat by C$8.74 million on consensus estimates.

In USD terms, revenue growth during the quarter was only 12.56%, the lowest rate since the company went public. Enthusiast Gaming has historically grown quite aggressively through bolt-on acquisitions which have all but ended on the back of a collapsed stock price and a precarious liquidity position. The company has shifted focus to profitability.

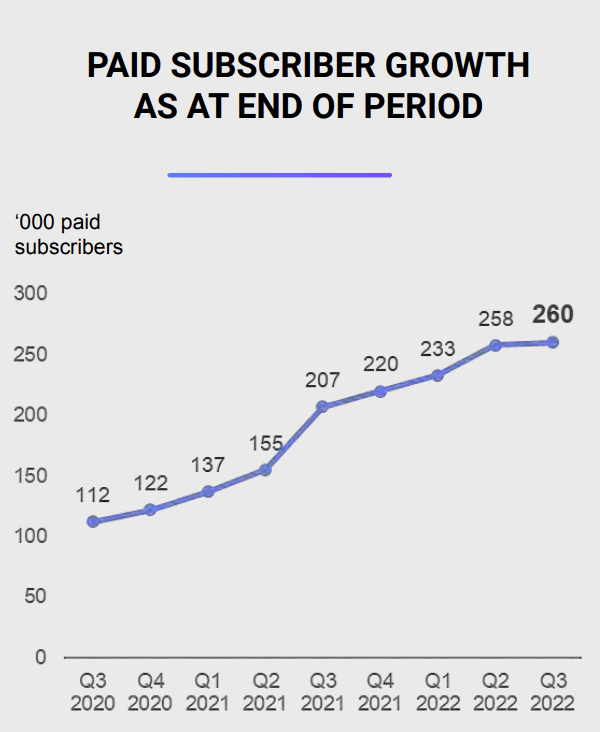

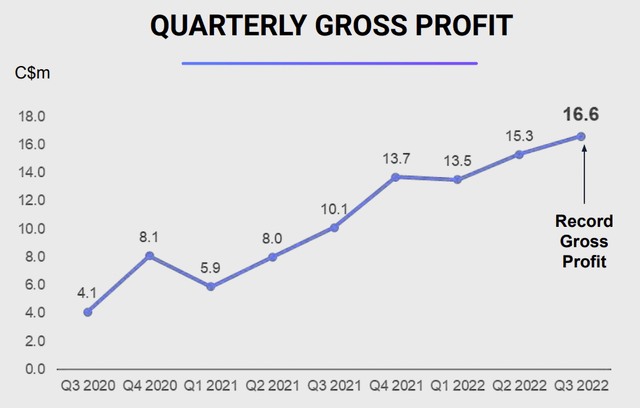

This saw the gross profit margin for the third quarter come in at 32.7%, up by 938 basis points from the year-ago comp. This margin expansion drove a record gross profit of C$16.6 million and was due to several factors. Most notable was from higher margin subscription revenue which grew by 51% year-over-year to reach C$3.8 million as paying subscribers grew to reach 260,000.

Enthusiast Gaming

Bears would also flag the near quarter-over-quarter flatlining of paid subscriber growth. This saw only 2,000 subscribers added, a record low for net adds. Further, the company’s elevated cash burn from operations at C$14.2 million was the highest on record. This was driven by net loss and comprehensive loss for the period that grew to reach C$30.2 million from $12.3 million in the year-ago period.

Will 2023 Maintain 2022’s Sentiment?

A non-cash goodwill impairment of C$31.3 million formed some of this loss with the quarter also seeing the disposal of certain legacy editorial web assets for $6.8 million. This resulted in a gain on the sale of intangible assets of C$4.8 million.

The third quarter was inherently disruptive but also transformative from a profitability perspective with management during the earnings call stating that the business is set to move into profitability from fiscal 2023 and that they’ve raised the liquidity required to reach this point. Indeed, proceeds from the sale of legacy websites were aggregated with a C$10 million expansion credit facility to boost cash and equivalents to C$15.8 million as of the end of the quarter.

Gaming will remain a core part of internet culture. Whilst the broader industry is under stress from the current market risk-off sentiment, the continued long-term growth of gaming should remain the focus. To be clear here, the stock price performance implies a Blockbuster-esque fate for Enthusiast Gaming but this is far from the truth. A company‘s value is primarily determined by how astute it is in generating profits and cash flow and its future prospects. And bulls would be happy to know that the company is seeking to better position itself across all these factors next year with the disposal of non-core assets to focus on driving subscription growth and profitability.

The company has built a media and content platform that connects gamers through communities, content, creators, and experiences. This connection will remain a growth driver even against a recession. However, I don’t think Enthusiast Gaming is currently a buy due to no near-term catalysts. The summer of next year might offer a renewed chance to review the company’s push into profitability over what would have been two quarters, but the risk is that the stock falls further from this point if efforts to gain profitability fail.

Be the first to comment