imaginima

(Note: This article was in the newsletter on November 8, 2022.)

Enterprise Products Partners L.P. (NYSE:EPD) has been touted as a value play. It is also frequently cited as a good place to look for those who are primarily interested in income. Even at the current price, the common units are a good value and they offer a well-covered distribution for income. But there is a lot more to the value and income story than many thought.

A very common comment in my earlier articles was that the only meaningful return for Enterprise Products Partners was the distribution and the tax advantages of that distribution in a taxable account. The idea of growth was a nonstarter with a lot of commenters in my earlier articles. Back in my November 2021, article, no one could imagine that value would outperform the tech crowd (let alone grow in this case).

Latest Quarter

But good management is not to be underestimated. Even good value stocks that are meant for income investors can have growth spurts. Midstream companies like this one often have a delay during the early recovery that allows for more free cash flow until demand for more capacity arises to begin the next capacity expansion cycle (growth).

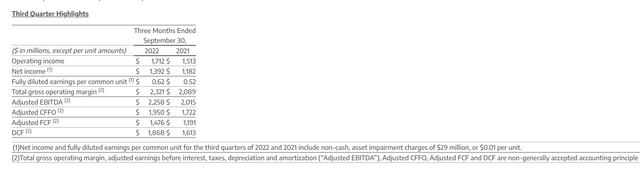

Enterprise Products Partners Summary Of Third Quarter 2022, Financial Results (Enterprise Products Partners Third Quarter 2022, Earnings Press Release)

Management made an acquisition, and activity has been increasing to fill up the idle capacity available. The result was a quarter that, back in November 2021, no one saw coming. Per common unit growth approaching 20% is something investors usually see in a place outside of midstream.

Then again, Enterprise Products Partners management paid cash for the acquisition because they keep a fair amount of cash to reinvest in the business while keeping debt low. That meant no shareholder dilution when the assets were acquired. Investors got the full benefit of the acquisition without increased financial risk as well.

Booming Operations

Every single part of the company reported improved results, as shown below.

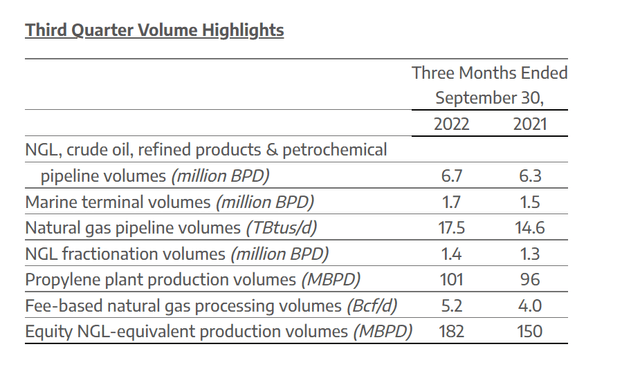

Enterprise Products Partners Summary Of Volumes Handled Third Quarter 2022 (Enterprise Products Partners Earnings Press Release Third Quarter 2022)

Investors generally underestimate the effect of operating leverage when a recovery is underway. Instead, they concentrate on the initially low capital budget to demonstrate that earnings are not going to grow. A potential acquisition was not a consideration. Yet that is exactly what happened.

The acquisition made was not large enough to account for the earnings improvement by itself. The improvement came from the capital projects completed during the downturn that had the capacity to do more business combined with the benefits of the acquisition. Obviously, some established assets also had some spare capacity from the cyclical downturn.

What will provide some downside protection in the next downturn is the capital projects underway as well as the larger ones being considered that will likely happen. Midstream companies like this one typically “catch-up” to demand in the initial stages of an upstream cyclical downturn. That growth has committed buyers of the capacity who will begin to pay under the minimum “take-or-pay” contracts they sign whether or not they are producing product for the new asset. The result is that as long as pipelines have some growth projects underway, the midstream partnerships generally do not follow the upstream company earnings down (you would not know it from the stock or unit price). But that action also hides the upside potential in the coming recovery.

This leaves investors thinking that there will not be growth until there is an increase in capital projects. The potential improvements from more partnership capacity used is nearly always underestimated as a result. Hence the comments in my November 2021 article and succeeding articles about no growth in the future because the capital budget was too small for meaningful growth.

Finances

The debt ratio is still at a conservative 3.4. This provides the ability of management to make more acquisitions using solely debt. In fact, management can finance a construction pipeline or two using all debt and the ratio would likely remain conservative.

Management repurchased 3.9 million of the common units in the quarter and 5.3 million common units in the nine months of the current fiscal year. With 2 billion shares outstanding, it would take a repurchase of 20 million units to reduce shares outstanding by roughly 1%. Still, the shares repurchased are enough to push the distribution up a little bit during lean times without increasing the cash needed for the distribution.

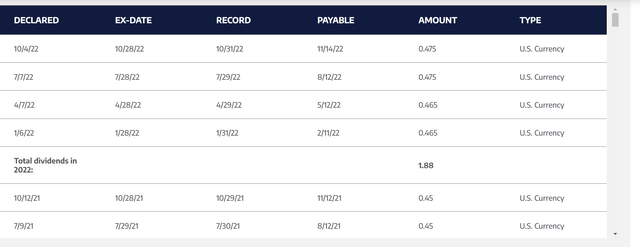

Enterprise Products Partners History Of Distributions (Enterprise Products Partners Website November 15, 2022)

Distributions are running about 5% ahead of the previous year (same quarter). That was actually an acceleration of the distribution increase pace and it does indicate a more optimistic view of the future.

Investors need to realize that management maintains a fair amount of cash flow waiting for the expansion projects to begin. Discussions about needing more capacity are likely ramping up when you see a quarter like the past one.

Future distribution increases are likely to be balanced against the need for cash for expansion projects to keep debt levels at desirable levels. In the meantime, unit purchases are likely to continue with the cash flow part that is earmarked for future capital projects once the need arises.

Here We Go Again

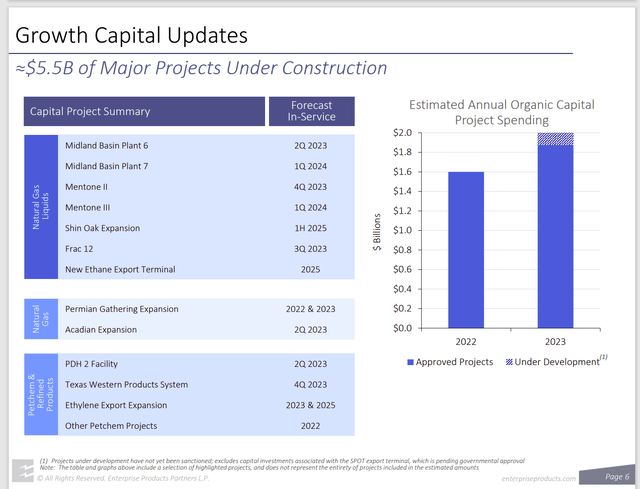

The last time I showed this slide, the comments overwhelmingly sided with the no-growth view. Of course, commodity prices are a lot higher now and there is talk of production increases after a year of balance sheet repairs.

But maybe it’s time for individual investors to realize that this management will grow the company over time one way or another. What is shown is what is “solid.” But management can always improve the current picture on an optimistic basis from time to time.

Enterprise Products Partners Capital Projects In Process (Enterprise Products Partners Third Quarter 2022, Earnings Conference Call Slides)

Individual investors have a lot of advantages over the market in that they can put their faith in good management knowing that the management is likely to treat them well.

So, the budget shown above all by itself represents a very minimal level of growth. In fact, many of the projects could be potentially classified as debottlenecking projects. Those are small projects with high rates of return and quick paybacks.

But if Enterprise Products Partners management stays “true to form,” there will be more growth in the future. If it does not come from an increasing number of capital projects, then there will likely be another opportunistic acquisition with some of the spare cash flow. In the meantime, the latest acquisition should provide an earnings boost for at least 4 quarters.

The Future

This financially strong midstream company with a very well covered dividend is one of the safer income investments available. Midstream companies are known for their steady earnings without the upstream risk. For that reason, they are considered the utilities of the oil and gas industry.

Enterprise Products Partners should continue to provide a growing (well covered) distribution along with enough growth (and sometimes unit purchases and retirements) to provide at least a low double-digit percentage return.

Management can be expected to keep this company as a growth and income play even if much of the growth happens when the upstream business needs more capacity. The rest of the growth will come from an opportunistic acquisition when investors least expect it. It should average out to a combined return from the distribution and the average growth rate in the teens. That is not bad for a midstream company where the risks are lower than upstream.

The market, of course, does not believe that until it actually sees capital projects or acquisitions. But Enterprise Products Partners management has a very long record of decent returns while running the company conservatively. That is likely to continue well into the future.

Be the first to comment