CHUNYIP WONG/E+ via Getty Images

It’s astonishing how quickly the tide can change, and the anti-fossil fuel rhetoric disappears. During the 2020 presidential debates, Joe Biden stated that there was no place for fossil fuels in his administration. More recently, the Federal Energy Regulatory Commission (FERC) made its first policy update since 1999 as they voted to place a greater emphasis on new pipelines as they would consider how proposed gas projects could affect climate change and whether such projects are even in the public interest; any project expected to emit 100K metric tons/year of CO2 equivalent emissions “will be deemed to have a significant impact on climate change.” Unfortunately, it took a war in Ukraine for the free world leaders to realize how dependent society is on fossil fuel.

Suddenly, fossil fuels are important again, President Biden meets with world leaders, and the White House releases a statement announcing the creation of a task force to reduce Europe’s dependence on Russian fossil fuels. The U.S just went from an administration that wanted to abolish fossil fuels to working with international partners and striving to ensure additional LNG volumes for the EU market of at least 15bcm in 2022. It gets even better; the statement indicated that EU member states will ensure demand for approximately 50bcm/y of additional US LNG until 2030. Then, suddenly, FERC came out with a statement that they will delay requirements to consider greenhouse gas emissions before approving liquefied natural gas terminals and other gas projects. The vote they took miraculously isn’t real and is classified as a draft that won’t apply to pending projects until FERC issues any final guidance.

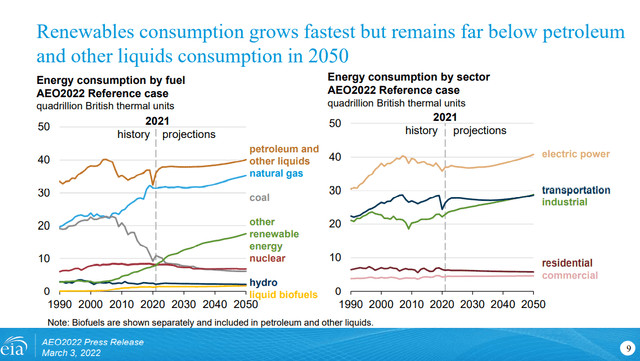

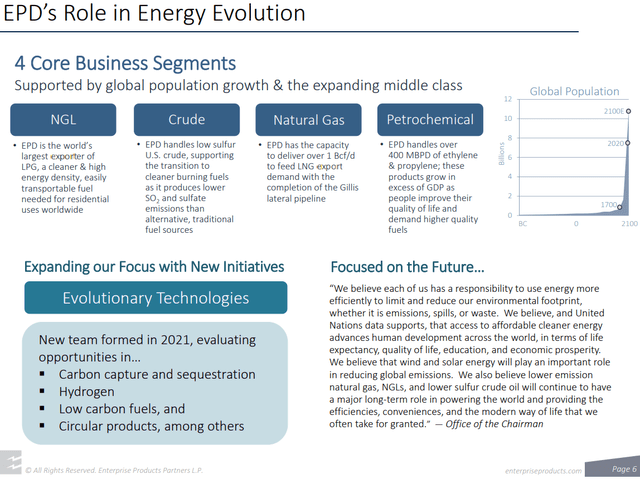

Many of the companies I have written about will benefit from the changing stance on fossil fuels, but some of the industry’s unsung heroes may finally have their day. Enterprise Products Partners (NYSE:EPD) is one of the most well-run midstream operations with critical infrastructure that is a necessity to our way of life. EPD stands to benefit greatly from the changing stance on fossil fuels. My only wish is that this didn’t occur because of a war in Ukraine that has left tens of thousands dead and countless civilians seeking food, water, and shelter. I have been citing the EIA reports for years, and prior to this grand revolution, the EIA has stated that the global energy demand will continue to increase through 2050, and petroleum and natural gas will be the two largest consumed fuels. The only way to supply our allies in Europe with the energy that has been displaced from Russian sanctions is to drill, and the only way to deliver it is to transport. EPD and other midstream operators are about to see capacity demand throughout their systems as the liquified natural gas (LNG) boom is about to get started.

Why Enterprise Products Partners will benefit from increased exploration and production activity and it’s not from LNG

Due to the White House statement, LNG export facility companies exploded to the upside during trading today. Tellurian (TELL) jumped 20.41%, NextDecade Corporation (NEXT) increased 32.33%, and even larger companies such as Cheniere Energy (LNG) jumped by 5.46% on the day. Companies in the exporting sector certainly caught a bid as investors piled in to capitalize on the future momentum. The one side of the trade that was left in the cold was midstream operators, and many will play one of the most integral roles throughout the process. There have been many great articles about EPD on Seeking Alpha, and I have certainly written my fair share. This is going to be a different type of EPD article as I am going to outline how EPD is going to benefit throughout the natural gas value chain.

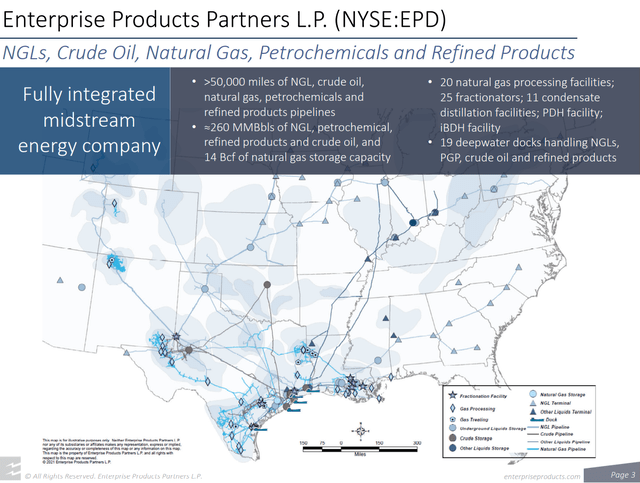

EPD has 50,000 miles of pipeline, large amounts of storage, processing & fractionation facilities, and significant exporting capabilities. Today was all about LNG because LNG takes up about 1/600th the volume of natural gas in the gaseous state as its been cooled down to liquid form for ease and safety of non-pressurized storage or transport. Importing LNG is nothing new as the world’s first LNG ship carried LNG from Louisiana to the United Kingdom in 1959. Five years later, the United Kingdom began importing Algerian LNG, making the Algerian state-owned oil and gas company Sonatrach’s the first major LNG exporter. Japan first imported LNG from Alaska in 1969 and moved to the forefront of the international LNG trade in the 1970s and 1980s with a heavy expansion of LNG imports. Prior to these announcements, on March 3rd, the EIA projected in their latest energy outlook that natural gas and petroleum would still be the 2 largest consumed fuels through 2050.

Now that the Biden Administration has come around and other federal agencies such as FERC are changing their stance, I think fossil fuels will be less demonized as they become a much-needed necessity of our closest allies.

Alright, so how does this benefit EPD exactly?

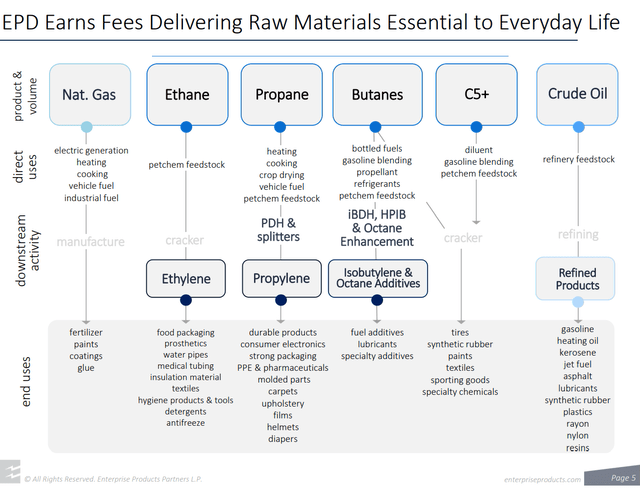

In its raw form, natural gas produced at the wellhead contains varying amounts of natural gas liquids (NGLS) such as ethane and propane. Natural gas streams containing NGLs and other impurities are usually not acceptable for transportation in downstream natural gas transmission pipelines or for commercial use as fuel. This creates an abundance of unprocessed natural gas, which must be transported to a natural gas processing facility to remove the NGLs and other impurities. Once the unprocessed natural gas is processed and the NGLs and impurities are removed, the residue natural gas meets downstream natural gas pipeline and commercial quality specifications.

Interestingly enough, EPDs NGL Pipelines & Service business segment includes 19 natural gas processing facilities and related NGL marketing activities. EPD has 19,079 miles of NGL pipelines, 177 MMBbls of NGL storage, 18 fractionators that can process 1,538 MBPD, and 2 export/import terminals. On the natural gas side of the house, EPD has 19,079 miles of pipeline and 14.2 Bcf of storage.

Initially, EPD will benefit from its dedicated natural has pipelines as exploration and production ramps up to meet the growing demand for natural gas. For natural gas to reach the liquefication centers so it can be transformed into LNG, it needs to be transported, and pipelines are the most efficient and safest means of transportation. EPD is going to benefit from a growing demand for its natural gas transportation capacity across its system. The key, though, is in the NGL sector for EPD, as this is what will set them apart from other midstream operators. Keep in mind that EPD earns fees across its entire value chain, and while there are many pipeline companies, there are few with EPDs NGL capabilities.

The natural gas streams containing NGLs and other impurities is useless to the LNG process until it’s been treated and processed. This becomes a profit center for EPD as the contaminated natural gas runs through EPD’s facilities then gets transported to its final destination points, leaving behind the NGLs. This becomes a critical component for EPD as NGLs have greater economic value as a feedstock for petrochemical and motor gasoline production than as components of a natural gas stream. The primary use cases for NGLS becomes:

-

Ethane is primarily used in the petrochemical industry as a feedstock in ethylene production. Ethylene is one of the basic building blocks for many plastics and other chemical products.

-

Propane is used for heating, as an engine and industrial fuel, and as a petrochemical feedstock in ethylene and propylene production.

-

Normal butane is used as a petrochemical feedstock in the production of ethylene and butadiene (a key ingredient of synthetic rubber), as a blendstock for motor gasoline, and to produce isobutane through isomerization.

-

Isobutane is fractionated from mixed butane (a mixed stream of normal butane and isobutane) or produced from normal butane through the process of isomerization and is used in refinery alkylation to enhance the octane content of motor gasoline, in the production of isooctane and other octane additives, and in the production of propylene oxide.

-

Natural gasoline, a mixture of pentanes and heavier hydrocarbons, is primarily used as a blendstock for motor gasoline, diluent in crude oil to aid in transportation, and as a petrochemical feedstock.

Here is where this becomes greatly beneficial. EPDs natural gas processing utilizes service contracts that are either fee-based, commodity-based, or a combination of the two. The commodity-based contracts include keeping whole, margin-band, percent-of-liquids, percent-of-proceeds, and contracts featuring a combination of commodity and fee-based terms. This means that EPD will retain all or a portion of the extracted NGLs as consideration for their processing services. EPDs marketing activities for NGLs allow them to not only sell Ethane, Propane, Butane, and Isobutane on the open market they also control 33% of U.S NGL exports. EPD will get paid twice on the same product as they will accumulate these NGLs as part of their processing contracts, then be contracted to export them globally.

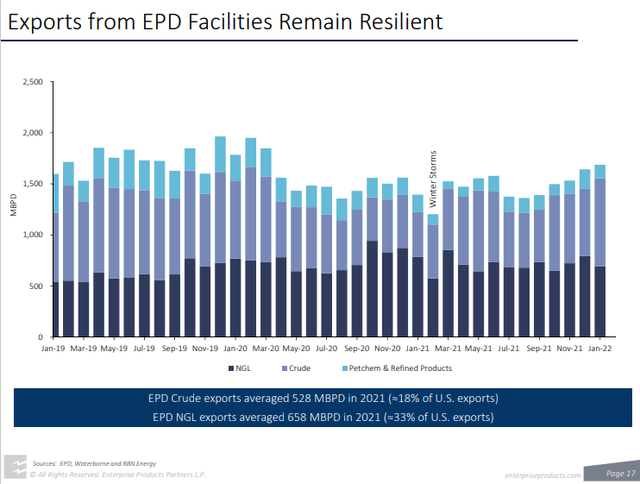

EPD is a primary exporter of NGLs and crude as 18% of U.S crude and 33% of U.S NGL exports flow through their exporting facilities. EPD owns and operates marine terminals located on the Houston Ship Channel and has 19 deepwater docks that handle crude, NGLs, PGP, and refined products. As U.S-based exploration and production companies drill more aggressively to meet the current and future energy demand, EPD will benefit from more capacity being contracted throughout its system and amassing a large stockpile of NGLs from their processing services will be sold and generate additional profits.

Enterprise Products Partners has been a champion of capital allocation and the next several years should be very exciting for investors

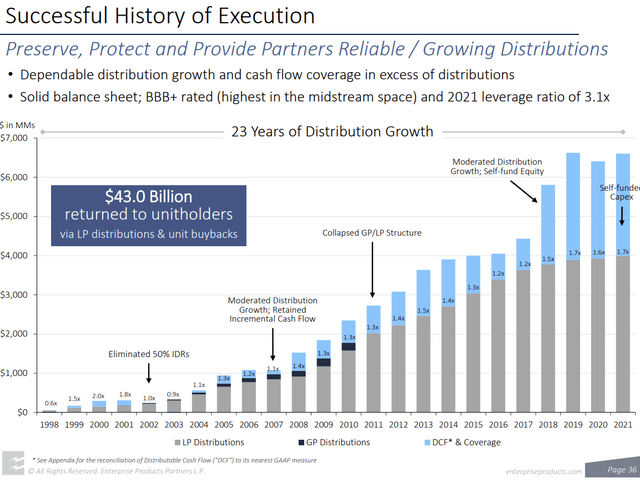

Energy companies are known for their return of capital as many investors look to companies in the oil patch for places to generate streams of income through dividends and distributions. EPD is one of the pinnacles for capital being returned to unitholders through their longstanding distributions and more recent buybacks. Investors have enjoyed 23 consecutive years of distributions from EPD with a 7% CAGR. Since 1998 EPD has returned $43 billion to its unitholders. Today EPD pays a distribution of $1.86, which is a forward yield of 7.37%. Throughout every crisis over the past two decades, EPD has consistently provided distribution increases that could be counted on. In 2021 EPD generated over $6 billion in distributable cash flow, created a 1.7x coverage ratio, and self-funded all its Capex.

EPD has been ramping up its buybacks, and at the end of 2021, they utilized 24% of its outstanding $2 billion buyback program, which was authorized in 2019. There aren’t many opportunities where a company has a 7.37% yield backed by 23 consecutive distribution increases. EPD has been adamant about returning capital to its shareholders, and I think the distribution increases could become larger in the future. EPD has one of the strongest distribution plans in the oil patch and arguably throughout the market. They are operating in a space that should become more lucrative and, if the narrative changes enough, could become a standout in the investment community.

Conclusion

EPD has an intricate energy infrastructure system that would be next to impossible to replicate in 2022. The fossil fuel industry has been under pressure for years, but due to the most unfortunate circumstances, many are realizing that the sector in its entirety is too important to society. Midstream operators haven’t recovered from the oil crash of 2014/15, and EPD hasn’t fully recovered from the pandemic crash. The recent narrative change will be great for the midstream sector as the demand for capacity to transport natural gas will increase over the years. I think EPD will be one of the largest beneficiaries in the sector due to its NGL contract structure. As the LNG boom moves into full swing, they will initially benefit from increased natural gas transportation and processing demand. The key for EPD is the stockpile of NGLs they will amass due to the influx of natural gas running through their system. I think this will drive revenue and distributable cash flow to new heights in the coming years. I think EPD is an undervalued company, and investors get to feast on a 7.37% yield while they wait for future appreciation. I believe EPD is a great income-generating investment as they have provided 23 years of consecutive distribution increases and can become a good capital appreciation investment as the energy sector witnessed a transformation in the overall narrative of fossil fuels.

Be the first to comment