Sky_Blue/iStock via Getty Images

Excelerate Energy (NYSE:EE) is a liquified natural gas service provider with the world’s largest fleet of floating storage regasification units (FSRUs). And now it’s looking to expand into downstream gas sales. The company went public earlier this year in an IPO amidst a hot market for anything LNG-related following Russia’s invasion of Ukraine and the subsequent natural gas shortage.

Despite its recent IPO, Excelerate has gotten relatively little attention and its upcoming projects remain underappreciated by the market. As a result, I see two important catalysts in the coming quarter that will unlock significant upside.

Earnings, Briefly

For the second quarter, its first since its IPO, Excelerate reported a net loss of $4 million, or $0.08 per share (of the $2 million attributable to shareholders, but we’ll get into that later). This loss came largely as the effect of a $21.8 million expense from the extinguishment of a lease liability as a part of the IPO, which was a one-time charge; adjusted net income was $21.4 million.

In the first quarter, Excelerate reported net income of $12.8 million and adjusted net income of $15.6 million. The company’s revenue was also up from $591.7 million in the first quarter to $622.9 million in the second.

In sum, Excelerate’s earnings improved quarter over quarter since going public, but due to an IPO-related expense, net income fell.

No Longer An FSRU Play; Excelerate is a Brazilian Gas Company This Quarter

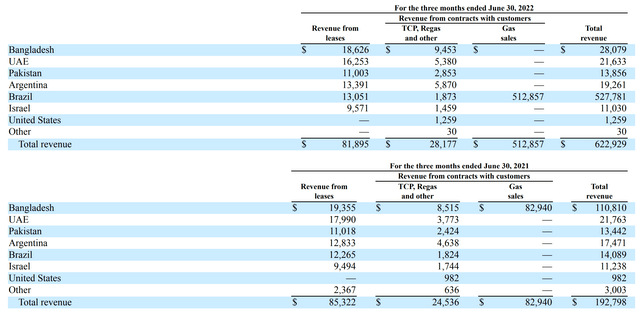

If you have looked at Excelerate’s revenue over the past year, you might have noticed it pop just a wee bit:

Excelerate Energy Second Quarter 10-K

Despite accounting for over 80% of the company’s revenue for the quarter, and over half a billion dollars, the new gas sales from the company’s Bahia terminal account to Petrobras (PBR) for only around $10 million in EBITDA (even less in net income).

In comparison to the second quarter of last year, this year’s second quarter adjusted EBITDA was up $10 million, an increase of about 15%. The year-over-year increase was driven primarily by gas sales in Brazil, which commenced in December of 2021.

This is a mere 15% of the company’s adjusted EBITDA for the second quarter, displaying how this business model provides much lower margins than the company’s other leasing and regasification activities. The income from Brazil is a fixed margin for Excelerate, which should mean the project has consistent returns for the near future:

[Excelerate Energy negotiated] a fixed margin rate on our gas sales contract in Brazil.

So even though the revenue will be somewhat lumpy and somewhat volatile, depending on how prices move, our margin rates and our EBITDA will be relatively constant on a rate basis.

Seeing as the direct cost of gas sales (which for this quarter, only includes Brazil) was $485.0 million, and the value of the lease and regasification services are assessed separately, we can roughly gauge what that margin is. After costs, Excelerate brought in $27,857,000 from its Brazilian gas sales. This is roughly a gross margin of 5.4%.

Though this isn’t the most impressive margin, it is respectable in this context and with $27.86 million in gross profits, it is clear that Excelerate’s Brazilian gas sales are an important part of the company’s current business. And this is corroborated by the company’s 10-K:

Gross Margin and Adjusted Gross Margin were higher primarily due to increased direct margin earned on gas sales in Brazil during the three months ended June 30, 2022 ($27.8 million), which exceeded direct margin earned on LNG sales that occurred in Bangladesh during the three months ended June 30, 2021 ($4.9 million). These increases were partially offset by increases in cost of revenue and vessel operating expenses($10.3 million), primarily due to the commencement of the Bahia terminal lease in the fourth quarter of 2021.

With a gross margin of $54.9 million and an adjusted gross margin of $79.2 million per the company’s 10-K, and $27.8 million from Brazil alone, it’s clear that the company is currently heavily invested in this Brazil project for its top and bottom line. At least through 2023 when the lease ends.

But That is About to Change: Two Important Upcoming Catalysts

This Brazil segment is part of a larger shift in the company’s strategy to enter the downstream market and sell LNG to customers rather than simply provide the service of a chartered FSRU:

By going downstream after we open a new LNG market, we expect to capture a larger percentage of the economics along the value chain, whether it’s through our E-FIT flexible terminal offering or actually selling molecules downstream of our terminals via onshore pipelines. We have created a business model capable of significantly enhancing our growth

And Excelerate is targeting its next downstream expansion in Albania (our second major catalyst. But first, let’s talk about Finland.

Number One: Finland

One of the nearest term and most important catalysts for Excelerate is the commencement of a time charter and regasification agreement with the Finnish government. Excelerate is helping to provide up to 5 billion cubic feet per year in regasified LNG and the company’s FSRU Exemplar is expected to reposition to Finland as soon as it ends its current assignment so that this LNG import facility can begin importing in the fourth quarter.

Now, we know that this new project is expected to begin in the fourth quarter of this year and we know that a contract was signed for a ten-year duration but we don’t know the contract’s value. Even Seeking Alpha, among other coverage of the deal, acknowledged that Excelerate didn’t disclose the value. Though, Seeking Alpha did provide the following (albeit without a linked citation):

Gasgrid Finland said the total cost of the floating LNG terminal with the 10-year lease is estimated at as much as €460M ($487M).

However thanks to Finnish public procurement law, we can find out exactly how much Excelerate’s new contract is worth!

Searching the EU’s centralized database, I found two contracts pertaining to the Finnish LNG import terminal. The first contract relates to the planning and construction of the terminal itself, specifically:

Products and Services related to Charter of the FSRU Vessel and Establishment of a Floating LNG Terminal. The products include loading arms, gas pipes, fender systems, steel valves, elbows and pipeline components, gangway tower and access ladder. The services include procurement planning and advisory, technical and engineering planning and design, project leadership, permit applications, loading arm modifications, marine analysis, port and fairway planning, vessel planning and testing.

Admittedly, not all of this is coming from Excelerate. Excelerate is contracted for a “Marine loading arm with equipment” worth…

Total value of the contract/lot: 4 100 900.00 EUR

Given that the Euro is currently at parity with the US Dollar, this contract is worth face value in US currency (future fluctuations notwithstanding).

But this isn’t the exciting contract that we really care about. That was just to pay for some of Excelerate’s setting up and equipment costs. The real contract is for the “Charter of the FSRU Vessel Including Regasification Agreement.” And that contract is worth…

Total value of the contract/lot: 480 000 000.00 EUR

With a 10-year duration, this contract is worth around $48 million per year (assuming even dispersion). Assuming 100% utilization, this is a time charter rate of $131,506 per day. Not bad at all – though the contract also covers regasification.

This rate is a premium compared to some of Excelerate’s existing projects, based on the company’s quarterly revenue. At $48 million a year, the Finnish terminal is worth around $12 million per quarter.

Compare that to Excelerate’s two projects in the UAE that bring in a combined $21.63 million per quarter, or roughly $10.82 million per terminal. Comparatively, this new Finnish contract is at an 11% better rate (and with a 10-year duration). Some other FSRUs are bringing in more or less, but the overall point is that Excelerate has a new, reliable customer paying a solid rate on a long-term charter that is kicking in at the end of the year.

Number Two: Albania

The second major project is Albania’s Vlora LNG Terminal. Excelerate has pointed to being able to relocate its FSRU Excelsior from Israel to Vlora by the end of 2022 and could begin regasification at the terminal by the end of summer 2023. This puts the project less than a year away and we may see income from the lease coming in

We know this project is potentially imminent but what are its earnings? Excelerate is providing 5 bcm per year in regasification capacity in Vlora and supporting the conversation of a nearby power plant. Excelerate along with Snam S.p.A. (OTCPK:SNMRY) and Albgaz have also signed an MOU to connect Vlora via a new pipeline to the rest of Albania’s grid and the Southern Gas Corridor.

The exact terms are unclear. And that is because they aren’t settled yet (though the emergency power plant solution is reportedly advancing separately). The company is “advancing the project in several fronts in parallel, engineering, permitting and negotiations.” But we did see a memorandum of understanding (MOU) with Overgas (Bulgaria’s largest private gas distributor) for them to buy 1 bcm of gas annually from Excelerate via this terminal for the next ten years. This is roughly one-third of Bulgaria’s annual gas consumption.

As for the rest of the gas, it seems to be open for the European market, perhaps with 1 bcm for Albania:

In terms of gas, that’s a very good question. Our goal is to have an interconnector that will allow us to deliver up to 5 bcm per year to Europe. The capacity of the FSRU is roughly the same. But just to give you a better proportion, we expect about 1 bcm to be dedicated to the Albanian market and 4 bcm on some of the peaking capacity to be dedicated to the European market.

Seeing as the European market for natural gas has gone parabolic over the past year, this would be an exorbitant amount of revenue for Excelerate.

Based on my calculations at today’s sky-high prices, 5 bcm (roughly 52,335,000 MWh) of natural gas would be worth around $17.8 billion in revenue. Admittedly this isn’t all profit for Excelerate (gas isn’t exactly cheap to source), but it would be a massive increase from the company’s current revenue of ~$2.5 billion per year.

Now, the terms are still being negotiated so the exact deal is uncertain, but if Excelerate gets anything like the same margin it gets in Brazil (5.4%), the gross margin from this Albanian project could be worth almost $958 million.

It is also possible that other companies may come in and provide LNG via Excelerate’s terminal. Exxon Mobil (XOM) is a partner in the original emergency power plan for Albania and despite having promised to invest, does not appear to be related to the more recent dealings surrounding the terminal. However, this could change and if Exxon Mobil becomes involved, possibly through a JV, the terms, and Excelerate’s portion of the revenue and earnings involved could further shift.

Overall, the Albanian project looks extremely promising and has the potential to be a significant catalyst for the company. While the Finnish project is an earnings catalyst in the fourth quarter and beyond, the Albanian project could unlock a major increase in share price from a final deal alone given its scale. With the potential to move the FSRU Excelsior by December, the pressure to finish a deal and lock in this vessel is high (it would be great for Excelerate’s shareholders, and the Southern European countries involved need to show their constituents they are taking action ahead of the winter when the LNG conversation will grow stronger, even if this terminal will not be finished until next fall).

As a result, I expect a final investment decision and terms of the deal to come out within the next quarter (or December at the latest). And a clear, definitive deal of this scale would be a massive boon to Excelerate’s shares.

Additional Tailwinds

There are several other projects (20 per the company’s 10-K) that Excelerate is currently looking at in very early stages as prospective future developments.

Vietnam is one of these. Excelerate currently has a Vietnam office and is in negotiations to provide its services there. The only somewhat-unique insight I can offer here is to point to is from a recent meeting of Japan and Vietnam’s Ministers of the Economy:

…the early signing of a memorandum of understanding on cooperation in energy transformation to implement projects to support Vietnam in energy transition with funding from the Asia Energy Transition Fund.

Japan will also support training and share experience related to liquefied natural gas (LNG) with Vietnam…

This is a sign of Vietnam’s interest in LNG if nothing else, but a very timely update from this past week.

In the near term, Excelerate is also in the process of negotiations to expand its Maheshkhali LNG terminal, possibly by 60% just by swapping the vessel. This is a swap that could occur by the second half of 2023, becoming accretive to earnings.

These negotiations come alongside discussions of a new Payra LNG facility that would allow Excelerate to enter the downstream market in Bangladesh as well. Likely a smart move, given the country’s fast-growing energy demand.

Finally, the overall market for FSRUs is very strong right now, putting Excelerate in a sublime position to recharter its vessels:

Charter rates for FSRUs have increased by at least 50 per cent to between $150,000 and $180,000 a day since the outbreak of the Ukraine war, according to industry sources.

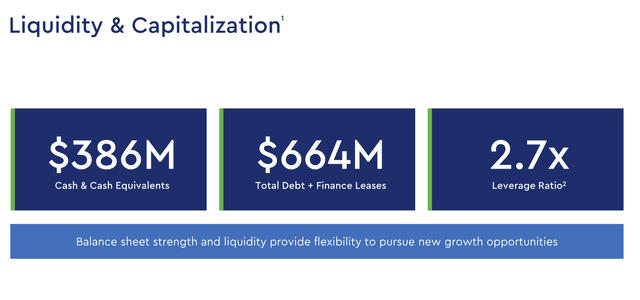

Balance Sheet

Following its IPO earlier this year, Excelerate now has a sizable cash balance. The company has $386 million in cash with $664 million in total debt and lease liabilities.

Excelerate Energy Q2 Presentation

This leaves us with a relatively small net debt of $278 million. The company also has a yet-undrawn $350 million revolver at a low interest rate of SOFR plus 0.10% (though with the Fed hikes as they are, it may not be cheap credit for long).

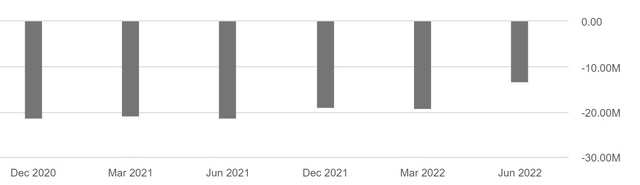

As for the company’s current interest expense, it has been declining since June 2021, largely thanks to debt repayment related to its IPO.

Excelerate Energy Quarterly Interest Expense (Seeking Alpha)

With new CapEx costs expected, an estimated $1 billion for several upcoming projects, Excelerate’s debt load will almost certainly rise. But for now, the company is in sound-enough financial shape to pursue its expansion with over $700 million in liquidity on hand between cash and its revolver.

An Overview of Risks to the Company

LNG Market Risk

There is a risk with the large fluctuations in the LNG market for Excelerate though it is much smaller than might be imagined. The company claims to be “price agnostic” and though it is looking to supply natural gas and directly sell it, the company seems to be structuring its contracts to pay a consistent margin on top of its cost of acquiring and delivering the LNG.

Fleet-Related Risks

Though, when employed as FSRUs as designed, there is not a spot market to point to like there is for other LNG vessels, it is still important to pay attention to newbuildings. So far, there have been relatively few in the past decade until Excelerate’s announcement that it has a letter of intent for a 2026-delivered FSRU from Hyundai Heavy Industries. Hoegh LNG has also indicated it may soon consider ordering new vessels as demand heats up. So far, only good news for Excelerate, but something to be aware of.

The age of Excelerate’s fleet is also worth considering as some vessels near 20 years old. However, with its vessels already being contracted through the 2030s (soon to be 2038 in Bangladesh it seems), they look to have a good amount of life ahead of them.

Organization-Related Risks

One of the main “risks” related to Excelerate Energy is that the common stockholders have no voting power. When the IPO occurred, the company was split into Class A and B shares. Class A is the publicly-traded stock and Class B belongs to George Kaiser, who has “75.8% of the combined voting power of [Excelerate’s] common stock” via EE Holdings.

The good news is that only Class A shares receive dividends (don’t worry Kaiser owns a lot of this too), so the non-trading B shares won’t ruin your income dreams if Excelerate ever moves past $0.10 per year.

However, there are also a gazillion complicated related party deals and transactions with Kaiser that I haven’t the time to go into here that play into the company’s operations. For more info, read here and then look at the most recent report on how some of this is being cleaned up. The most important bit is that publicly traded shares are fundamentally minority shareholders in the company until Class Bs are converted (which presents other problems with dilution potentially).

The members of EE Holdings initially […] hold a majority of the economic interest in […] EELP as non-controlling interest holders, through indirect ownership of Class B interests of EELP […] Class A common stock […] entitled only to a minority economic position in EELP […] As Class B interests of EELP are exchanged for our Class A common stock over time (or, at our election, for cash), the percentage of the economic interest in EELP’s operations to which Excelerate and the public stockholders are entitled will increase relative to the members of EE Holdings.

In sum: the “non-controlling interest” on the income sheet is George Kaiser’s Class B shares and he controls all the voting power.

Brazilian Business Risks

As mentioned on the conference call, Brazil is interested in natural gas from LNG because Bolivia’s natural gas reserves are running out. As a result, it is unlikely Bolivia returns to meet Brazil’s energy needs, though other suppliers may materialize. Specifically, Venezuela could potentially substitute for Bolivia. With a friendlier government in Colombia, Venezuela is now considering reviving natural gas exports between the nations. With Lula expected to win the presidency in Brazil this October, we may see a similar deal take place. However, the logistics are hard, with the majority of Brazil’s population in the south across the Amazon and no real infrastructure in place. Such a trade would still require LNG (and thus Excelerate’s service) and would also be impossible due to Venezuela’s lack of liquefaction capabilities.

Additionally, for the Brazil business, the lease on the Bahia terminal is scheduled to run through 2023 and any further extension is far from certain and subject to Petrobras’ approval. If Petrobras can get another FSRU, like the one it leases from Golar LNG (GLNG), it may take back over the Bahia terminal. On the other hand, it would free up an FSRU for Excelerate to shop around in what is likely to be a still-hot market.

Valuation

Excelerate Energy is somewhat expensive if you look at only its current forward GAAP price-to-earnings ratio, which is 39.27 (or nearly 5 times the industry average). This ratio also roughly lines up with the company’s estimates for “income before income taxes” in the range of $58-93 million for 2022.

However, 2023 promises to be a much more promising year for the company. Excelerate had just under $27 million in expenses related to its transition/IPO in the first and second quarters alone – costs that won’t be present in 2023. Additionally, with the new Finnish project online this December, and the Albanian terminal likely running in the third quarter of next year, Excelerate will have several improved earnings streams.

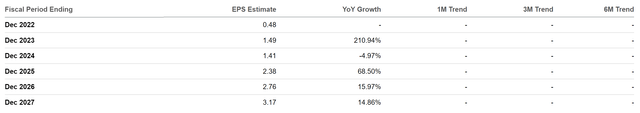

Looking at earnings revisions for 2023, we can see analysts expect a significant improvement, but then a drop-off in 2024:

These are the first estimates for the company (published by SA on August 15), and I think analysts are underestimating the effect of the catalysts mentioned above in this article. And there is good reason, there is not a definitive contract signed, making it harder to model.

Looking at the breakdown of the company’s estimates, we see the range between $1.15 and $2.40 in earnings, between 4 analysts.

And the estimates after 2023 are largely inaccurate as well, and very inconsistent, pointing to the seeming limited understanding of when/which projects will actually come online

If we assume the Albanian project does come online in Q3 (as I have argued it will), we should see only a further increase in 2024 as sales occur over the entire fiscal year. Especially since many of Excelerate’s vessels are already locked in for the next year anyways.

And with the 2023 EPS consensus in mind, we get a price-to-earnings ratio of 17.85 which seems to be a fair valuation for a company with so many impending growth projects on such a large scale. Especially since I think this estimate will get further revised up over the coming months anyways, potentially towards the higher end of $2.40 which puts Excelerate’s PE ratio just over 11.

Takeaway

Excelerate Energy is an interesting play for the current energy crisis the world finds itself in. While a lot of attention is paid to natural gas producers and exporters, less is paid to the companies facilitating regasification and LNG import.

However, as Excelerate’s ongoing projects demonstrate, this is no less important. Excelerate’s incoming projects are not well-communicated to the public (effectively nobody, including the company itself, is publishing the value of the Finnish deal).

For investors, this presents opportunity. The commencement of regasification at the Finnish terminal in Q4 is one of two catalysts that could spur interest and value in the stock as its accretive value to earnings is realised.

Second, with the cold winter months coming and the vessel earmarked for Albania coming off of hire (also in December), I expect a final deal signed in the next quarter. This, in turn, should spur re-evaluations of the company’s earnings for 2023 and beyond.

There are several other catalysts from Bangladesh to Vietnam to Pakistan that lurk just behind and promise further potential. Finally, normalization from the IPO costs all but guarantees a stronger 2023.

Overall, Excelerate is an underappreciated player in the hot LNG space. Even though the company went public in a hot market, its valuation still doesn’t account for everything “coming down the pipe” and new catalysts are poised to unlock significant upside.

Be the first to comment