sarkophoto

I recently received a message from a Seeking Alpha member asking several questions on Enterprise Products Partners (NYSE:EPD). He was asking if there was anything the market was missing and the back-up the truck price for units of EPD. This article will try to answer those questions along with providing a brief recap of Q2 earnings.

Investment Thesis

EPD is still the cream of the crop when it comes to the midstream MLP sector. The company is conservatively run by management (who also happen to own about 1/3 of the outstanding units) and is set to grow despite a reputation for being in a low growth sector. The company looks like it will ramp up unit buybacks in the next couple quarters, and management hiked the distribution for the second time in 2022 for its most recent payout. The valuation is still cheap at 7x cash flows, which is an absolute steal when you consider the quality of EPD. The yield currently sits at 7.2%, which means you get a juicy distribution while you get paid to wait for further upside.

Q2

EPD recently reported earnings for Q2, and to be honest, I don’t have any complaints. All the operating segments are humming along, and the company appears to be digesting the Navitas acquisition nicely. The company might look to acquisition opportunities in the future to grow, but they are still growing organically as well.

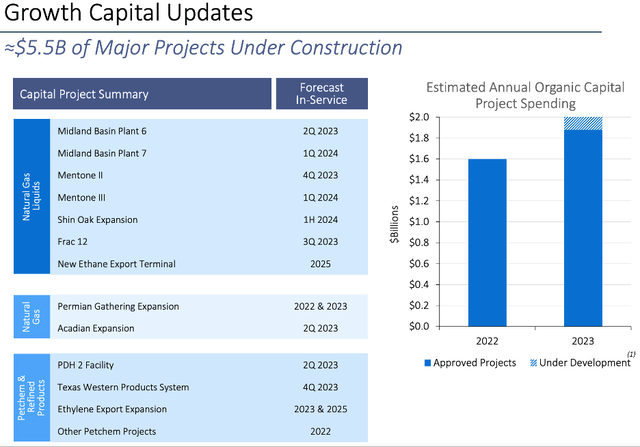

EPD Growth Projects (enterpriseproducts.com)

I’m curious to see what happens with the company and its growth projects moving forward, but I think we will see more acquisitions for EPD at some point in the future. This isn’t just company specific, as I think we will continue to see larger midstream operators continue to gobble up smaller companies in the coming years. While I like the future growth potential, one of my favorite things about EPD is the valuation.

Valuation

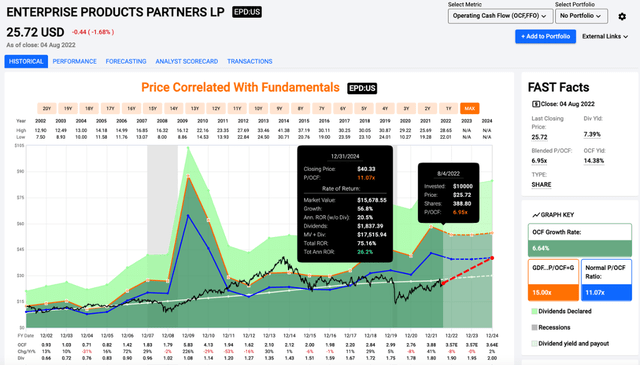

While EPD isn’t as cheap as it was at the beginning of the year, I still think it’s cheap enough to buy today. Units trade at 7x cash flows, which is well below the normal 11.1x multiple. Even if we just get a little bit of multiple expansion, double-digit returns lie ahead. I think units are still undervalued and worth at least $30 today. If things go well in the future, we could see units blow past $30 in the next couple of years.

Price/Cash Flow (fastgraphs.com)

The first question I got was asking if there was anything the market was missing. I think most of the market (and most Seeking Alpha contributors) has identified EPD as one of the best, if not the best, run MLP in the midstream space. Where I think the market is still catching up is the unit price. I think EPD is worth at least $30, if not more. While the units have performed well in 2022 despite weaker markets, I still think there is room to run for long term shareholders.

The other question was about the back up the truck price for units of EPD. Don’t get me wrong, I still think EPD is a buy around $25. I think the back up the truck price is around $20, which I don’t think we will see again. I could be wrong on that prediction, but if I am, I would start buying aggressively just like I was at the end of 2021 at similar prices. That would put the yield near 9.5% meaning you could almost lock in double-digit returns simply based on the income.

Distribution Growth & Buybacks

I said in a June article that EPD might surprise investors with the distribution growth in the coming years. I didn’t think that would mean a second distribution hike in 2022. The most recent bump was a 2.2% increase from $0.465 to $0.475 per quarter. The company already has a 23-year streak going and I think that streak will continue to grow. The current yield is 7.2%, which means it won’t take much price appreciation to get to double-digit returns.

While some investors are clamoring for more buybacks, EPD only repurchased a small number of units in Q2. The total was 1.4M units for a total of $35M, a small amount for a company the size of EPD. On the recent earnings call, management said they plan to take a balanced approach to debt reduction and buybacks in the second half of 2022, which likely means we will more buybacks in Q3 and Q4 than we saw in Q2. They have plenty left on the buyback authorization, but I’m curious to see how aggressive they get in the next couple quarters with buybacks. Based on what I have seen since I started buying units, management is price sensitive when it comes to buybacks, which is something I love to see.

Conclusion

EPD is still my largest position, and I don’t think that will change anytime soon. The company reported solid Q2 earnings that show that the company is still humming along. EPD is still growing, and the valuation is still too cheap at 7x cash flows. I’m expecting multiple expansion and a 7.2% yield to drive double-digit returns, and I think units are worth at least $30 today. The distribution growth is set to continue, and we will likely see more buybacks in the second half of the year. While MLPs get different tax treatment, and that includes EPD, I like everything else about the company and I think we will see attractive returns moving forward.

Be the first to comment