monsitj

Investment Thesis

Jacobs’ (NYSE:J) bookings were strong across the segments in the recent quarter, which led to a healthy build of backlog. The bookings related to the Infrastructure Investments and Jobs Act have started to flow but should start materially impacting the company’s financials from 2023 and beyond. The company is also experiencing strong demand across its other end markets, such as semiconductor chips, data analytics, climate response, life sciences, etc. The healthy backlog and strong trends across Jacob’s end markets should support the revenue growth of the company in the near term and long term. The company’s margin should start improving beyond Q4 FY22 as the shorter cycle and higher margin projects start to ramp up.

Jacob’s Q3 FY22 Earnings

Jacobs recently reported better than expected third quarter financial results. The revenue in the quarter was up 7% Y/Y to $3.83 bn (vs. the consensus estimate of $3.80 bn). The adjusted EPS in the quarter was up 13% Y/Y to $1.86 (vs. the consensus estimate of $1.81). The increase in revenue was due to the strength across Critical Mission Solutions (CMS), People & Places Solutions (P&PS), and PA Consulting segments, partially offset by 400 bps of unfavorable currency translation. The adjusted operating margin was down 30 bps Y/Y to 10.3% due to the pressure on the gross margin. However, the adjusted EPS in the quarter improved due to good revenue growth and a lower share count.

Bookings and Backlog to support the revenue growth

The bookings in Q3 FY22 were strong across the business portfolio, leading to 10% Y/Y backlog growth or 13% on a constant currency basis. The awards related to the U.S. infrastructure modernization (bipartisan infrastructure law) drove the bookings in the Americas business. The total backlog in the CMS segment grew 7% Y/Y to $10.2 bn. Within the P&PS segment, the bookings grew 11% Y/Y with a 13% Y/Y growth in the order backlog. The PA Consulting business saw strong sales bookings that were up 25%, and the backlog was up 19% Y/Y on a constant currency basis. The book-to-bill ratio in the quarter was 1.08x compared to 0.88x in the previous year’s same quarter.

Looking forward, the company is positioned for strong, profitable growth due to strong bookings and backlog across its business and the solid infrastructure investment trends across its end markets. Jacobs’s CMS strategy is focused on creating recurring revenue growth and margin expansion by offering technology-enabled solutions aligned with critical national priorities. The end markets of the CMS segment include space, national security, cyber and intelligence, and energy and the environment. The company is leveraging its data solutions, climate response, and consulting and advisory services to catalyze its business. Approximately 85% of CMS’s portfolio consists of large enterprise contracts with durations greater than four years, and 88% of contracts are for federal-level government funding. This gives substantial revenue visibility for the segment.

Despite the recessionary pressures and geopolitical uncertainties, the strong backlog of the CMS segment at the end of Q3 FY22 should support the revenue over the next 12 months. Apart from this, the trends in space debris management, robotics, and 5G network buildout should contribute to the revenue growth. The company integrated the Resolve Robotics Team in the U.K. into its CMS segment in July 2022 to bring software expertise and accelerate growth. While the rollout of 5G infrastructure is still in its early phases, the company is seeing increased demand for both integrated 4G and 5G solutions from its commercial telco, health care, and government clients. The company added awards totaling $150 mn in the quarter for delivering projects related to advancing 5G nationwide. Overall, the company is seeing solid demand for its CMS solutions. The sales pipeline remains robust, with the next 24-month qualified business pipeline at approximately $25 bn.

In the P&PS segment, despite macroeconomic concerns, the company performed well in Q3 FY22 due to the strength from both public and private sector clients. Within the segment, there are four ongoing themes related to supply chain diversification, infrastructure modernization, climate response, and data solutions. In the supply chain diversification theme, the continued breakthrough in biotechnology, strong customer demand, and robust operating cash flow are leading to increased investment in manufacturing by Jacob’s life science clients. The company is also seeing robust demand for semiconductor chips, data center capacity expansion, and growth in the electric vehicle market, which has led to award wins across all three categories. The strong demand for semiconductor chips and the passing of the $53 bn U.S. CHIPS bill should benefit the company. The CHIPS Act focuses on incentivizing investments in U.S. semiconductor manufacturing and specialized tooling. As more companies invest in semiconductor manufacturing plants in the U.S., Jacobs should be able to provide the necessary services and solutions to its existing as well as new clients.

In infrastructure modernization, Jacobs’s clients are continuing to invest in mega and giga-scale infrastructure. The funding from the Infrastructure Investment and Jobs Act (IIJA) is resulting in a steady increase in new project awards to modernize and increase the resiliency of the U.S. infrastructure. Jacobs’s advisory team is positioning its clients to win funding opportunities with over 50 differentiated grant applications across the transportation, water, and energy markets. In the climate response theme, Jacob’s clients are investing in clean energy, especially in grid modernization, cost-effective renewable energy generation, and EV charging infrastructure. Additionally, the Inflation Reduction Act, which was passed by the Biden Administration recently, should benefit the company as the act consists of $370 bn of funding (in the form of clean-energy tax credits) to deal with the climate change crisis. Moving to the data solutions theme, the company is using advanced data analytics to optimize its clients’ decision-making and derisk their long-term investments. In summary, the strong sales pipeline is supported by infrastructure funding and commercial clients that are focusing on secular growth opportunities. The revenue and backlog visibility for the P&PS segment look good in the near term and long term.

The sales pipeline for the PA Consulting business was up 40% Y/Y at the end of Q3 FY22. The business is gaining momentum in the U.S. with an expanding portfolio. The revenue in the U.S. for PA Consulting has grown in double digits over the last six months. Jacobs other segments and PA Consulting have significant collaborative opportunities in multiple markets, including health and life sciences, energy and utilities, and consumer products. The outlook for the business remains solid given the synergies with Jacobs and trends in its end markets.

I believe the diverse portfolio of Jacobs gives the company the ability to grow under multiple economic scenarios and geopolitical uncertainties. Additionally, the strong backlog at the end of Q3 FY22 should benefit the company’s revenue over the next few quarters. On a constant currency basis, the revenue in the fourth quarter of FY22 is expected to grow by double-digits according to management guidance.

Margins

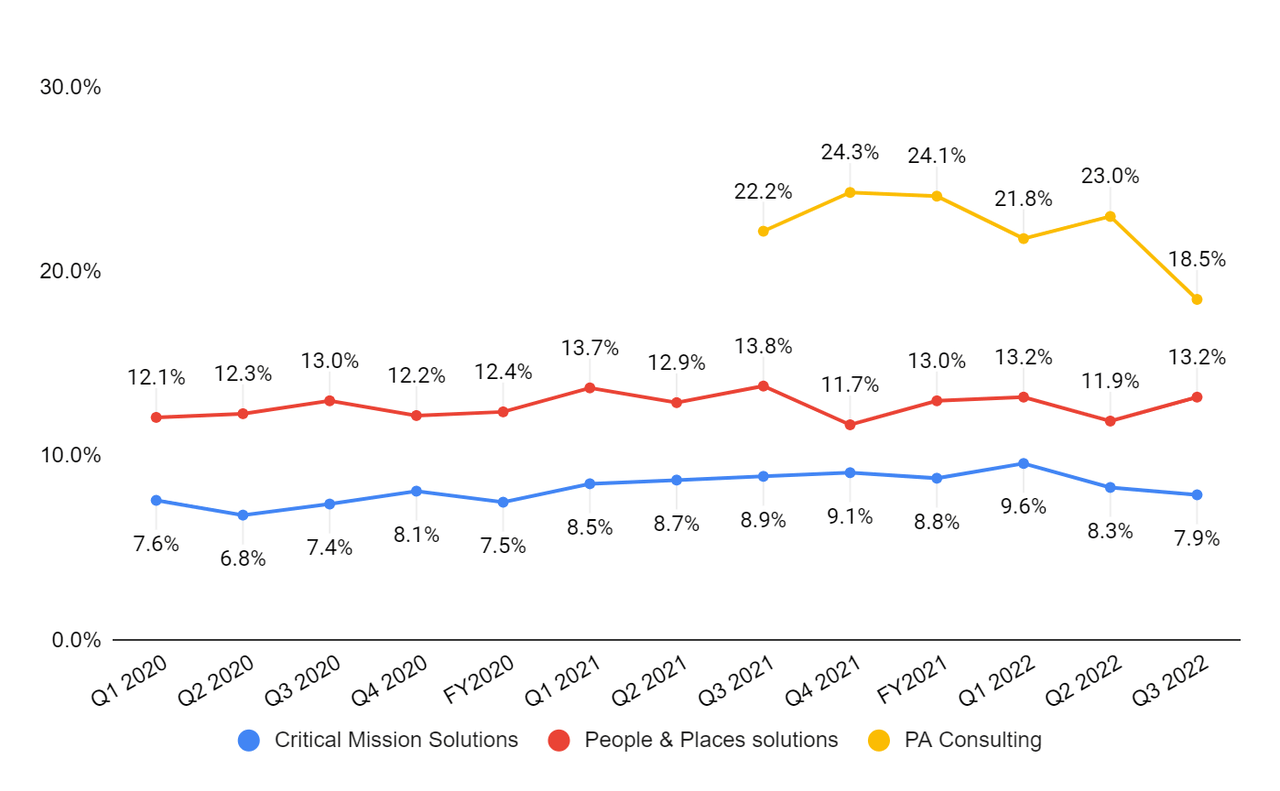

The company’s margin in Q3 FY22 were negatively impacted by the ramping of lower margin projects in the CMS segment, delays in the execution of higher margin projects, and investments in incremental resources in the PA Consulting segment. The operating margin in the CMS segment was down 90 bps Y/Y to 7.9% due to the delay of higher margin, shorter-cycle awards that were pushed due to the continuing resolution, and investments. The operating margin of the PA Consulting segment was down 370 bps Y/Y due to an impact of 200 bps from unfavorable currency translation and lower utilization. The lower utilization was due to the company’s proactive efforts to add resources for additional growth that is expected in 2022 and 2023 for the PA business. The PA Consulting business has been hiring employees at executive and partner levels, which has pressurized the gross margin in the quarter.

Jacobs’ segment operating margins (Company data, GS Analytics Research)

Looking forward, the company’s margins are expected to improve marginally in the fourth quarter and expand further in FY23 and beyond, driven by a higher-margin backlog and sales pipeline, favorable revenue mix within CMS, an acceleration in P&PS revenue, and continued strong PA consulting performance. Due to the ongoing investments in the CMS segment and the timing of both new and anticipated awards, the operating margin in the CMS segment should stay under 8% in Q4 FY22 but it should improve in 2023 and beyond as the short cycle projects and cyber and intelligence awards start to ramp up beyond Q4 FY22. The company won two cyber and intelligence awards in Q3 FY22, which are margin accretive and should start reflecting in the company’s P&L by the first quarter of FY23. The investments made by the company in PA Consulting are impacting the margins currently, but in the long term, this should benefit the company to increase its revenue and margins.

Valuation & Conclusion

The stock is currently trading at 19.21x FY22 consensus EPS estimate of $6.95 and 16.87x FY23 consensus EPS estimate of $7.91. The company’s near-term and long-term revenue growth prospects look solid due to its healthy order backlog, sales pipeline, and healthy trends in its end markets across its business segments. The funding of infrastructure investment, investments in clean energy to tackle the climate change crisis, and demand for semiconductor chips are some of the factors driving positive trends in Jacobs’s end markets. The company’s margin should also start improving as more higher-margin and shorter cycle projects start ramping up. On its March investor day, management highlighted its target to reach between $10 and $12 in EPS by FY2025 versus the FY2022 expected EPS of $6.95 (consensus estimates). So, the company has good growth prospects. Hence, I have a buy rating on the stock.

Be the first to comment