Sundry Photography

Apartment REITs like Mid-America Apartment Communities (NYSE:MAA) have been winners against the broader disruption to real estate over the last few years by pandemic-era stay-at-home orders. This would see long-established industries from office REITs to mall REITs get upended by what now looks to be sticky behavioural changes that were catalyzed or sped up by the pandemic. Whilst down year-to-date, the fundamentals of the Sunbelt-focused apartment owner and developer look strong with the dividend raised three times since the pandemic.

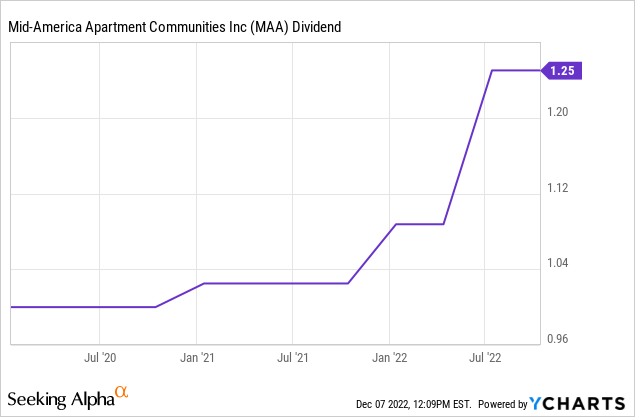

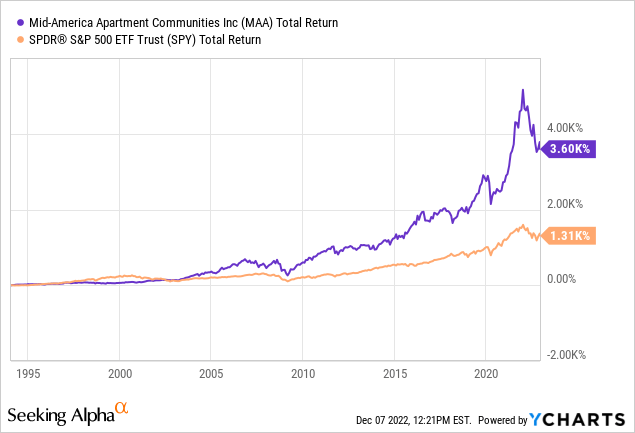

The last quarterly cash dividend was $1.25 per share for an annual yield of 3.16%. This is also well covered by FFO with a payout ratio of 82.10%. The company has paid consecutive quarterly cash dividends on its common since 1994 and has been a top performer on a total return basis over this time period.

REIT bears would be somewhat right to state that some of this outperformance has been built on the back of record-low interest rates and the era of cheap debt. The next few years of high inflation and rising Fed fund rates present a new and more intricately difficult paradigm that could reduce the probability of alpha in the years ahead. That said, housing remains an industry relatively impervious to the type of structural disruption being experienced by mall REITs like Macerich (MAC) and office REITs like Vornado (VNO).

Buy, DRIP, And Profit

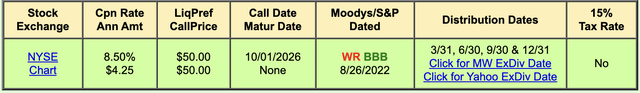

Shelter, safety, and security are the core provisions of a home and will always remain in demand even against the broader oscillations and volatility of the economy and creative destruction. This creates a sense of relative safety with MAA’s commons and sole Series I Cumulative Redeemable Preferred Shares (NYSE:MAA.PI).

The Series I preferred currently pays out a $4.25 coupon in quarterly instalments for a yield of 7.65%. Whilst this is considerably higher than the yield on the commons, the preferred does not have the same upside potential the commons provide. At $55.5 per share, they actually currently trade above their $50 redemption value. Whilst this is less of a near-term risk due to an October 2026 call date, potential owners should be aware that they are paying a $5.55 premium.

Fundamentally, whilst the preferred might have less volatility going into what some economists have flagged as a potential economic quagmire next year, the commons remain the better choice for most investors. The preferred have significantly underperformed over the last 5 years and I do not see this trend changing even with the commons facing more volatility on the back of headwinds from Fed rate hikes, high inflation, and a possible recession.

Common shareholders essentially hold an asset that has historically overperformed even in times of great economic discombobulation. The strategy hence should be to hold and let their automatic dividend reinvestment plan acquire more shares to build on any potential capital gains.

The Core Financials Look Healthy

As of the end of its fiscal 2022 third quarter ending September 30, 2022, MAA had an ownership interest in 101,769 apartment units. The company also reported revenue of $520.73 million for this period, up 15.1% over the year-ago quarter and a beat by $13.09 million on consensus estimates. FFO during the quarter at $2.19 grew from $1.78 in the year-ago quarter for a beat of $0.08 on consensus estimates. This came on the back of net operating income growing by 15% over its year-ago comp to reach $329.4 million.

The company is now guiding for higher core AFFO and NOI growth for its full fiscal 2022. AFFO and NOI growth at the midpoint are both expected to be $7.67 and 17%, respectively, with revenue growth expected at 13.5% versus prior guidance of 12%.

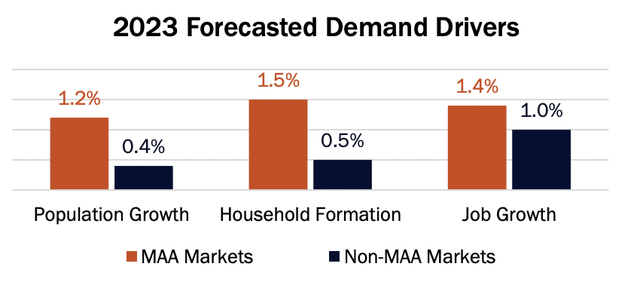

This growth comes despite the broader cooldown in the US housing market with MAA’s geographic focus on the Sunbelt markets forming a relative advantage against some of its peers due to the continued population growth these states are experiencing.

Mid-America Apartment Communities

Average daily occupancy for the quarter was high at 95.8% with the company’s blended lease-over-lease pricing at 8.3% post-period end in October.

MAA held over $1.2 billion in near-term liquidity from cash and borrowing capacity available with its net debt profile remaining quite low at a 3.97x net debt to adjusted EBITDA ratio. The company is also relatively insulated from rising rates with 97% of its debt fixed at an average interest rate of 3.4% and with an average maturity of 8 years. This sets the backdrop for a stable balance sheet going into 2023 that should support continued investments in developing new apartments without the risk of its FFO being compressed by higher interest payments. Whilst the current price to forward FFO of 18.72x is around 32% higher than its sector median, MAA looks set to experience 2023 with relatively little risk of its business model unravelling. I’m likely going to start a position in the new year.

Be the first to comment