straga

The Quarter

Enterprise Products (NYSE:EPD) reported a typically solid and steady eddy quarter yesterday (11/1). Adjusted EBITDA matched estimates at $2.26 billion while distributable cash flow slightly beat estimates at $1.9 billion. Capital expenditure was guided for 2022 at $1.6 billion and $2 billion respectively ($350 million maintenance) and the balance sheet was below the 3.5x leverage ratio target at 3.1x.

The only surprise to me was the company buying back $95 million of units during the quarter and a plan to buy back up to $350 million more units in the “near-term”. Given that the company had only repurchased $35 million of units in the first half of the year and $213 million for all of the 2021 year, this activity represents a pretty significant step up in activity. I certainly applaud this step up given the amount of free cash being generated, the 70% FCF payout ratio over the past twelve months, the underleveraged balance sheet, and most importantly, the 11-12% free cash flow yield the units are currently trading at. I similarly approve of the 5.6% distribution growth for this quarter versus Q3 last year.

I believe these increased returns of capital represent a bit of a sea change for EPD. As mentioned above, capital expenditures are still robust, but they are lower than the previous few years ($3-4.5 billion annually between 2015 and 2020). Moreover, thanks to the successful realization of past capital investment, the company is simply larger. Combining smaller capital spending over a larger base with a lower than usual leverage ratio, and the stock STILL trades below its pre-Covid levels and the company is absolutely doing the right thing by increasing distributions and buybacks.

Recession Commentary

Co-CEO Jim Teague spoke about the global macroeconomic backdrop on the call. He said tellingly:

Today, uncertainties in the global economic environment are weighing on the petrochemical industry, where sluggish demand is leading to reduced runs and destocking. There are some serious concerns about recession, especially in Europe, where the question isn’t whether they go into recession, but about the depth and length of the downturn. Meanwhile, on the other side of the globe, China’s GDP has taken a nosedive from double-digit growth over the past number of years to low single digits at best.

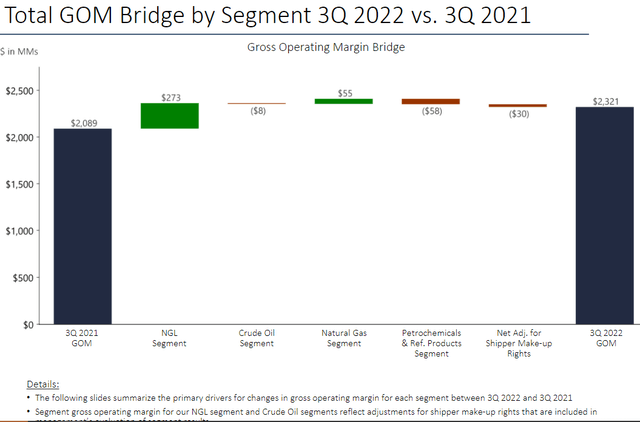

EPD’s has many levels of exposure to the global economy but the biggest is servicing the petrochemical and refined products industry. That segment was definitely weaker this quarter versus last year as you can see in the breakdown below.

Enterprise Product Segment Gross Operating Margin Bridge (Q3 Company Presentation)

Fortunately, as one can also see above, the NGL segment (the piece of the business I have focused on since I first wrote about this company) continues to deliver. Given the shortage and strong pricing on natural gas in Europe and Asia, I suspect that NGL’s should remain in high demand regardless of economic activity. Therefore, EPD’s unparalleled NGL processing and export infrastructure should allow the company to “always deliver” as Teague declared on the call.

Valuation

At 9x EBITDA, a 7.6% distribution yield and a free cash flow yield exceeding 11%, I do not think EPD is priced for the quality of its assets or the growth in cash flows that this company has delivered. In times of inflation, you want hard assets whose replacement value increases and which can generate increasing amounts of cash. EPD’s assets do both.

Risks

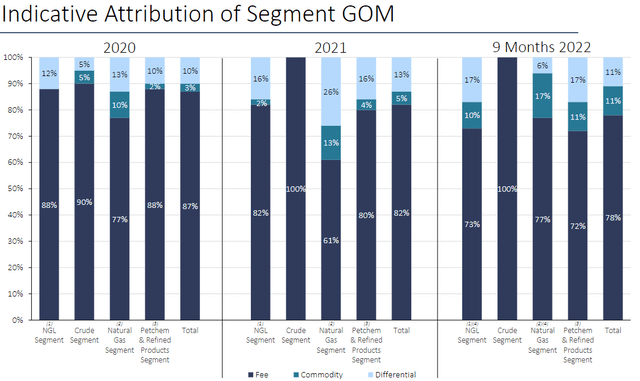

Given EPD’s high percentage of fee income (78% of GOM TTM) the main risk seems to be in differentials. While differentials are fairly difficult to predict, environments of fairly high commodity prices are usually conducive to healthy differentials. As you can see below, the past two years have both been better than 2020 and ties in with the higher price/healthier differential argument.

EPD Segment GOM Breakdown (Q3 EPD presentation)

That said, prices can and do vary and so do differentials. Fortunately, the differences are not huge and we seem like we’re in a higher for longer commodity pricing environment for the time being.

Conclusion

I think the combination of bulletproof balance sheet, irreplaceable assets, growing cash flows, and cheap valuation makes EPD one of the premier energy investments available in this and almost any environment. An added feature is the relatively recession-proof nature of the business. The units have returned about 19% since I first wrote about the company last September. While that’s healthy, it still trails the broader energy complex and is down from the June peak of $28.47. I think the stock should be trading at least there if not over the five-year high of north of $30.

Be the first to comment