imaginima/E+ via Getty Images

A lot was made of the 75-basis point rate hike last week, and the broader market got thumped today (it’s Thursday as I’m writing this). However, if any group of stocks is going to fare better in a rising rate environment, it’s going to be defensive value stocks with big dividends. Today’s article is going to be on my favorite midstream partnerships, Enterprise Products Partners (NYSE:EPD) and Magellan Midstream Partners (NYSE:MMP).

Investment Thesis

EPD and MMP represent two of the safest MLPs to own in today’s volatile markets. EPD is one of the largest energy infrastructure companies in the US, with over 50,000 miles of pipelines. MMP is smaller but carries a larger distribution yield and is buying back a large chunk of their outstanding units at attractive valuations. Both MLPs are an opportunity for investors to lock in yields near 8% and wait for potential price appreciation from multiple expansion.

A Potential New Investment For Enterprise

EPD popped up in the news recently related to a potential new project in Southeast Texas. They are looking at building a $5B steam cracker to process ethane and propane.

Enterprise wants to build the steam cracker, which could process 2M metric tons/year of ethane and propane, at its marine site in Beaumont along the Neches River, according to the report.

Some investors view EPD as a no growth, old economy stock, but the company has shown that they are able to grow in various ways, from the acquisition of Navitas earlier in 2022 to new projects that could help the business continue to grow. They might not light the world on fire with new growth, but if they can continue to grow the business, the distribution growth will follow. At the current valuation, that should drive attractive returns for unitholders.

Two Wall Street Upgrades for Magellan

I don’t really follow Wall Street analysts closely, but I do pay attention when they have something to say about a company I own. Magellan recently caught a couple of upgrades from two large banks, JPMorgan (JPM) and Goldman Sachs (GS). Both analyst notes pointed to Magellan as an inflation beneficiary, but they also pointed out a couple of things worth noting.

The JPMorgan note pointed to the $435M independent terminal sale that is expected to close in the next couple of months as a potential near term catalyst that could boost buybacks. Both notes also mentioned that Magellan is going to reprice a significant chunk of their tariffs in the next year and a half. JPMorgan put a price target of $57 on MMP, while Goldman’s target was $59. I think that is certainly closer to fair value than the current price, which brings me to the attractive valuations for both pipelines.

Valuation

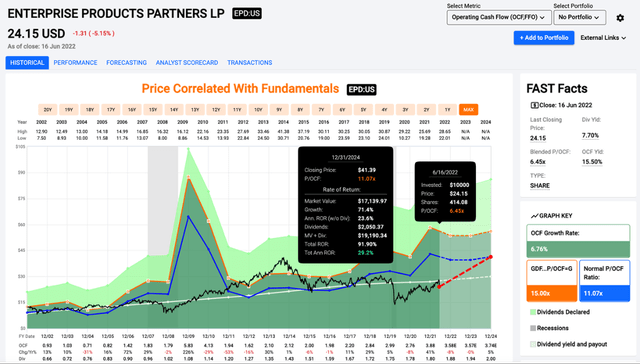

I have written about both pipelines several times since the start of 2022, and the undervaluation still remains. EPD is trading at 6.5x cash flows, which is very undervalued in my opinion. While we might not get a ton of multiple expansion, all it takes to get to $30 is an 8x or 9x cash flow multiple, which would still be attractive. EPD has sold off more than 10% in the last couple of weeks, which provides new investors a margin of safety and the potential to buy the dip for this undervalued MLP. I think shares are a strong buy for income investors under $25.

Price/Cash Flow (fastgraphs.com)

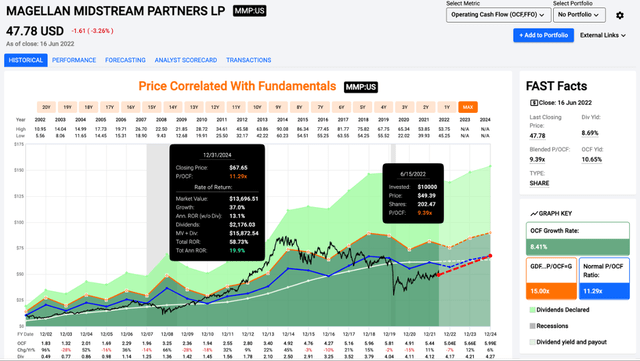

MMP is trading at a slightly higher cash flow multiple, which is likely due to the higher distribution. At 9.4x cash flows, I still think there is room for multiple expansion, but it might not be as much as EPD. While there might not be as much upside as EPD due to the higher multiple, I still think shares are a strong buy under $50.

Price/Cash Flow (fastgraphs.com)

In the coming months, I think investors will be looking for income investments that can protect them from inflation and a slowing economy. EPD yields 7.7% and MMP yields 8.7% after the recent selloff, which is certainly enough to attract new investors looking for income.

Conclusion

I really think about EPD and MMP as one investment in the pipeline infrastructure of the US. With the political environment making it nearly impossible to get new pipelines up and running, EPD and MMP stand to benefit as two existing players with a wide moat due to their existing infrastructure network. Both are significantly undervalued at current prices, and I think investors will be richly rewarded with growing distributions and multiple expansion in the coming years.

EPD is one of the largest pipeline networks in the US, and their massive insider ownership ensures that they will continue to act in the best interests of unitholders. I think that the distribution growth in the coming years could surprise some investors, but they continue to grow, and the valuation provides a significant margin of safety for new investors, especially after the recent selloff in the last couple weeks.

MMP is a smaller MLP than the behemoth that is EPD, but they still have an impressive portfolio of assets that will continue to produce attractive returns in the coming years. They continue to buy back units at attractive valuations, and they could ramp up the buybacks after the sale of their independent terminals closes in the next couple months. As a crucial part of the energy infrastructure of the US, they are well positioned to deal with any issues on the horizon with the economy.

Both MLPs are materially undervalued and have large distributions that should continue to attract income investors. EPD trades at 6.5x cash flows, with a distribution yield of 7.7%, while MMP is trading at 9.4x cash flows and a yield of 8.7%. If these two companies weren’t already my two largest positions, I would be looking to add to my position at current prices. In my mind, EPD is worth at least $30 a unit and MMP is worth at least $60. It’s only a matter of time before they trade at those prices, and investors buying today are likely to see double-digit returns from an attractive mix of income and price appreciation.

Be the first to comment